BofA On Stock Market Valuations: Reasons For Investor Confidence

Table of Contents

BofA's Positive Outlook on Long-Term Growth

BofA maintains a positive outlook on long-term economic growth, projecting sustained expansion despite current inflationary pressures. This optimistic forecast is underpinned by several key factors. BofA's predictions are based on rigorous analysis of numerous economic indicators and a deep understanding of global market dynamics.

-

Strong Corporate Earnings Reports Despite Inflation: Despite persistent inflation, many corporations have reported robust earnings, demonstrating resilience and adaptability. This indicates underlying strength in the economy and suggests that companies are effectively managing rising costs.

-

Positive Projections for Future Earnings Growth: BofA's analysts project continued growth in corporate earnings over the coming years, fueled by innovation, technological advancements, and increasing consumer demand in various sectors.

-

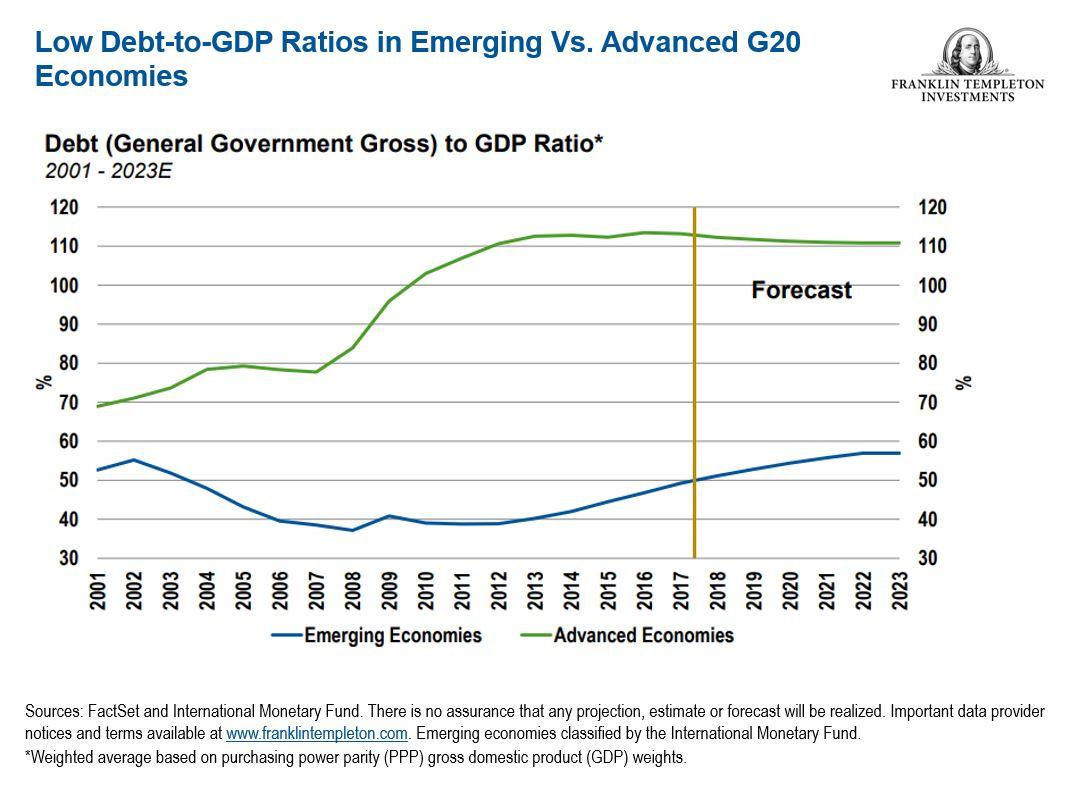

Analysis of Key Economic Indicators Supporting Long-Term Growth: BofA's analysis incorporates a wide range of key economic indicators, including GDP growth, employment figures, and consumer spending, all pointing towards a positive long-term trajectory. Their models account for potential headwinds, such as interest rate hikes, and still predict sustained growth.

-

BofA's Assessment of the Impact of Interest Rate Hikes on Long-Term Growth: While interest rate hikes pose a challenge, BofA's assessment suggests that their impact on long-term growth will be manageable, and that the benefits of controlling inflation outweigh the potential short-term economic slowdown.

Addressing Concerns about High Valuations

While some sectors exhibit seemingly high valuations, raising concerns about a potential market correction, BofA offers counterarguments supported by a detailed analysis of various valuation metrics.

-

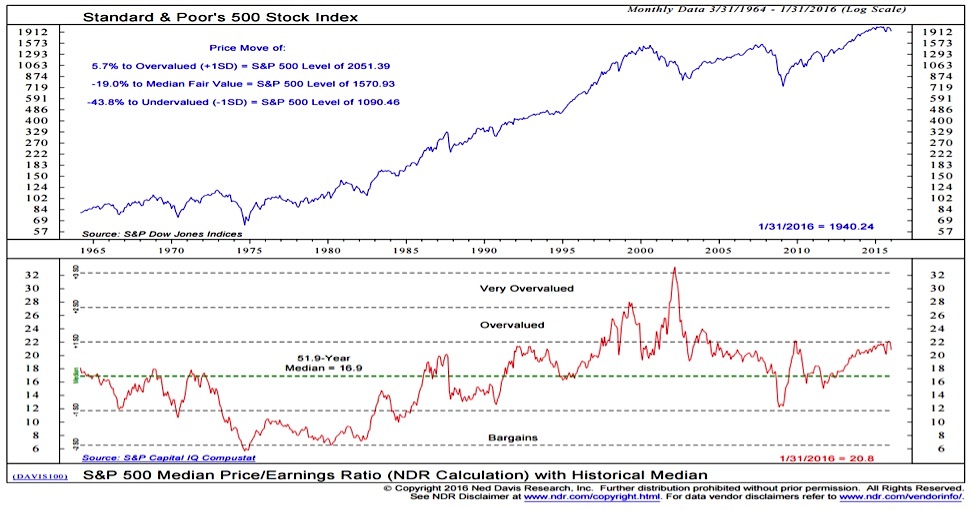

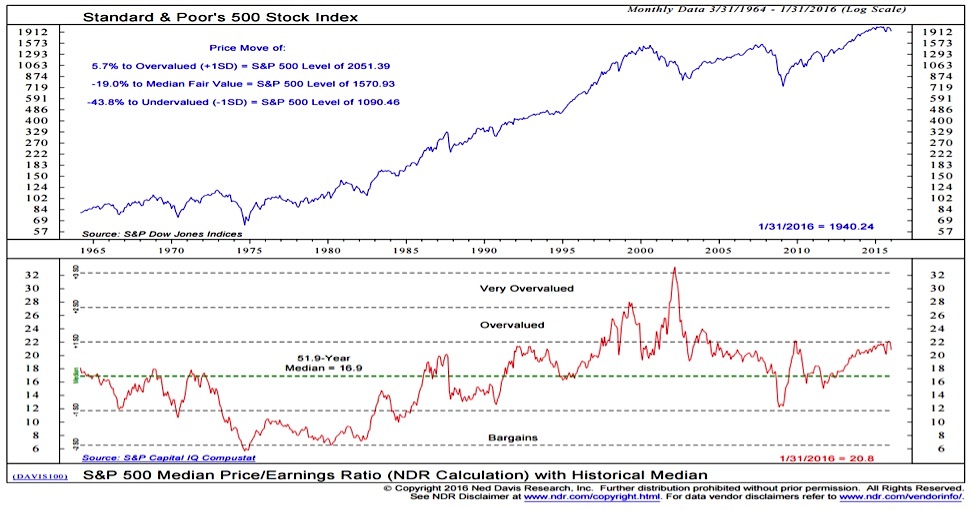

BofA's Analysis of Current Price-to-Earnings Ratios (P/E) and Other Relevant Valuation Metrics: BofA's analysts examine P/E ratios alongside other metrics like price-to-sales and dividend yield to provide a comprehensive picture of market valuations. Their analysis suggests that while certain sectors appear expensive, the overall market is not significantly overvalued when considering future earnings growth.

-

Discussion of Potential Market Corrections and Their Likely Impact: BofA acknowledges the possibility of short-term market corrections, but stresses that these are normal occurrences in a healthy market cycle. They emphasize that well-diversified portfolios can withstand these fluctuations.

-

Explanation of Factors that Justify Current Valuations from BofA's Perspective (e.g., Innovation, Technological Advancements): BofA argues that current valuations in some sectors are justified by the rapid pace of innovation and technological advancements. These innovations drive future growth and justify premium valuations.

-

Comparison to Historical Valuations and Market Cycles: BofA's analysis places current valuations within the context of historical market cycles, demonstrating that they are not unprecedented and are within reasonable parameters considering long-term growth prospects.

The Role of Innovation and Technological Advancements

BofA strongly emphasizes the transformative role of technological advancements in shaping stock market valuations. Innovation is a key driver of growth and investor confidence.

-

Focus on Specific High-Growth Sectors Benefiting from Technological Advancements (e.g., Artificial Intelligence, Renewable Energy): BofA highlights sectors like artificial intelligence, renewable energy, and biotechnology as key beneficiaries of technological innovation, poised for significant long-term growth.

-

Analysis of the Long-Term Growth Potential of These Sectors: The analysis delves into the long-term growth potential of these sectors, projecting significant returns based on technological advancements and increasing market demand.

-

Discussion on How These Advancements are Influencing Investor Confidence: BofA underscores how these advancements are boosting investor confidence, attracting capital to these high-growth sectors and further fueling their expansion.

-

Examples of Companies Driving Growth in These Sectors: The report cites specific examples of companies that are leading the charge in these innovative sectors, showcasing the potential for significant returns on investment.

BofA's Recommendations for Investors

Based on their in-depth analysis, BofA provides key recommendations for investors to navigate the current market environment effectively.

-

Specific Investment Strategies Suggested by BofA: BofA suggests a strategic approach to investing, prioritizing long-term growth potential and diversification across various sectors.

-

Importance of Portfolio Diversification to Mitigate Risk: The importance of diversification is stressed, emphasizing the need to spread investments across different asset classes and sectors to reduce overall portfolio risk.

-

Advice on Risk Management and Assessing Personal Risk Tolerance: BofA emphasizes the need for each investor to assess their personal risk tolerance and adjust their investment strategy accordingly. Risk management is crucial for long-term success.

-

Recommendations for Long-Term Versus Short-Term Investment Strategies: BofA advocates for a long-term investment horizon, emphasizing the potential for higher returns over the long haul, while acknowledging the role of short-term tactical adjustments based on market conditions.

Conclusion

BofA's positive outlook on stock market valuations is driven by a confluence of factors: strong corporate earnings, positive projections for future growth, the transformative power of technological innovation, and a historical perspective on market cycles. Understanding BofA's perspective on stock market valuations is crucial for informed investment decisions. While acknowledging potential short-term corrections, BofA emphasizes the importance of a well-diversified investment strategy focused on long-term growth. Explore BofA's research and resources to refine your investment strategy and navigate market uncertainty effectively.

Featured Posts

-

Ella Bleu Travolta Nevjerojatna Tranformacija Kceri Johna Travolte

Apr 24, 2025

Ella Bleu Travolta Nevjerojatna Tranformacija Kceri Johna Travolte

Apr 24, 2025 -

Quentin Tarantino Zasto Izbjegava Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Izbjegava Ovaj Film S Johnom Travoltom

Apr 24, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 24, 2025 -

Us Market Slumps As Emerging Markets Erase Losses

Apr 24, 2025

Us Market Slumps As Emerging Markets Erase Losses

Apr 24, 2025 -

The Countrys Rising Business Stars Locations And Opportunities

Apr 24, 2025

The Countrys Rising Business Stars Locations And Opportunities

Apr 24, 2025