Power Finance Corporation's FY25 Dividend: March 12th Announcement

Table of Contents

Key Highlights of the Power Finance Corporation FY25 Dividend Announcement

The Power Finance Corporation's FY25 dividend announcement on March 12th, 2024, revealed crucial information for shareholders. The specifics of the announcement provide a clear picture of the company's financial health and its commitment to returning value to its investors.

- Dividend amount declared per share: [Insert the actual dividend amount per share announced on March 12th, 2024. For example: ₹5.00 per share]. This represents a [percentage increase/decrease] compared to the previous year's dividend.

- Record date for dividend eligibility: [Insert the record date. For example: March 20th, 2024]. Shareholders holding PFC shares on or before this date will be eligible to receive the dividend.

- Payment date for dividend distribution: [Insert the payment date. For example: April 10th, 2024]. This is the date when the dividend will be credited to eligible shareholder accounts.

- Total dividend payout: [Calculate and insert the total dividend payout based on the number of outstanding shares. For example: ₹500 Crore]. This signifies a significant capital return to investors.

- Comparison with previous year's dividend: [Compare this year's dividend with the previous year's dividend, showing percentage change. For example: A 10% increase compared to FY24]. This highlights the company's growth and profitability.

- Special considerations or announcements: [Mention any additional announcements or special considerations mentioned alongside the dividend declaration. For example: Any share buyback programs or future investment plans].

Impact of the PFC FY25 Dividend on Investors and Shareholders

The PFC FY25 dividend announcement has several implications for investors and shareholders. Analyzing the dividend yield and its relative attractiveness is crucial for evaluating the investment's overall return.

- Dividend yield calculation and explanation: [Calculate and explain the dividend yield. For example: A dividend yield of 4% based on the current share price indicates a 4% return on investment from dividends alone].

- Comparison with industry average dividend yields: [Compare PFC's dividend yield to the average dividend yield of similar companies in the Indian power sector. For example: This is higher/lower than the industry average of X%].

- Potential tax implications for shareholders: [Outline the tax implications for shareholders based on their individual tax bracket and applicable tax laws. For example: Dividends are subject to dividend distribution tax, etc.].

- How the dividend might affect the share price: [Discuss the potential short-term and long-term effects of the dividend announcement on the share price. For example: A short-term dip followed by a gradual increase, depending on market sentiment].

- Implications for different types of investors: [Analyze the impact on various investor types: long-term investors might value the consistent dividend income, while short-term investors may focus on share price movements].

Power Finance Corporation's Financial Performance in FY24 Contributing to the Dividend

PFC's strong financial performance in FY24 significantly contributed to the substantial FY25 dividend. Examining key financial metrics provides insights into the company's ability to generate profits and distribute dividends.

- Key financial highlights of FY24: [Present key financial figures like net profit, revenue, earnings per share (EPS), and return on equity (ROE) from PFC's FY24 financial report. For example: Net profit increased by 15% year-on-year, reaching ₹X billion].

- Factors influencing the dividend decision: [Explain the rationale behind the dividend decision, highlighting factors such as profitability, strong cash flow, and future growth prospects].

- Comparison of FY24 performance with previous years: [Illustrate the growth trend by comparing FY24's performance with previous financial years. Highlight any improvements or declines in key metrics].

- Significant investments or projects: [Describe significant investments or projects undertaken by PFC during FY24 that contributed to the financial success].

Future Outlook for Power Finance Corporation and its Dividend Policy

The future outlook for Power Finance Corporation and its dividend policy is contingent upon several factors, including the ongoing growth of India's power sector and the company's strategic initiatives.

- PFC's strategic plans for future growth: [Discuss PFC's strategic plans for future growth, including expansion into new markets, technological advancements, and diversification strategies].

- Anticipated future financial performance: [Present forecasts or predictions for PFC's future financial performance based on market analysis and expert opinions. For example: Analysts predict continued growth in revenue and profits].

- Potential changes to PFC's dividend policy: [Discuss any potential changes or adjustments to PFC's dividend policy in the coming years. For example: Any plans to increase or decrease dividend payouts].

- Expert opinions or analyst forecasts: [Include expert opinions and analyst forecasts regarding PFC's future dividend payouts to provide a comprehensive perspective].

Conclusion

Power Finance Corporation's FY25 dividend announcement on March 12th, 2024, detailed a [insert dividend amount per share] dividend payout, with a record date of [insert record date] and a payment date of [insert payment date]. This dividend reflects PFC's robust financial performance in FY24 and its commitment to shareholder returns. The dividend's impact on investors varies based on individual circumstances and investment strategies. While the dividend yield is attractive, investors should carefully consider the overall market conditions and their own risk tolerance. Stay updated on all future Power Finance Corporation dividend announcements and financial news by following PFC's official channels and reliable financial news sources. Learn more about investing in Power Finance Corporation and its dividend policy through further research.

Featured Posts

-

Dubai Return Svitolina Defeats Kalinskaya In First Round

Apr 27, 2025

Dubai Return Svitolina Defeats Kalinskaya In First Round

Apr 27, 2025 -

David Geiers Vaccine Study Review An Hhs Controversy

Apr 27, 2025

David Geiers Vaccine Study Review An Hhs Controversy

Apr 27, 2025 -

Pne Group Expands Wind Energy Portfolio With Two New Farms

Apr 27, 2025

Pne Group Expands Wind Energy Portfolio With Two New Farms

Apr 27, 2025 -

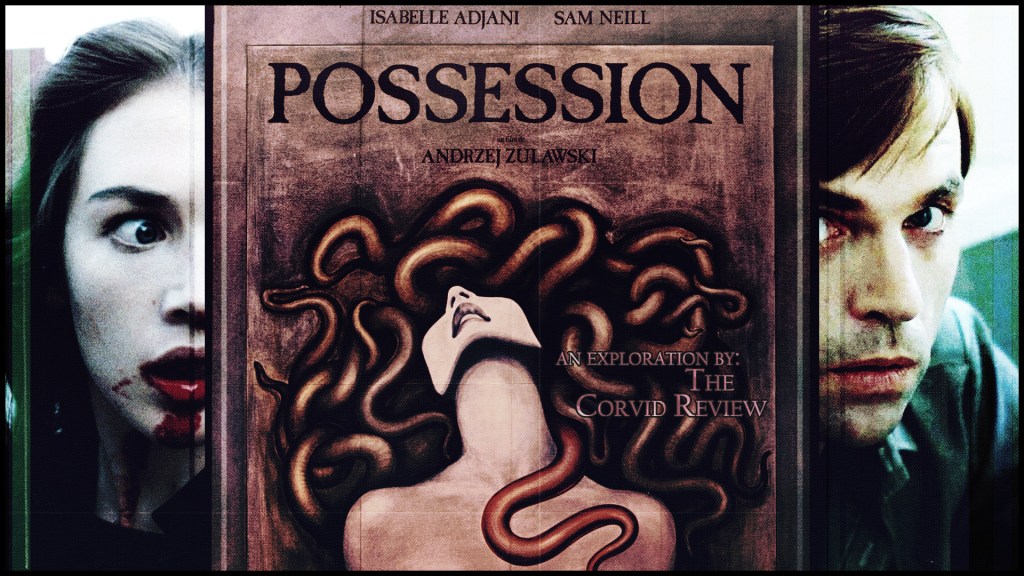

Untangling Sister Faith And Sister Chance In Andrzej Zulawskis Possession A Lady Killers Podcast Analysis

Apr 27, 2025

Untangling Sister Faith And Sister Chance In Andrzej Zulawskis Possession A Lady Killers Podcast Analysis

Apr 27, 2025 -

Grand National Horse Deaths A Look Ahead To 2025

Apr 27, 2025

Grand National Horse Deaths A Look Ahead To 2025

Apr 27, 2025