Microsoft's Activision Buy: FTC's Appeal And Antitrust Concerns

Table of Contents

The FTC's Case Against the Microsoft Activision Merger

The FTC's core argument against the Microsoft Activision merger centers on its potential to significantly reduce competition within the video game market. The commission argues that this acquisition would give Microsoft an unfair advantage, potentially stifling innovation and harming consumers. Their concerns are multifaceted:

-

Reduced Competition in Console Gaming: The FTC fears that Microsoft, bolstered by Activision Blizzard's extensive portfolio, particularly the immensely popular Call of Duty franchise, could leverage its increased market power to disadvantage its main competitor, Sony's PlayStation. This could involve exclusive deals, making PlayStation less attractive to gamers.

-

Anti-Competitive Practices Regarding Game Exclusivity: A central concern is the potential for Microsoft to make key Activision Blizzard titles, such as Call of Duty, Xbox exclusives or offer them on other platforms at a significant disadvantage. This could lock players into the Xbox ecosystem, reducing choice and competition.

-

Potential Harm to Consumers: The FTC worries that the Microsoft Activision merger could lead to higher prices for games, fewer innovative titles, and reduced overall choice for consumers. The loss of competitive pressure could lead to stagnation in the market.

The FTC initially sought a preliminary injunction to block the merger, a request that was ultimately denied by a federal judge, paving the way for the current appeal.

Antitrust Concerns and the Future of Game Mergers

The Microsoft Activision Blizzard deal highlights broader antitrust concerns surrounding large-scale mergers in the tech industry. The sheer size and scope of this acquisition raise questions about the role of regulatory bodies in preventing monopolies and preserving competition.

-

The Role of Regulatory Bodies: The FTC, along with other international regulatory bodies like the EU Commission, plays a critical role in evaluating mergers and acquisitions to prevent anti-competitive practices. Their decisions have far-reaching implications for the tech landscape.

-

Analysis of Similar Past Mergers: Examining past mergers and acquisitions in the gaming and technology sectors can provide valuable insight into the potential consequences of the Microsoft Activision buy. Analyzing successes and failures of similar mergers can inform future regulatory decisions.

-

Impact on Innovation and Consumer Welfare: The concern is that a lack of competition can stifle innovation, as companies no longer need to compete aggressively to attract consumers. This, in turn, can lead to reduced consumer welfare, with less choice and potentially higher prices.

Microsoft's Defense and Arguments

Microsoft counters the FTC's claims by emphasizing its commitment to maintaining Call of Duty's availability across various platforms, including PlayStation. Microsoft argues that the merger will actually benefit gamers and innovation.

-

Call of Duty Availability: Microsoft has publicly pledged to continue releasing Call of Duty on PlayStation, suggesting that the merger won't limit consumer choice. They've proposed long-term contracts to solidify this commitment.

-

Benefits for Game Development: Microsoft argues that the combined resources of Microsoft and Activision Blizzard will lead to enhanced game development, resulting in more innovative and high-quality games for players.

-

Microsoft's Market Share: Microsoft points to its relatively small market share in the gaming console market compared to Sony, arguing that the acquisition won't create a monopoly.

The Appeal Process and its Potential Outcomes

The FTC's appeal against the judge's decision is now underway. The appeal process is complex and can be lengthy, potentially impacting the timeline of the Microsoft Activision merger significantly.

-

Appeal Process Timeline: The appellate process could take months, even years, to resolve, creating significant uncertainty for both companies and the gaming industry.

-

Potential Outcomes: Potential outcomes range from the FTC winning its appeal and blocking the merger to the appellate court upholding the lower court's decision, allowing the merger to proceed. There's also a possibility of a negotiated settlement.

-

Further Legal Challenges: Even if the FTC's appeal is unsuccessful, the merger could still face challenges from other regulatory bodies in different regions, potentially delaying or even preventing the acquisition's completion.

The Ongoing Battle Over Microsoft's Activision Buy – What's Next?

The Microsoft Activision buy remains a highly contentious issue, with both sides presenting compelling arguments. The FTC's concerns regarding anti-competitive practices are significant, and the potential consequences for the gaming industry are far-reaching. The ongoing legal battles and the uncertainty surrounding the future of the merger highlight the complexities of regulating mega-mergers in the rapidly evolving tech sector. Follow the latest updates on Microsoft's Activision buy and stay informed about this landmark case impacting Microsoft's Activision acquisition. Share your thoughts on how this monumental deal will shape the future of the gaming industry.

Featured Posts

-

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025

Russias Easter Truce Ends Renewed Fighting In Ukraine

Apr 22, 2025 -

Ace The Private Credit Job Hunt 5 Dos And Don Ts For Success

Apr 22, 2025

Ace The Private Credit Job Hunt 5 Dos And Don Ts For Success

Apr 22, 2025 -

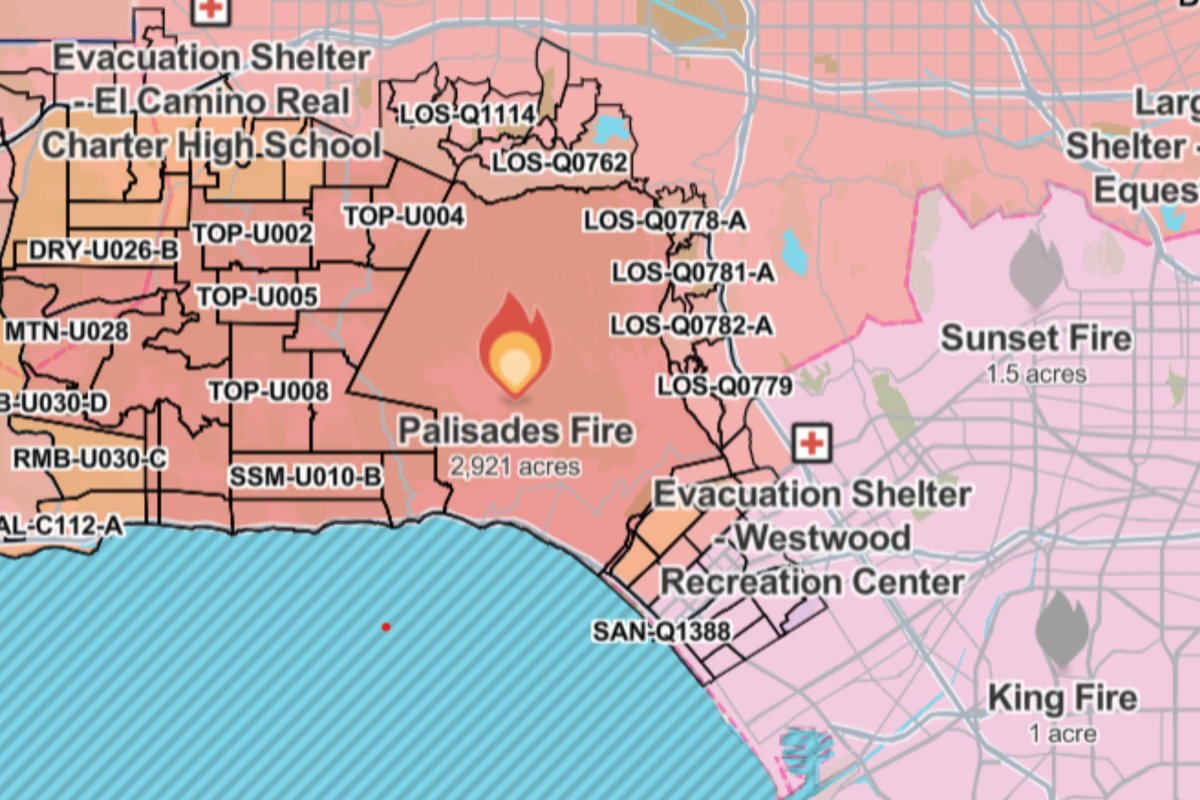

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 22, 2025 -

Pope Franciss Impact Challenges And Opportunities For The Next Papacy

Apr 22, 2025

Pope Franciss Impact Challenges And Opportunities For The Next Papacy

Apr 22, 2025 -

The Passing Of Pope Francis His Impact On The Catholic Church

Apr 22, 2025

The Passing Of Pope Francis His Impact On The Catholic Church

Apr 22, 2025