Loonie Loses Ground Despite US Dollar Strength

Table of Contents

Impact of Global Economic Uncertainty on the Loonie

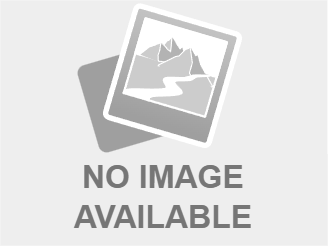

The global economic landscape is currently fraught with uncertainty, significantly impacting the Canadian dollar. Rising inflation, persistent recessionary fears, and ongoing geopolitical instability are all contributing to a climate of investor apprehension. This uncertainty translates directly into market volatility, affecting the value of the Loonie.

- Rising interest rates globally: Central banks worldwide are aggressively raising interest rates to combat inflation, creating a ripple effect across global markets. This increased cost of borrowing can dampen economic growth and negatively affect investor sentiment towards riskier assets, including the Loonie.

- Concerns about global supply chains: Disruptions to global supply chains, a lingering effect of the pandemic and exacerbated by geopolitical events, continue to impact Canadian exports and overall economic confidence. This instability weighs on the Loonie's value.

- Uncertainty surrounding the war in Ukraine: The ongoing conflict in Ukraine creates significant geopolitical risk, contributing to market volatility and dampening investor confidence in emerging market currencies, including the Canadian dollar.

Commodity Prices and the Loonie's Performance

Canada's economy is heavily reliant on commodity exports, particularly oil and natural gas. The Loonie's value is therefore strongly correlated with the prices of these commodities. Fluctuations in global commodity markets directly impact the Canadian dollar's exchange rate.

- Fluctuations in oil prices: Oil price volatility, influenced by factors such as OPEC+ production decisions and global demand, has a significant impact on the Canadian economy and consequently, the Loonie. A decline in oil prices can weaken the Canadian dollar.

- The influence of global demand for Canadian commodities: Global demand for Canadian resources plays a crucial role. Strong international demand can boost the Loonie, while weak demand can lead to depreciation.

- The effect of supply chain disruptions on commodity exports: Supply chain disruptions can limit Canada's ability to export commodities, negatively impacting economic growth and weakening the Loonie.

Bank of Canada Monetary Policy and its Influence

The Bank of Canada's monetary policy decisions play a vital role in influencing the Loonie's value. The Bank's actions, particularly interest rate adjustments, aim to control inflation and maintain economic stability. These actions have a direct impact on currency exchange rates.

- The Bank of Canada's efforts to control inflation: The Bank of Canada's aggressive interest rate hikes are intended to curb inflation. However, these hikes can also slow economic growth, potentially weakening the Loonie in the short term.

- The impact of interest rate hikes on attracting foreign investment: Higher interest rates can attract foreign investment, potentially strengthening the Loonie. However, this effect is often counterbalanced by other economic factors.

- Potential future policy changes and their implications for the Loonie: Future Bank of Canada policy changes will continue to significantly influence the Loonie's performance. Investors closely watch announcements for clues about the future direction of the Canadian dollar.

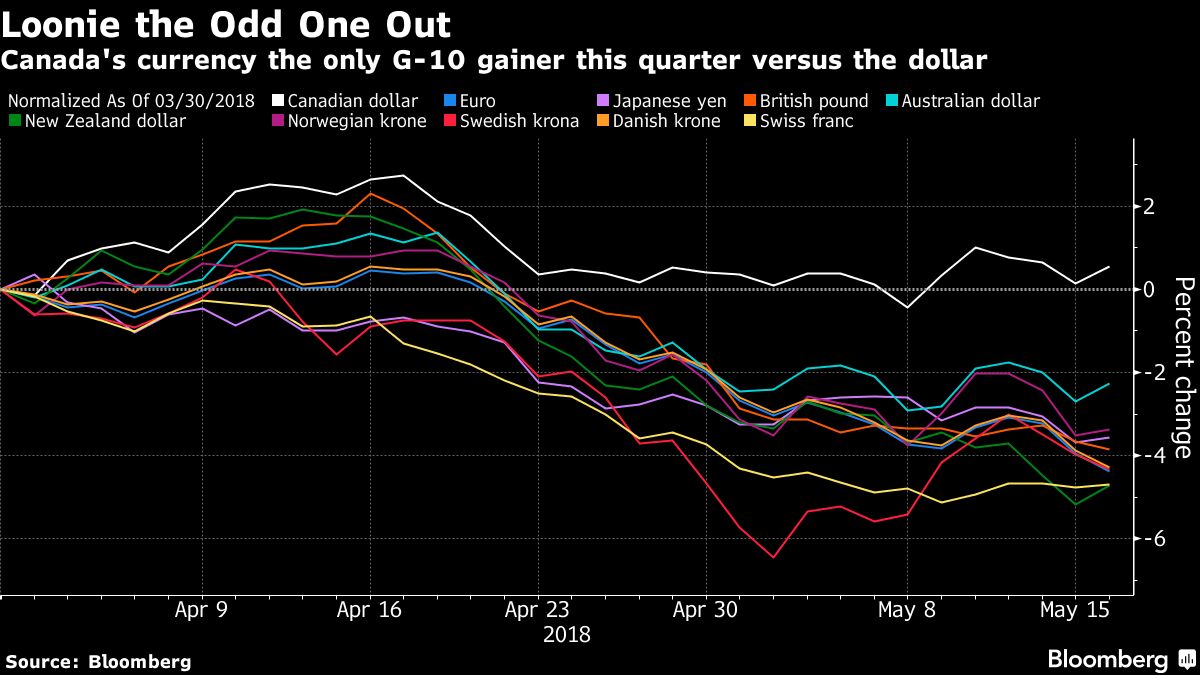

US Dollar Strength and its Effect on the Loonie

The strength of the US dollar is a major factor affecting the Loonie. Several factors contribute to the USD's current strength, creating a headwind for the Canadian dollar.

- The US Federal Reserve's monetary policy decisions: The US Federal Reserve's aggressive interest rate hikes have made the US dollar more attractive to investors seeking higher returns, bolstering its value and putting downward pressure on other currencies, including the Loonie.

- The US economy's relative strength compared to other global economies: The relative strength of the US economy compared to other major economies further enhances the US dollar's appeal.

- The US dollar's status as a safe-haven currency: In times of global uncertainty, investors often flock to the US dollar as a safe-haven currency, increasing its demand and further strengthening it against other currencies like the Loonie.

Conclusion: Navigating the Loonie's Fluctuations

The recent weakness of the Loonie, despite the strong US dollar, is a result of a confluence of factors. Global economic uncertainty, fluctuating commodity prices, Bank of Canada monetary policy, and the inherent strength of the US dollar all contribute to the current exchange rate dynamics. Understanding these intertwined factors is crucial for investors and businesses operating in the Canadian economy. The outlook for the Loonie remains cautious, with potential scenarios ranging from further depreciation to a stabilization depending on the evolution of these global and domestic factors. To make informed financial decisions, it is vital to stay abreast of Loonie exchange rates and global economic trends. We encourage further research into Loonie exchange rate forecasts and Canadian dollar investment strategies to navigate this dynamic landscape effectively. Keep a close eye on the Loonie and its relationship with the USD – your financial well-being may depend on it.

Featured Posts

-

Uil State Bound Hisd Mariachis Viral Whataburger Performance

Apr 24, 2025

Uil State Bound Hisd Mariachis Viral Whataburger Performance

Apr 24, 2025 -

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield In Close Final

Apr 24, 2025

Tyler Herro Wins Nba 3 Point Contest Defeats Buddy Hield In Close Final

Apr 24, 2025 -

7

Apr 24, 2025

7

Apr 24, 2025 -

Stock Market Gains S And P 500 Nasdaq And Dows Significant Rise

Apr 24, 2025

Stock Market Gains S And P 500 Nasdaq And Dows Significant Rise

Apr 24, 2025 -

Early Detection Is Key Lessons From Tina Knowles Breast Cancer Journey

Apr 24, 2025

Early Detection Is Key Lessons From Tina Knowles Breast Cancer Journey

Apr 24, 2025