Stock Market Gains: S&P 500, Nasdaq, And Dow's Significant Rise

Table of Contents

Analyzing the S&P 500's Impressive Growth

The S&P 500, a broad market index representing 500 large-cap U.S. companies, has seen remarkable growth. This impressive performance is a result of several interconnected factors.

Strong Corporate Earnings Reports

Better-than-expected earnings reports from major S&P 500 companies have been a significant driver of stock market gains. This positive trend reflects robust corporate performance and investor confidence in future growth.

- Technology: The tech sector has consistently exceeded expectations, with companies reporting significant revenue and earnings growth.

- Healthcare: The pharmaceutical and biotechnology industries also contributed significantly, fueled by new drug approvals and increased demand.

- Financials: Strong performance in the financial sector, driven by rising interest rates, also bolstered overall S&P 500 performance.

Revised earnings forecasts, reflecting upward revisions from analysts, have further fueled investor confidence and contributed to the stock market gains. For example, in Q2 2024 (hypothetical data for illustrative purposes), the technology sector showed a 15% increase in earnings, while the healthcare sector saw a 12% increase. These positive revisions significantly influence investor sentiment and market valuations.

Positive Economic Indicators

Positive economic indicators play a crucial role in driving stock market gains. Strong economic data translates to increased confidence among investors, leading to higher demand for stocks.

- GDP Growth: Robust GDP growth indicates a healthy and expanding economy, boosting investor optimism.

- Employment Figures: Low unemployment rates point to a strong labor market and increased consumer spending, further fueling economic growth.

- Consumer Confidence: High consumer confidence reflects positive consumer sentiment, indicating increased spending and economic activity.

However, it's essential to consider the interplay of factors. While low unemployment is positive, rising inflation rates and potential interest rate hikes by the Federal Reserve can impact market sentiment and potentially moderate stock market gains. For example, a rise in inflation could lead to increased interest rates, which can make borrowing more expensive for businesses and potentially slow down economic growth. Staying informed on these interconnected variables is key to understanding market fluctuations. (Source: [Link to reputable economic data source])

Nasdaq's Rise: The Tech Sector's Driving Force

The Nasdaq Composite, heavily weighted towards technology stocks, has experienced exceptional stock market gains, largely fueled by the tech sector's dynamism.

Technological Advancements and Innovation

Breakthroughs in technology are a primary driver of the Nasdaq's rise. Continuous innovation fuels growth and attracts investment.

- Artificial Intelligence (AI): The rapid advancements in AI, particularly in generative AI, have sparked significant investment in AI-related companies, leading to increased stock valuations.

- Cloud Computing: The ongoing expansion of cloud computing infrastructure and services continues to drive growth for leading cloud providers.

- Big Data and Analytics: The increasing importance of data analysis and processing fuels demand for companies specializing in this area.

Emerging technologies like extended reality (XR), blockchain, and quantum computing hold immense potential for future stock market gains, contributing to the overall positive sentiment surrounding the tech sector. Companies leading these advancements often see significant increases in their stock prices.

Investor Sentiment and Increased Investment in Tech

Investor sentiment plays a pivotal role in shaping the Nasdaq's trajectory. Positive investor sentiment translates into increased investment in tech stocks.

- Increased Venture Capital: Significant flows of venture capital continue to fund innovative tech startups, contributing to higher valuations and further stock market gains.

- Mergers and Acquisitions: Consolidation within the tech sector, through mergers and acquisitions, also contributes to the overall growth and valuation of companies within the index.

- Positive Media Coverage: Positive news and media coverage surrounding technological breakthroughs and successful tech company launches frequently impact investor sentiment.

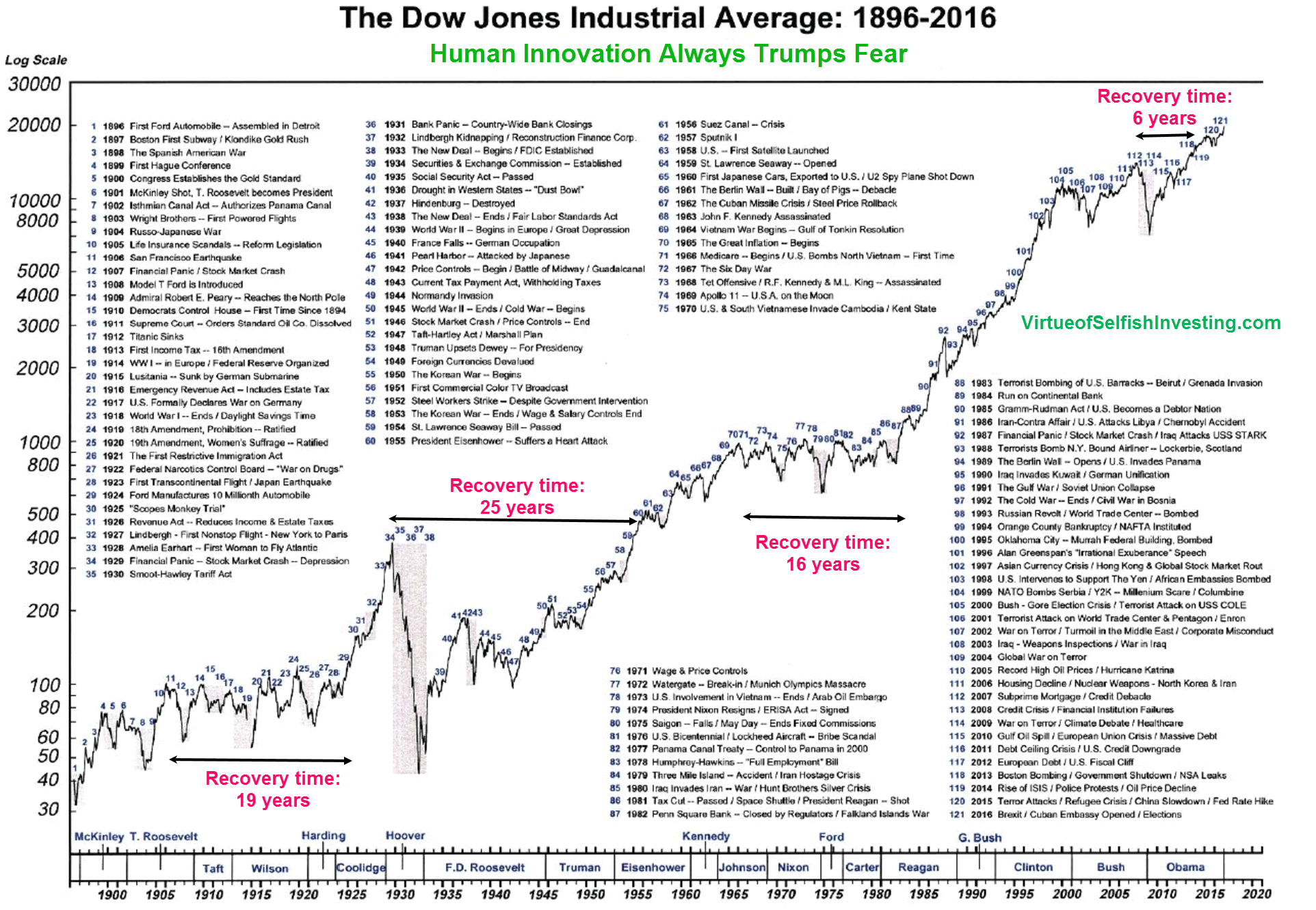

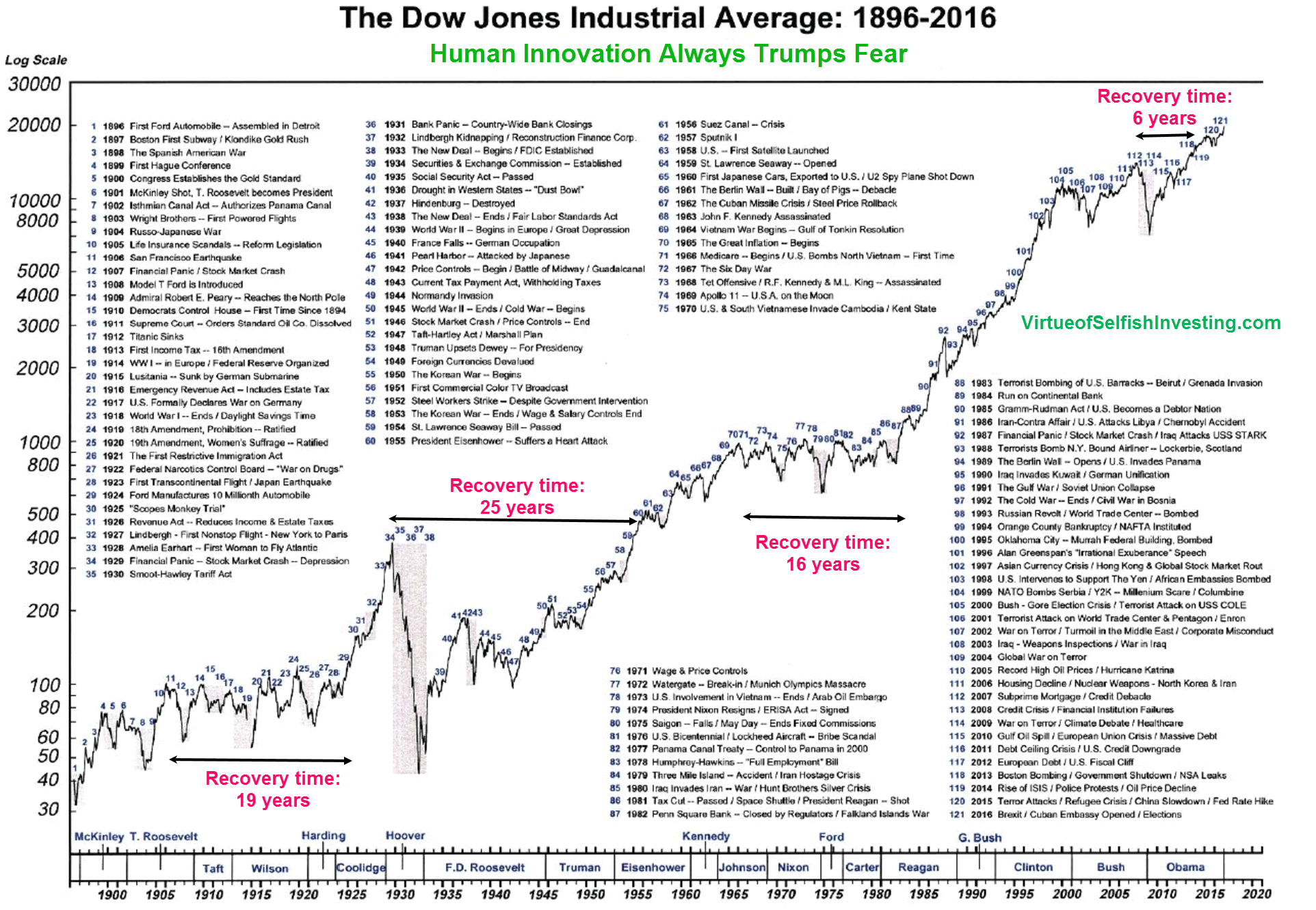

Dow Jones Industrial Average: A Reflection of Broad Market Strength

The Dow Jones Industrial Average, comprising 30 large, publicly owned companies, reflects the overall strength of the broader U.S. market. Its performance provides a valuable perspective on stock market gains across various sectors.

Performance of Dow Jones Components

The performance of individual Dow Jones components significantly impacts the overall index's rise. Strong performance from key companies across different sectors drives the index higher.

- Energy: Companies in the energy sector, benefiting from increased global demand, have contributed strongly to the Dow's gains.

- Industrials: Companies in manufacturing and industrial production have also shown positive growth, reflecting broader economic strength.

- Consumer Goods: Strong consumer spending drives the performance of companies in the consumer goods sector.

Comparing the Dow's performance to other major indices like the S&P 500 and Nasdaq provides a comprehensive view of the overall market trends and the relative strength of different market segments.

Global Economic Factors Influencing the Dow

Global economic factors significantly influence the Dow Jones Industrial Average. International trade, geopolitical stability, and global economic growth all play a crucial role.

- International Trade: Smooth international trade relationships and reduced trade tensions positively impact the performance of multinational companies listed on the Dow.

- Geopolitical Stability: Periods of geopolitical stability reduce uncertainty and foster investor confidence, contributing to stock market gains.

- Global Economic Growth: Strong global economic growth benefits U.S. companies with international operations, driving their stock prices higher.

However, potential risks and uncertainties, such as unexpected geopolitical events, economic downturns, or shifts in global trade policies, can impact investor confidence and potentially moderate future stock market gains.

Conclusion

This article highlighted the significant stock market gains observed in the S&P 500, Nasdaq, and Dow Jones Industrial Average. Contributing factors include strong corporate earnings, positive economic indicators, technological advancements, and positive investor sentiment. Understanding these interconnected factors is crucial for navigating the complexities of the market and making informed investment decisions.

Call to Action: Stay informed about future stock market gains by regularly monitoring economic indicators, company performance, and technological advancements. Understanding these market trends will help you make informed decisions about your investment strategy and maximize your potential for success in the dynamic world of stock market gains. Develop a diversified investment portfolio and consider consulting a financial advisor for personalized guidance.

Featured Posts

-

Understanding The Liberal Party Platform A Voters Guide

Apr 24, 2025

Understanding The Liberal Party Platform A Voters Guide

Apr 24, 2025 -

Alterya Acquired By Blockchain Giant Chainalysis A Strategic Move In Ai

Apr 24, 2025

Alterya Acquired By Blockchain Giant Chainalysis A Strategic Move In Ai

Apr 24, 2025 -

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

Apr 24, 2025

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

Apr 24, 2025 -

Google Fis 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025

Google Fis 35 Month Unlimited Plan A Comprehensive Guide

Apr 24, 2025 -

John Travolta Pogledajte Koliko Je Njegova Kci Ella Odrasla

Apr 24, 2025

John Travolta Pogledajte Koliko Je Njegova Kci Ella Odrasla

Apr 24, 2025