Liberal Spending Habits: A Call For Fiscal Responsibility In Canada

Table of Contents

Analysis of Recent Liberal Spending Initiatives

Liberal governments have implemented various initiatives impacting Canada's fiscal landscape. Analyzing these programs requires a balanced perspective, acknowledging both their positive social impacts and potential long-term economic consequences.

Increased Social Spending

The Liberal government has significantly increased social spending, particularly through programs like the Canada Child Benefit (CCB) and increased healthcare transfers to provinces.

- Positive Social Outcomes: The CCB has been credited with reducing child poverty and improving the financial well-being of families. Increased healthcare transfers aim to improve access to healthcare services across the country.

- Potential Downsides: The increased spending has contributed to the growth of the national debt. Sustaining these levels of spending without corresponding economic growth could strain future budgets and necessitate difficult choices in other areas.

- Data and Examples: Statistics Canada provides data on child poverty rates before and after the implementation of the CCB. Similarly, publicly available federal budget documents detail the amounts transferred to provinces for healthcare. Analyzing these data sets is crucial for a thorough understanding of the impact of increased social spending.

Infrastructure Investments

Significant investments in infrastructure have been a hallmark of recent Liberal governments. These projects aim to modernize Canada's infrastructure and stimulate economic growth.

- Economic Benefits: These investments create jobs in construction and related industries, improve transportation networks, and enhance the overall productivity of the economy. Examples include investments in public transit systems, bridges, and broadband internet access.

- Cost-Effectiveness and Return on Investment: The long-term economic benefits of infrastructure projects need careful evaluation. Factors such as project completion timelines, cost overruns, and the actual economic impact must be considered to determine the true return on investment.

- Examples and Data: The government's infrastructure website details ongoing and completed projects, along with associated budgets and job creation figures. Independent economic impact studies can provide further insight into the cost-effectiveness of these initiatives.

Environmental Initiatives and Spending

The Liberal government has committed significant resources to environmental protection and clean energy initiatives. This includes investments in renewable energy sources, carbon pricing mechanisms, and environmental protection programs.

- Environmental Impact and Long-Term Benefits: These initiatives aim to reduce greenhouse gas emissions, protect biodiversity, and transition towards a more sustainable economy. The long-term benefits include cleaner air and water, mitigating the effects of climate change, and fostering a greener economy.

- Cost-Effectiveness and Return on Investment: The cost-effectiveness of environmental programs is a subject of ongoing debate. While the long-term benefits of a healthier environment are significant, the immediate costs can be substantial. Careful analysis is needed to ensure these investments deliver a strong return.

- Examples and Data: Specific programs include investments in renewable energy projects (e.g., wind farms, solar energy), carbon tax revenue allocation, and funding for environmental conservation initiatives. Government reports and independent analyses provide data on the environmental impact and economic costs of these programs.

The National Debt and its Implications

The increasing national debt under Liberal governments is a significant concern for many Canadians. Understanding the factors contributing to the debt growth and its long-term implications is crucial.

Growth of the National Debt under Liberal Governments

Data from the Bank of Canada and the federal government clearly illustrate the growth of Canada's national debt during recent Liberal administrations.

- Comparison to Previous Governments: It's important to compare the rate of debt growth under Liberal governments to that of previous administrations to establish a clearer context. Economic factors specific to each period must be considered.

- Contributing Factors: Several factors contribute to the debt increase, including economic downturns (like the COVID-19 pandemic), increased government spending on social programs and infrastructure, and interest payments on the existing debt.

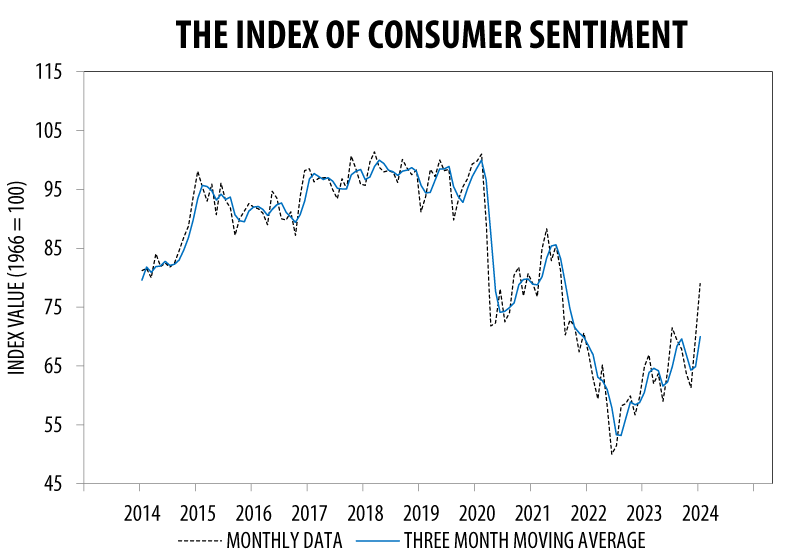

- Data and Charts: Visual representations, such as charts and graphs, can effectively illustrate the growth of the national debt over time. Data sources include the Bank of Canada and the Department of Finance Canada.

The Long-Term Consequences of High Debt

A high national debt poses several risks to Canada's long-term economic prospects.

- Potential Risks: These risks include higher interest rates, reduced economic growth, and increased competition for investment capital. A high debt-to-GDP ratio can negatively impact the country's credit rating.

- Impact on Future Generations: A substantial portion of future government revenue will be dedicated to servicing the national debt, potentially limiting resources available for other essential services and investments.

- Solutions: Strategies for managing the debt include controlled spending, economic growth initiatives to increase tax revenues, and careful consideration of the long-term implications of borrowing.

Calls for Fiscal Responsibility and Alternative Approaches

Addressing the concerns surrounding Liberal spending habits requires a commitment to fiscal responsibility and the exploration of alternative approaches.

Strategies for Reducing Government Spending

Several strategies could be implemented to reduce government spending while still addressing crucial social and economic needs.

- Spending Cuts and Efficiency Improvements: Identifying areas for spending cuts requires careful consideration of the potential impact on essential services. Implementing measures to improve efficiency in government operations can also lead to significant savings.

- Fiscal Policy Options: Various fiscal policy options can be considered, including adjusting tax rates, implementing targeted spending cuts, or exploring alternative funding mechanisms for specific programs.

- Examples of Cost-Saving Measures: Examples include streamlining government operations, reducing administrative costs, and improving procurement processes. The feasibility and effectiveness of each measure require thorough analysis.

The Importance of Transparency and Accountability

Increased transparency and accountability in government spending are crucial for building public trust and ensuring responsible use of taxpayer funds.

- Improving Transparency: The government should provide more detailed and readily accessible information on its spending, allowing citizens to understand how their tax dollars are being used.

- Enhancing Accountability: Mechanisms for holding the government accountable for its spending decisions need strengthening. This includes independent audits and oversight bodies.

- Recommendations: Recommendations include strengthening independent oversight bodies, implementing stricter guidelines for government procurement, and improving data transparency.

Conclusion

This examination of Liberal spending habits in Canada reveals a complex picture. While investments in social programs and infrastructure have yielded positive outcomes, the rising national debt necessitates a renewed focus on fiscal responsibility. To secure Canada’s economic future, a balanced approach is crucial, combining necessary social investments with strategic spending cuts and enhanced transparency and accountability. The ongoing debate over Liberal spending habits demands informed discussion and responsible policy decisions to ensure a sustainable economic path for all Canadians. Let's demand greater fiscal responsibility from our government and hold them accountable for their spending choices. We need to move beyond simply criticizing Liberal spending habits and engage in a constructive dialogue about sustainable and responsible fiscal policy for Canada.

Featured Posts

-

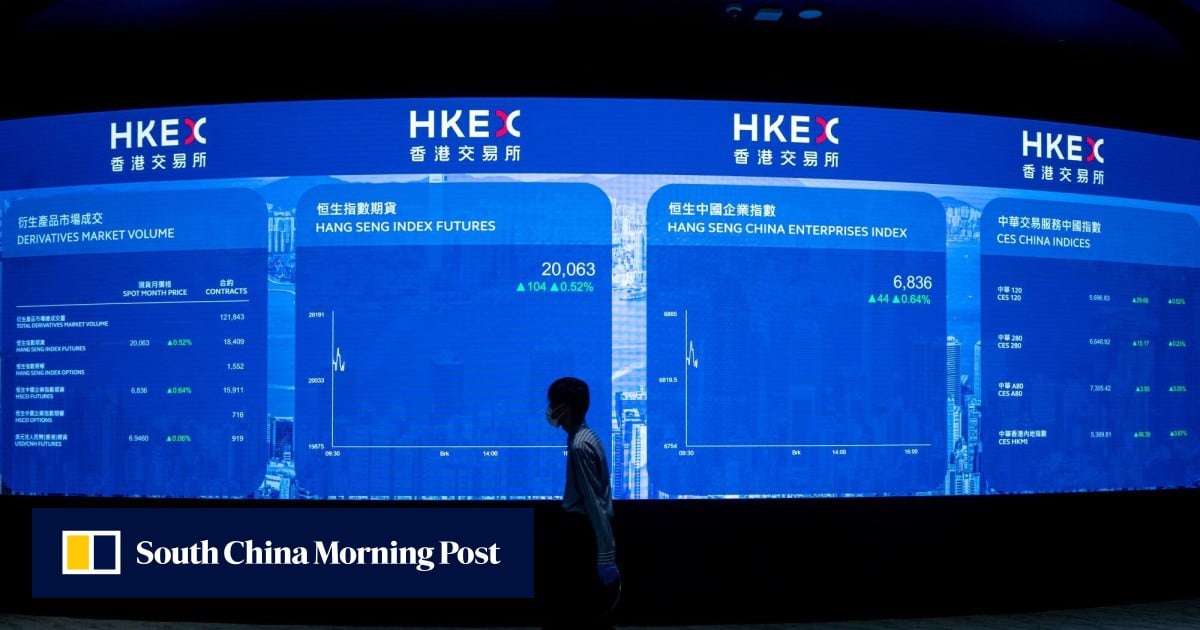

Easing Trade Tensions Boost Chinese Stocks Listed In Hong Kong

Apr 24, 2025

Easing Trade Tensions Boost Chinese Stocks Listed In Hong Kong

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Score A Statistical Analysis

Apr 24, 2025

John Travoltas Rotten Tomatoes Score A Statistical Analysis

Apr 24, 2025 -

Private Credit Jobs 5 Dos And Don Ts For Career Success

Apr 24, 2025

Private Credit Jobs 5 Dos And Don Ts For Career Success

Apr 24, 2025 -

Positive Market Sentiment In India The Niftys Strong Performance Explained

Apr 24, 2025

Positive Market Sentiment In India The Niftys Strong Performance Explained

Apr 24, 2025 -

Wednesday April 9 The Bold And The Beautiful Recap Bill Finn And Liams Impact On Steffy

Apr 24, 2025

Wednesday April 9 The Bold And The Beautiful Recap Bill Finn And Liams Impact On Steffy

Apr 24, 2025