Easing Trade Tensions Boost Chinese Stocks Listed In Hong Kong

Table of Contents

Reduced Trade Uncertainty Fuels Investment Confidence

Decreased trade war anxieties are a primary catalyst for the surge in investment confidence surrounding Hong Kong-listed Chinese companies. This reduced economic uncertainty has several key effects:

-

Increased Foreign Investment: The lessening of US-China trade tensions has significantly improved investor sentiment, encouraging greater foreign investment flows into Hong Kong. Investors are less hesitant to allocate capital to Chinese assets, seeing reduced risk compared to periods of heightened trade disputes. This influx of capital directly boosts stock prices.

-

Boosted Consumer and Business Confidence: Reduced trade uncertainty translates to increased consumer and business confidence within China itself. Businesses are more willing to invest and expand, while consumers feel more secure about their economic future, leading to increased spending and overall economic growth, which positively impacts the performance of many listed companies.

-

Improved Market Sentiment: A positive feedback loop is created: easing trade tensions lead to improved market sentiment, further attracting investment, which in turn pushes stock prices higher. This positive cycle is visible across various sectors within the Hong Kong market.

-

Reduced Risk Aversion: Investors are less risk-averse when trade tensions are low. They're more inclined to allocate capital to potentially higher-growth markets, such as those represented by Chinese stocks listed in Hong Kong, contributing to a rise in market capitalization.

Specific Sectors Benefitting from Eased Tensions

While the entire Hong Kong market benefits, some sectors experience disproportionately significant growth due to eased trade tensions.

-

Technology Stocks: Chinese technology companies listed in Hong Kong are particularly sensitive to US-China relations. Easing trade tensions allows these companies to access global markets more easily, fostering innovation and driving growth. Companies like Tencent and Alibaba, major players in the Hong Kong market, have seen significant stock price increases.

-

Consumer Goods: Increased consumer confidence in China directly benefits the consumer goods sector. Companies producing and distributing goods for domestic consumption within China witness a boost in sales and profits, reflected in their stock valuations.

-

Financial Stocks: The improved economic outlook boosts the performance of financial institutions. Increased investment activity and business lending lead to higher profits for banks and other financial services companies listed on the HKEX.

-

Real Estate: While influenced by various factors, the real estate sector also sees a positive impact from easing trade tensions, thanks to the improved overall economic climate and increased business activity.

These sectors represent substantial investment opportunities, but thorough market analysis and due diligence remain vital before committing capital.

Navigating the Hong Kong Market: Opportunities and Challenges

The current market conditions in Hong Kong present both significant opportunities and inherent challenges for investors interested in Chinese stocks.

-

Investment Opportunities: The current positive market sentiment provides a window of opportunity for substantial returns, particularly within the sectors mentioned above.

-

Investment Risks: Geopolitical risks remain, including potential future trade disputes or other unforeseen international events that could impact market sentiment. Regulatory changes within both China and Hong Kong also pose potential challenges.

-

Investment Strategies: A diversified investment approach, combining long-term and short-term strategies, is recommended. Careful risk management, including setting stop-loss orders and diversifying your portfolio across various sectors and companies, is essential.

-

Due Diligence: Thorough due diligence is crucial before making any investment decision. This involves comprehensive research into the financial health and future prospects of each company you consider, understanding the associated risks and potential rewards.

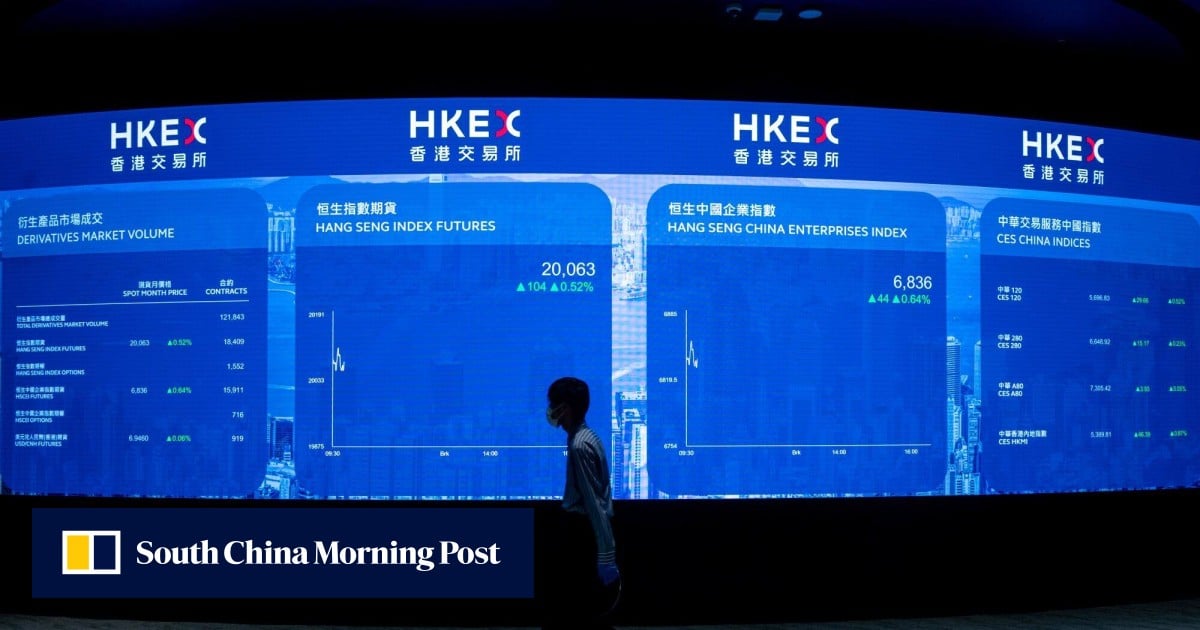

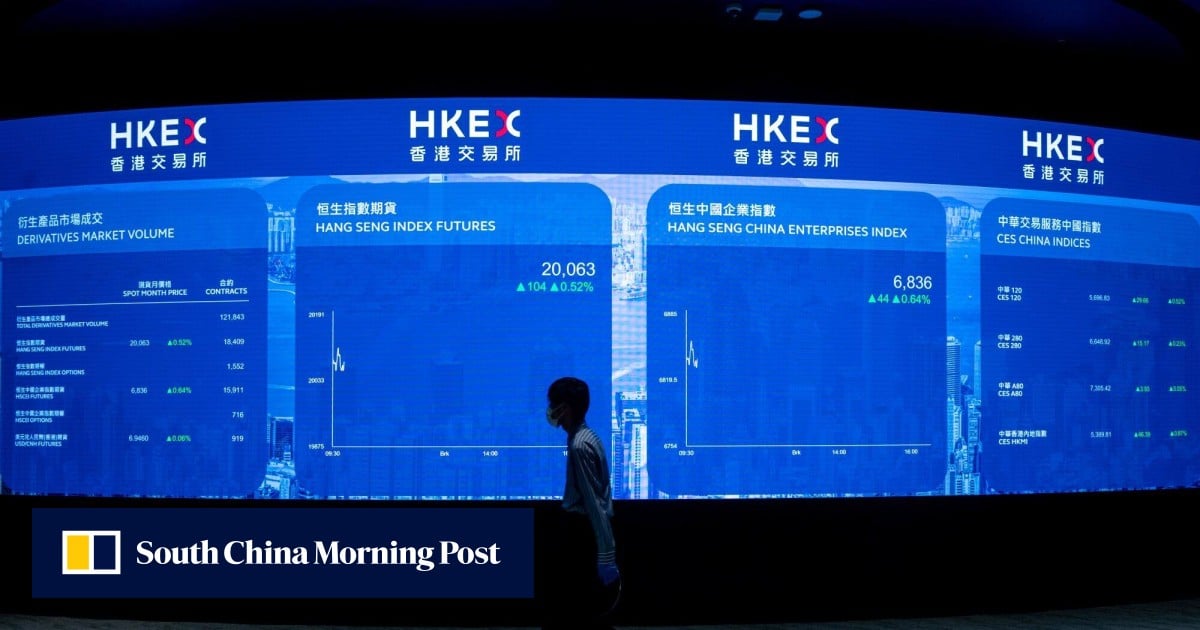

The Role of the Hong Kong Stock Exchange

The HKEX plays a vital role in facilitating investment in Chinese companies.

-

Attracting Foreign Investment: The HKEX's robust regulatory framework and established infrastructure make it an attractive venue for Chinese companies seeking international capital. Its established liquidity and international recognition provide confidence to foreign investors.

-

Listing Requirements: The HKEX's listing requirements ensure a certain standard of transparency and accountability, making it a more reliable market for international investors compared to some other exchanges.

-

Market Liquidity: High trading volumes and market liquidity on the HKEX offer investors the ability to buy and sell stocks easily and efficiently.

-

Regulatory Framework: A sound regulatory framework protects investors and maintains market integrity, creating a stable and attractive environment for investment.

Conclusion

The easing of US-China trade tensions has significantly boosted Chinese stocks listed in Hong Kong, creating a period of heightened investment opportunity. While market volatility remains a possibility due to ongoing global uncertainties, the current trend suggests continued growth, particularly in certain sectors. However, investors must employ a well-informed and cautious strategy. Thorough due diligence, diversification, and a well-defined risk management plan are critical for success.

Call to Action: Learn more about navigating the opportunities within the dynamic Hong Kong market for Chinese stocks and capitalize on this exciting period of growth. Invest wisely in Chinese stocks listed in Hong Kong today!

Featured Posts

-

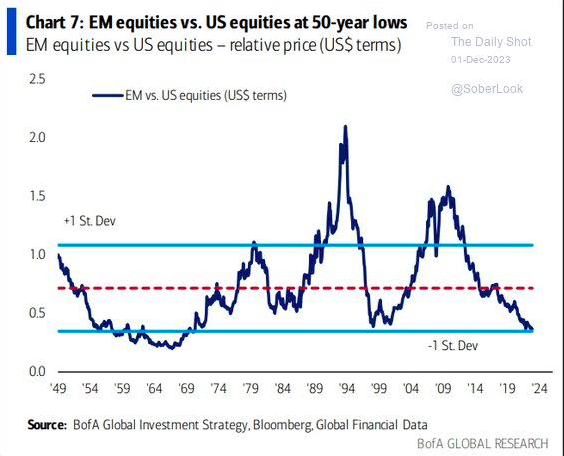

Strong Performance Of Emerging Market Equities Vs Us Decline

Apr 24, 2025

Strong Performance Of Emerging Market Equities Vs Us Decline

Apr 24, 2025 -

B And B Recap April 3 Liams Collapse Following Fallout With Bill

Apr 24, 2025

B And B Recap April 3 Liams Collapse Following Fallout With Bill

Apr 24, 2025 -

John Travolta Honors Late Son Jett Travoltas 33rd Birthday With Poignant Photo

Apr 24, 2025

John Travolta Honors Late Son Jett Travoltas 33rd Birthday With Poignant Photo

Apr 24, 2025 -

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025

Instagrams Latest App A Direct Challenge To Tik Toks Dominance

Apr 24, 2025 -

San Franciscos Anchor Brewing Company Announces Closure

Apr 24, 2025

San Franciscos Anchor Brewing Company Announces Closure

Apr 24, 2025