Is The U.S. Dollar Headed For Its Worst Performance Since Nixon? A 100-Day Analysis.

Table of Contents

Inflation and the U.S. Dollar's Weakening

High inflation consistently erodes the purchasing power of a currency, leading to a depreciating dollar. This is a crucial factor impacting U.S. dollar performance.

The Impact of Persistent Inflation

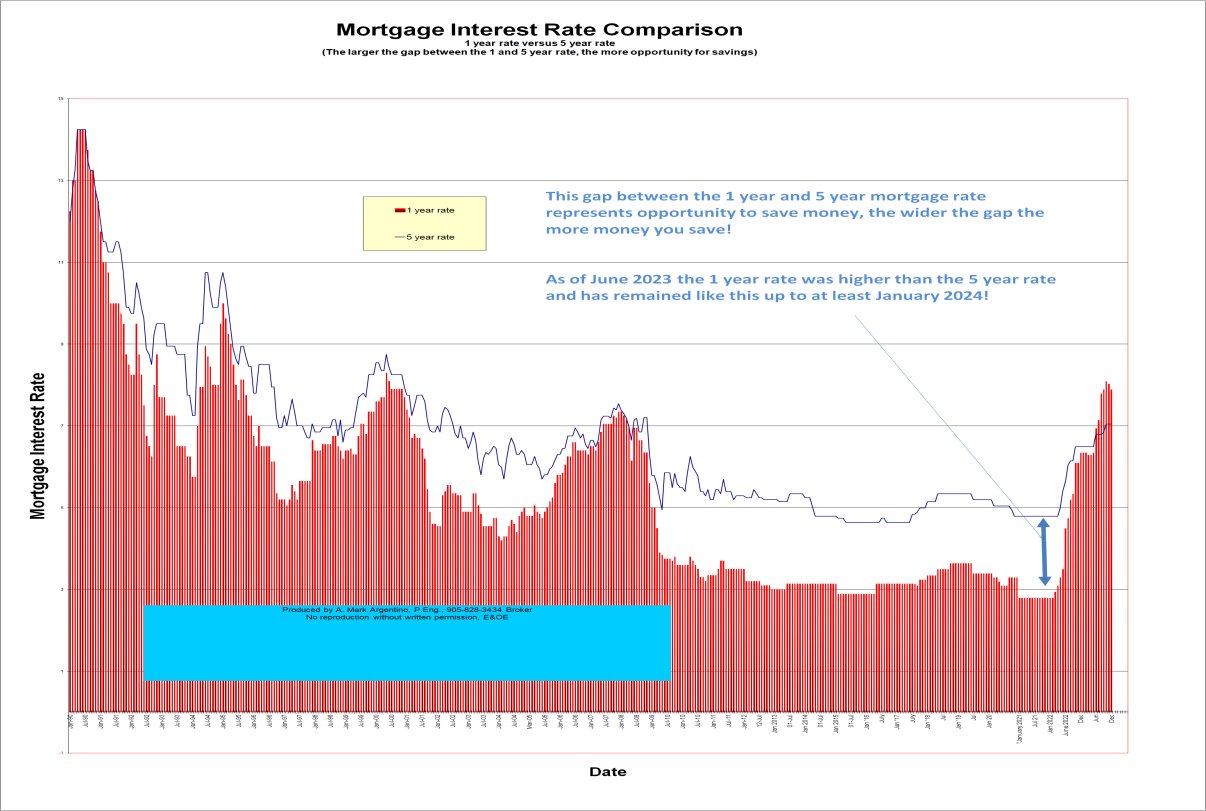

- Rising Interest Rates: The Federal Reserve's attempts to combat inflation through interest rate hikes can inadvertently strengthen the dollar in the short term, attracting foreign investment seeking higher returns. However, excessively high rates can also stifle economic growth, potentially weakening the dollar long-term.

- Consumer Price Index (CPI) Data: Recent CPI data reveals persistently high inflation, exceeding the Federal Reserve's target rate. This sustained inflationary pressure puts downward pressure on the dollar's value.

- Impact on Purchasing Power: High inflation reduces the real value of the dollar, impacting consumers' purchasing power and potentially leading to decreased consumer confidence and economic slowdown, further impacting the dollar's value.

Current inflation rates, while significantly lower than the hyperinflationary periods of the early 1970s preceding the Nixon shock, are still considerably higher than the Federal Reserve's target, raising concerns about sustained pressure on the dollar. [Insert relevant chart/graph illustrating inflation trends].

Federal Reserve Policy and its Influence

The Federal Reserve's monetary policies play a pivotal role in influencing U.S. dollar performance.

- Interest Rate Hikes: Aggressive interest rate hikes aim to curb inflation, but they also risk triggering a recession, weakening the dollar.

- Quantitative Easing (QE): While QE can stimulate the economy, it can also lead to inflation and weaken the dollar's value in the long run by increasing the money supply.

- Impact on Investor Confidence: The Fed's policy decisions significantly influence investor confidence. Uncertain or inconsistent policies can lead to capital flight and a weakened dollar.

Comparing current Fed policy to historical responses to economic crises reveals a similar focus on interest rate adjustments, although the scale and speed of the current interventions are unprecedented in recent decades. The unintended consequences of these policies remain to be seen, heavily impacting the future of U.S. dollar performance.

Geopolitical Factors and the U.S. Dollar

Geopolitical instability significantly influences the dollar's value, especially its role as a safe-haven asset.

The War in Ukraine and Global Uncertainty

The ongoing war in Ukraine has created significant global uncertainty, impacting the U.S. dollar's performance.

- Energy Prices: The war has disrupted global energy markets, leading to soaring energy prices, and fueling inflation, negatively impacting the dollar.

- Supply Chain Disruptions: The conflict has exacerbated existing supply chain disruptions, contributing to inflation and economic uncertainty.

- Flight to Safety: During times of geopolitical instability, investors often flock to the dollar as a safe-haven asset. However, prolonged uncertainty can erode this confidence.

The current global landscape, while undeniably volatile, differs from the early 1970s in several key aspects. The interconnectedness of the global economy means that the impact of geopolitical events on the dollar is more immediate and far-reaching. [Insert relevant data points supporting this analysis].

U.S. Foreign Policy and its Effect on the Dollar

U.S. foreign policy decisions directly influence international confidence in the dollar.

- Trade Wars: Trade disputes and protectionist policies can damage international relations and undermine confidence in the dollar.

- Sanctions: The imposition of sanctions can trigger retaliatory measures and destabilize global markets, impacting the dollar's value.

- International Alliances: Strong international alliances and cooperation can bolster confidence in the dollar as a stable and reliable currency.

Comparing current foreign policy dynamics with those of the Nixon era highlights a shift toward greater interconnectedness and interdependence, making the impact of foreign policy decisions on U.S. dollar performance even more complex. [Include expert opinions and quotes].

Alternative Currencies and the Rise of Multipolarity

The emergence of alternative currencies and the rise of decentralized finance pose a potential challenge to the U.S. dollar's dominance.

The Emergence of the Euro and Other Major Currencies

The Euro and other major currencies are increasingly challenging the dollar's dominance.

- Eurozone Stability: The relative stability of the Eurozone presents a compelling alternative to the dollar for international transactions and reserves.

- Chinese Yuan: The growing internationalization of the Chinese Yuan poses a long-term threat to the dollar's hegemony.

- Other Emerging Market Currencies: The rise of other emerging market currencies further diversifies the global currency landscape.

Data on currency exchange rates and market share indicate a gradual shift in global currency reserves, although the dollar still maintains a significant lead. [Include data on currency exchange rates and market share].

Cryptocurrencies and Decentralized Finance

The growing adoption of cryptocurrencies and decentralized finance (DeFi) could potentially disrupt the traditional financial system and challenge the U.S. dollar's dominance.

- Bitcoin: Bitcoin's status as a decentralized digital currency presents an alternative to traditional fiat currencies.

- Stablecoins: Stablecoins, pegged to the value of the U.S. dollar or other assets, offer a bridge between traditional finance and the crypto world.

- DeFi Protocols: DeFi protocols facilitate peer-to-peer financial transactions without intermediaries, potentially reducing reliance on traditional banking systems and the dollar.

The long-term impact of crypto adoption on the USD is still uncertain. While the current market capitalization of cryptocurrencies is relatively small compared to the global financial system, its potential for disruption should not be underestimated. [Include relevant data on cryptocurrency market capitalization and adoption rates].

Conclusion: Will the U.S. Dollar Experience its Worst Performance Since Nixon? A Final Assessment

Our 100-day analysis reveals a complex interplay of factors impacting U.S. dollar performance. While the current situation doesn't mirror the specific circumstances leading up to the Nixon shock, the confluence of persistent inflation, geopolitical instability, and the rise of alternative currencies presents significant challenges to the dollar's long-term stability. The potential for the U.S. dollar to experience its worst performance since Nixon is real, though not inevitable. Mitigating factors include the dollar's entrenched position as a reserve currency and the potential for the Federal Reserve to effectively manage inflation.

However, sustained high inflation, further geopolitical turmoil, and increased adoption of alternative currencies could significantly weaken the dollar's value. The U.S. dollar outlook remains uncertain, and monitoring key economic indicators, geopolitical events, and the evolution of alternative currencies is crucial. The future of the U.S. dollar hinges on effective policy responses to inflation, adept management of geopolitical risks, and the pace of adoption of alternative financial technologies. Stay informed about the factors affecting the dollar's value; understanding the potential for dollar devaluation is essential for navigating the complexities of the global financial landscape. For more in-depth analysis, explore resources from the Federal Reserve, the International Monetary Fund, and reputable financial news organizations.

Featured Posts

-

Marv Albert Mike Breens Choice For Top Basketball Announcer

Apr 28, 2025

Marv Albert Mike Breens Choice For Top Basketball Announcer

Apr 28, 2025 -

Abu Dhabi Investment Surge 1 1 Billion In Key Projects And A Booming Real Estate Market

Apr 28, 2025

Abu Dhabi Investment Surge 1 1 Billion In Key Projects And A Booming Real Estate Market

Apr 28, 2025 -

The Grim Truth About Retail Sales What It Means For Canadian Interest Rates

Apr 28, 2025

The Grim Truth About Retail Sales What It Means For Canadian Interest Rates

Apr 28, 2025 -

Jack Link 500 Talladega 2025 Prop Bets And Winning Strategies

Apr 28, 2025

Jack Link 500 Talladega 2025 Prop Bets And Winning Strategies

Apr 28, 2025 -

Who Will Replace Tyler O Neill For The Boston Red Sox In 2025

Apr 28, 2025

Who Will Replace Tyler O Neill For The Boston Red Sox In 2025

Apr 28, 2025