Incentivizing Film Production In Minnesota: The Tax Credit Question

Table of Contents

The Current State of Minnesota Film Tax Credits

Structure and Eligibility

Minnesota currently offers a film tax credit program designed to attract film production to the state. However, the program's structure and eligibility criteria are crucial factors affecting its effectiveness. The specifics of the program – including credit amounts, qualifying expenses, and eligible productions – significantly influence its appeal to filmmakers.

- Qualifying Expenses: The Minnesota film tax credit typically covers a range of expenses incurred during production, including:

- Labor costs (cast and crew salaries)

- Location fees

- Equipment rentals

- Post-production services

- Credit Amounts & Thresholds: The program usually sets thresholds for credit amounts, often requiring a minimum level of spending within the state to qualify for the full credit. For example, a production might need to spend $1 million in Minnesota to receive a 20% tax credit. This threshold significantly impacts the attractiveness of the program to smaller productions.

- Eligible Productions: The program generally includes a range of eligible productions such as:

- Feature films

- Television series

- Commercials

- Documentaries

Successes and Shortcomings

While the Minnesota film tax credit program has seen some successes, attracting certain productions and generating some economic activity, it also faces shortcomings that limit its overall effectiveness.

- Successful Productions: [Insert examples of successful productions attracted to Minnesota through the tax credit program, including specifics like the title, production company, and estimated economic impact]. This demonstrates the program's capacity to attract productions and support the industry.

- Job Creation and Economic Impact: [Insert data on job creation and economic impact generated by the film tax credit program. Include sources for data]. These figures help quantify the program's success in stimulating the Minnesota economy.

- Areas for Improvement: The program’s shortcomings could include:

- Insufficient Funding: Limited budget size may restrict the number of productions that can be supported.

- Complex Application Process: A cumbersome application process can deter filmmakers from applying.

- Competition from Other States: More generous incentives offered by neighboring states (such as Wisconsin or Iowa) create significant competition for productions.

Comparing Minnesota's Incentives to Other States

Benchmarking Against Competitors

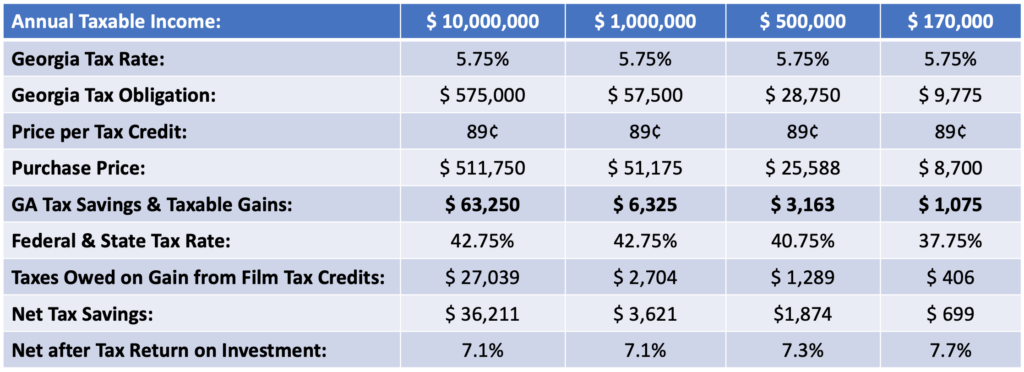

To assess the competitiveness of Minnesota's film tax credit program, a comparison with other states with thriving film industries is crucial. States like Georgia, New York, and California are often cited for their successful programs.

- Comparative Analysis: A detailed comparison should analyze:

- Credit Amounts: The percentage of qualifying expenses covered by the credit varies significantly across states.

- Eligibility Criteria: The requirements for qualifying productions differ, influencing the types of projects attracted.

- Administrative Processes: The ease and efficiency of the application and approval process impact filmmaker participation.

- Impact of Differences: These differences significantly influence the decision-making process for filmmakers, who are naturally drawn to programs offering the most favorable incentives.

The Competitive Landscape

Minnesota's geographical proximity to other states with competitive film incentives creates a challenging competitive landscape.

- Neighboring States' Impact: [Discuss specific examples of states with more generous programs and the impact on Minnesota's ability to attract film productions. Quantify the potential loss of productions]. This section showcases the need for improved incentives to remain competitive.

- Potential Loss of Productions: The lack of a competitive advantage could lead to a significant loss of productions to other states, impacting economic development and job opportunities in Minnesota.

Potential Improvements and Future Directions for Minnesota Film Incentives

Increasing the Credit Amount

Increasing the size of the tax credit could significantly enhance Minnesota's competitiveness, but careful consideration of financial implications is crucial.

- Projected Increase in Film Production Activity: [Provide estimates or projections on how a larger credit amount could lead to increased production activity]. This illustrates the potential return on investment.

- Potential Cost to the State Government: Increasing the credit amount will increase the state's financial commitment. [Provide estimates and explore potential funding mechanisms]. Transparency in cost analysis is vital.

- Return on Investment: Analyzing the potential economic benefits resulting from increased film production activity (e.g., job creation, tourism, revenue generation) is essential to justify the increased cost.

Streamlining the Application Process

Simplifying the application process for film tax credits is key to attracting more productions.

- Reducing Bureaucratic Hurdles: Identify and eliminate unnecessary steps or requirements in the current application process.

- Implementing Online Application Systems: Modernizing the process with an online platform will improve efficiency and transparency.

- Improving Communication and Transparency: Clear communication, readily available guidelines, and prompt responses to inquiries will foster a positive experience for filmmakers.

Targeting Specific Production Types

Tailoring incentives to attract specific production types can diversify the film industry in Minnesota.

- Identifying Niche Markets: Focusing on specific genres (e.g., independent films, documentaries) can attract unique productions and build expertise in specific areas.

- Benefits of Diverse Productions: Attracting a diverse range of productions creates a more robust and resilient film industry.

Conclusion

Competitive film tax credits are vital for attracting film productions to Minnesota and boosting its economy. This analysis highlights the current state of Minnesota's film tax credit program, its successes, and critical areas for improvement. Increasing the credit amount, streamlining the application process, and targeting specific production types are key strategies to enhance competitiveness.

We urge readers to learn more about Minnesota film tax credits and contact their state representatives to advocate for improvements. Strengthening Minnesota's film production incentives is crucial for fostering economic growth and establishing the state as a leading destination for film production. Let's work together to support the growth of the Minnesota film industry through effective and competitive Minnesota film production incentives.

Featured Posts

-

Ayesha Howard Awarded Custody After Paternity Dispute With Anthony Edwards

Apr 29, 2025

Ayesha Howard Awarded Custody After Paternity Dispute With Anthony Edwards

Apr 29, 2025 -

Analyzing The Effectiveness Of Film Tax Credits In Minnesota

Apr 29, 2025

Analyzing The Effectiveness Of Film Tax Credits In Minnesota

Apr 29, 2025 -

Attorney General Issues Transgender Sports Ban Ultimatum To Minnesota

Apr 29, 2025

Attorney General Issues Transgender Sports Ban Ultimatum To Minnesota

Apr 29, 2025 -

160km

Apr 29, 2025

160km

Apr 29, 2025 -

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

Apr 29, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

Apr 29, 2025