Analyzing The Effectiveness Of Film Tax Credits In Minnesota

Table of Contents

Economic Impact Assessment of Minnesota Film Tax Credits

The economic impact of Minnesota film tax credits extends far beyond the immediate film production itself. A thorough assessment requires analyzing job creation, revenue generation, and infrastructure development.

-

Job Creation: Film productions utilizing these credits generate numerous jobs, both directly and indirectly.

- Direct jobs include on-set roles like directors, cinematographers, actors, and crew members.

- Indirect jobs encompass supporting industries such as catering, transportation, hotel services, and equipment rental.

- While precise figures are needed for a comprehensive analysis (and obtaining such data from official reports is crucial), preliminary estimates suggest significant job growth in the film industry since the implementation of the tax credits. Further research comparing employment data before and after the incentive's implementation is needed.

-

Revenue Generation: Increased spending by film productions translates into substantial revenue for the state and local economies.

- Hotels, restaurants, and local businesses experience a surge in revenue as crews and cast members spend money during productions.

- This ripple effect boosts the economy beyond the film industry, benefitting a wide range of businesses and contributing to overall tax revenue. Studies quantifying this increased revenue are needed for a conclusive evaluation.

-

Infrastructure Development: The presence of film tax credits often incentivizes investment in film infrastructure.

- Construction of new studios, soundstages, and post-production facilities attracts larger productions and creates long-term economic benefits.

- This infrastructure investment generates further employment opportunities and positions Minnesota as a more attractive filming location. Identifying specific infrastructure projects directly linked to the tax credits would strengthen this analysis.

Analysis of Film Production Growth Since Tax Credit Implementation

Tracking film production growth in Minnesota before and after the tax credit implementation provides crucial insights into the program's effectiveness.

-

Production Numbers: A clear upward trend in the number of film productions in Minnesota, coupled with increased budget sizes, would indicate success. However, careful analysis is needed to avoid confounding factors. Data must be rigorously collected and compared to production numbers in neighboring states with and without similar incentives.

-

Types of Productions: The program’s success should be measured not only by quantity but also by quality.

- Attracting high-budget feature films and television series signifies a stronger impact on the economy compared to a large number of smaller productions.

- A diverse range of productions, from independent films to large-scale studio projects, signifies the program’s broad appeal and ability to support different scales of filmmaking.

-

Geographic Distribution: Analyzing geographic distribution helps determine whether the credits have stimulated growth across the entire state or primarily in specific areas.

- Data on where productions are taking place allows for evaluation of the program's overall impact, and identifying areas that could benefit from additional, targeted incentives.

Evaluating the Cost-Effectiveness of Minnesota Film Tax Credits

A critical aspect of evaluating the Minnesota film tax credits is determining their cost-effectiveness.

-

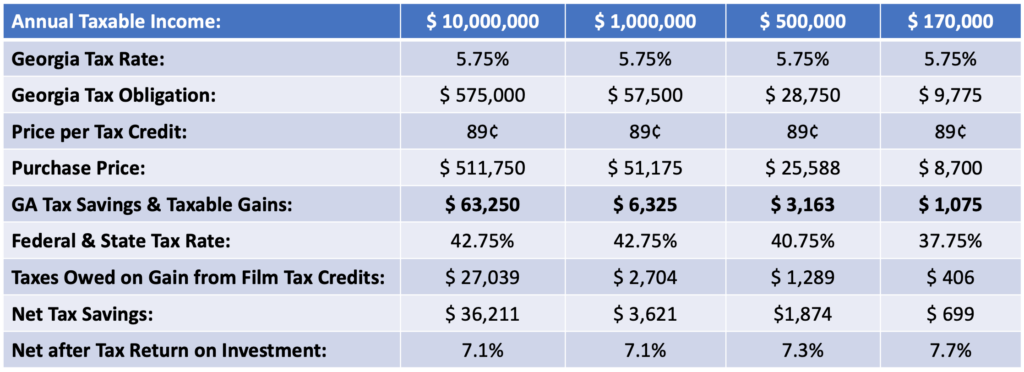

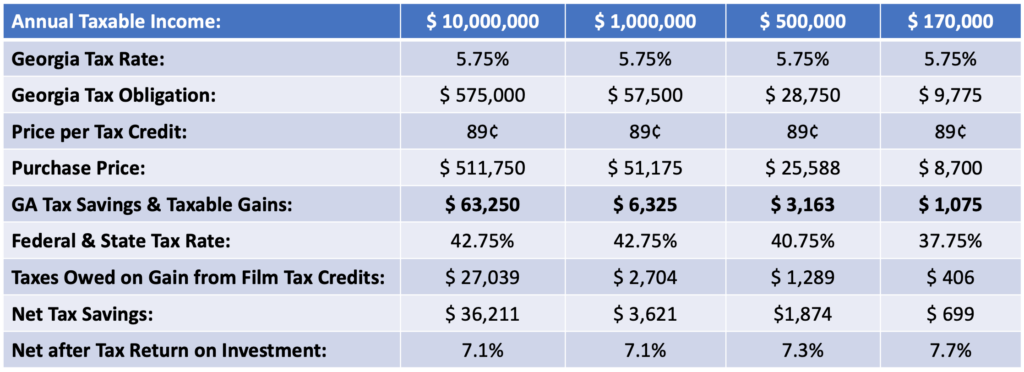

Return on Investment (ROI): A thorough cost-benefit analysis is needed to calculate the ROI of the program. This requires comparing the total amount of tax credits disbursed to the economic benefits generated, such as job creation and revenue increases. Benchmarking this ROI against other states is essential for evaluating the program's efficiency.

-

Loophole Identification: Analyzing the program for potential loopholes and inefficiencies is crucial. Identifying areas where the tax credits might be misused or not maximizing their impact could lead to better policy adjustments.

-

Equitable Distribution: The analysis should also examine the distribution of tax credit benefits among different-sized productions. Ensuring equitable distribution and assessing whether smaller productions or those outside major cities are receiving sufficient support is a crucial part of evaluating effectiveness.

Comparison with Other States' Film Tax Credit Programs

Benchmarking Minnesota's program against other successful film incentive programs in other states allows for a comparative analysis.

-

Comparative Analysis: Analyzing the tax credit rates, eligibility criteria, and overall program structures of successful programs in other states offers valuable insights into best practices.

-

Areas for Improvement: Identifying the strengths and weaknesses of Minnesota’s program against those in other states provides actionable recommendations. For instance, adjustments to eligibility criteria or the types of productions incentivized may improve the overall effectiveness of the program.

Conclusion: The Future of Film Tax Credits in Minnesota

This analysis has highlighted both the positive and negative aspects of the Film Tax Credits in Minnesota program. While the program demonstrates potential to stimulate economic activity and job creation, more rigorous data collection and analysis are necessary to fully understand its ROI and long-term impact. Continued evaluation is vital for informed policy decisions that ensure the program achieves its intended objectives. We urge readers to engage in further discussions regarding Minnesota film tax credits and advocate for improvements based on the findings presented here. Contact your state representatives and participate in industry discussions to help shape a future where the program effectively supports the growth and vibrancy of Minnesota's film industry. The potential for the Minnesota film industry is significant, and effective film tax credits will be crucial in its continued success.

Featured Posts

-

Tylor Megill And The Mets Analyzing His Effective Pitching Techniques

Apr 29, 2025

Tylor Megill And The Mets Analyzing His Effective Pitching Techniques

Apr 29, 2025 -

Anthony Edwards Injury Update Will He Play In Timberwolves Lakers Game

Apr 29, 2025

Anthony Edwards Injury Update Will He Play In Timberwolves Lakers Game

Apr 29, 2025 -

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

Apr 29, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

Apr 29, 2025 -

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025 -

Do Film Tax Credits Work A Minnesota Case Study

Apr 29, 2025

Do Film Tax Credits Work A Minnesota Case Study

Apr 29, 2025