Are Stretched Stock Market Valuations A Worry? BofA Weighs In

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's stock market outlook often relies on a comprehensive analysis of various valuation metrics. Their recent reports have highlighted concerns regarding stretched valuations across several sectors. While specific numbers fluctuate, their analysis typically incorporates key metrics such as the price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and market capitalization to assess whether current prices accurately reflect underlying company performance and future growth potential. These valuations are then compared to historical averages and industry benchmarks to gauge whether overvaluation or undervaluation exists.

- BofA's stated concerns regarding specific sectors showing high valuations: Reports may cite technology, consumer discretionary, and certain growth sectors as exhibiting particularly high P/E ratios compared to historical norms. This suggests a potential premium priced into these sectors based on future growth expectations.

- Key valuation metrics used in BofA's analysis: BofA utilizes a blend of absolute and relative valuation metrics. Absolute metrics, like discounted cash flow (DCF) analysis, attempt to find intrinsic value, while relative metrics like P/E ratios compare the company to its peers.

- Comparison of current valuations to historical data: BofA's analysis often reveals that current valuations in certain sectors are significantly above their long-term historical averages, indicating a potentially elevated level of risk.

- Any specific warnings or cautions issued by BofA: BofA's analysts regularly caution investors about the inherent risks associated with investing in a highly valued market, emphasizing the potential for a market correction.

Factors Contributing to Stretched Stock Market Valuations

Several macroeconomic factors contribute to the current environment of stretched stock market valuations. Understanding these factors is crucial for investors seeking to make informed decisions.

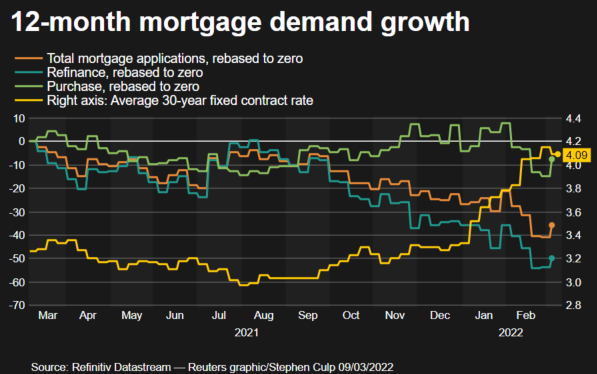

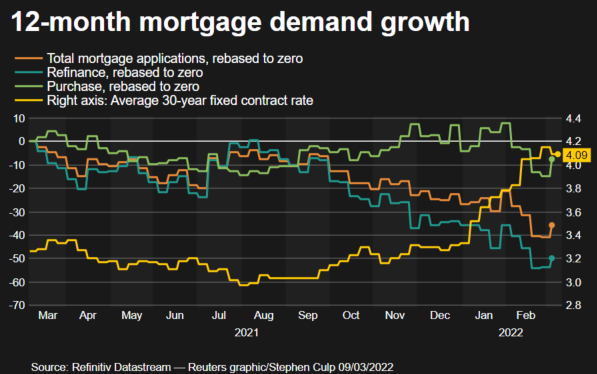

- Impact of low interest rates on investor behavior and stock prices: Low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks, thus increasing demand and potentially driving up prices beyond fundamental values.

- Role of quantitative easing in boosting market liquidity: Quantitative easing (QE) programs inject liquidity into the market, further fueling demand and potentially contributing to inflated asset prices.

- Influence of inflation expectations on valuations: Anticipation of future inflation can influence valuations as investors adjust their expectations for future earnings and discount rates. High inflation expectations can lead to increased demand for assets perceived as hedges against inflation.

- Contribution of technological advancements to specific sector valuations: Rapid technological advancements, particularly in sectors like technology and biotechnology, can drive significant growth and lead to higher valuations, even if current profitability is limited.

Potential Risks Associated with High Valuations

Investing in a market with stretched stock market valuations carries inherent risks. While potential rewards exist, it's crucial to acknowledge and plan for potential downsides.

- Increased vulnerability to negative news or economic shocks: Overvalued markets tend to be more susceptible to sharp corrections when unexpected negative news or economic downturns occur.

- Potential for significant capital losses if valuations revert to the mean: If valuations revert to historical averages, investors holding overvalued assets could experience significant capital losses.

- Importance of diversification to mitigate risk: Diversifying a portfolio across different asset classes and sectors can help reduce the impact of a market correction in any single sector.

- Strategies for managing risk in a high-valuation market: Strategies for risk management include reducing overall equity exposure, increasing allocation to defensive assets, and employing stop-loss orders to limit potential losses.

BofA's Recommendations and Investment Strategies

BofA's recommendations typically emphasize a cautious approach given the current market conditions. Their suggestions for investors vary depending on individual risk tolerance and investment timelines.

- Suggested asset allocation for different risk tolerance levels: Investors with higher risk tolerance might maintain a higher equity allocation, while more conservative investors might shift towards a larger allocation to fixed-income instruments.

- Recommended sectors or investment styles (e.g., value investing, growth investing): BofA might advocate for a more balanced approach, favoring value stocks over highly priced growth stocks in the current environment.

- Advice regarding diversification and risk management: Diversification and strategic risk management remain crucial components of any investment strategy in a high-valuation market.

- BofA's long-term outlook for the stock market: BofA's long-term outlook for the stock market often depends on various economic forecasts and their interpretations of future market conditions.

Conclusion

BofA's assessment of stretched stock market valuations highlights potential risks associated with the current market conditions. While opportunities may still exist, a cautious and diversified approach is often recommended. Their analysis emphasizes the need for careful consideration of valuation metrics, macroeconomic factors, and individual risk tolerance. While BofA's analysis provides valuable insights into the current market situation, remember that investing always involves risk. Carefully consider your own risk tolerance and investment goals before making any decisions regarding your portfolio. Conduct thorough research and, if needed, consult with a financial advisor to develop a comprehensive investment strategy that addresses concerns about stretched stock market valuations. Stay informed about market trends and continue monitoring for updates on stock market valuation.

Featured Posts

-

Chronology Of The Karen Read Murder Trials

Apr 26, 2025

Chronology Of The Karen Read Murder Trials

Apr 26, 2025 -

Ceos Sound Alarm Trump Tariffs Harm Economy Frighten Consumers

Apr 26, 2025

Ceos Sound Alarm Trump Tariffs Harm Economy Frighten Consumers

Apr 26, 2025 -

Ai Digest Transforming Repetitive Documents Into Engaging Podcasts

Apr 26, 2025

Ai Digest Transforming Repetitive Documents Into Engaging Podcasts

Apr 26, 2025 -

Getting My Nintendo Switch 2 Preorder The Game Stop Approach

Apr 26, 2025

Getting My Nintendo Switch 2 Preorder The Game Stop Approach

Apr 26, 2025 -

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025

Latest Posts

-

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025

How Professionals Helped Ariana Grande Achieve Her New Look

Apr 27, 2025 -

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025

The Impact Of Professional Help On Celebrity Image Ariana Grandes Case Study

Apr 27, 2025 -

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025

Hair And Tattoo Transformations Learning From Ariana Grandes Choices

Apr 27, 2025 -

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Bold New Look A Look At Professional Styling And Body Art

Apr 27, 2025 -

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025

Understanding Ariana Grandes Style Changes The Importance Of Professional Guidance

Apr 27, 2025