Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's market outlook considers a multitude of factors influencing the current state of the equity market and the resulting high stock prices. Their assessment takes into account global economic growth, inflation rates, interest rate policies, and geopolitical events, all of which play a significant role in shaping stock market valuations.

-

BofA's Economic Outlook: BofA's recent reports often highlight the ongoing interplay between strong corporate earnings and persistent inflationary pressures. While corporate profits remain robust in certain sectors, sustained inflation raises concerns about future earnings growth and the sustainability of high stock prices. The bank's analysts continually monitor these intertwined forces to project potential shifts in market dynamics.

-

Drivers of High Stock Market Valuations: BofA attributes the current high stock market valuations to a combination of factors, including historically low interest rates (until recently), strong corporate earnings (in select sectors), and continued technological advancements fueling innovation and growth in specific industries. These factors, while positive, also contribute to a potentially inflated market environment.

-

Inflationary Predictions and Impact: BofA’s economists closely monitor inflation trends and their potential impact on stock prices. High inflation erodes purchasing power and can lead to interest rate hikes, which generally negatively affect stock valuations. Their predictions for inflation are crucial in understanding the long-term sustainability of current market levels. Recent reports (cite specific BofA report here if available) indicate [insert BofA's specific prediction on inflation and its potential market impact].

-

Sectoral Analysis: BofA's analysis often highlights specific sectors. They may identify sectors like technology as potentially overvalued due to high growth expectations baked into current prices, while simultaneously pointing to undervalued sectors such as [insert example from BofA research, citing source]. This granular level of analysis helps investors refine their portfolio allocation strategies.

Analyzing Valuation Metrics

Understanding high stock market valuations necessitates the careful application of relevant valuation metrics. BofA, like other financial institutions, utilizes several key metrics to gauge the overall market valuation and identify potential overvaluation or undervaluation.

-

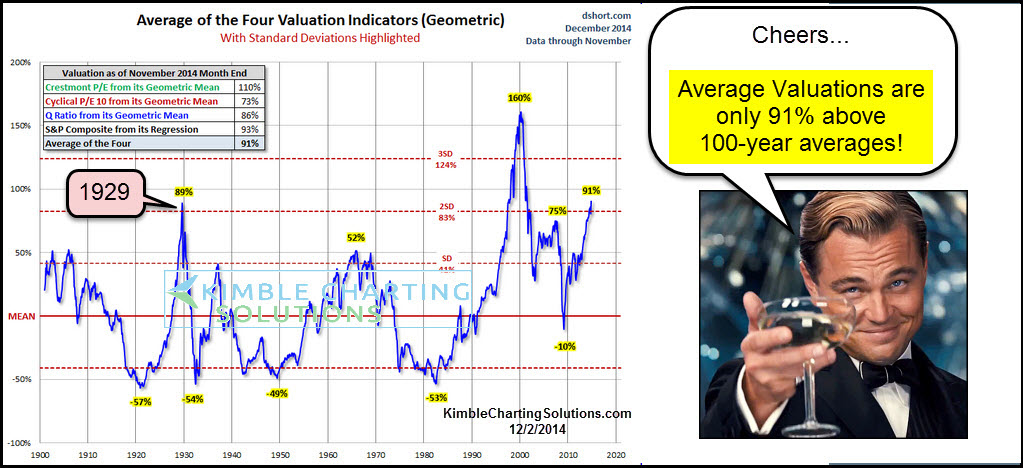

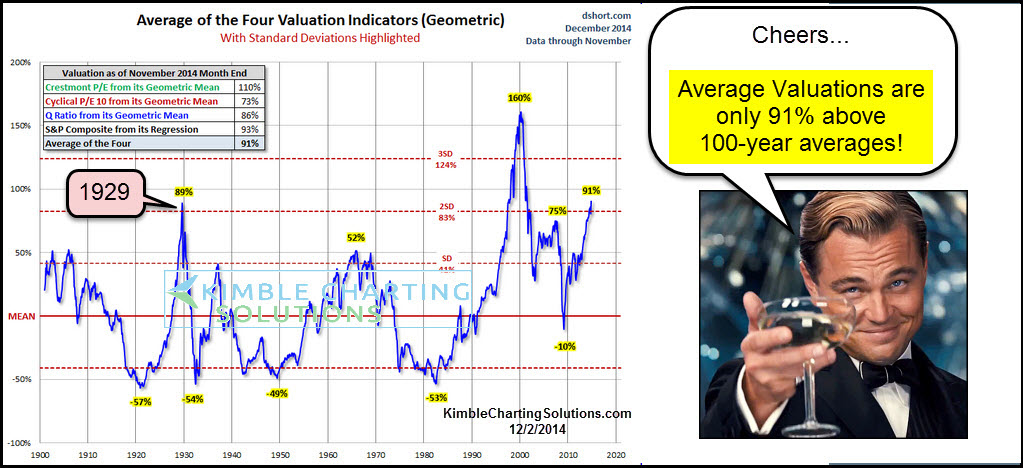

Key Valuation Metrics: Commonly used metrics include the Price-to-Earnings Ratio (P/E), Price-to-Sales Ratio (P/S), and dividend yield. The P/E ratio compares a company's stock price to its earnings per share, providing insights into how much investors are willing to pay for each dollar of earnings. The P/S ratio compares a company's stock price to its revenue, offering another perspective on valuation, particularly useful for companies with limited or negative earnings. Dividend yield reflects the annual dividend payment relative to the stock price.

-

BofA's Use of Valuation Metrics: BofA incorporates these metrics into their comprehensive analysis. They compare current ratios to historical averages and industry benchmarks to identify potential discrepancies and pinpoint overvalued or undervalued assets. They also consider the overall market cap, taking into account the total value of all outstanding shares.

-

Identifying Overvaluation/Undervaluation: High P/E ratios compared to historical averages or industry peers may suggest potential overvaluation. Conversely, low P/E ratios could indicate undervaluation, although it's crucial to analyze the underlying reasons for such discrepancies. Similarly, comparing P/S ratios and dividend yields against historical trends provides additional context.

-

Limitations of Using Metrics in Isolation: It's crucial to understand that using these metrics in isolation can be misleading. A high P/E ratio, for example, might be justified if a company is experiencing rapid growth. Therefore, BofA's analysts utilize a holistic approach, considering these metrics in conjunction with other qualitative factors like financial health, industry trends, and competitive landscape. [Include a hypothetical chart or graph illustrating P/E ratios over time if possible, citing source].

Strategies for Navigating High Stock Market Valuations (BofA's perspective)

Navigating a market characterized by high stock market valuations requires a cautious and strategic approach. BofA's recommendations often emphasize the importance of risk management and diversification.

-

BofA's Suggested Strategies: In high-valuation environments, BofA often advises investors to prioritize risk management. This may involve reducing overall equity exposure or shifting toward more defensive investments. They might suggest focusing on companies with strong balance sheets and consistent earnings growth.

-

Diversification and Risk Management: Diversifying across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. A well-diversified portfolio reduces the impact of any single asset's underperformance. BofA's recommendations might include specific asset allocation strategies tailored to individual risk tolerance.

-

Identifying Undervalued Assets: BofA’s research helps investors identify potentially undervalued stocks or sectors by using fundamental analysis, comparing company performance against industry peers and historical trends. This involves analyzing factors such as financial statements, growth prospects, and competitive positioning.

-

Investment Approaches: BofA's insights might suggest different investment strategies depending on the investor's risk profile. Value investing, which focuses on identifying undervalued companies, might be more attractive in a high-valuation market, while a defensive investment strategy prioritizing capital preservation might be preferred by risk-averse investors.

The Role of Interest Rates

Interest rates play a significant role in shaping stock market valuations.

-

Interest Rate Influence: Higher interest rates typically increase borrowing costs for companies, reducing their profitability and potentially leading to lower stock prices. Conversely, lower interest rates stimulate borrowing and investment, boosting company profits and stock prices.

-

BofA's Interest Rate Outlook: BofA's economists provide insights into the future trajectory of interest rates, influencing investor expectations about market performance. Their forecasts of interest rate hikes or cuts significantly impact investment strategies. (Cite a relevant BofA report here if available).

-

Bond Yields and Stock Market Valuations: Bond yields often have an inverse relationship with stock market valuations. Higher bond yields can attract investors seeking safer returns, potentially leading to lower demand for stocks. BofA's analysis considers the interplay between bond yields and stock prices to provide a complete picture of market dynamics.

Conclusion

BofA's perspective on high stock market valuations emphasizes the need for a nuanced and cautious approach. Their assessment considers the interplay of economic indicators, valuation metrics, and interest rate movements. Key takeaways include the importance of understanding the factors driving current high stock prices, employing appropriate valuation metrics, and adopting a diversified investment strategy with robust risk management. By carefully analyzing BofA's insights and integrating them into a well-defined investment plan, investors can better navigate this dynamic market environment and mitigate the risks associated with potentially inflated stock prices. Understanding and managing high stock market valuations requires ongoing monitoring of market trends and a proactive approach to portfolio management. Consult with financial professionals to create a personalized strategy tailored to your risk tolerance and financial goals. Learn more about managing high stock market valuations today!

Featured Posts

-

Cnn Exposes Tik Toks Role In Circumventing Trump Tariffs

Apr 22, 2025

Cnn Exposes Tik Toks Role In Circumventing Trump Tariffs

Apr 22, 2025 -

Analyzing The Pan Nordic Military Strengths Of Sweden And Finland

Apr 22, 2025

Analyzing The Pan Nordic Military Strengths Of Sweden And Finland

Apr 22, 2025 -

San Franciscos Anchor Brewing To Shut Down After 127 Years Of History

Apr 22, 2025

San Franciscos Anchor Brewing To Shut Down After 127 Years Of History

Apr 22, 2025 -

Analyzing The Impact Of Blue Origins Setbacks Compared To Katy Perrys Career Trajectory

Apr 22, 2025

Analyzing The Impact Of Blue Origins Setbacks Compared To Katy Perrys Career Trajectory

Apr 22, 2025 -

The Blue Origin Debacle A Larger Scale Failure Than Katy Perry S

Apr 22, 2025

The Blue Origin Debacle A Larger Scale Failure Than Katy Perry S

Apr 22, 2025