Deloitte Sees Considerable Slowdown In US Economic Growth

Table of Contents

Deloitte's Key Findings and Methodology

Deloitte's analysis is based on a comprehensive research methodology utilizing a wide array of economic indicators and data sources. Their team of economists employs rigorous statistical modeling and incorporates qualitative assessments to arrive at their conclusions. The report meticulously examines key metrics to assess the health of the US economy, including Gross Domestic Product (GDP) growth, consumer spending patterns, and unemployment rates.

The key figures presented in Deloitte's report paint a concerning picture:

- GDP growth projection for 2024: A significant drop from previous projections, potentially falling below [Insert Projected Percentage]% (This needs to be replaced with the actual figure from the Deloitte report).

- Projected decline in consumer spending: A noticeable decrease, potentially impacting various retail sectors and overall economic activity. (Again, replace with the actual percentage from the report).

- Forecasted unemployment rate changes: A potential rise in unemployment, reflecting a weakening labor market. (Insert projected percentage increase from the report).

These figures, supported by rigorous Deloitte research, underscore the seriousness of the predicted economic slowdown and highlight the need for proactive measures. Understanding the key economic indicators is crucial for navigating this challenging period.

Impact on Key Economic Sectors

The predicted US economic slowdown will undoubtedly ripple through various sectors of the economy, with some feeling the impact more acutely than others.

Manufacturing

The manufacturing sector is expected to experience a considerable slowdown in output. This could lead to:

- Decreased production volumes

- Reduced investment in new equipment and technology

- Potential job losses in the manufacturing workforce

The decline in consumer spending will further exacerbate the challenges faced by manufacturers.

Real Estate

The housing market is likely to feel the pressure of rising interest rates and reduced consumer confidence. This could result in:

- A decrease in home sales

- A slowdown in construction activity

- Potential price corrections in certain markets

The real estate sector's performance is closely tied to overall economic health, making it particularly vulnerable during an economic slowdown.

Retail and Consumer Spending

The anticipated decline in consumer spending will have a profound impact on the retail sector. Retailers may face:

- Decreased consumer spending power

- Rise in inventory levels due to reduced demand

- Potential store closures and business failures

Businesses must adapt to shifting consumer behavior and implement strategies to maintain profitability in this challenging environment. Understanding the shifting dynamics of consumer confidence will be crucial for businesses to navigate these changes.

Potential Causes of the Economic Slowdown

Deloitte's prediction of a considerable economic slowdown is attributed to a confluence of factors:

Inflation and Interest Rates

High inflation and the subsequent increases in interest rates by the Federal Reserve are significant contributors. Higher interest rates increase borrowing costs for businesses and consumers, dampening investment and spending.

Global Economic Uncertainty

Global economic uncertainty, fueled by geopolitical instability and ongoing conflicts, is creating a risk-averse environment, reducing investment and impacting global supply chains.

Supply Chain Disruptions

Lingering effects of supply chain disruptions, while somewhat alleviated, continue to contribute to inflationary pressures and constrain economic growth. These disruptions lead to increased costs and reduced availability of goods and services.

Deloitte's Recommendations and Outlook

Deloitte's report offers recommendations for businesses and policymakers to navigate the challenges ahead. These include:

- Implementing proactive business strategies to adapt to reduced consumer demand and rising costs.

- Developing economic policy measures to stimulate economic activity and support affected industries.

Deloitte's outlook suggests a potential short-term dip in economic activity, but the severity and duration depend largely on how effectively the aforementioned challenges are addressed. The longer-term economic recovery depends on effective policy responses and the overall global economic environment. This uncertainty highlights the need for careful planning and strategic decision-making.

Conclusion: Understanding the Deloitte Prediction of US Economic Slowdown

Deloitte's report paints a concerning picture of a considerable US economic slowdown, driven by a combination of high inflation, rising interest rates, global uncertainty, and lingering supply chain issues. The predicted impacts on key economic sectors, including manufacturing, real estate, and retail, could be significant. Understanding the severity of this predicted economic downturn and its potential consequences is paramount for businesses and policymakers alike. Stay informed about the predicted economic downturn by accessing the full Deloitte report. Prepare your business for the anticipated slowdown in US economic growth by reviewing Deloitte's comprehensive analysis.

Featured Posts

-

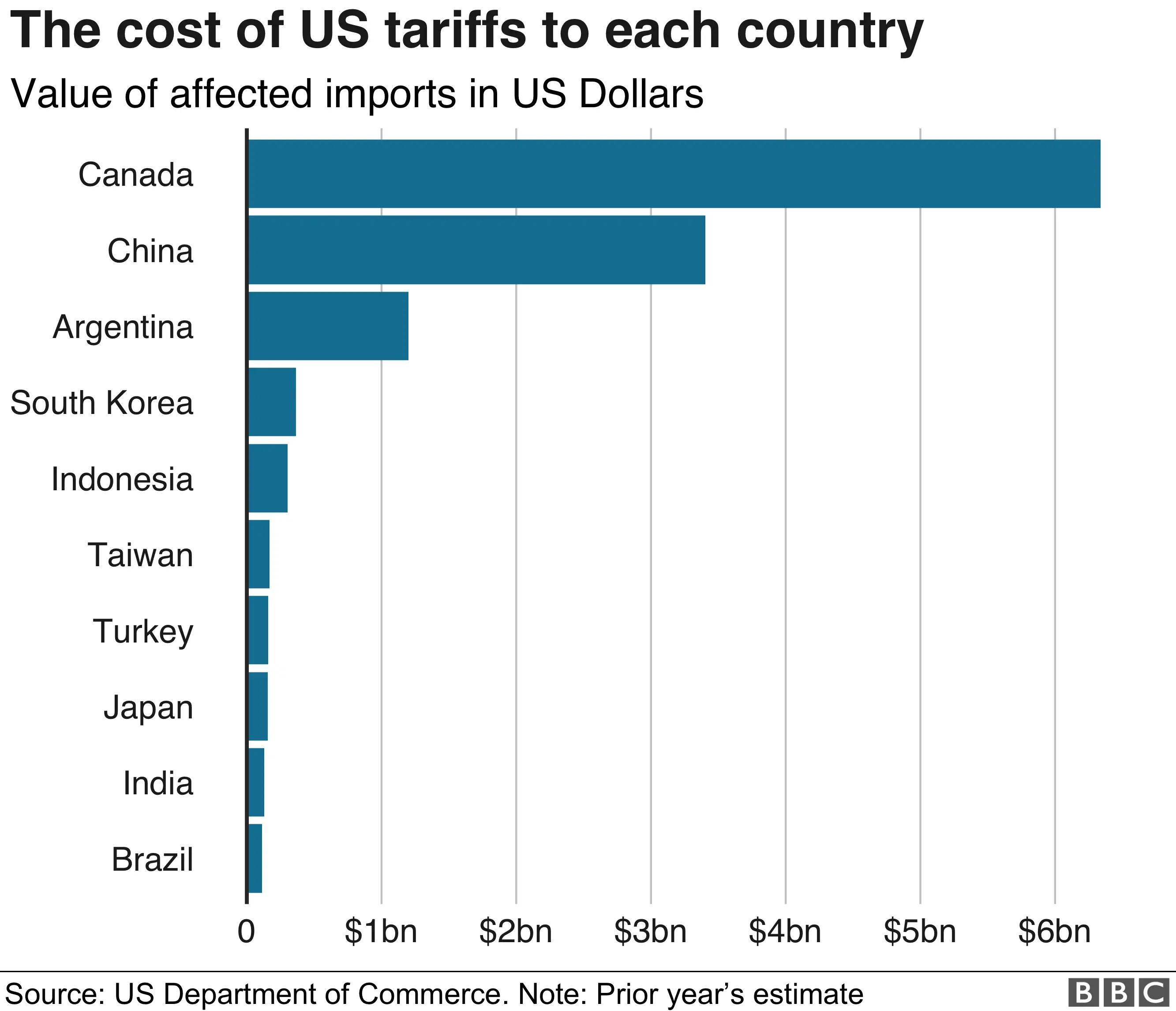

Trumps Tariffs Inevitable Job Losses In Canadas Auto Sector

Apr 27, 2025

Trumps Tariffs Inevitable Job Losses In Canadas Auto Sector

Apr 27, 2025 -

Bundestag Elections And Their Ripple Effect On The Dax Index

Apr 27, 2025

Bundestag Elections And Their Ripple Effect On The Dax Index

Apr 27, 2025 -

Pne Ag Ad Hoc Mitteilung Gemaess Wp Hg 40 Abs 1

Apr 27, 2025

Pne Ag Ad Hoc Mitteilung Gemaess Wp Hg 40 Abs 1

Apr 27, 2025 -

Private Credit Instability Examining The Pre Crisis Cracks Credit Weekly

Apr 27, 2025

Private Credit Instability Examining The Pre Crisis Cracks Credit Weekly

Apr 27, 2025 -

Free Movies And Shows On Kanopy What To Watch Now

Apr 27, 2025

Free Movies And Shows On Kanopy What To Watch Now

Apr 27, 2025