Trump's Tariffs: Inevitable Job Losses In Canada's Auto Sector

Table of Contents

The Direct Impact of Tariffs on Canadian Auto Manufacturing

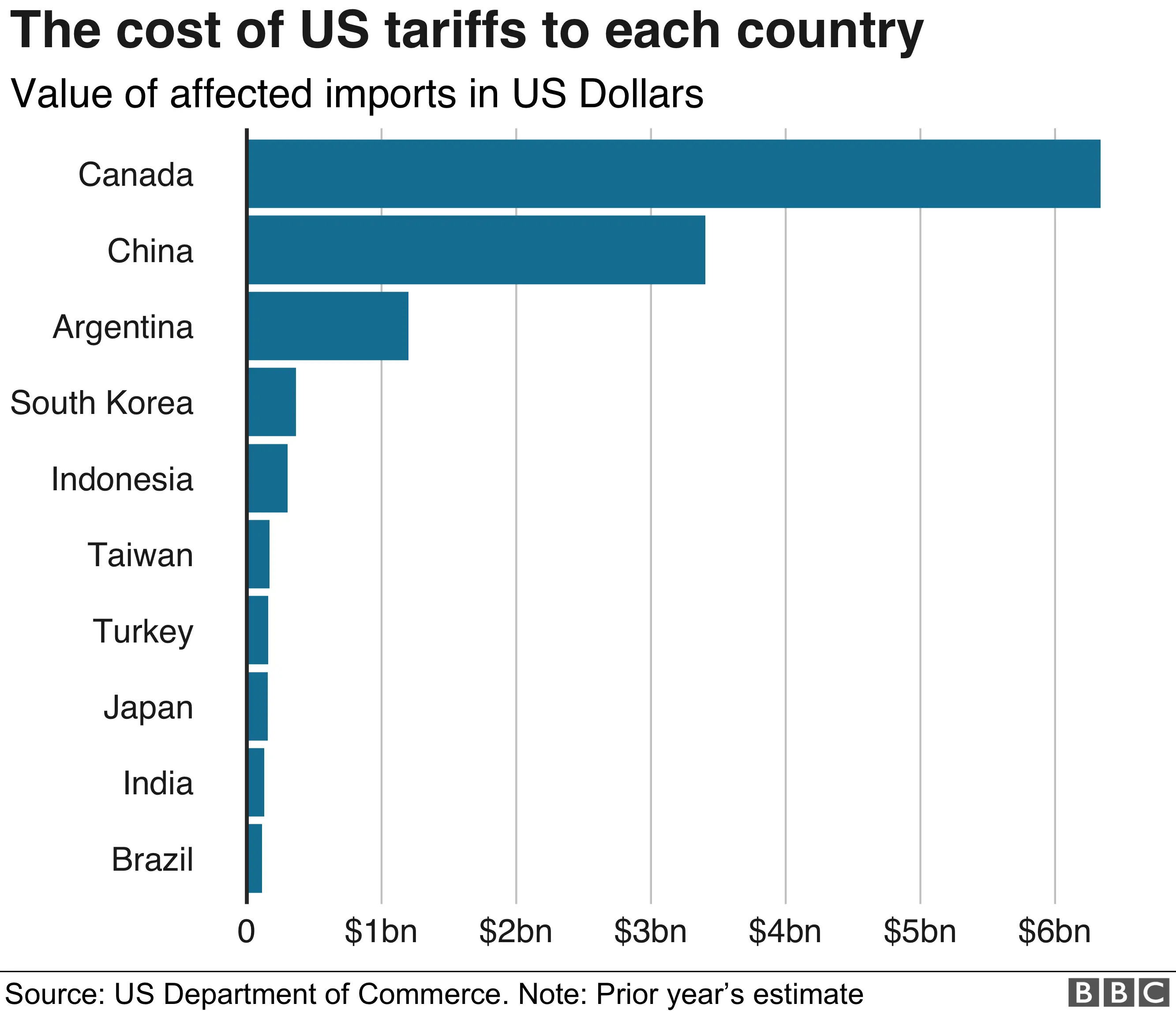

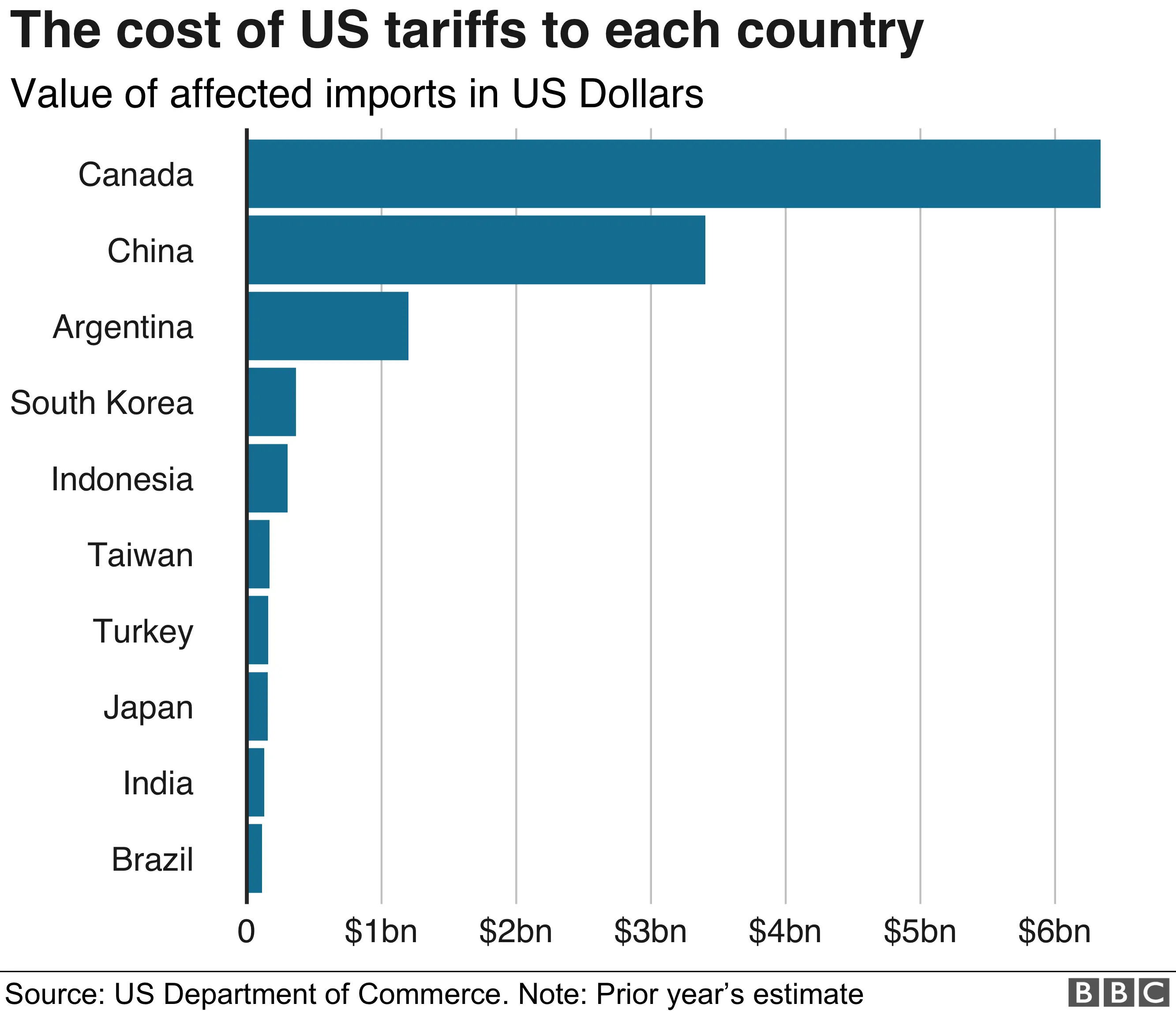

Trump's tariffs directly increased the cost of exporting Canadian-made auto parts and vehicles to the United States, significantly reducing competitiveness and decreasing demand. This had a cascade effect throughout the Canadian auto manufacturing sector.

- Increased production costs: Tariffs added substantial costs to each vehicle or part exported, making Canadian products less attractive compared to those from countries without the same tariff burdens.

- Reduced exports to the United States: The increased cost of exporting led to a sharp decline in shipments to the US, the largest market for Canadian auto manufacturers. This drop in demand forced difficult choices.

- Loss of market share to competitors: Companies in countries unaffected by the tariffs gained a considerable competitive advantage, seizing market share previously held by Canadian manufacturers. This further exacerbated the downward pressure on production.

- Plant closures and production cuts: Facing reduced demand and increased costs, several Canadian auto plants were forced to reduce production or shut down completely, resulting in widespread job losses. The closure of the General Motors plant in Oshawa, Ontario, serves as a stark example of the devastating impact.

- Specific examples: The impact varied regionally. Ontario, a hub for automotive manufacturing, experienced particularly significant job losses, impacting communities heavily reliant on the industry. Precise figures on job losses require in-depth analysis of government data, but numerous reports documented substantial reductions across the sector.

The Ripple Effect: Job Losses Beyond Auto Manufacturing Plants

The job losses in auto manufacturing plants extended far beyond the immediate workforce, creating a ripple effect that impacted numerous related industries. This broader economic fallout significantly amplified the initial blow.

- Job losses in auto parts manufacturing and supply chain companies: Companies supplying parts to auto manufacturers faced decreased demand, leading to layoffs and business closures. This disruption affected the entire supply chain, from raw material suppliers to logistics firms.

- Reduced employment in transportation and logistics sectors: The decline in automotive exports directly impacted the transportation and logistics sectors, reducing demand for trucking, rail, and shipping services. This resulted in further job losses across these vital industries.

- Impact on related service industries: Dealership networks and auto repair shops also felt the pinch. Lower sales and reduced service demands led to staff reductions and financial hardship.

- Decline in consumer spending: Widespread job losses in the automotive sector and related industries resulted in reduced consumer spending, further weakening the overall economy and creating a vicious cycle.

- Regional disparities: The impact was not uniform across Canada. Regions with a higher concentration of automotive-related industries, such as Southwestern Ontario, experienced a more profound and lasting economic impact.

The USMCA and its Failure to Fully Mitigate the Damage

The United States-Mexico-Canada Agreement (USMCA), intended to replace NAFTA, aimed to address some of the challenges posed by Trump's tariffs. However, its effectiveness in mitigating the damage to the Canadian auto sector is debatable.

- USMCA provisions: While the USMCA contained provisions related to the automotive industry, they were not sufficient to completely offset the negative consequences of the previous tariffs. Rules of origin were altered, but the overall impact was less than hoped for.

- Protection from tariffs: The USMCA did offer some level of protection, but it didn't fully eliminate the increased costs associated with exporting to the US market. Canadian manufacturers still faced a competitive disadvantage.

- Mitigation of job losses: While the USMCA might have prevented further job losses, it did little to reverse the damage already done. Many jobs lost due to the tariffs were not recovered.

- Economic indicators: A comparison of pre- and post-USMCA economic indicators in the Canadian automotive sector shows a slow recovery, but the sector has not returned to its pre-tariff levels of production or employment.

- Remaining challenges: Even with the USMCA in place, significant trade barriers and challenges remain, hindering the Canadian auto sector's full recovery and potential for growth.

Long-Term Implications for Canada's Automotive Industry and Workforce

The long-term consequences of the job losses caused by Trump's tariffs are significant, demanding proactive strategies for the future competitiveness of Canada's automotive industry and its workforce.

- Workforce retraining: A significant investment in retraining and upskilling programs is crucial to equip workers displaced from the automotive sector with the skills needed for new jobs in other growing sectors.

- Economic diversification: Reducing reliance on the automotive sector alone is vital for long-term economic stability. Investment in other industries and sectors will ensure a more resilient economy.

- Global competitiveness: The Canadian auto industry needs to adapt and innovate to regain its competitive edge in the global market, focusing on advanced technologies and sustainable practices.

- Governmental support: Government support programs, including financial incentives and investment in research and development, are essential to supporting the industry's transition and recovery.

- Strategies for regaining competitive edge: This requires investment in automation, electric vehicle technology, and other advancements, alongside addressing supply chain vulnerabilities to reduce reliance on any single market.

Conclusion

Trump's tariffs inflicted a devastating blow on Canada's auto sector, leading to significant and lasting job losses. The direct impact on auto manufacturing plants rippled through related industries, causing widespread economic hardship and highlighting the interconnectedness of the Canadian economy. While the USMCA offered some mitigation, it didn't fully reverse the damage. To secure the future of the Canadian automotive industry and its workforce, proactive measures, including workforce retraining, economic diversification, and strategic government support, are urgently needed. We must advocate for policies that foster fair trade, protect Canadian jobs, and prevent future threats to our vital industries – learning from the devastating impact of Trump's tariffs on the Canadian auto sector. Let's work to ensure the long-term health and resilience of our automotive industry.

Featured Posts

-

Perfect Couple Season 2 Confirmed Cast Changes And Source Material Inspiration

Apr 27, 2025

Perfect Couple Season 2 Confirmed Cast Changes And Source Material Inspiration

Apr 27, 2025 -

The Perfect Couple Season 2 New Cast And Source Material Revealed

Apr 27, 2025

The Perfect Couple Season 2 New Cast And Source Material Revealed

Apr 27, 2025 -

Aintree Grand National 2025 Preview Of The Runners And Riders

Apr 27, 2025

Aintree Grand National 2025 Preview Of The Runners And Riders

Apr 27, 2025 -

The Us Economy Under Pressure Assessing The Impact Of The Canadian Travel Boycott

Apr 27, 2025

The Us Economy Under Pressure Assessing The Impact Of The Canadian Travel Boycott

Apr 27, 2025 -

Grand National Deaths And Injuries Of Horses Ahead Of The 2025 Race

Apr 27, 2025

Grand National Deaths And Injuries Of Horses Ahead Of The 2025 Race

Apr 27, 2025