Canada's Fiscal Future: A Vision Of Responsible Spending

Table of Contents

Addressing Canada's Growing National Debt

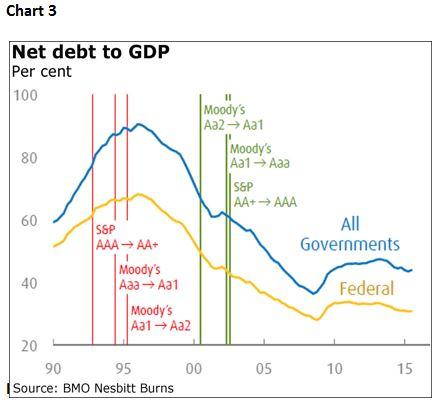

The Current State of Canada's Debt

Canada's national debt, while manageable compared to some countries, is steadily increasing. The current debt-to-GDP ratio, while below many other G7 nations, still presents a considerable challenge. Uncontrolled growth could lead to:

- Higher interest payments, crowding out essential government services.

- Reduced investor confidence in the Canadian economy.

- Increased vulnerability to economic shocks.

- A diminished capacity to respond to future crises.

Strategies for Debt Reduction

Effectively managing and reducing Canada's national debt requires a multi-pronged approach:

- Increased Tax Revenue: Implementing progressive tax reforms, such as closing tax loopholes exploited by high-income earners and corporations, could generate significant revenue. Careful consideration of tax policy's impact on economic growth is crucial.

- Reduced Government Spending: Conducting thorough reviews of government programs to identify inefficiencies and eliminate wasteful spending is vital. This includes prioritizing essential services and streamlining bureaucratic processes.

- Economic Growth Strategies: Investing in infrastructure projects, education, and innovation stimulates economic activity, increasing tax revenue and reducing the debt-to-GDP ratio organically. A focus on sustainable, long-term growth is paramount.

The Role of Fiscal Policy in Debt Management

Fiscal policy, encompassing government spending and taxation, plays a critical role in debt management. Responsible fiscal policy requires a delicate balance between stimulating economic growth and controlling spending to prevent excessive debt accumulation. Strategic investments, as discussed below, are key components of a successful fiscal policy.

Investing in Canada's Long-Term Growth

Infrastructure Development and Economic Impact

Investing in modern and efficient infrastructure is crucial for long-term economic growth. Strategic investments in transportation, energy, and digital infrastructure:

- Create jobs during construction and operation.

- Improve productivity and efficiency across various sectors.

- Attract foreign investment, boosting economic activity.

- Enhance Canada's global competitiveness.

Human Capital Development

Investing in human capital – education, skills training, and healthcare – is a cornerstone of responsible spending. A skilled and healthy workforce is essential for a thriving economy.

- Improved education leads to higher earning potential and increased innovation.

- Accessible and affordable healthcare ensures a productive workforce and reduces long-term healthcare costs.

- Targeted skills training programs address labor market needs and reduce unemployment.

Sustainable Development and Green Initiatives

Addressing climate change requires significant investment in sustainable development and green initiatives. This is not just an environmental imperative but also a strategic economic investment.

- Investing in renewable energy creates jobs and reduces reliance on fossil fuels.

- Green technologies offer economic opportunities and export potential.

- Protecting natural resources ensures long-term economic and environmental sustainability.

Ensuring Transparency and Accountability in Government Spending

Strengthening Oversight Mechanisms

Robust oversight mechanisms are crucial for responsible spending. Independent audits, transparent budget processes, and publicly available financial information are essential for accountability.

- Independent audits ensure that government funds are used efficiently and effectively.

- Transparent budget processes allow citizens to scrutinize government spending decisions.

- Publicly accessible financial information promotes accountability and fosters trust.

Engaging Citizens in Budgetary Processes

Involving citizens in budgetary processes enhances transparency and accountability. Open consultations and public forums allow for informed public discourse on fiscal policy.

- Citizen involvement ensures that government spending reflects the priorities of the population.

- Public engagement fosters a sense of ownership and responsibility regarding public finances.

- Increased transparency leads to more informed and responsible decision-making.

Conclusion: A Path Towards Responsible Spending in Canada's Future

Achieving responsible spending in Canada requires a comprehensive strategy that addresses our national debt, invests in long-term growth, and ensures transparency and accountability. By implementing the strategies discussed – from strategic infrastructure investments to fostering citizen engagement – Canada can build a more sustainable and prosperous future. Learn more about how you can advocate for responsible spending in your community, and demand transparency and accountability from your elected officials regarding Canada's fiscal future. Let's work together to build a fiscally responsible Canada.

Featured Posts

-

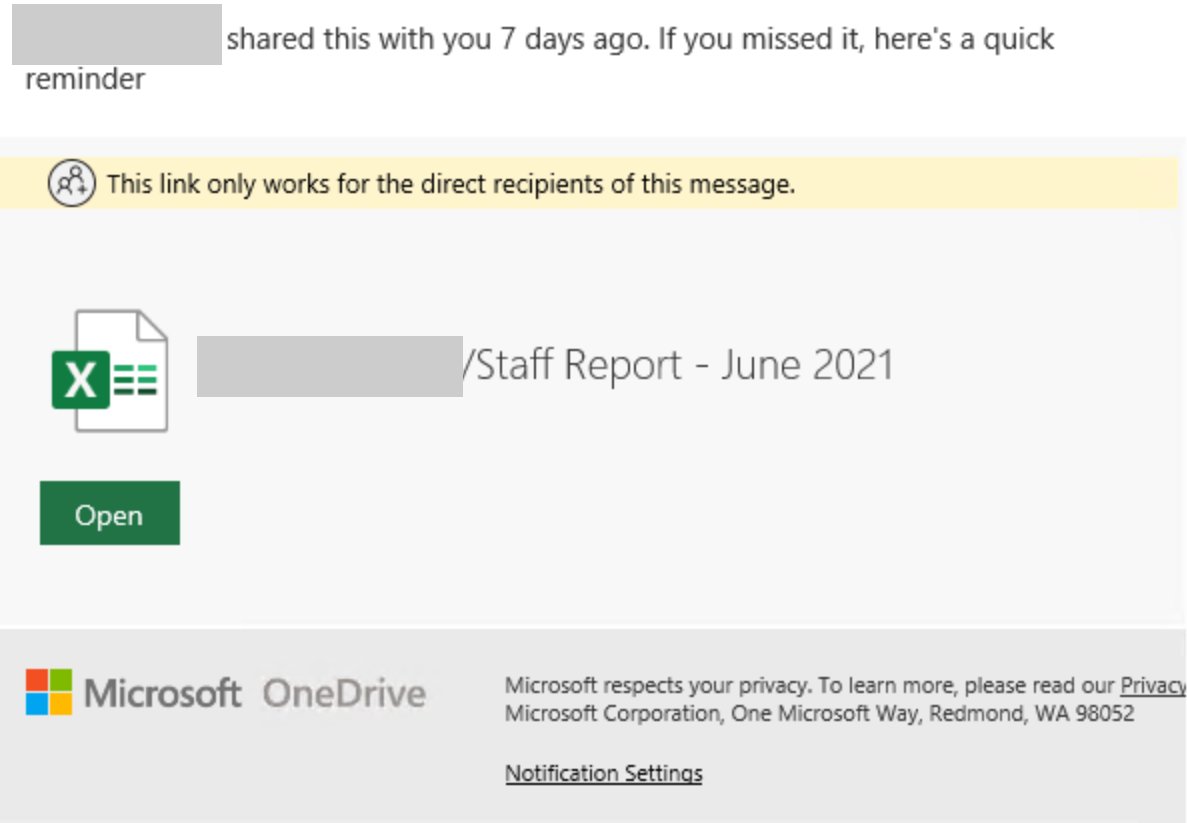

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

Apr 24, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Hacking Scheme

Apr 24, 2025 -

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 24, 2025

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 24, 2025 -

7

Apr 24, 2025

7

Apr 24, 2025 -

Steffy Comforts Liam Poppy Warns Finn Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025

Steffy Comforts Liam Poppy Warns Finn Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025 -

Delayed Launch Blue Origins Rocket Grounded By Subsystem Issue

Apr 24, 2025

Delayed Launch Blue Origins Rocket Grounded By Subsystem Issue

Apr 24, 2025