Chinese Stocks In Hong Kong Surge: Trade Tension Easing Fuels Rally

Table of Contents

Easing US-China Trade Relations Boost Investor Confidence

Recent positive developments in US-China trade negotiations have significantly impacted investor sentiment towards Chinese companies listed in Hong Kong. Reduced tariffs and the progress towards a more stable trade relationship have instilled confidence, leading to increased investment.

- Specific examples of positive trade news: The "Phase One" trade deal, pauses in tariff increases, and renewed dialogue between the two superpowers all contributed to the positive market sentiment.

- Key indices performance: The Hang Seng Index, a key benchmark for the Hong Kong stock market, has shown considerable gains, reflecting the overall bullish trend in Chinese stocks in Hong Kong. The increase in the Hang Seng China Enterprises Index, which tracks mainland Chinese companies listed in Hong Kong, further underscores this positive trend.

- Analyst quotes: Many analysts have directly linked the improved trade outlook to the surge in Hong Kong stock prices. Statements such as "Easing trade tensions have unlocked significant pent-up investor demand for Chinese equities," are frequently cited in financial news.

Strong Corporate Earnings Drive Hong Kong Market Growth

The impressive performance of major Chinese companies listed in Hong Kong is another key driver of the market's growth. Robust corporate earnings, fueled by strong domestic consumption and technological advancements, have further bolstered investor confidence.

- Examples of companies with exceptional earnings reports: Several leading technology firms and consumer goods companies have reported exceeding expectations, demonstrating the strength of the Chinese economy. These strong results directly translate to higher stock prices.

- Sectors showing strong growth: The technology, consumer goods, and financial sectors have been particularly strong performers, showcasing the diverse growth opportunities within the Hong Kong market for Chinese stocks.

- Impact of earnings on stock prices: Positive earnings announcements have consistently led to significant upward movements in the stock prices of these companies, driving the overall market rally. Strong earnings reports signal future growth potential, attracting more investment.

Increased Foreign Investment Flows into Hong Kong

The Hong Kong stock market has witnessed a noticeable increase in foreign investment, adding further momentum to the rally. This influx of capital is driven by several factors, including the perceived value of Chinese stocks in Hong Kong and a generally improved risk appetite among global investors.

- Data on foreign investment inflows: Official data from the Hong Kong Monetary Authority or other relevant sources can quantify the scale of this foreign investment. This data provides a tangible measure of the investment surge.

- Analysis of investor behavior and motivations: Investors are increasingly seeing Hong Kong as a compelling entry point to the Chinese market, drawn by the relatively stable regulatory environment and the ease of access.

- Specific investment funds: Many global investment funds and strategies are now actively targeting Hong Kong stocks, recognizing the potential for significant returns. This increased institutional interest further fuels the market’s growth.

Geopolitical Factors and their Influence on the Market

While US-China trade relations are a major factor, other geopolitical factors also influence the Hong Kong market. A generally stable regional political environment and positive global economic indicators contribute to the overall positive sentiment.

- Relevant political and economic developments: Stability in the region, coupled with positive global economic news, reduces uncertainty and encourages investment.

- Potential risks and uncertainties: While the outlook is positive, investors should remain aware of potential risks, such as geopolitical instability or unexpected shifts in economic policy.

- Expert opinions: Analysts and experts consistently highlight the interplay between global and regional events and their impact on the Hong Kong stock market. This analysis helps contextualize the ongoing rally.

Conclusion: Navigating the Opportunities in the Booming Chinese Stock Market in Hong Kong

The surge in Chinese stocks in Hong Kong is driven by a confluence of factors: easing trade tensions, strong corporate earnings, and increased foreign investment. The overall outlook remains positive, presenting significant opportunities for investors. However, potential risks and uncertainties must be carefully considered. To learn more about investing in Hong Kong stocks, or Hong Kong Chinese equities, and to explore the opportunities within the Hong Kong stock market, it's crucial to conduct thorough research and consult with qualified financial professionals before making any investment decisions. Remember, investing in the Hong Kong stock market, particularly in Chinese equities, involves inherent risk, and careful due diligence is essential.

Featured Posts

-

I Thlipsi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Thlipsi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

Ice Denies Columbia Student Mahmoud Khalils Request To Attend Sons Birth

Apr 24, 2025

Ice Denies Columbia Student Mahmoud Khalils Request To Attend Sons Birth

Apr 24, 2025 -

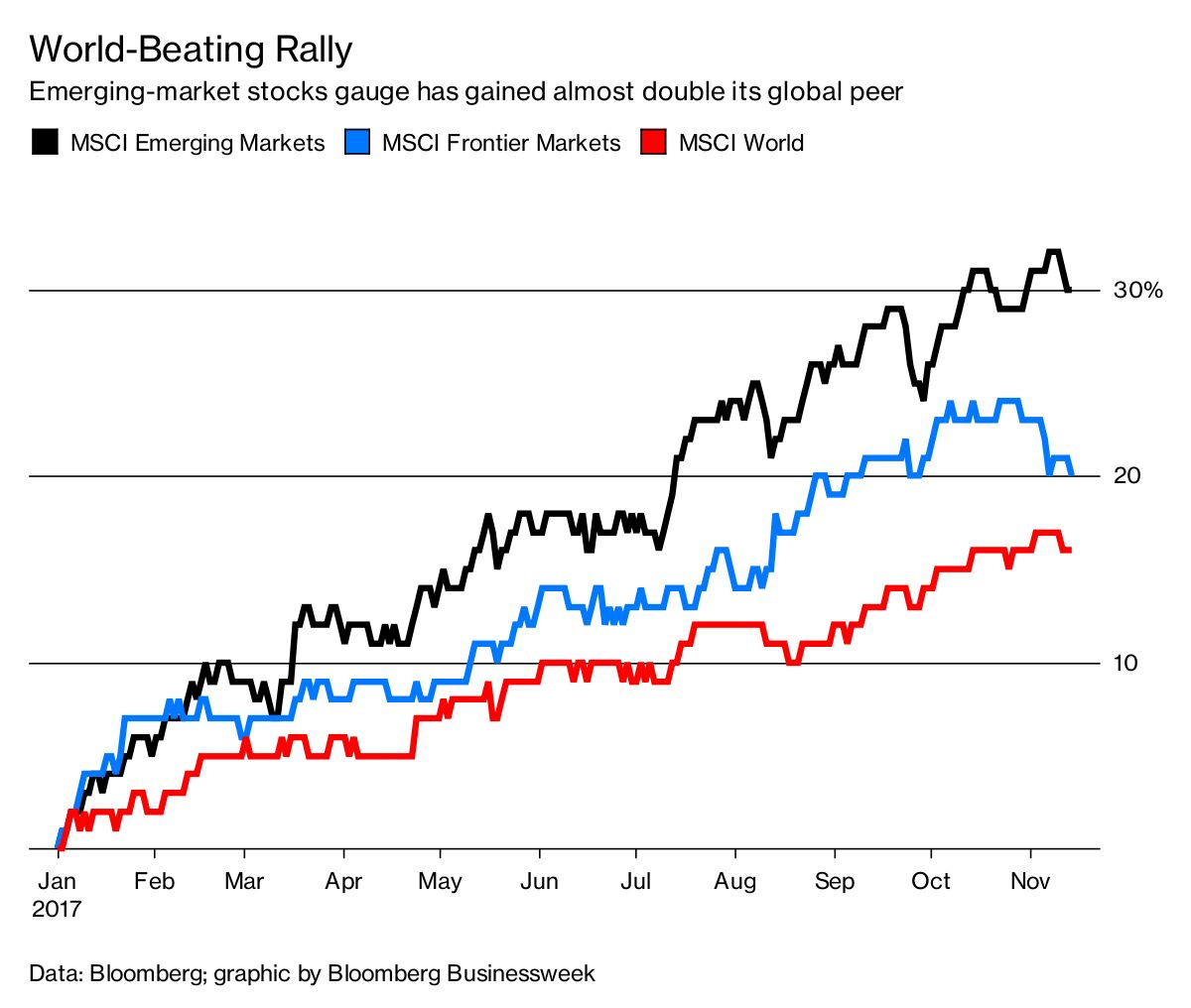

Emerging Market Stocks Outperform Us Year To Date Gains

Apr 24, 2025

Emerging Market Stocks Outperform Us Year To Date Gains

Apr 24, 2025 -

Understanding The Dynamics Of New Business Hotspots In The Country

Apr 24, 2025

Understanding The Dynamics Of New Business Hotspots In The Country

Apr 24, 2025 -

Office365 Executive Inbox Hacking Millions In Losses Reported To Fbi

Apr 24, 2025

Office365 Executive Inbox Hacking Millions In Losses Reported To Fbi

Apr 24, 2025