Chinese Firm Mulls Sale Of Semiconductor Tester UTAC

Table of Contents

UTAC's Role in the Semiconductor Industry

UTAC is a sophisticated piece of automated test equipment (ATE) specializing in the testing of advanced integrated circuits (ICs). Its precise function lies in rigorously verifying the functionality and performance of these chips before they are integrated into various electronic devices. UTAC's capabilities extend to testing a wide range of chips, including:

- Microprocessors: Ensuring the CPUs function correctly.

- Memory chips: Verifying data storage and retrieval capabilities.

- Graphics processing units (GPUs): Testing the performance of graphical processing.

- Application-specific integrated circuits (ASICs): Testing specialized chips for specific applications.

UTAC boasts a significant market share within its niche, providing critical testing solutions for numerous major semiconductor manufacturers. Its key features and competitive advantages include:

- High-speed testing: Reducing testing time and improving efficiency.

- Advanced diagnostic capabilities: Pinpointing defects with precision.

- Scalability: Adaptable to different chip types and production volumes.

- Proprietary algorithms: Ensuring accurate and reliable testing results. Keywords: Semiconductor testing equipment, automated test equipment (ATE), chip manufacturing, integrated circuit testing, UTAC specifications.

Reasons Behind the Potential Sale

The decision by the Chinese firm to consider selling UTAC is likely multifaceted. While the specific reasons remain undisclosed, several factors could be at play:

- Financial difficulties: The global economic downturn and increased competition within the semiconductor industry might have impacted the firm's financial performance, leading to the consideration of asset sales.

- Strategic restructuring: The company might be focusing its resources on core competencies and divesting from less strategically aligned businesses like UTAC.

- Regulatory pressures: Increased scrutiny and potential regulatory hurdles in the Chinese semiconductor sector could be influencing the decision.

- Debt reduction: Selling UTAC could be a means to reduce debt and improve the firm's overall financial health.

The current economic climate in China, coupled with intensifying global competition, presents significant challenges to the domestic semiconductor industry. Keywords: Chinese semiconductor market, mergers and acquisitions, financial performance, regulatory environment, strategic divestment.

Potential Buyers and Implications

Several potential buyers could be interested in acquiring UTAC, including:

- Large international semiconductor companies: Seeking to expand their testing capabilities or secure a competitive edge.

- Private equity firms: Looking for lucrative investments in the technology sector.

- Smaller, specialized ATE companies: Aiming to expand their market share through acquisition.

The sale's geopolitical implications are substantial, particularly concerning US-China relations and potential technology transfer. The buyer's nationality and business practices will significantly influence the implications. For example, an acquisition by a US company could raise concerns about technology transfer to the West. Keywords: Semiconductor industry acquisition, foreign investment, global semiconductor market, geopolitical implications, technology transfer.

Future of UTAC and the Chinese Semiconductor Industry

The sale of UTAC will undeniably affect its future trajectory. Under new ownership, UTAC may:

- Experience increased investment in R&D, leading to technological advancements.

- Benefit from access to broader markets and distribution channels.

- Undergo restructuring and potential job changes.

For the Chinese semiconductor industry, the sale could signal a broader trend of consolidation or a strategic retreat from certain sectors. The long-term implications for China's ambitions in achieving technological independence in the semiconductor sector remain uncertain. The outcome will heavily influence future investment strategies and development plans. Keywords: Future of semiconductor technology, China's semiconductor strategy, technological independence, semiconductor industry trends, investment in semiconductor technology.

Conclusion: The Uncertain Future of the UTAC Semiconductor Tester Sale

The potential sale of UTAC by a Chinese firm is a significant development with wide-ranging implications for the global semiconductor industry. The reasons behind the sale are complex, and the potential buyers and their motivations remain speculative. The outcome will affect not only UTAC's future but also the broader landscape of the Chinese semiconductor industry and its global standing. To understand the long-term impact, it's crucial to follow the developments regarding the UTAC sale closely. Stay updated on the future of Chinese semiconductor testing equipment and the evolving dynamics of this crucial sector.

Featured Posts

-

The Countrys Rising Business Stars Locations And Opportunities

Apr 24, 2025

The Countrys Rising Business Stars Locations And Opportunities

Apr 24, 2025 -

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025 -

Hollywood Production At Standstill Amidst Actors And Writers Strike

Apr 24, 2025

Hollywood Production At Standstill Amidst Actors And Writers Strike

Apr 24, 2025 -

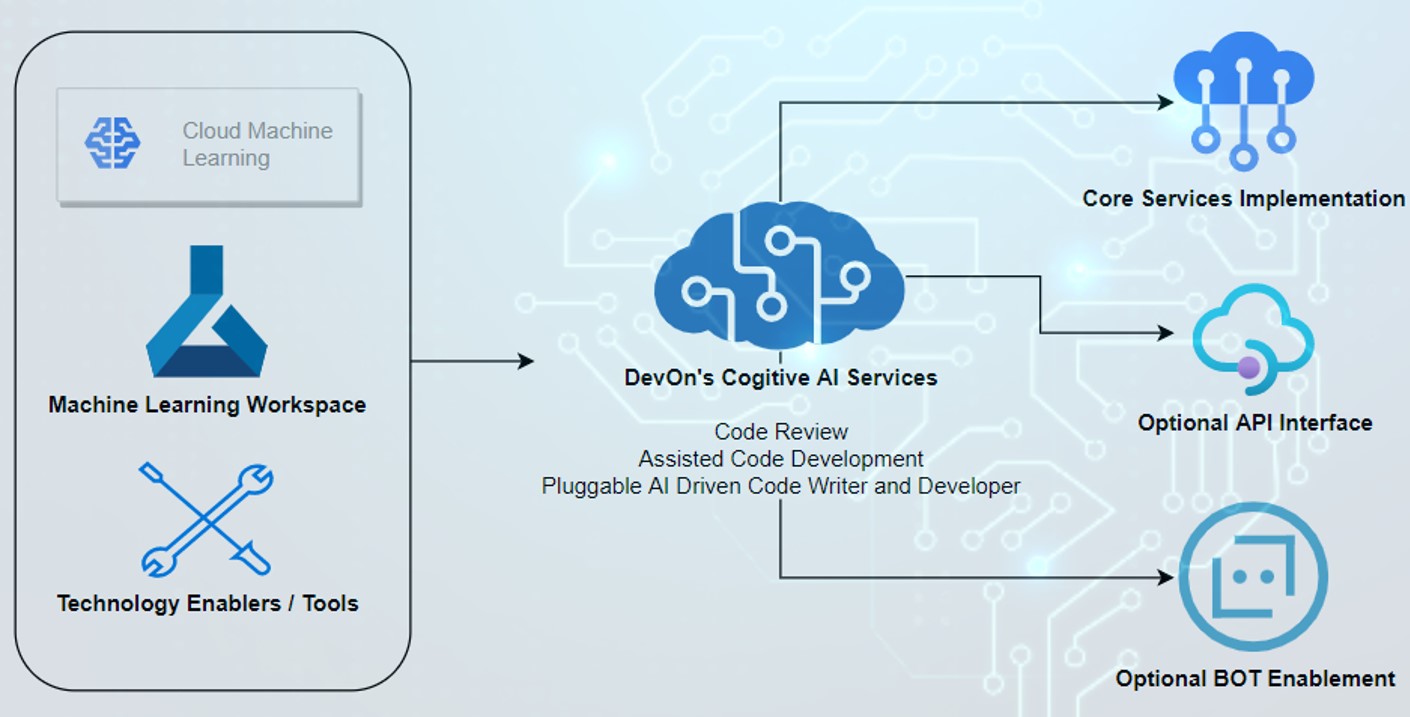

From Repetitive Documents To Podcast An Ai Driven Solution For Poop Content

Apr 24, 2025

From Repetitive Documents To Podcast An Ai Driven Solution For Poop Content

Apr 24, 2025 -

Office365 Executive Inbox Hacking Millions In Losses Reported To Fbi

Apr 24, 2025

Office365 Executive Inbox Hacking Millions In Losses Reported To Fbi

Apr 24, 2025