Diversification Of LPG Sources: China's Response To US Trade Policies

Table of Contents

Increased Reliance on Middle Eastern and Southeast Asian Suppliers

China's strategy for diversification of LPG sources heavily involves forging stronger partnerships with alternative LPG suppliers. This shift reduces over-reliance on any single nation and minimizes vulnerability to potential trade disputes or political instability.

Shifting Trade Partnerships

China is actively cultivating deeper relationships with LPG-producing nations in the Middle East and Southeast Asia. This involves:

- Increased investment in infrastructure projects: Significant investments are being made in pipelines, terminals, and other crucial infrastructure to facilitate the smooth flow of LPG imports from these new sources. This includes upgrades to existing ports and the construction of new LPG import terminals capable of handling larger vessels.

- Negotiation of long-term supply contracts: China is securing long-term contracts with Middle Eastern and Southeast Asian suppliers to guarantee stable LPG supplies and price predictability. These contracts often include clauses that protect against sudden price hikes and supply disruptions.

- Exploration of joint ventures and partnerships: Collaborations with local companies in these regions are being pursued, fostering economic ties and facilitating smoother trade relations. This approach also provides access to local expertise and knowledge of the LPG market.

Geopolitical Implications

This strategic diversification of LPG sources carries significant geopolitical implications:

- Reduced vulnerability to US trade sanctions or tariffs: By relying less on US LPG imports, China mitigates the risk of being impacted by future trade disputes or sanctions. This enhances energy security and reduces dependence on a potentially unreliable supplier.

- Increased bargaining power in international LPG markets: Diversifying its sources gives China more leverage in negotiating prices and terms with suppliers. This reduces its vulnerability to price volatility and enhances its position within the global energy landscape. This stronger position translates into more favorable deals for LPG procurement.

Domestic LPG Production Enhancement

Simultaneously, China is focusing on bolstering its domestic LPG production capabilities. This two-pronged approach, combining imports and domestic production, strengthens its energy security significantly.

Investment in Refining and Petrochemical Industries

China is investing heavily in upgrading its refining infrastructure to increase LPG production as a byproduct of oil refining. This includes:

- Construction of new refineries with advanced LPG extraction technologies: Modern refineries equipped with state-of-the-art technology are being built to maximize LPG yield from crude oil processing. This increases efficiency and improves the quality of domestically produced LPG.

- Incentivizing domestic LPG production through subsidies and tax breaks: Government incentives are designed to stimulate domestic LPG production, making it a more economically viable option for companies. This includes tax reductions, subsidies, and preferential loan programs.

Exploration and Development of Domestic Gas Resources

China is also actively exploring and developing its own natural gas reserves. This strategy addresses the long-term need for sustainable LPG production:

- Investment in shale gas exploration and extraction technologies: Significant resources are allocated to developing shale gas reserves as a primary feedstock for LPG production. This improves the nation's energy independence and reduces its dependence on foreign sources of gas.

- Development of new pipelines and transportation infrastructure: Investments in pipelines and other transport infrastructure are crucial for efficient distribution of domestically produced natural gas and LPG. This ensures smooth and timely delivery to consumers across the country.

- Focus on improving energy efficiency to reduce LPG demand: Initiatives promoting energy efficiency help reduce the overall demand for LPG, lessening the strain on both domestic production and imports.

Technological Advancements and Alternative Energy Sources

China's diversification strategy extends beyond geographical sources. Innovation and exploration of alternative energy sources play a significant role.

Exploring Alternative Energy Sources

China is investing in alternative fuels and energy sources to reduce its reliance on LPG in the long term:

- Investment in renewable energy sources such as solar and wind power: A significant push towards renewable energy sources helps reduce dependence on fossil fuels like LPG and contributes to environmental sustainability.

- Research and development of biofuels and other sustainable alternatives: Continued research into biofuels and other sustainable alternatives offers potential long-term solutions for reducing LPG consumption and diversifying the energy mix.

Improving LPG Storage and Transportation Efficiency

Efficient and reliable delivery systems are integral to any successful LPG strategy. China is improving its LPG infrastructure significantly:

- Construction of new LPG storage facilities: Increased storage capacity helps mitigate supply disruptions and ensures a consistent supply of LPG to consumers.

- Investment in modern LPG transportation technologies: Upgrading transport systems improves efficiency and reduces the risk of spills and accidents during transportation.

Conclusion

China's proactive approach to the diversification of LPG sources highlights its commitment to energy security and resilience in the face of global market fluctuations and geopolitical uncertainties. By strategically diversifying its import sources, boosting domestic production, and exploring alternative energy solutions, China is mitigating risks and solidifying its position in the global LPG market. This comprehensive strategy is essential for long-term energy security and economic stability. Understanding the intricacies of this diversification of LPG sources is critical for businesses and policymakers alike. Further analysis into the long-term implications of this multifaceted approach will be crucial for future forecasting and informed decision-making.

Featured Posts

-

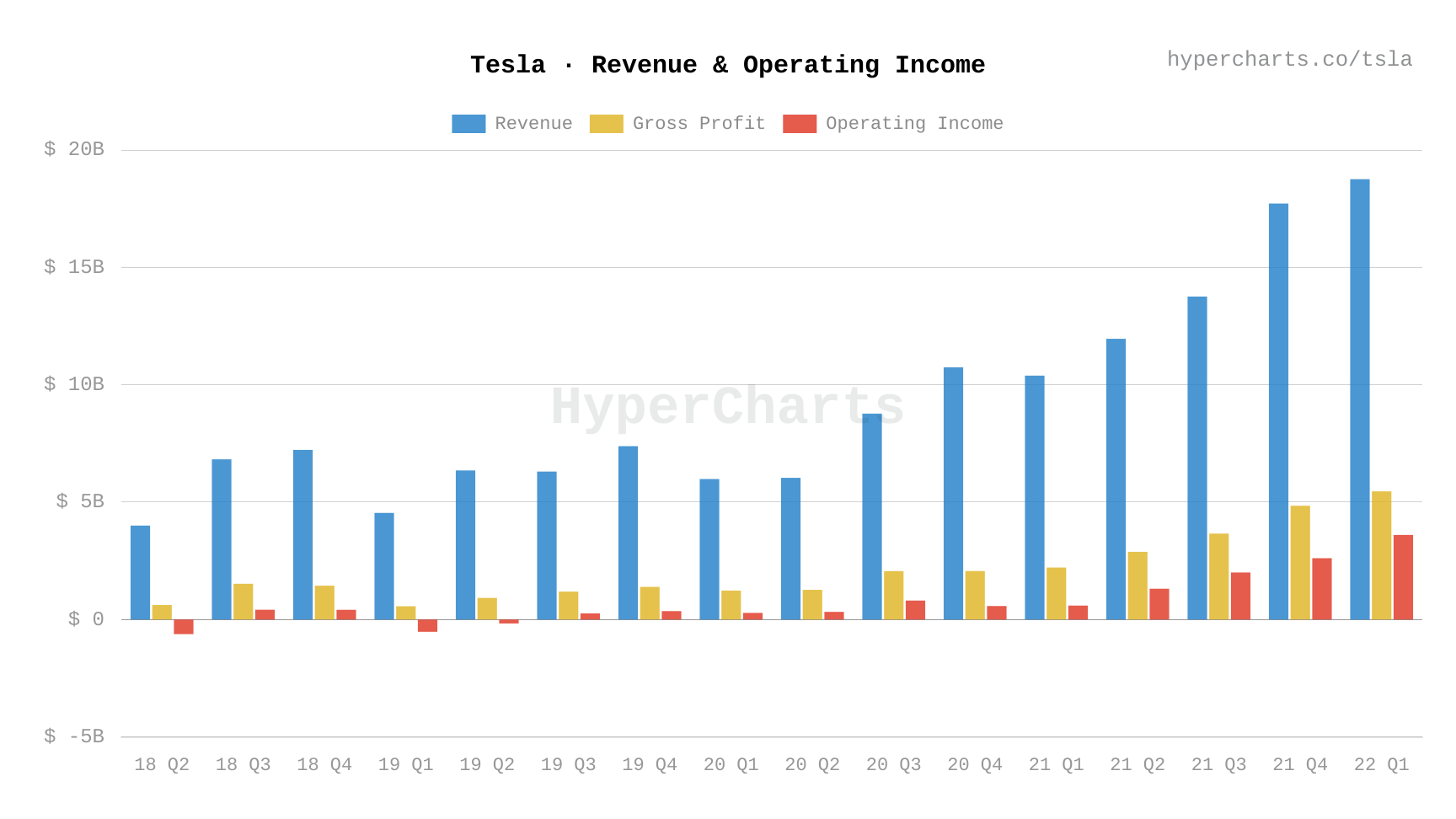

Analysis Of Teslas Q1 Earnings 71 Net Income Reduction Explained

Apr 24, 2025

Analysis Of Teslas Q1 Earnings 71 Net Income Reduction Explained

Apr 24, 2025 -

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

Apr 24, 2025

Landlords Accused Of Exploiting La Fire Victims Selling Sunset Star Weighs In

Apr 24, 2025 -

60 Minutes Faces Fallout Executive Producer Quits Amid Trump Lawsuit Controversy

Apr 24, 2025

60 Minutes Faces Fallout Executive Producer Quits Amid Trump Lawsuit Controversy

Apr 24, 2025 -

Court Challenges Slow Trump Administrations Immigration Crackdown

Apr 24, 2025

Court Challenges Slow Trump Administrations Immigration Crackdown

Apr 24, 2025 -

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025

Teslas Q1 2024 Earnings Report A 71 Drop In Net Income

Apr 24, 2025