Bitcoin's Rise: Analyzing The Impact Of Trade And Monetary Policy

Table of Contents

Bitcoin, the pioneering cryptocurrency, has experienced a meteoric rise since its inception. This unprecedented growth isn't solely attributable to technological innovation; it's intricately linked to global trade dynamics and the evolving landscape of monetary policy. This article delves into the complex interplay between these factors and Bitcoin's dramatic ascent, exploring how macroeconomic shifts have fueled its adoption and price volatility. The decentralized nature of Bitcoin, facilitated by blockchain technology, has played a pivotal role in its ability to navigate these macroeconomic forces.

The Role of Global Trade in Bitcoin Adoption

Facilitating Cross-Border Transactions

Bitcoin circumvents traditional banking systems, offering a compelling alternative for international trade. This is achieved by reducing transaction fees and processing times significantly. For businesses operating in emerging markets with limited access to robust financial infrastructure, Bitcoin offers a lifeline, enabling easier and cheaper access to global markets. The peer-to-peer nature of Bitcoin transactions eliminates the need for intermediaries, further streamlining the process.

- Reduced transaction costs: Bitcoin transactions typically involve far lower fees than traditional bank wire transfers, especially for cross-border payments.

- Faster processing times: Bitcoin transactions are often confirmed much faster than traditional bank transfers, improving efficiency in international trade.

- Increased accessibility for businesses in developing countries: Bitcoin provides a pathway to global markets for businesses in countries with underdeveloped banking systems.

- Enhanced security and transparency: The blockchain's immutable ledger provides a transparent and secure record of all transactions, building trust in cross-border exchanges.

Impact of Geopolitical Instability

Periods of political and economic uncertainty often drive increased demand for Bitcoin as a safe haven asset. Investors seeking refuge from volatile national currencies or unstable political climates view Bitcoin's decentralized nature and limited supply as attractive qualities. The correlation between global events, such as sanctions, currency devaluations, and political upheaval, and Bitcoin's price fluctuations is a subject of ongoing research, but a clear trend suggests that during times of instability, Bitcoin's value often rises. This is largely due to its position as a hedge against inflation and currency devaluation.

- Safe haven asset: Bitcoin's decentralized and non-governmental nature makes it attractive during times of geopolitical instability.

- Hedge against inflation: Bitcoin's fixed supply acts as a hedge against inflation, protecting purchasing power in times of economic uncertainty.

- Reduced reliance on centralized financial institutions: Bitcoin allows users to bypass traditional financial systems, providing an alternative during crises.

- Increased demand during times of uncertainty: Fear and uncertainty often lead investors to seek refuge in alternative assets like Bitcoin.

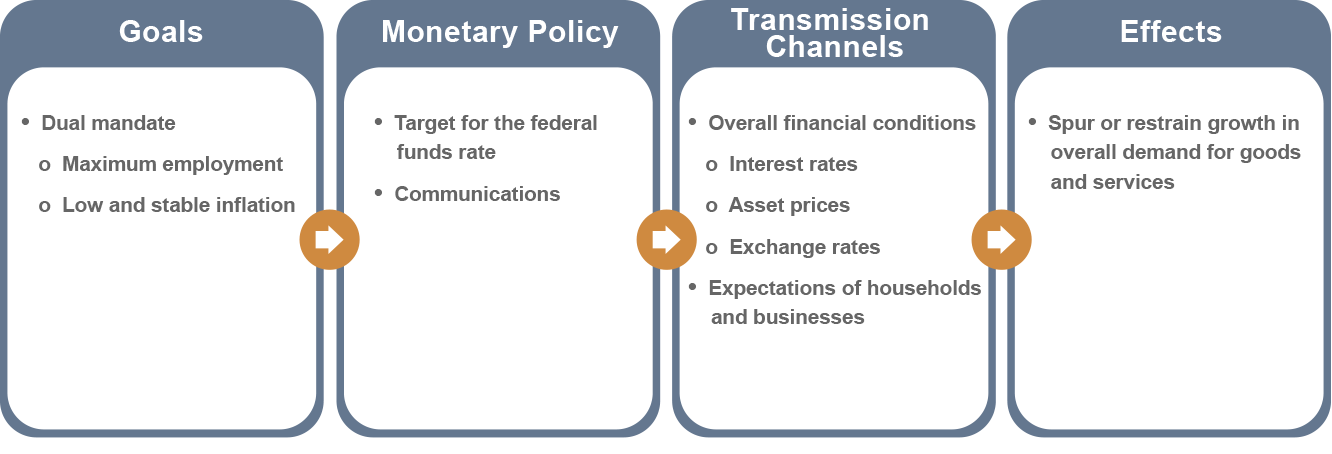

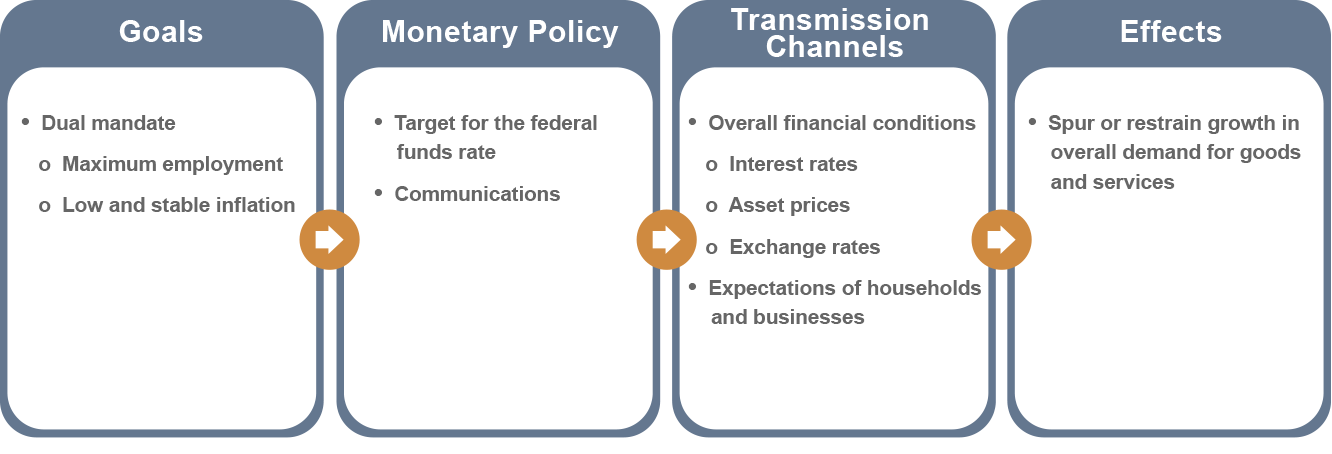

The Influence of Monetary Policy on Bitcoin's Value

Quantitative Easing and Bitcoin's Price

Central banks' expansionary monetary policies, such as quantitative easing (QE), have indirectly contributed to Bitcoin's price appreciation. QE programs inject vast sums of money into the economy, potentially leading to inflation and devaluation of fiat currencies. This devaluation can drive investors toward alternative assets, such as Bitcoin, perceived to retain or increase purchasing power. Low interest rates, a common outcome of QE, also reduce the attractiveness of traditional savings accounts, pushing investors towards potentially higher-yielding assets like Bitcoin.

- Increased money supply: QE increases the overall money supply, potentially leading to inflation and decreased value of fiat currencies.

- Fiat currency devaluation: The devaluation of national currencies encourages investment in assets perceived as more stable.

- Search for alternative assets: Investors seek assets that may offer protection against inflation and currency devaluation.

- Higher returns compared to low-interest savings accounts: Low interest rates on savings accounts make Bitcoin's potential returns more appealing.

Regulatory Uncertainty and Bitcoin's Volatility

The regulatory landscape surrounding Bitcoin remains in flux globally. Varying governmental regulations across different countries significantly impact Bitcoin's price and overall market sentiment. The inherent challenge of regulating a decentralized digital currency creates uncertainty, leading to price volatility. This volatility, however, is a double-edged sword – while it poses risks for investors, it also attracts those seeking higher potential returns.

- Regulatory uncertainty: Inconsistent or unclear government regulations create market uncertainty and affect Bitcoin's price.

- Price volatility: Regulatory changes and uncertainty contribute significantly to Bitcoin's fluctuating price.

- Differing national regulations: The fragmented regulatory landscape across the globe impacts Bitcoin adoption rates and trading activity.

- Impact on investor confidence: Clear and consistent regulations can boost investor confidence, while uncertainty can negatively affect market sentiment.

- Implications for international trade: Regulatory clarity is crucial for facilitating the wider adoption of Bitcoin in international commerce.

Conclusion

This analysis demonstrates the significant impact of global trade and monetary policy on Bitcoin's remarkable rise. The cryptocurrency's ability to facilitate cross-border transactions and act as a hedge against economic instability has fueled its adoption worldwide. Meanwhile, the effects of quantitative easing and regulatory uncertainty continue to shape its volatile price trajectory.

Understanding the intricate relationship between Bitcoin, trade, and monetary policy is crucial for navigating the evolving landscape of digital finance. Further research into these interconnected factors is essential to grasp the full potential and challenges presented by Bitcoin and other cryptocurrencies. Continue your exploration of Bitcoin and its implications by researching the latest trends in cryptocurrency trading and monetary policy. Stay informed on Bitcoin's future as it continues to evolve within the global economic system.

Featured Posts

-

Stock Market Valuations Bof As Reassuring View For Investors

Apr 24, 2025

Stock Market Valuations Bof As Reassuring View For Investors

Apr 24, 2025 -

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 24, 2025

Toxic Chemicals From Ohio Train Derailment Months Long Building Contamination

Apr 24, 2025 -

Analysis Broadcoms V Mware Acquisition And The Potential For Extreme Price Hikes

Apr 24, 2025

Analysis Broadcoms V Mware Acquisition And The Potential For Extreme Price Hikes

Apr 24, 2025 -

The Impact Of The La Palisades Fires Which Celebrities Lost Their Homes

Apr 24, 2025

The Impact Of The La Palisades Fires Which Celebrities Lost Their Homes

Apr 24, 2025 -

Analyzing The Decision Why A Startup Airline Is Opting For Deportation Flights

Apr 24, 2025

Analyzing The Decision Why A Startup Airline Is Opting For Deportation Flights

Apr 24, 2025