India Market Buzz: Nifty's Bullish Run Fueled By Positive Trends

Table of Contents

H2: Robust Economic Growth Driving Nifty's Ascent

India's impressive economic growth is a primary driver of the Nifty's bullish run. Strong GDP figures consistently surpass expectations, bolstering investor confidence and fueling further investment.

H3: GDP Growth and its Impact

India's GDP growth has consistently outperformed many global economies in recent quarters. This robust growth is directly correlated with the Nifty's upward trajectory.

- Bullet Point: The services sector, including IT, finance, and healthcare, has been a significant contributor to overall GDP growth, exceeding projections for several consecutive quarters. Manufacturing also shows signs of healthy expansion, contributing to this positive trend.

- Bullet Point: Government initiatives like "Make in India" and infrastructure development projects have stimulated economic activity, creating a positive feedback loop impacting the India market and the Nifty's performance.

- Bullet Point: According to the Reserve Bank of India (RBI) and the International Monetary Fund (IMF), India's GDP growth is projected to remain strong in the coming years, further supporting the Nifty bullish run.

H3: Increased Foreign Institutional Investor (FII) Investment

The influx of Foreign Institutional Investor (FII) capital into the Indian stock market significantly contributes to the Nifty's ascent. FIIs are increasingly optimistic about India's long-term growth potential.

- Bullet Point: Strong fundamentals, including a young and growing workforce, a large domestic market, and ongoing reforms, attract significant FII interest. This influx of foreign capital boosts liquidity and drives up stock prices.

- Bullet Point: Recent data shows a substantial increase in FII investments in the Indian equity market, surpassing previous records in several quarters, further fueling the Nifty bullish run.

- Bullet Point: While global geopolitical uncertainties exist, India's relatively stable political environment and proactive economic policies continue to attract FII investments, despite global headwinds.

H2: Positive Investor Sentiment and Market Confidence

Positive investor sentiment and increased market confidence are crucial factors driving the Nifty's upward momentum. This confidence stems from several key indicators.

H3: Improved Consumer Confidence

Rising consumer confidence indicates a healthy domestic economy and strengthens the Nifty's bullish run.

- Bullet Point: Several consumer confidence indices show a steady increase, reflecting improved purchasing power and optimism about future economic prospects.

- Bullet Point: Government initiatives focused on boosting rural incomes and consumer spending have positively influenced consumer sentiment, contributing to the overall market confidence.

H3: Falling Inflation Rates

Decreasing inflation rates further enhance investor confidence, creating a favorable environment for the Nifty's upward trajectory.

- Bullet Point: India's inflation rate has shown a consistent downward trend in recent months, providing relief to consumers and businesses alike. This stability encourages investment and boosts market sentiment.

- Bullet Point: Lower inflation reduces uncertainty and encourages greater investment, as investors are more willing to commit capital when they can better predict future returns. This contributes significantly to the Nifty's bullish run.

H2: Sector-Specific Performance Boosting the Nifty

The robust performance of several key sectors significantly contributes to the Nifty's impressive rise.

H3: IT Sector's Continued Strength

The Indian IT sector continues to be a significant driver of the Nifty's growth.

- Bullet Point: Global demand for IT services and technological advancements continue to fuel growth within this sector, contributing significantly to the overall market performance.

- Bullet Point: Leading Indian IT companies have shown impressive financial results, with stock prices reflecting their strong performance and contributing to the Nifty bullish run.

H3: Growth in Other Key Sectors

Other key sectors, including banking, financials, and fast-moving consumer goods (FMCG), are also demonstrating robust growth.

- Bullet Point: The banking and financial sectors are benefiting from increased credit growth and government initiatives aimed at financial inclusion.

- Bullet Point: The FMCG sector is showing positive growth driven by rising consumer spending and a growing middle class. Policy changes and regulatory updates in these sectors also support their continued growth.

3. Conclusion:

The Nifty's current bullish run is a testament to India's strong economic fundamentals, positive investor sentiment, and the robust performance of key sectors. The combination of strong GDP growth, increased FII investment, decreasing inflation, and positive consumer confidence paints a positive picture for the Indian stock market.

Call to Action: Stay informed about the ongoing Nifty bullish run and understand the positive economic trends shaping the Indian market. Follow our updates for continuous analysis and insights into the dynamic world of India's stock market performance and make informed investment decisions based on the ongoing Nifty's upward trajectory. Learn more about navigating the India market and capitalizing on the Nifty's potential.

Featured Posts

-

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025 -

Is Google Chrome Next For Open Ai Chat Gpt Leadership Weighs In

Apr 24, 2025

Is Google Chrome Next For Open Ai Chat Gpt Leadership Weighs In

Apr 24, 2025 -

John Travoltas Rotten Tomatoes Score A Statistical Analysis

Apr 24, 2025

John Travoltas Rotten Tomatoes Score A Statistical Analysis

Apr 24, 2025 -

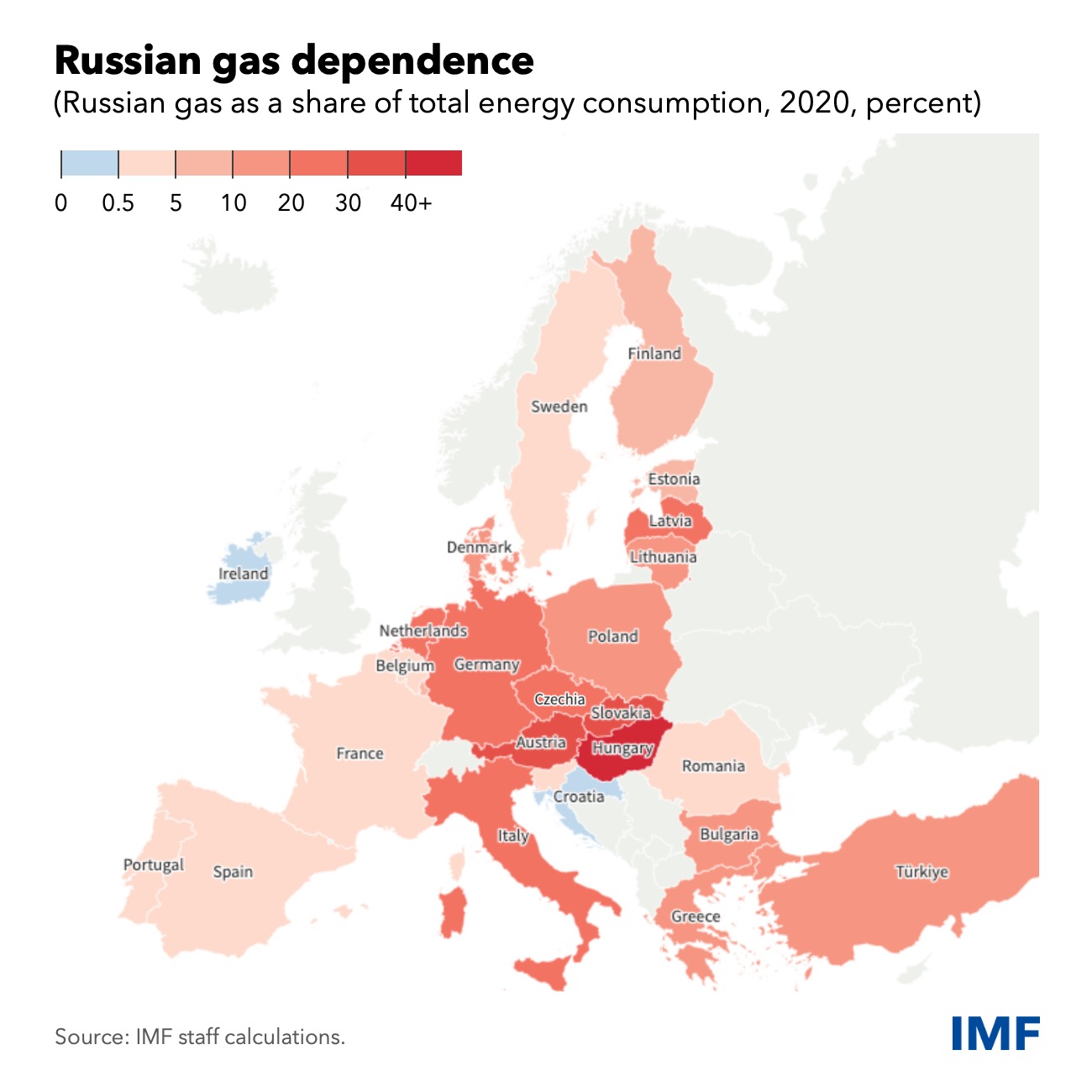

Spot Market For Russian Gas Eu Discussion On Phaseout Strategies

Apr 24, 2025

Spot Market For Russian Gas Eu Discussion On Phaseout Strategies

Apr 24, 2025 -

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 24, 2025

Land Your Dream Private Credit Job 5 Dos And Don Ts To Follow

Apr 24, 2025