Auto Carrier Faces $70 Million Loss From US Port Fees

Table of Contents

The Impact of Increased US Port Fees on Auto Carriers

The $70 million loss isn't a random figure; it's the direct result of a confluence of factors driving up US port fees. Several types of charges have contributed significantly to this financial burden. These include substantial increases in container handling fees, storage fees, and terminal fees, all of which have skyrocketed in recent years. The increase isn't uniform across all ports; some locations have seen more dramatic increases than others, creating further logistical challenges for auto carriers.

- Breakdown of the $70 Million Loss: While the exact breakdown across different port locations remains confidential for business reasons, industry analysts suggest that the ports of Los Angeles and Long Beach, notorious for congestion, bear a significant portion of this loss.

- Specific Examples of Increased Fees: Reports indicate increases ranging from 15% to 30% in certain port fees per vehicle or container, depending on the size and type of shipment. This translates to a substantial added cost per vehicle imported.

- Fee Comparison (Year-over-Year): Comparing current fees to those of just two years ago reveals a dramatic upward trend, showcasing the rapidly escalating costs auto carriers are facing. This unprecedented increase is unsustainable for many businesses.

Port Congestion and its Contribution to the Financial Losses

The problem is compounded by severe port congestion. Delays at US ports are adding significant costs. Increased dwell times—the amount of time vehicles sit idle at the port awaiting processing—lead to substantial additional storage and handling charges. This contributes significantly to the overall financial strain on auto carriers.

- Statistics on Average Dwell Time: Industry data reveals an alarming increase in average dwell time at major US ports, with some reporting delays exceeding a week or more in certain cases. This idle time translates directly into increased costs.

- Impact on Delivery Schedules and Customer Satisfaction: These delays have a cascading effect, disrupting delivery schedules, causing production bottlenecks, and impacting customer satisfaction. Late deliveries can result in penalties and lost sales.

- Solutions to Mitigate Congestion: Addressing port congestion requires a multi-pronged approach. This includes investment in improved port infrastructure, implementation of more efficient scheduling systems, and potential government intervention to streamline processes. More effective communication between all parties involved is also critical.

The Broader Implications for the Automotive Supply Chain

The $70 million loss for this single auto carrier is just the tip of the iceberg. The impact ripples throughout the entire automotive supply chain, creating significant challenges for manufacturers, distributors, and ultimately, consumers.

- Impact on Vehicle Production and Sales: Increased shipping costs are squeezing profit margins, potentially leading to reduced vehicle production and sales. Manufacturers may be forced to absorb some of these costs, impacting profitability.

- Increased Costs Passed Onto Consumers: The inevitable outcome is a potential increase in vehicle prices for consumers. As costs rise across the supply chain, manufacturers are likely to pass some of these increased expenses onto the end buyer.

- Government Intervention and Industry Solutions: The severity of the situation may necessitate government intervention, perhaps in the form of subsidies or incentives to improve port infrastructure and efficiency. Collaboration among industry stakeholders will be essential to developing comprehensive, long-term solutions.

Potential Solutions and Mitigation Strategies

Auto carriers are actively seeking ways to mitigate future losses. A combination of strategies is needed to address this complex issue.

- Negotiating Lower Fees with Port Authorities: Auto carriers can attempt to negotiate more favorable rates with port authorities, leveraging their collective bargaining power.

- Efficient Logistics and Inventory Management: Optimizing logistics and inventory management can significantly reduce dwell time and associated costs. Improved forecasting and streamlined processes can help minimize delays.

- Exploring Alternative Transportation: Exploring alternative transportation methods such as rail transport, where feasible, can reduce reliance on congested ports and associated fees.

Conclusion

This article highlighted the substantial $70 million loss incurred by an auto carrier due to the combined impact of increased US port fees and significant port congestion. This situation extends far beyond a single company, affecting the entire automotive supply chain and potentially leading to vehicle shortages and higher prices for consumers. Understanding the complexities of US port fees and their impact on automotive logistics is crucial for businesses involved in the automotive industry. Stay informed about changes in US port fees and automotive logistics to protect your business from similar financial setbacks. Learn more about navigating the challenges of vehicle transportation in today's complex global market.

Featured Posts

-

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025

Gold Price Record Rally Bullion As A Safe Haven During Trade Wars

Apr 26, 2025 -

Bof A On Stock Market Valuations Reasons For Investor Calm

Apr 26, 2025

Bof A On Stock Market Valuations Reasons For Investor Calm

Apr 26, 2025 -

The Closure Of Anchor Brewing Company Impact And Legacy

Apr 26, 2025

The Closure Of Anchor Brewing Company Impact And Legacy

Apr 26, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 26, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 26, 2025 -

How Middle Management Contributes To Employee Satisfaction And Business Results

Apr 26, 2025

How Middle Management Contributes To Employee Satisfaction And Business Results

Apr 26, 2025

Latest Posts

-

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025 -

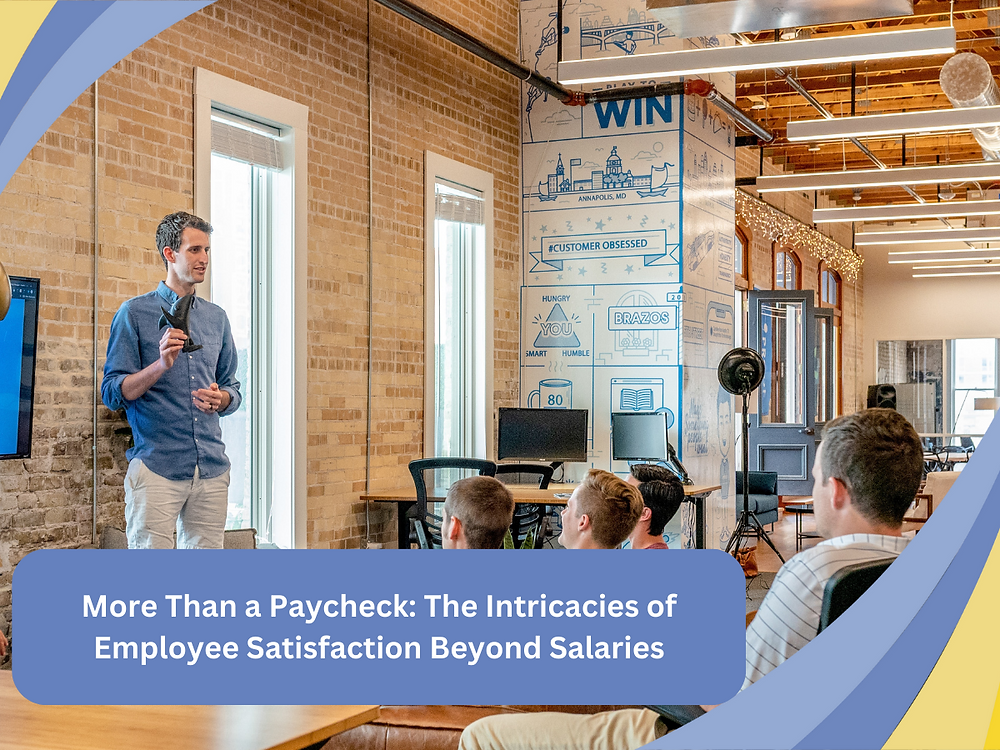

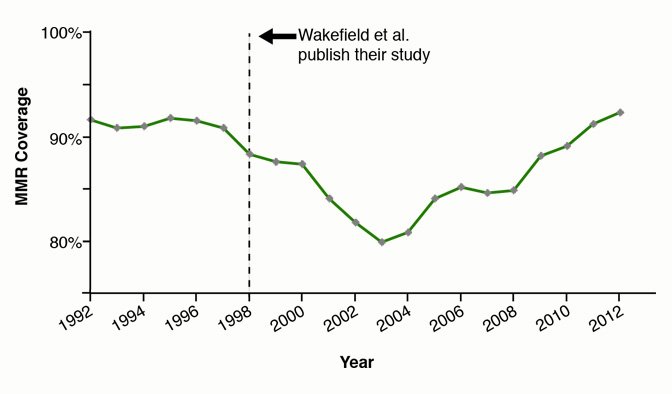

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025 -

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025