AT&T's Opposition To Broadcom's VMware Deal: Concerns Over Extreme Pricing

Table of Contents

AT&T's Antitrust Concerns and the High Price Tag

AT&T's primary concern revolves around the potential for antitrust violations and the resulting impact on pricing. The company argues that the merger would consolidate significant market power in the hands of Broadcom, leading to reduced competition and ultimately, higher prices for telecommunication services. This "extreme pricing," as AT&T has suggested, could significantly harm consumers and stifle innovation within the telecom sector.

- Specific services potentially affected: AT&T's concerns extend to various services, including cloud computing infrastructure, network virtualization, and software-defined networking (SDN) solutions, all areas where VMware holds significant market share.

- Statements from AT&T executives: While specific quotes require further research and may be subject to change, the general sentiment expressed by AT&T leadership centers on the potential for monopolistic practices and the negative effects on fair competition. Their argument emphasizes the importance of maintaining a diverse and competitive marketplace to prevent price gouging.

- Impact on the telecommunications market: The merger's impact on the overall telecom industry could be far-reaching, potentially leading to reduced choices for consumers and hindering the development of innovative solutions.

The Impact on Innovation and Competition within the Telecom Sector

The potential for stifled innovation is a major concern stemming from the Broadcom-VMware merger. Reduced competition could lead to:

- Less choice for consumers: A lack of competitive alternatives could result in consumers having fewer choices regarding service providers and technological solutions.

- Lower-quality services: Without the pressure of competition, there's a risk that the quality of services might decline, as companies have less incentive to innovate and improve.

- Slowed technological advancements: The merger could hinder technological advancements in the telecom sector by reducing the impetus for innovation driven by competition.

Alternative solutions and competitors could also be negatively impacted, limiting the development of new technologies and services. The concentration of power in the hands of a single entity could lead to a less dynamic and innovative market.

Regulatory Scrutiny and Potential Outcomes of AT&T's Opposition

Regulatory bodies, including antitrust agencies in various countries, will play a crucial role in determining the fate of the merger. Their scrutiny will focus on whether the merger violates antitrust laws and potentially harms competition.

- Potential Outcomes: The outcomes could range from the deal being completely blocked to it being approved with significant conditions, such as divestitures or behavioral remedies.

- Scenarios and implications: If the deal is blocked, it would preserve competition and potentially stimulate innovation. If approved with conditions, the extent of these conditions will determine the ultimate impact on the market.

- Legal precedents: Past merger cases and legal precedents regarding antitrust laws will likely be considered during the regulatory review process, providing guidance for the decision-making process.

The Broader Implications for the Tech Industry

The repercussions of the Broadcom-VMware merger extend beyond the telecom sector. Many other industries rely on VMware's products, and the merger could have a ripple effect across the tech landscape.

- Impact on other industries: Businesses in various sectors, including finance, healthcare, and manufacturing, which rely on VMware's virtualization technologies, could face price increases or reduced service quality.

- Economic impact: The merger could lead to market consolidation, impacting employment levels and investment in technological innovation. The potential for job losses and reduced investment in research and development is a significant concern.

Analyzing AT&T's Opposition to Broadcom's VMware Deal: The Price of Monopoly?

In conclusion, AT&T's opposition to Broadcom's acquisition of VMware highlights crucial concerns regarding extreme pricing, reduced competition, and stifled innovation. The potential for monopolistic practices and the broader implications for the tech industry are significant. The regulatory review process will be pivotal in determining the outcome, with significant consequences for consumers and the future of the telecom sector.

Key Takeaways: AT&T's primary concerns are focused on the potential for increased prices, reduced competition, and stifled innovation resulting from the merger's increased market concentration. Regulatory bodies will play a crucial role in ensuring fair competition and preventing the creation of a monopoly.

Call to Action: Stay informed about the ongoing developments in AT&T's opposition to Broadcom's VMware deal and voice your concerns about the potential for extreme pricing in the telecom industry. Engage with your representatives and regulatory bodies to express your views on the importance of maintaining a competitive marketplace. [Insert links to relevant regulatory websites and news articles here].

The future of competitive pricing in the telecom sector depends on the outcome of AT&T's opposition to the Broadcom-VMware deal.

Featured Posts

-

Brewers Defeat Rockies Chourios 5 Rbis Highlight Dominant Performance

Apr 23, 2025

Brewers Defeat Rockies Chourios 5 Rbis Highlight Dominant Performance

Apr 23, 2025 -

Brewers Base Stealing Spree New Team Record Set

Apr 23, 2025

Brewers Base Stealing Spree New Team Record Set

Apr 23, 2025 -

Detroit Tigers Drop Series Finale Keider Monteros Performance Reviewed

Apr 23, 2025

Detroit Tigers Drop Series Finale Keider Monteros Performance Reviewed

Apr 23, 2025 -

Mlb Upholds Questionable Plate Call Against Tigers Hinch Seeks Replay Review

Apr 23, 2025

Mlb Upholds Questionable Plate Call Against Tigers Hinch Seeks Replay Review

Apr 23, 2025 -

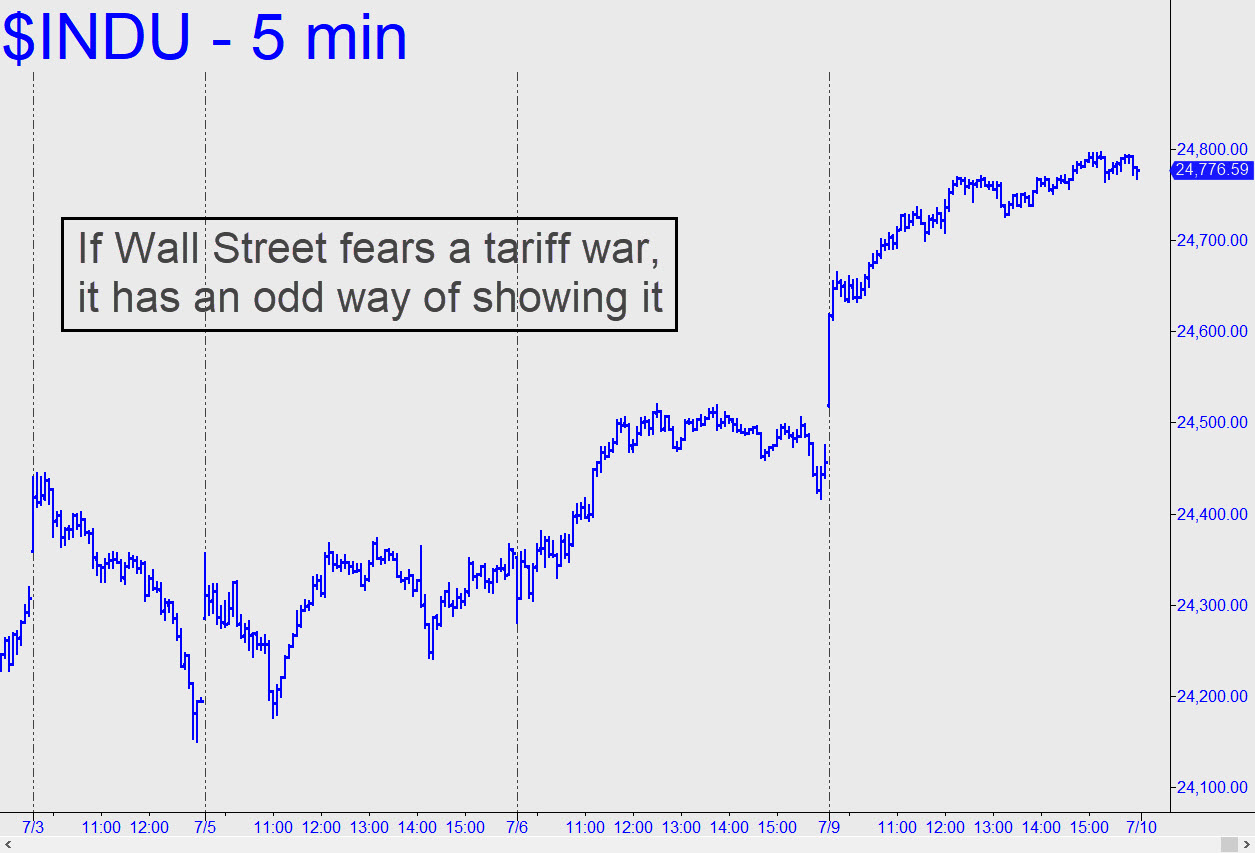

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025

Netflixs Resilience Amidst Big Tech Downturn A Wall Street Tariff Haven

Apr 23, 2025