Are Stretched Stock Market Valuations Justified? BofA's Take.

Table of Contents

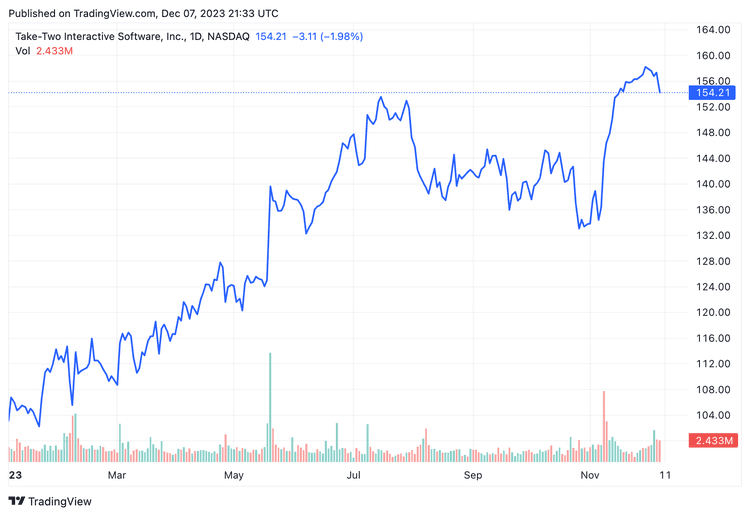

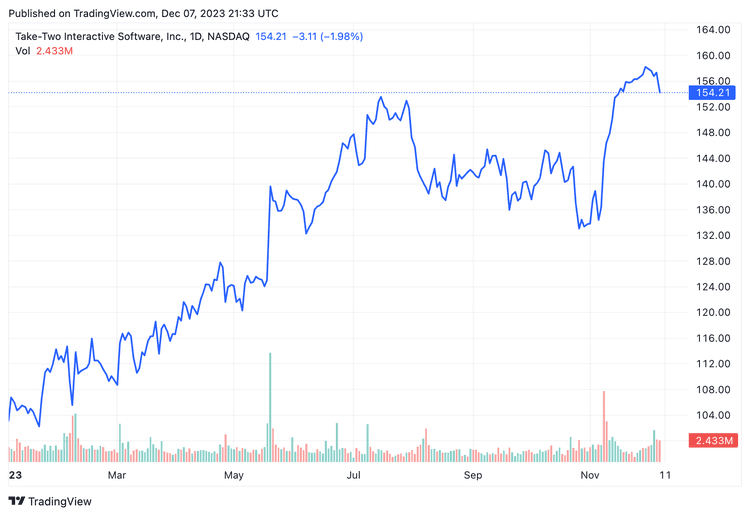

The stock market has reached dizzying heights, leaving many investors questioning whether current valuations are justified. This debate is central to any effective investment strategy, and Bank of America (BofA), a leading voice in market analysis, offers valuable insights. This article examines BofA's perspective on stretched stock market valuations, exploring their assessment of market conditions, the justifications (and risks) behind high valuations, and their resulting investment strategy recommendations. We’ll delve into key indicators, sector performance, and potential market corrections to help you understand this crucial topic.

BofA's Assessment of Current Market Conditions

BofA's overall market outlook (as of [Insert Date - be sure to keep this updated]) is [Insert BofA's current outlook - e.g., cautiously optimistic, neutral, etc.]. This assessment is driven by a complex interplay of economic indicators and global events.

-

Key Market Indicators:

- P/E Ratios: BofA likely cites elevated Price-to-Earnings ratios across various sectors, suggesting potentially overvalued assets. Specific data points should be included here, referencing BofA's reports. (e.g., "BofA notes that the S&P 500's P/E ratio currently stands at [Insert Data from BofA Report], exceeding historical averages.")

- Interest Rates: The impact of interest rate hikes by central banks, like the Federal Reserve, is a significant factor. (e.g., "BofA highlights the potential dampening effect of [Insert interest rate percentage] interest rates on economic growth and corporate earnings.")

- Economic Growth Projections: BofA's forecasts for GDP growth and other macroeconomic factors directly influence their view of market valuations. (e.g., "BofA projects [Insert GDP growth percentage] GDP growth for [Insert Year], potentially supporting higher valuations, but with caveats related to [mention specific challenges].")

-

Influencing Factors:

- Inflationary Pressures: Persistent inflation significantly impacts corporate profitability and investor sentiment. (e.g., "BofA acknowledges the persistent inflationary pressures as a major uncertainty, impacting consumer spending and potentially corporate margins.")

- Geopolitical Events: Global instability, including conflicts or trade tensions, introduce considerable uncertainty. (e.g., "The ongoing geopolitical uncertainty in [mention specific region] is considered a significant risk factor by BofA, potentially affecting supply chains and market confidence.")

- Corporate Earnings: The strength and consistency of corporate earnings are critical. (e.g., "While corporate earnings have been strong in [mention specific sectors], BofA warns that future earnings growth may be more challenging due to [mention specific headwinds].")

Justification for High Valuations (According to BofA)

Despite the risks, BofA may present arguments supporting the current elevated valuations. These justifications often center on specific sectors and companies exhibiting strong performance.

-

Reasons for High Valuations (According to BofA):

- Strong Corporate Earnings Growth: Certain sectors might demonstrate robust earnings growth, justifying premium valuations. (e.g., "BofA points to the strong performance of the technology sector, with companies showing significant revenue growth and market share gains.")

- Technological Innovation: Breakthrough innovations in various sectors could be driving higher valuations, especially in growth stocks. (e.g., "The rapid advancements in [mention specific technologies] have spurred significant investment in related companies, leading to higher valuations.")

- Low Interest Rates (if applicable): Historically low interest rates (if this is the case) may contribute to higher valuations by lowering the cost of capital. (e.g., "Historically low interest rates have encouraged investment and contributed to higher valuations in certain sectors, but this may change depending on future interest rate movements.")

-

Specific Examples:

- BofA might highlight specific companies within the technology, healthcare, or other high-growth sectors as examples of strong performance justifying higher valuations. (e.g., "BofA cites companies like [Company A] and [Company B] as examples of strong earnings growth and technological leadership driving high valuations within the technology sector.")

Risks and Potential Downsides Identified by BofA

BofA, however, almost certainly acknowledges significant risks associated with stretched valuations.

-

Potential Downsides:

- Market Correction: The potential for a sharp market correction is a significant risk. (e.g., "BofA warns about the possibility of a market correction, given the current elevated valuations and potential for future interest rate hikes.")

- Impact of Rising Interest Rates: Higher interest rates increase borrowing costs for businesses, potentially impacting earnings. (e.g., "Rising interest rates could significantly impact corporate profitability and trigger a market correction, according to BofA’s analysis.")

- Geopolitical Risks: Unforeseen global events can negatively impact market sentiment. (e.g., "BofA considers the geopolitical uncertainty in [region] a major risk, potentially impacting investor confidence and triggering a market decline.")

-

Triggers for a Market Downturn:

- Unexpected economic slowdown, a significant geopolitical event, or a sudden surge in inflation could all trigger a market downturn. (e.g., "BofA identifies a significant economic slowdown, exacerbated by escalating geopolitical tensions, as a potential catalyst for a major market downturn.")

BofA's Investment Strategy Recommendations

Based on their analysis, BofA will likely offer specific investment strategies to navigate the current market conditions.

-

Investment Strategy Suggestions:

- Diversification: Diversifying across asset classes and sectors is key to mitigating risk. (e.g., "BofA recommends diversifying across asset classes, including equities, fixed income, and alternative investments, to reduce overall portfolio volatility.")

- Sector Rotation: Shifting investments from overvalued to undervalued sectors might be suggested. (e.g., "BofA suggests a cautious approach to sector rotation, moving investments from potentially overvalued growth stocks to more defensive sectors.")

- Defensive Positioning: A more conservative investment approach may be recommended, prioritizing capital preservation. (e.g., "BofA advocates for a more defensive investment strategy, focusing on high-quality, dividend-paying stocks with lower volatility.")

-

Asset Allocation Recommendations:

- BofA likely offers specific recommendations on asset allocation based on individual investor risk profiles. (e.g., "BofA recommends a specific asset allocation strategy tailored to the investor's risk tolerance and investment timeline.")

Conclusion

BofA's analysis of stretched stock market valuations presents a nuanced perspective. While strong corporate earnings and technological innovation in some sectors may justify higher valuations, significant risks remain. The potential for a market correction due to rising interest rates, persistent inflation, or unforeseen geopolitical events is substantial. BofA’s recommendations emphasize diversification, strategic sector rotation, and potentially a more defensive approach, depending on individual investor risk tolerance.

Call to Action: Stay informed about evolving stock market valuations and adjust your investment strategy accordingly. Consider consulting with a financial advisor to discuss your own risk tolerance and develop a personalized investment plan based on your financial goals. Remember to conduct thorough research and stay updated on the latest market analysis to make informed investment decisions concerning stock market valuations.

Featured Posts

-

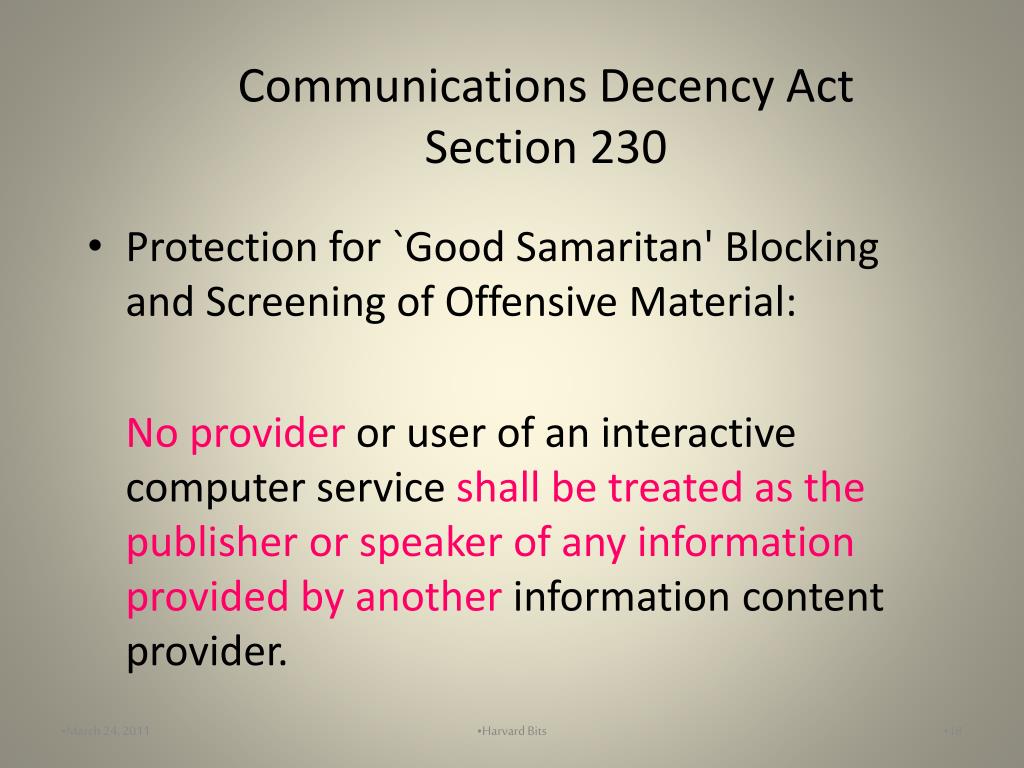

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025

E Bay Listings For Banned Chemicals Section 230 Protection Challenged

Apr 22, 2025 -

The Rise Of Disaster Betting Examining The Los Angeles Wildfire Case

Apr 22, 2025

The Rise Of Disaster Betting Examining The Los Angeles Wildfire Case

Apr 22, 2025 -

Are Stock Investors Prepared For More Market Downturns

Apr 22, 2025

Are Stock Investors Prepared For More Market Downturns

Apr 22, 2025 -

La Landlord Price Gouging After Fires A Selling Sunset Stars Perspective

Apr 22, 2025

La Landlord Price Gouging After Fires A Selling Sunset Stars Perspective

Apr 22, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 22, 2025