Are Stock Investors Prepared For More Market Downturns?

Table of Contents

Understanding the Current Economic Landscape and Predicting Future Market Downturns

Predicting market downturns with certainty is impossible, but understanding key economic indicators and geopolitical risks can significantly improve our preparedness.

Analyzing Economic Indicators

Several economic indicators offer clues about potential market instability. Monitoring these closely can help investors anticipate shifts and adjust their strategies accordingly.

- Inflation: High and persistent inflation erodes purchasing power and can trigger interest rate hikes, potentially slowing economic growth and impacting stock valuations. Sources like the Consumer Price Index (CPI) provide crucial data.

- Interest Rates: Interest rate increases by central banks aim to curb inflation, but can also slow economic activity, impacting corporate profits and stock prices. Federal Reserve announcements are key to watching.

- GDP Growth: A slowing or contracting GDP signals potential economic recession, often associated with market downturns. Data from government sources like the Bureau of Economic Analysis (BEA) is vital.

- Unemployment Rate: Rising unemployment indicates weakening consumer demand and potential economic slowdown, increasing the likelihood of a market correction. The Bureau of Labor Statistics (BLS) provides regular updates.

Understanding these indicators and their interrelationships is crucial for informed investment decisions. Reputable economic forecasts from organizations like the IMF and OECD can also provide valuable insights.

Geopolitical Risks and Their Influence

Global events significantly influence market stability. Geopolitical risks, such as wars, political instability, and pandemics, introduce uncertainty and can trigger sharp market reactions.

- Wars and Conflicts: Major conflicts disrupt global supply chains, increase commodity prices, and negatively impact investor confidence, leading to market volatility. The Russo-Ukrainian war is a recent example.

- Political Instability: Political uncertainty in major economies can create market uncertainty and trigger sell-offs. Elections and policy changes can be significant factors.

- Pandemics: The COVID-19 pandemic demonstrated the significant impact of global health crises on markets, causing sharp declines and increased volatility.

Diversification across different asset classes and geographies is a key strategy to mitigate the impact of geopolitical risks.

Assessing Investor Sentiment and Behavior During Downturns

Understanding investor psychology and portfolio composition is crucial for navigating market downturns effectively.

The Psychology of Investing

Market downturns often trigger emotional reactions, leading to poor investment decisions.

- Panic Selling: Fear drives investors to sell assets at a loss, exacerbating the downturn.

- Herd Behavior: Investors tend to mimic the actions of others, leading to amplified market swings.

- Confirmation Bias: Investors tend to seek information confirming their existing beliefs, ignoring contradictory evidence.

Maintaining a long-term investment strategy and avoiding emotional decision-making are crucial during market downturns.

Analyzing Investor Portfolio Composition

A poorly diversified portfolio is particularly vulnerable during market downturns.

- Asset Allocation: Concentrated investments in a single sector or asset class increase risk.

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk.

- Risk Tolerance: Investment strategies should align with individual risk tolerance levels.

Reviewing and adjusting portfolio composition based on risk tolerance and market conditions is essential for resilience during market downturns.

Strategies for Navigating Future Market Downturns

Proactive strategies can significantly reduce the impact of market downturns.

Diversification and Asset Allocation

Diversification remains the cornerstone of effective risk management.

- Asset Class Diversification: Investing across stocks, bonds, real estate, commodities, and alternative investments reduces the impact of sector-specific declines.

- Geographic Diversification: Investing in different countries reduces the risk associated with regional economic or political instability.

- Professional Advice: Seeking advice from a qualified financial advisor can help create a diversified portfolio tailored to individual needs and risk tolerance.

Defensive Investing Techniques

Defensive strategies can help preserve capital during market corrections.

- Value Investing: Focusing on undervalued companies with strong fundamentals can offer protection against market volatility.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of market fluctuations, reduces the impact of market timing.

- Hedging: Employing strategies like put options can help mitigate potential losses during market declines.

The Role of Emergency Funds and Financial Planning

A solid financial foundation is crucial for weathering market storms.

- Emergency Fund: Having 3-6 months' worth of living expenses in readily accessible savings provides a crucial buffer during job loss or unexpected expenses.

- Financial Planning: Regularly reviewing and updating your financial plan, including investment strategy and retirement goals, ensures you remain on track despite market fluctuations.

Conclusion

Preparing for market downturns requires a proactive and multifaceted approach. Understanding economic indicators, assessing investor sentiment, and implementing diversified investment strategies are crucial steps. Key takeaways include the importance of diversification across asset classes and geographies, employing defensive investing techniques like value investing and dollar-cost averaging, and maintaining a robust emergency fund and comprehensive financial plan. Are you prepared for the next market downturn? Start planning your investment strategy today! Don't wait for the next wave of market downturns to strike; take control of your financial future now and learn how to protect your investments effectively.

Featured Posts

-

Cassidy Hutchinsons Memoir A Jan 6 Witnesss Account

Apr 22, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witnesss Account

Apr 22, 2025 -

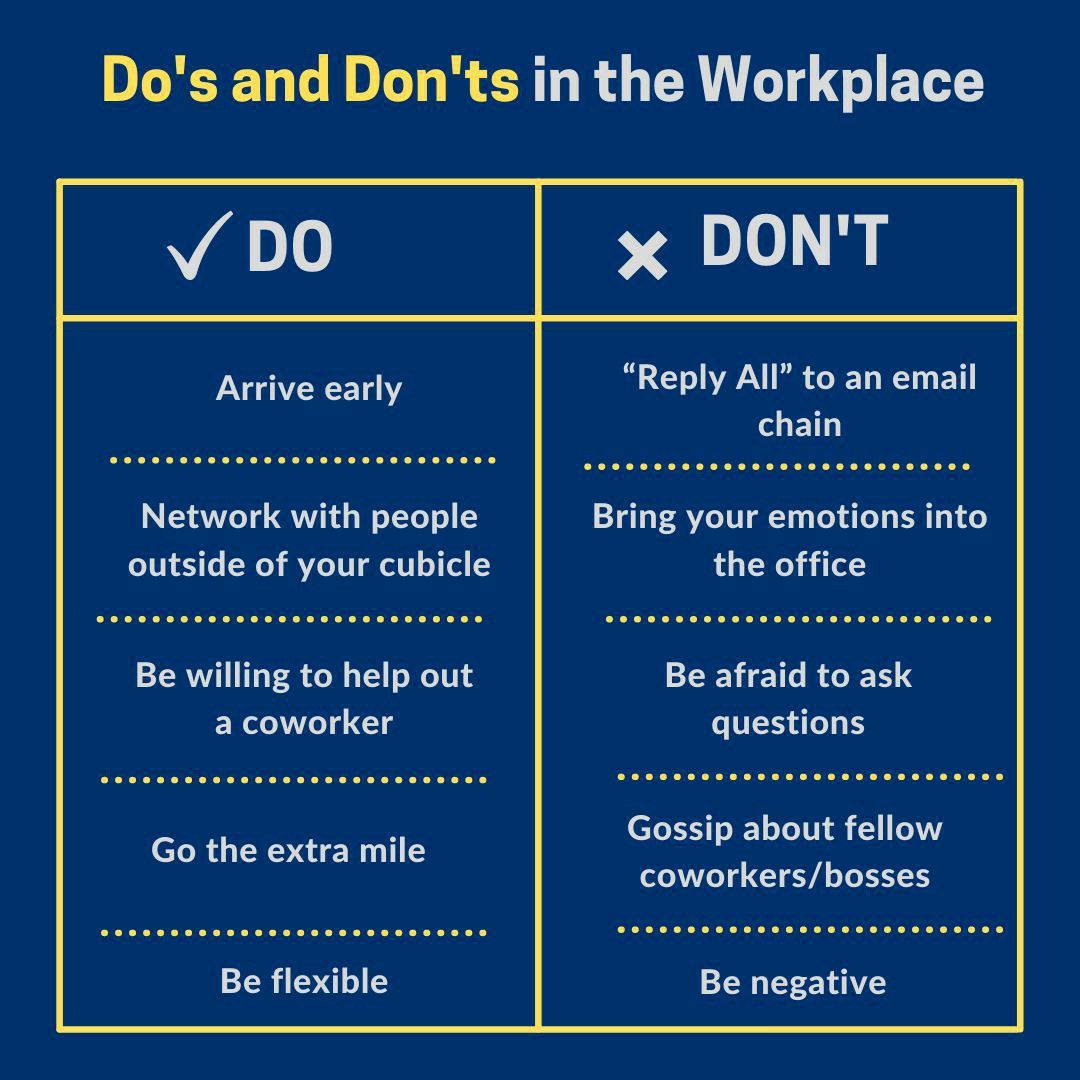

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 22, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut Trump Administrations Anger Explained

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Trump Administrations Anger Explained

Apr 22, 2025 -

Enhanced Security Collaboration China And Indonesia Forge Closer Bonds

Apr 22, 2025

Enhanced Security Collaboration China And Indonesia Forge Closer Bonds

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut From Trump Administration

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut From Trump Administration

Apr 22, 2025