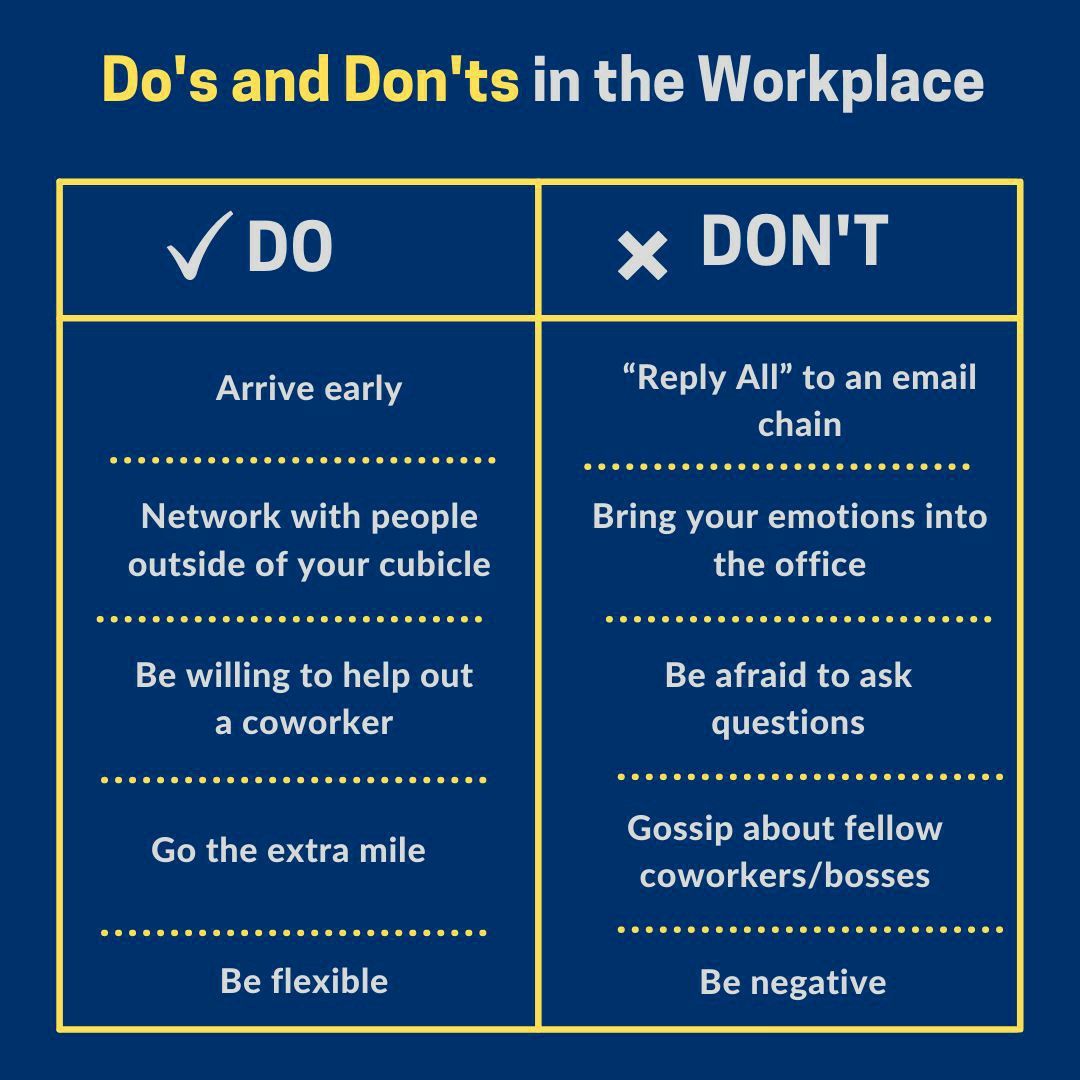

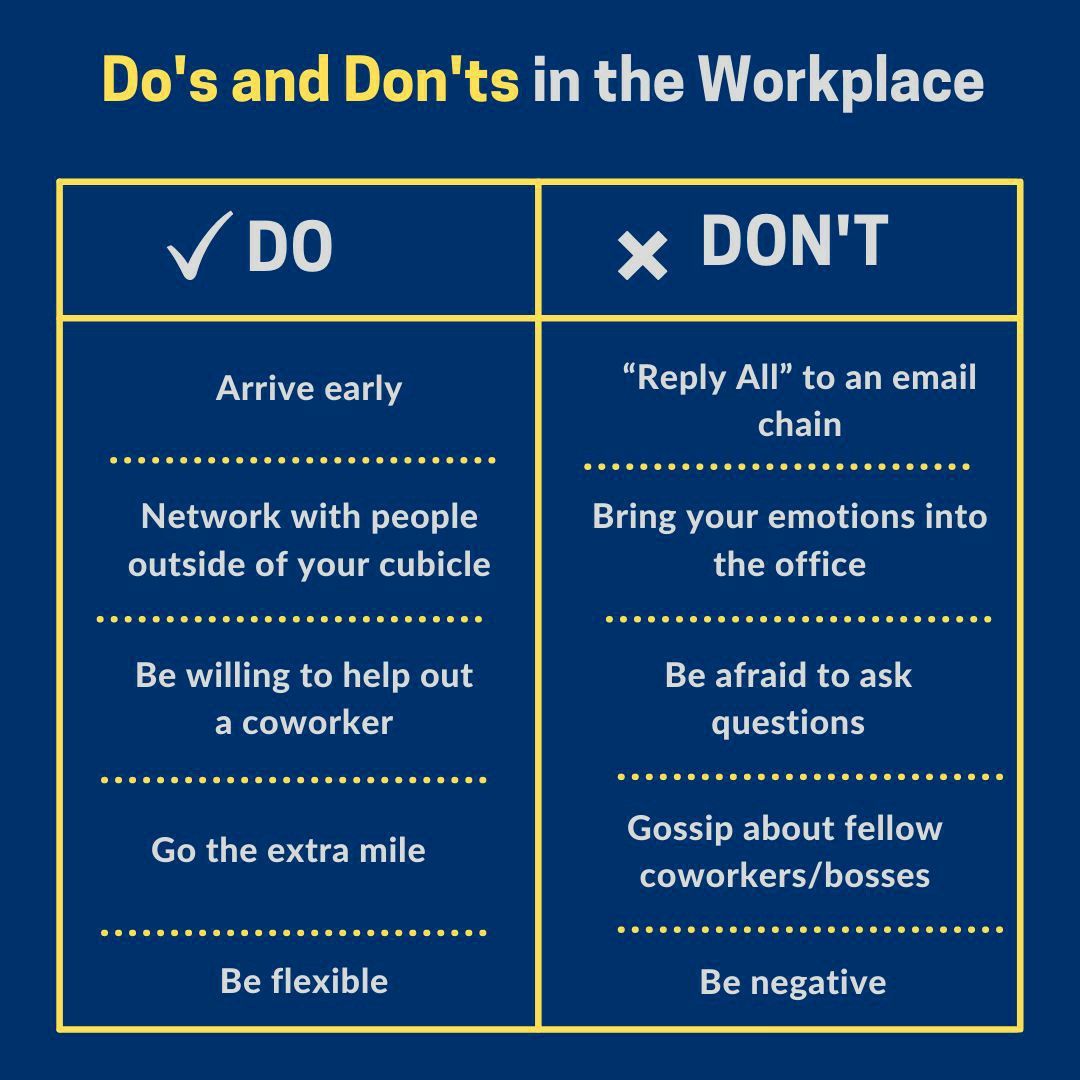

Navigate The Private Credit Boom: 5 Essential Dos And Don'ts

Table of Contents

Do Your Due Diligence: Understanding Private Credit Investments

Investing in private credit requires meticulous due diligence. Before committing your capital, thorough research is paramount. This involves scrutinizing both the fund managers and the underlying assets.

Thoroughly Research Fund Managers and Their Track Records:

- Experience: Examine the fund manager's experience in private credit, focusing on their specific experience within your target asset class (e.g., direct lending, distressed debt, mezzanine financing). A proven track record in similar investments is crucial.

- Performance Analysis: Analyze their historical performance data. Don't just look at raw returns; consider risk-adjusted returns like the Sharpe Ratio to understand the return relative to the risk taken. Pay close attention to downside protection mechanisms employed by the fund.

- Team Expertise: Assess the team's expertise in crucial areas such as underwriting (assessing borrower creditworthiness), portfolio management (actively managing the investment portfolio), and legal compliance (adherence to all relevant regulations).

- Investment Strategy Alignment: Carefully review the fund's investment strategy and ensure it aligns with your own investment goals, risk tolerance, and time horizon. Understanding their approach to capital deployment and portfolio construction is vital.

Analyze the Underlying Assets:

Due diligence extends beyond the fund manager to encompass a thorough analysis of the underlying assets – the loans themselves.

- Borrower Creditworthiness: Assess the creditworthiness of each borrower using their financial statements, industry analysis, and an evaluation of the management team's competence and experience.

- Loan Agreement Scrutiny: Scrutinize the loan agreements meticulously. Pay close attention to interest rates, covenants (conditions the borrower must meet), repayment schedules, and any prepayment penalties.

- Collateral Assessment: Understand the nature and value of the collateral backing the loan. In a default scenario, the collateral's value will determine potential recovery. Consider its liquidity and potential for quick liquidation.

- Portfolio Diversification: Examine the overall portfolio diversification. Identify potential concentration risks – excessive exposure to a single borrower, industry, or geographic region.

Don't Neglect Diversification: Spreading Your Private Credit Investments

Diversification is a cornerstone of risk management in private credit. Concentrating investments in a single fund or asset class can expose your portfolio to significant losses if that specific area experiences difficulties.

- Fund Manager Diversification: Invest across multiple fund managers with varying investment strategies and risk profiles to reduce dependence on any single manager's performance.

- Asset Class Diversification: Diversify across different asset classes within private credit, such as senior secured loans (lower risk), mezzanine debt (higher risk, higher potential return), and distressed debt (highest risk, highest potential return).

- Industry Diversification: Spread your investments across different industries to mitigate risks associated with economic downturns impacting specific sectors.

- Geographic Diversification: Consider geographic diversification to reduce exposure to regional economic downturns or political instability.

- Regular Portfolio Review: Regularly review and rebalance your portfolio to maintain your desired level of diversification and ensure it aligns with your evolving risk tolerance and investment objectives.

Do Understand the Risks: Evaluating Potential Downside

Private credit investments, while potentially lucrative, carry inherent risks. Understanding these risks is crucial for informed decision-making.

- Illiquidity: Private credit investments are typically illiquid, meaning they cannot be easily sold quickly without potentially significant price concessions. Ensure your investment horizon aligns with the anticipated liquidity profile of the investment.

- Credit Risk: The primary risk is the possibility of borrower default. Thorough due diligence is crucial to mitigate this risk.

- Interest Rate Risk: Changes in interest rates can impact the value of private credit investments, especially floating-rate loans. Consider the sensitivity of your portfolio to interest rate fluctuations.

- Loss Potential: Understand the potential for principal loss and the limitations of downside protection offered by certain strategies.

- Professional Advice: Consider seeking professional advice from a financial advisor specializing in alternative investments to gain a comprehensive understanding of the risks involved.

Don't Overlook the Legal and Regulatory Landscape: Navigating Compliance

The regulatory environment for private credit is complex and evolving. Staying informed about changes is essential to ensure compliance and avoid potential penalties.

- Regulatory Updates: Stay abreast of changes in regulations related to securities, banking, and tax laws that could affect your private credit investments.

- Legal Compliance: Ensure your investments comply with all applicable laws and regulations. Seek legal counsel to understand the legal implications of your investments.

- Reporting Requirements: Understand and adhere diligently to all reporting requirements imposed by regulatory bodies.

- Professional Legal Advice: Engage legal professionals specializing in private credit to navigate the complexities of the regulatory landscape and protect your interests.

Do Consider Your Investment Timeline: Aligning Investments with Your Goals

Private credit investments often have longer lock-up periods than publicly traded securities. Aligning your investment timeline with your financial goals is critical.

- Investment Horizon: Clearly define your investment objectives and the time horizon over which you expect to hold the investment. Private credit investments are generally better suited for long-term investors.

- Risk Tolerance: Align your private credit investments with your risk tolerance. Higher-risk strategies may offer greater returns but also carry a higher chance of loss.

- Strategic Review: Regularly review your investment strategy to ensure it continues to align with your evolving financial goals and circumstances.

- Tax Implications: Consider the tax implications of private credit investments and seek advice from a qualified tax professional.

Conclusion: Harnessing the Opportunities in Private Credit

The private credit boom offers substantial potential rewards for investors, but success hinges on a strategic approach. By diligently following these dos and don'ts, you can significantly improve your chances of navigating the private credit market effectively and maximizing returns while minimizing risk. Remember to always conduct thorough due diligence, diversify your portfolio appropriately, fully understand the inherent risks, navigate the legal landscape with care, and align your investments with your long-term goals and investment timeline. Don't hesitate to seek professional advice to unlock the full potential of private credit investing. Start your journey into private credit investing today by carefully applying these essential guidelines. Remember to always seek professional financial advice before making any investment decisions.

Featured Posts

-

Hegseth Faces Backlash Over Leaked Signal Chat And Pentagon Claims

Apr 22, 2025

Hegseth Faces Backlash Over Leaked Signal Chat And Pentagon Claims

Apr 22, 2025 -

Rapid Police Response Fails To Quell Student Fears After Fsu Security Flaw Exposed

Apr 22, 2025

Rapid Police Response Fails To Quell Student Fears After Fsu Security Flaw Exposed

Apr 22, 2025 -

Coordinating Deportees Return To South Sudan A Us Government Partnership

Apr 22, 2025

Coordinating Deportees Return To South Sudan A Us Government Partnership

Apr 22, 2025 -

The Conclave And The Future Evaluating Pope Franciss Reign

Apr 22, 2025

The Conclave And The Future Evaluating Pope Franciss Reign

Apr 22, 2025 -

Open Ais Chat Gpt Ftc Probe Into Ai Practices And Data Handling

Apr 22, 2025

Open Ais Chat Gpt Ftc Probe Into Ai Practices And Data Handling

Apr 22, 2025