Do Film Tax Credits Work? A Minnesota Case Study

Table of Contents

Minnesota's Film Tax Credit Program: Structure and Incentives

Program Overview

Minnesota's film tax credit program offers a 25% credit on qualified production spending within the state. To be eligible, productions must meet specific spending thresholds, often requiring a significant investment within Minnesota's economy. Eligible productions include feature films, television series, commercials, and other qualifying projects. The program aims to attract productions that would not otherwise consider Minnesota as a filming location, stimulating economic activity and job creation.

Incentive Mechanisms

Minnesota's film tax credits are refundable, meaning that productions can receive a refund for the credit amount even if it exceeds their state tax liability. This significantly boosts the incentive for film companies to choose Minnesota as a filming location. For example, a production spending $1 million in Minnesota would be eligible for a $250,000 tax credit, directly impacting their bottom line and making the state more attractive compared to locations without such incentives.

- Key Features of Minnesota's Program:

- Refundable tax credits, enhancing their attractiveness.

- Specific spending thresholds to ensure significant investment in the state.

- Inclusion of various production types, fostering a diverse film industry.

- Location requirements designed to spread economic benefits across the state.

Economic Impact Assessment: Jobs, Spending, and Revenue Generation

Job Creation

Studies suggest that Minnesota's film tax credit program has led to a notable increase in employment within the state. This includes direct jobs within film productions (crew members, actors, directors) and indirect jobs in supporting industries (catering, transportation, hospitality). While precise figures vary depending on the study and year, estimates suggest hundreds, if not thousands, of jobs directly or indirectly attributable to productions leveraging the tax credits.

Increased Spending

Film productions using Minnesota's tax credits contribute substantially to the state's economy through increased spending. This includes expenditures on local goods and services, hotel accommodations, equipment rentals, and other related expenses. For example, a major film production might contract local caterers, rent equipment from Minnesota-based companies, and utilize local hotels, injecting significant funds directly into the state's economy.

Tax Revenue Generated

While the film tax credit program involves a direct cost to the state, it generates both direct and indirect tax revenue. Direct revenue comes from taxes paid by film production companies and their employees. Indirect revenue stems from increased economic activity in related industries. The net effect – the difference between the cost of the credits and the increased tax revenue – is a critical factor in evaluating the program's success. Detailed economic impact studies are needed to accurately quantify this net effect.

- Data and Statistics (Illustrative - requires further research and updated data):

- X number of jobs created annually due to film productions utilizing tax credits.

- $X million in direct spending by film productions in Minnesota per year.

- Comparison of tax revenue generated in Minnesota with similar states lacking comparable film tax credit programs.

Challenges and Limitations of Minnesota's Film Tax Credit Program

Cost-Effectiveness

A crucial aspect of evaluating Minnesota's film tax credit program is its cost-effectiveness. Determining the actual ROI requires meticulous analysis, comparing the cost of the tax credits to the resulting economic benefits. Studies assessing the program's ROI are essential to ensure that the financial investment yields a positive return for the state.

Program Administration

The efficiency and transparency of the program's administration are vital for its success. Bureaucratic hurdles, delays in processing applications, and a lack of clear guidelines can hinder the program's effectiveness. Streamlining the application process and enhancing transparency can improve its overall efficiency.

Equity and Inclusivity

It's crucial to assess whether the benefits of Minnesota's film tax credit program are equitably distributed. Concerns regarding disparities in access to the program and a lack of inclusivity within the film industry itself need to be addressed. Promoting diversity and inclusion within the film productions utilizing the credits should be a key priority.

- Areas for Improvement:

- More rigorous evaluation of the program's ROI through independent studies.

- Streamlining the application and approval process to reduce administrative burdens.

- Implementing measures to ensure greater equity and inclusivity within the industry.

Conclusion: Do Minnesota's Film Tax Credits Deliver? A Final Verdict

Evaluating the effectiveness of Minnesota's film tax credit program requires a balanced perspective, considering both its economic benefits and its challenges. While the program has undoubtedly stimulated some economic growth through job creation and increased spending, a thorough assessment of its cost-effectiveness and ROI is crucial. Further research, including detailed economic impact studies and analyses of program administration, is necessary to provide a definitive answer. Addressing concerns about equity and inclusivity is also vital to ensure that the program benefits all segments of the Minnesota population.

To maximize the effectiveness of Minnesota’s film tax credits and similar programs in other states, improvements in program administration, transparency, and a focus on equitable distribution of benefits are crucial. We urge readers to research film tax credit programs in their own states, comparing costs and benefits, and engaging in discussions about their effectiveness and potential improvements. Evaluate the effectiveness of your state's film tax credits and learn more about how film tax credits impact local economies. Understand the complexities surrounding film tax credit programs to contribute to more informed policy discussions.

Featured Posts

-

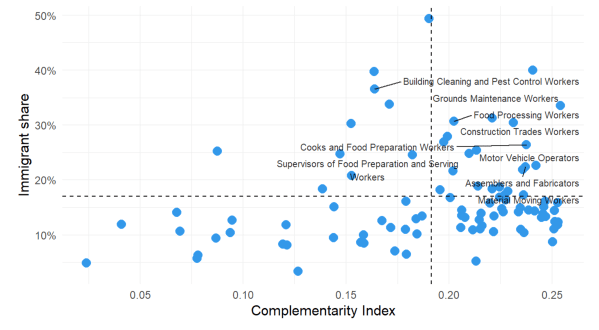

Minnesota Immigrant Workforce Shifts Towards Higher Earning Potential

Apr 29, 2025

Minnesota Immigrant Workforce Shifts Towards Higher Earning Potential

Apr 29, 2025 -

Minnesota Faces Attorney Generals Transgender Sports Ban Order

Apr 29, 2025

Minnesota Faces Attorney Generals Transgender Sports Ban Order

Apr 29, 2025 -

Lower Migration In Germany The Role Of Strengthened Border Security

Apr 29, 2025

Lower Migration In Germany The Role Of Strengthened Border Security

Apr 29, 2025 -

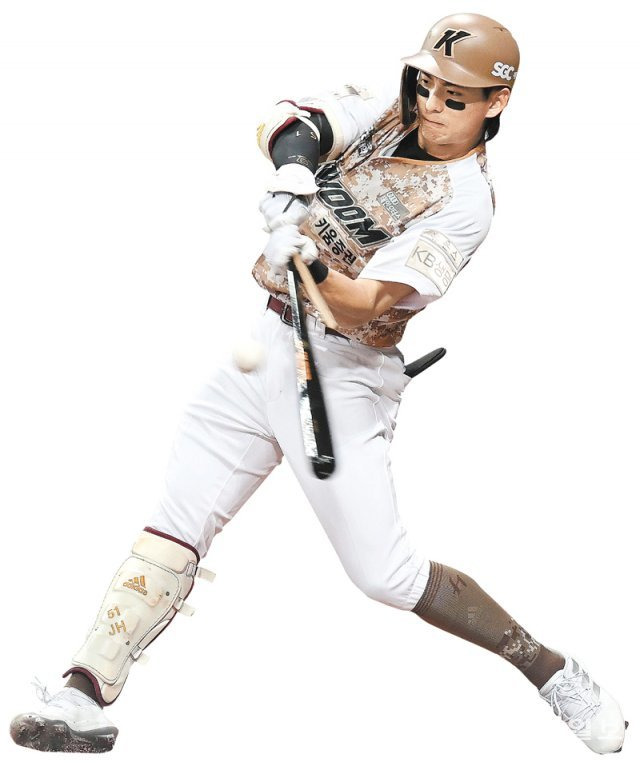

160km

Apr 29, 2025

160km

Apr 29, 2025 -

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025