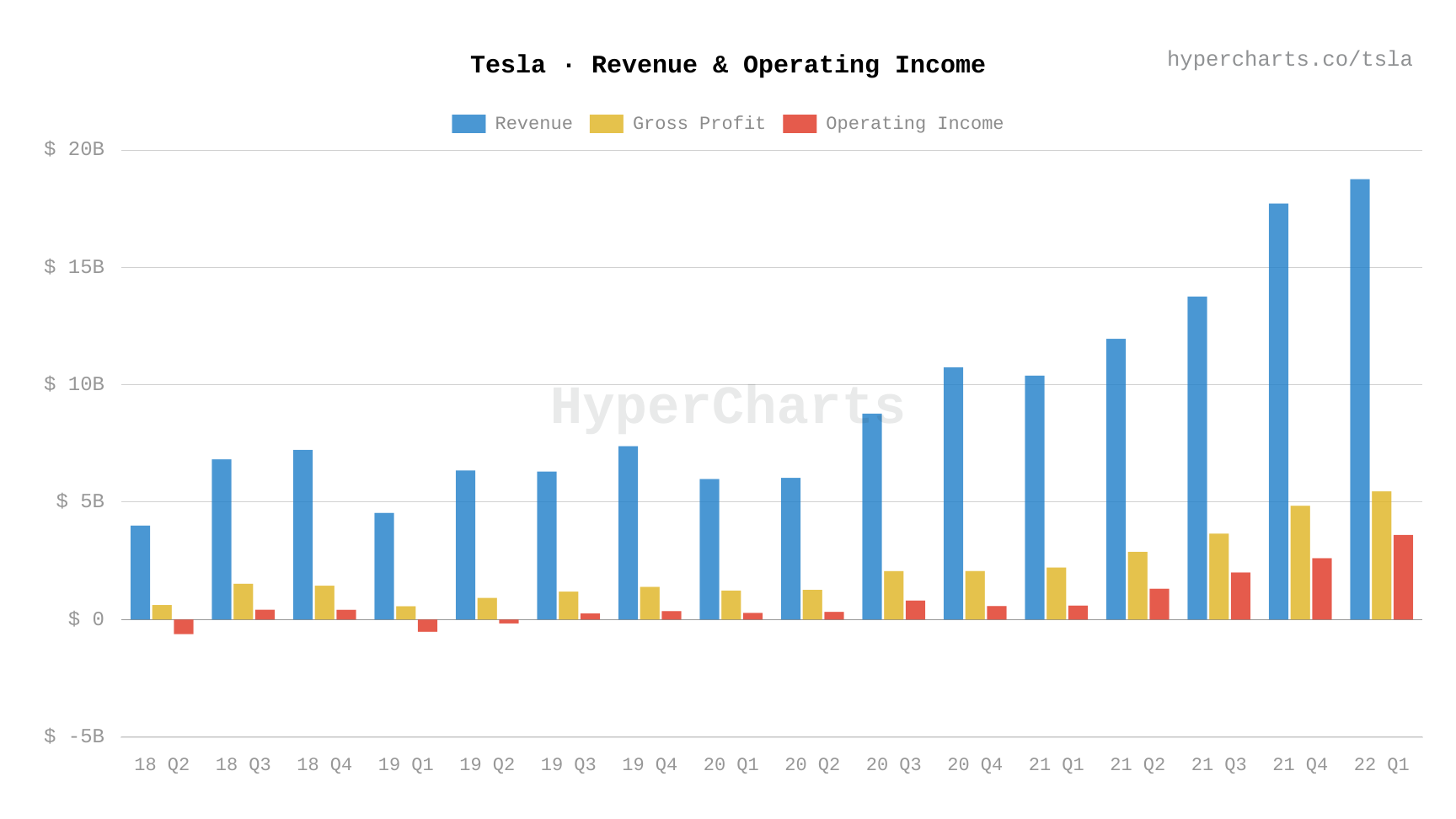

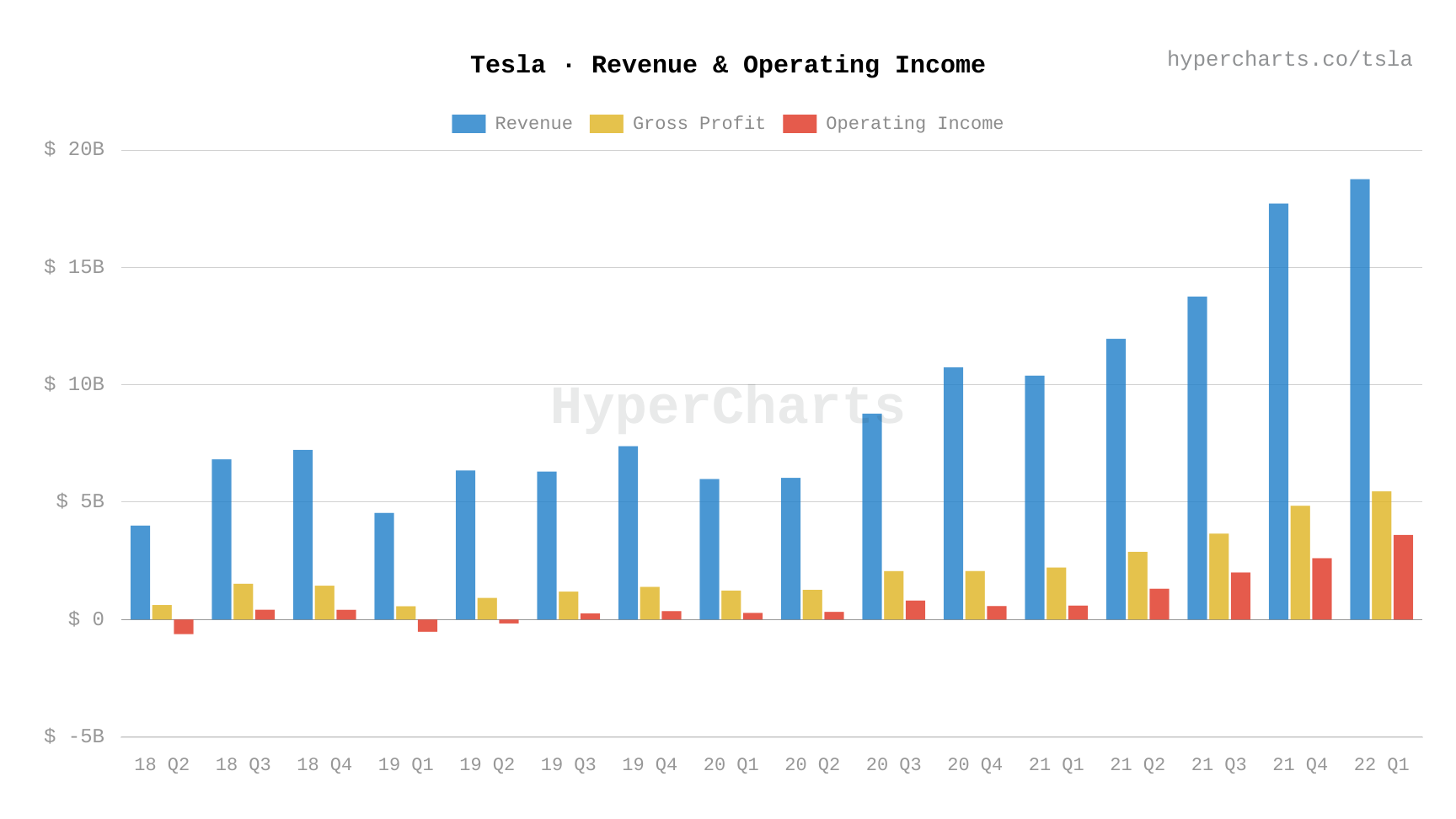

Analysis Of Tesla's Q1 Earnings: 71% Net Income Reduction Explained

Table of Contents

Tesla's Aggressive Price Cuts and Their Impact on Profitability

Tesla's decision to implement aggressive price cuts across its vehicle lineup was a pivotal factor contributing to the reduced Q1 net income. While the rationale behind these cuts—primarily to boost sales volume in the face of increasing competition and economic uncertainty—is understandable, the impact on profit margins has been substantial.

- Rationale: Tesla aimed to maintain its market share and stimulate demand amidst growing competition from established automakers and new EV entrants. The strategy was to prioritize volume over margin in the short term.

- Impact: The price cuts directly reduced the revenue per vehicle, significantly impacting Tesla's profit margins. While sales volume may have increased, the overall profit generated per unit sold decreased considerably. [Insert chart or graph showing comparison of profit margins before and after price cuts, if available].

- Examples: Tesla implemented significant price reductions on its Model 3, Model Y, and Model S vehicles in various markets globally. [Include specific examples of price changes with dates and regions, if available].

- Long-term Effects: The long-term viability of this strategy remains uncertain. While boosting sales volume is crucial for market dominance, sustained low profit margins could hinder Tesla's ability to invest in R&D and future growth.

Rising Competition in the Electric Vehicle (EV) Market

The EV market is rapidly evolving, with numerous established automakers and new players vying for market share. This intensified competition directly impacts Tesla's sales and profitability.

- Increased Competition: Companies like BYD, Volkswagen, and others are aggressively expanding their EV offerings, challenging Tesla's dominance. These competitors offer competitive pricing, innovative features, and increasingly sophisticated technologies.

- Competitor Strategies: Many competitors are focusing on aggressive pricing strategies, government incentives, and building strong dealer networks to capture market share. Some are focusing on specific niche markets that Tesla may be overlooking.

- Market Share Analysis: [Include a table or chart showing the market share of Tesla and its major competitors. Source the data].

- Competitive Landscape: The future of the EV market will be intensely competitive. Tesla will need to continue innovating and adapting its strategies to maintain its position.

Supply Chain Challenges and Their Influence on Production Costs

Tesla, like many manufacturers, has experienced significant challenges related to supply chain disruptions. These disruptions directly impact production costs and, consequently, profitability.

- Raw Material Shortages: Securing crucial raw materials like lithium, nickel, and cobalt for battery production has been consistently challenging, leading to increased costs.

- Component Availability: The availability of various components necessary for vehicle assembly has also been impacted, causing production delays and increased expenses.

- Impact on Costs: The rising costs of raw materials and components directly translate into higher production costs, squeezing profit margins. [If possible, include data on the increase in raw material costs].

- Mitigation Strategies: Tesla is likely investing in vertical integration (controlling more stages of the supply chain) and alternative sourcing to mitigate future supply chain risks.

Increased Operational Expenses and Investment in Future Growth

Tesla's substantial investment in research and development (R&D), expansion of manufacturing facilities, and other operational expenses also contributed to the reduced Q1 net income.

- R&D Spending: Tesla continues to heavily invest in developing new technologies, including battery technology, autonomous driving systems, and new vehicle platforms.

- Manufacturing Expansion: The expansion of Gigafactories globally requires significant capital investment, impacting short-term profitability.

- Operational Costs: Other operational costs, such as marketing, sales, and administration, also contribute to the overall expense base.

- Long-term Vision: These investments, while impacting short-term profitability, are crucial for Tesla's long-term growth and competitiveness in the rapidly evolving EV market.

Conclusion: Understanding Tesla's Q1 Earnings Dip and Future Outlook

Tesla's 71% reduction in Q1 net income was a result of a confluence of factors: aggressive price cuts impacting profitability, increasing competition in the EV market, persistent supply chain challenges, and significant investments in future growth. While the short-term outlook might appear challenging, Tesla's long-term prospects depend on its ability to navigate these challenges effectively and maintain its innovative edge. The company's continued investments in R&D and manufacturing expansion suggest a commitment to long-term growth, even if it means sacrificing short-term profitability. Will they regain profitability? That remains to be seen, and will depend on their ability to adjust strategies and market conditions.

To stay updated on Tesla's performance and future developments, subscribe to our newsletter and follow our website for more in-depth "Tesla Q1 earnings analysis" and related content. Share this article on social media to help others understand the complexities of Tesla's recent financial performance!

Featured Posts

-

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025

The Bold And The Beautiful February 20th Spoilers Steffy Liam And Finn

Apr 24, 2025 -

Understanding The Dynamics Of New Business Hotspots In The Country

Apr 24, 2025

Understanding The Dynamics Of New Business Hotspots In The Country

Apr 24, 2025 -

Instagram Targets Tik Tok Creators With New Video Editing App

Apr 24, 2025

Instagram Targets Tik Tok Creators With New Video Editing App

Apr 24, 2025 -

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025

The Value Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 24, 2025 -

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025

Metas Future Under A Trump Administration Zuckerbergs Challenges

Apr 24, 2025