Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Core Argument: Why Valuations Aren't Overblown

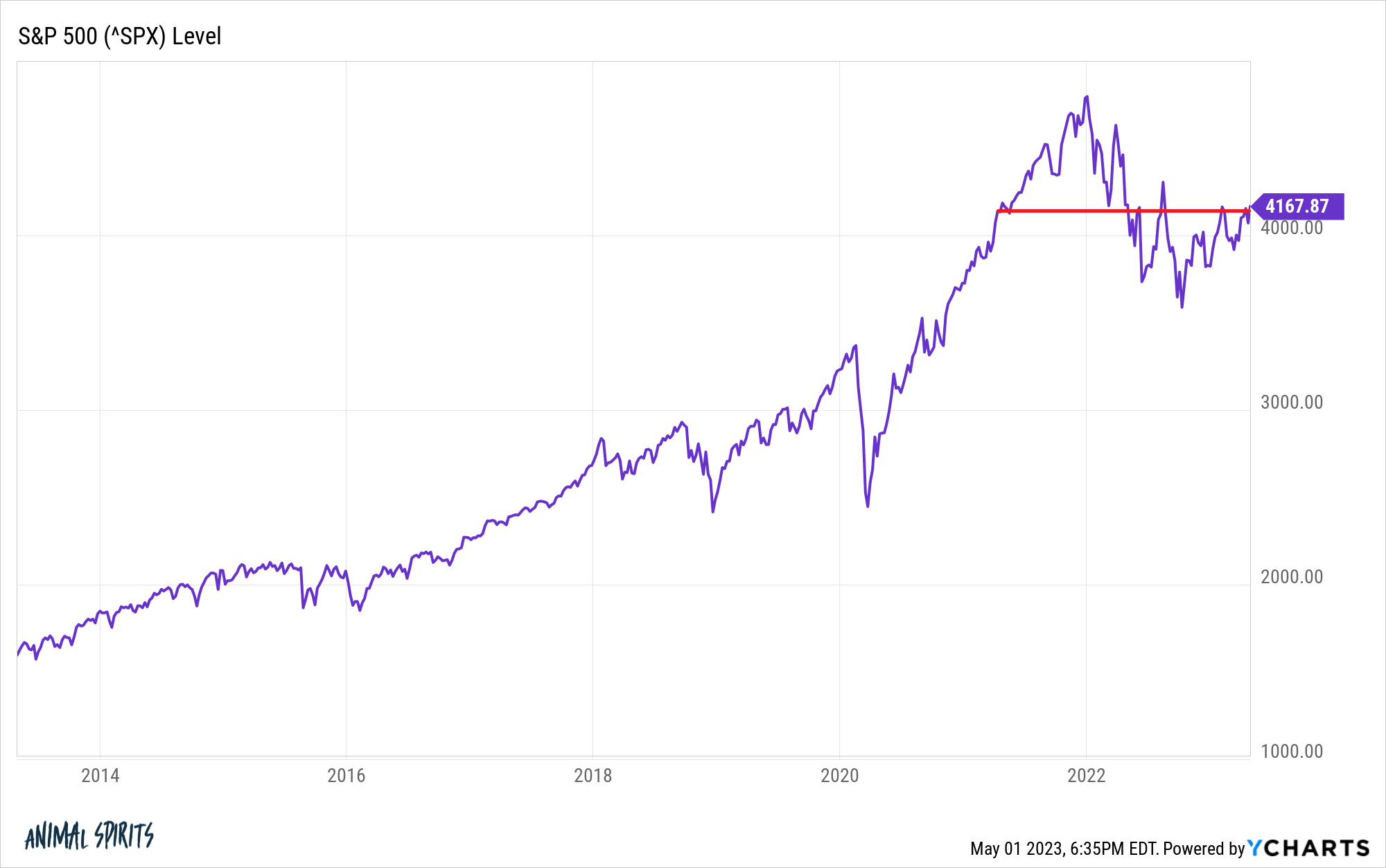

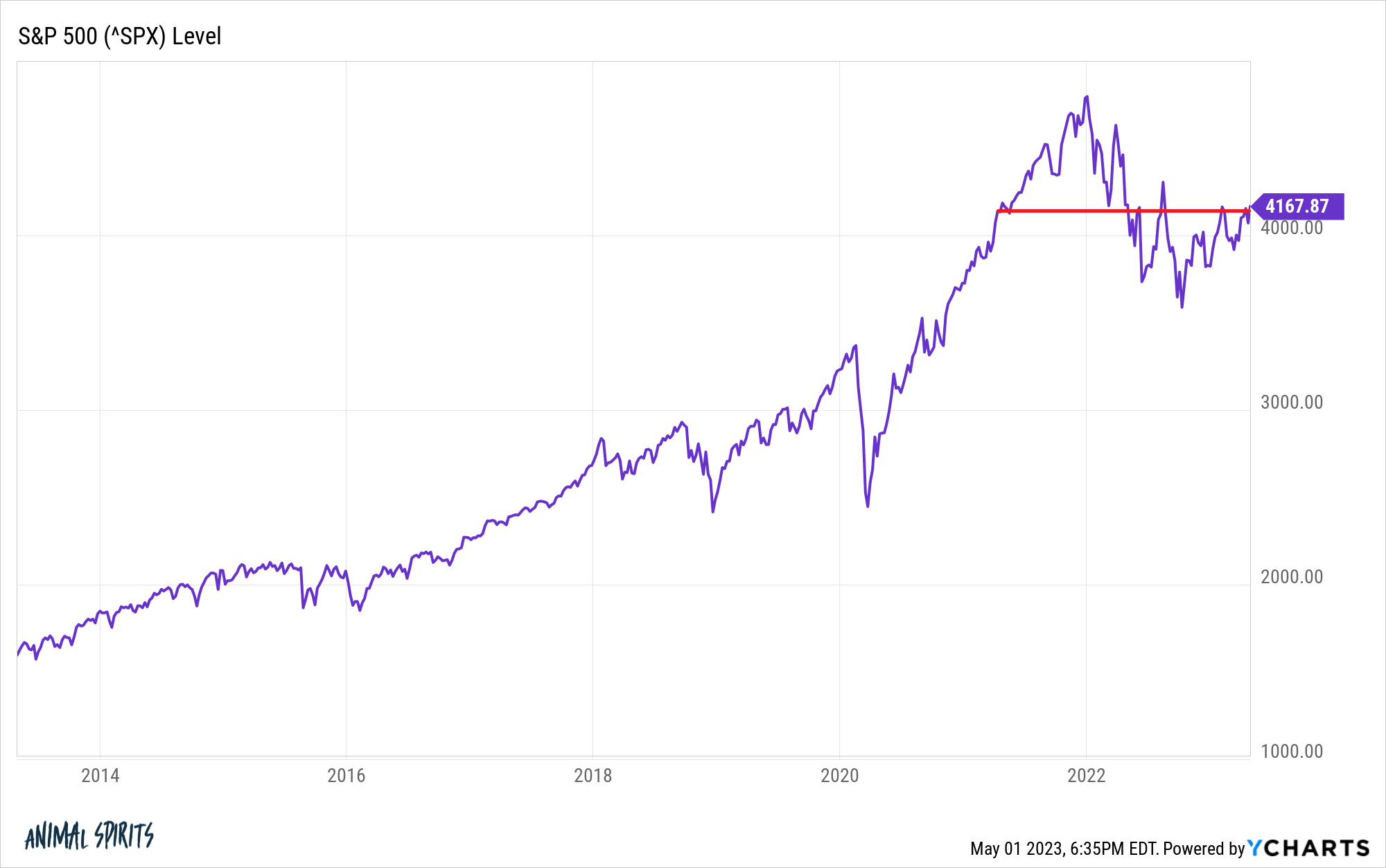

BofA's analysis of stock market valuations doesn't rely on a single metric but incorporates a multifaceted approach. While acknowledging the elevated price-to-earnings (P/E) ratios in certain sectors, they emphasize the importance of considering other valuation multiples and underlying economic fundamentals. They aren't dismissing the higher valuations entirely but argue that they are somewhat justified given the current economic climate and projected corporate performance.

-

BofA's reasoning for a relatively positive outlook: BofA points to strong corporate earnings growth projections, particularly in technology and consumer staples, as a key justification for their positive outlook. They believe these strong earnings will support current valuations and potentially drive further growth. Furthermore, they emphasize the resilience of the consumer sector, suggesting ongoing spending will bolster corporate profits.

-

Favorable sectors according to BofA: BofA highlights the technology sector, particularly AI-related companies, and the consumer staples sector as particularly promising areas. These sectors, they argue, are less susceptible to broader economic downturns.

-

Economic indicators considered: BofA's analysis incorporates factors like interest rates (while acknowledging potential for further hikes), inflation (expecting a gradual decline), and ongoing geopolitical instability (which they believe is largely priced into the market). They stress the importance of considering these factors in a balanced way.

-

Caveats and potential risks: BofA isn't blind to the risks. They acknowledge the possibility of further interest rate increases, persistent inflation, and unexpected geopolitical events that could negatively impact market valuations. They caution against overly aggressive investment strategies and emphasize the need for risk management.

Key Factors Supporting BofA's Positive View

BofA's optimistic view isn't based solely on speculation. Several key factors underpin their assessment of current stock market valuations:

-

Strong corporate earnings growth projections: BofA's analysts forecast robust corporate earnings growth, particularly in the technology and healthcare sectors, driven by technological innovation and strong demand.

-

Resilience of the consumer sector: Despite inflationary pressures, the consumer sector continues to show resilience, with relatively strong spending patterns. This suggests continued demand for goods and services, which supports corporate profitability.

-

Potential for further interest rate cuts: While interest rate hikes remain a possibility, BofA anticipates that if inflation cools significantly, central banks may begin to cut interest rates, potentially boosting economic activity and corporate investment.

-

Technological advancements driving innovation: Continued innovation, especially in AI and other emerging technologies, is anticipated to fuel future corporate growth, justifying higher valuations for companies in these sectors.

-

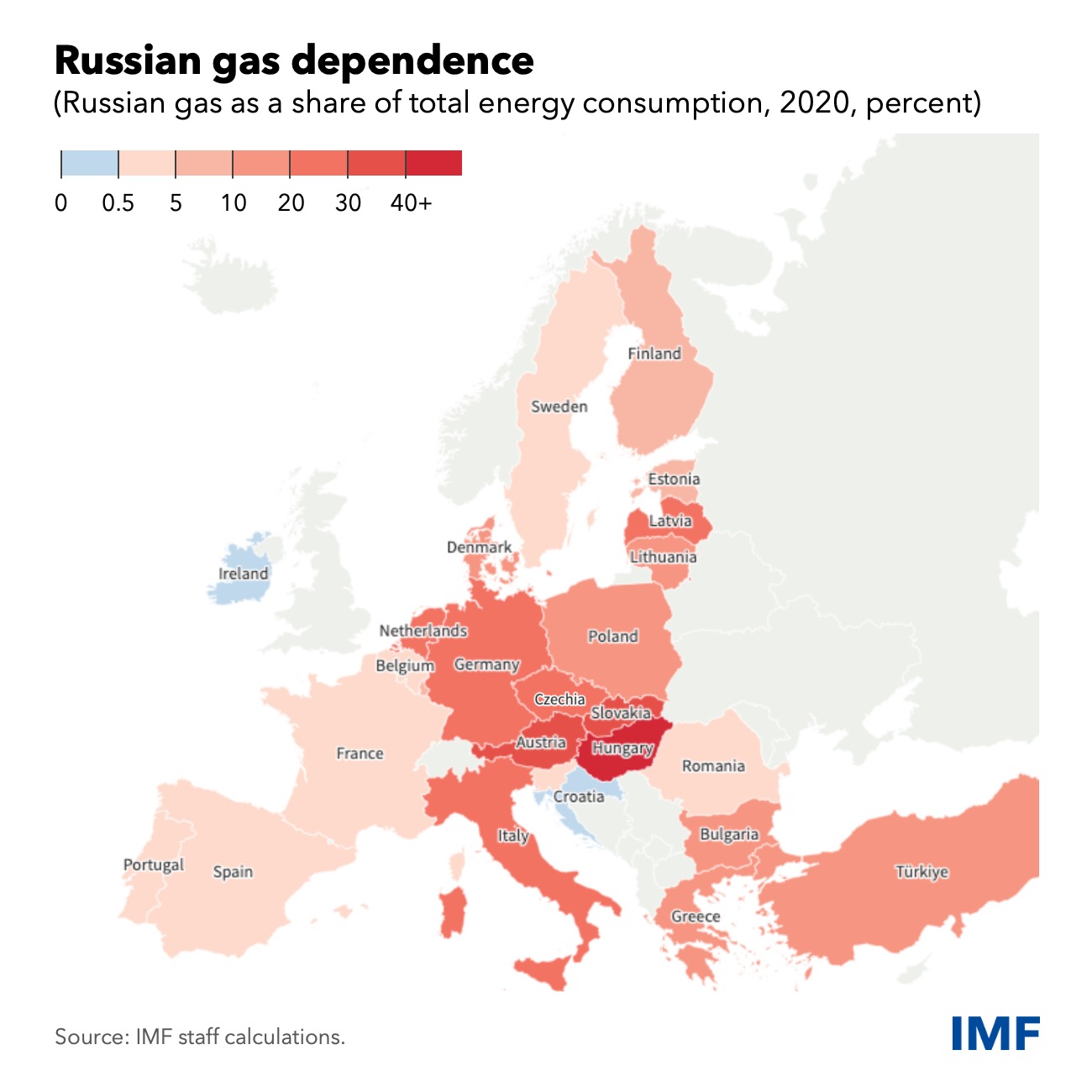

Geopolitical stability (or accounting for instability): BofA acknowledges existing geopolitical risks but suggests many of these are already factored into current market prices. They are, however, monitoring the situation closely.

Alternative Perspectives and Counterarguments

It's crucial to acknowledge that not all analysts share BofA's optimistic view. Many believe current valuations are stretched, particularly considering historical P/E ratios and potential future economic slowdowns.

-

Opposing viewpoints on valuations: Some analysts argue that current P/E ratios are unsustainable and predict a market correction. They point to high inflation, potential recessionary pressures, and geopolitical uncertainty as significant headwinds.

-

Potential risks or downsides not addressed by BofA: Critics point to potential underestimation of the impact of inflation on consumer spending and the potential for a sharper-than-expected economic slowdown.

-

Comparison with other financial institutions' assessments: Other financial institutions have expressed more cautious views on stock market valuations, highlighting the divergence in opinions among market experts. This highlights the importance of conducting your own due diligence.

Practical Implications for Investors

BofA's analysis provides valuable insights for investors, but it shouldn't be the sole determinant of your investment strategy.

-

Strategies for managing risk: Diversification is key. Spread your investments across different asset classes (stocks, bonds, real estate) and sectors to mitigate risk.

-

Sector-specific investment opportunities: BofA’s insights suggest opportunities in technology and consumer staples, but thorough research is vital before investing in any specific sector.

-

Importance of diversification and long-term investment horizons: Maintaining a long-term investment perspective can help mitigate short-term market volatility and capitalize on long-term growth opportunities.

-

Advice on whether to buy, hold, or sell: The decision to buy, hold, or sell depends on your individual risk tolerance, investment goals, and financial situation. Consider consulting a financial advisor.

Conclusion

BofA's assessment offers a relatively reassuring view on stock market valuations, emphasizing strong corporate earnings projections, a resilient consumer sector, and the potential for future interest rate cuts. However, they also acknowledge potential risks, including persistent inflation and geopolitical uncertainty. Alternative perspectives exist, highlighting the importance of considering various viewpoints and conducting thorough due diligence. While BofA's analysis provides valuable insights, the decision of whether to buy, hold, or sell assets remains a personal one, contingent on your risk tolerance and financial goals. Remember, understanding stock market valuations and building a robust portfolio are continuous processes. Learn more about analyzing stock market valuations and building a diversified portfolio tailored to your risk profile. Stay informed about the latest updates on stock market valuations to make informed investment decisions.

Featured Posts

-

Canadian Auto Industry Fights Back Five Point Plan To Combat Us Trade Threats

Apr 24, 2025

Canadian Auto Industry Fights Back Five Point Plan To Combat Us Trade Threats

Apr 24, 2025 -

Hollywood Production At Standstill Amidst Actors And Writers Strike

Apr 24, 2025

Hollywood Production At Standstill Amidst Actors And Writers Strike

Apr 24, 2025 -

Stock Market Rally Futures Soar On Trumps Remarks About Powell

Apr 24, 2025

Stock Market Rally Futures Soar On Trumps Remarks About Powell

Apr 24, 2025 -

Spot Market For Russian Gas Eu Discussion On Phaseout Strategies

Apr 24, 2025

Spot Market For Russian Gas Eu Discussion On Phaseout Strategies

Apr 24, 2025 -

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Rocket Launch Cancelled Vehicle Subsystem Issue

Apr 24, 2025