Analysis: Broadcom's VMware Acquisition And The Potential For Extreme Price Hikes

Table of Contents

Market Dominance and Reduced Competition

Broadcom's acquisition of VMware significantly increases its market share in the virtualization sector, potentially leading to reduced competition. This consolidation of power raises concerns about the future pricing of VMware products and services.

- Fewer Choices: Businesses may find themselves with fewer choices for virtualization solutions, potentially limiting their negotiating power and increasing their reliance on VMware.

- Broadcom's Acquisition History: Broadcom has a history of acquisitions, and in some cases, subsequent price increases in the acquired companies' product lines. This historical precedent fuels concerns about similar price hikes following the VMware acquisition.

- Antitrust Scrutiny: The acquisition is likely to face intense scrutiny from antitrust regulators worldwide. Investigations into potential anti-competitive practices and their impact on Broadcom's VMware acquisition are expected, potentially leading to delays or even modifications of the deal.

Analysis of VMware's Pricing Strategies Before and After the Acquisition

Understanding VMware's pricing strategies before the acquisition is crucial for predicting future trends. Historically, VMware has employed a tiered licensing model, offering various options based on features and usage.

- Potential Price Increases: Under Broadcom's ownership, existing VMware products and services could see substantial price increases. This could impact everything from core virtualization software to support and maintenance contracts.

- Licensing Fee Increases: Businesses can anticipate potential increases in licensing fees for existing products, along with potential changes in licensing terms. The impact on long-term contracts needs careful consideration.

- New Pricing Tiers and Bundles: Broadcom might introduce new pricing tiers or bundle VMware products with other Broadcom offerings, potentially altering the cost structure and making it more difficult to compare prices across vendors.

Impact on Businesses and Consumers

The potential price increases resulting from Broadcom's VMware acquisition will have significant repercussions for businesses and consumers alike.

- IT Budget Strain: Increased prices for VMware products and services will put a strain on IT budgets, potentially forcing businesses to prioritize spending or cut back on other crucial areas.

- Shifting to Alternatives: Businesses may be forced to explore alternative virtualization solutions, a process that can be time-consuming and costly. Migration costs and potential compatibility issues must be carefully evaluated.

- Cloud Computing Implications: The acquisition’s effects will ripple through the broader cloud computing market. Changes in VMware pricing could impact cloud providers' costs and, ultimately, the price of cloud services for consumers.

Alternative Virtualization Solutions and Mitigation Strategies

Businesses are not powerless against potential price hikes. Several alternative virtualization technologies can mitigate the risks associated with Broadcom's VMware acquisition.

- Key Competitors: Several strong competitors exist, including Microsoft Hyper-V, Citrix XenServer, and Oracle VirtualBox, offering alternatives for businesses seeking to diversify their virtualization infrastructure.

- Open-Source Options: Open-source virtualization platforms like Proxmox VE and oVirt provide cost-effective alternatives, although they may require more technical expertise to implement and manage.

- Negotiation and Vendor Diversification: Businesses should proactively negotiate with VMware (and explore alternative vendors) to secure favorable pricing and service agreements. Diversifying virtualization solutions can reduce reliance on a single vendor.

Conclusion: Navigating the Future of VMware Pricing Post-Acquisition

Broadcom's VMware acquisition presents significant uncertainty regarding future pricing. The potential for price increases across VMware's product range is real, and businesses must proactively prepare for this eventuality. The increased market dominance, coupled with Broadcom's acquisition history, points to potential challenges for both businesses and consumers. To mitigate the risks associated with Broadcom's VMware acquisition, stay informed about Broadcom's VMware acquisition and its impact on pricing, research alternative virtualization solutions, and prepare for potential price hikes in VMware products. Proactive planning and strategic negotiation are crucial to navigate the evolving landscape and minimize the financial impact of this significant merger. Don't wait; start exploring your options today to mitigate the risks of Broadcom's VMware acquisition.

Featured Posts

-

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025

Instagrams New Video Editing App A Threat To Tik Tok

Apr 24, 2025 -

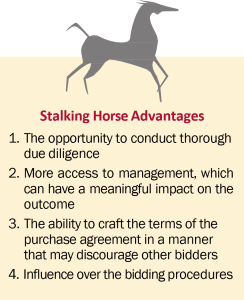

Village Roadshow Sale Alcons Stalking Horse Bid Wins At 417 5 Million

Apr 24, 2025

Village Roadshow Sale Alcons Stalking Horse Bid Wins At 417 5 Million

Apr 24, 2025 -

Covid 19 Test Fraud Lab Owners Guilty Plea

Apr 24, 2025

Covid 19 Test Fraud Lab Owners Guilty Plea

Apr 24, 2025 -

Chat Gpt And Open Ai Facing An Ftc Investigation Key Questions And Concerns

Apr 24, 2025

Chat Gpt And Open Ai Facing An Ftc Investigation Key Questions And Concerns

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025