AbbVie (ABBV) Stock Rises On Exceeding Sales Expectations And Revised Profit Guidance

Table of Contents

AbbVie's Q[Quarter] Earnings Beat Expectations

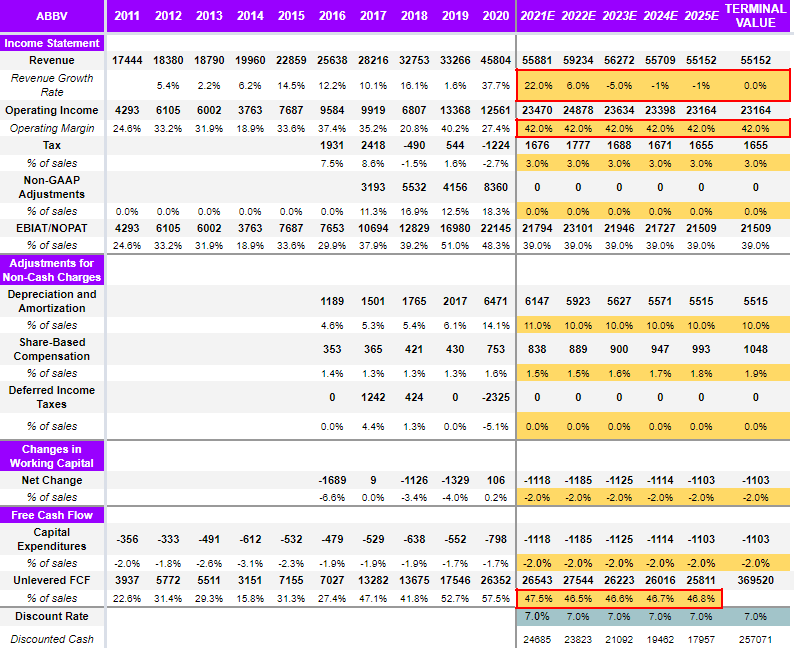

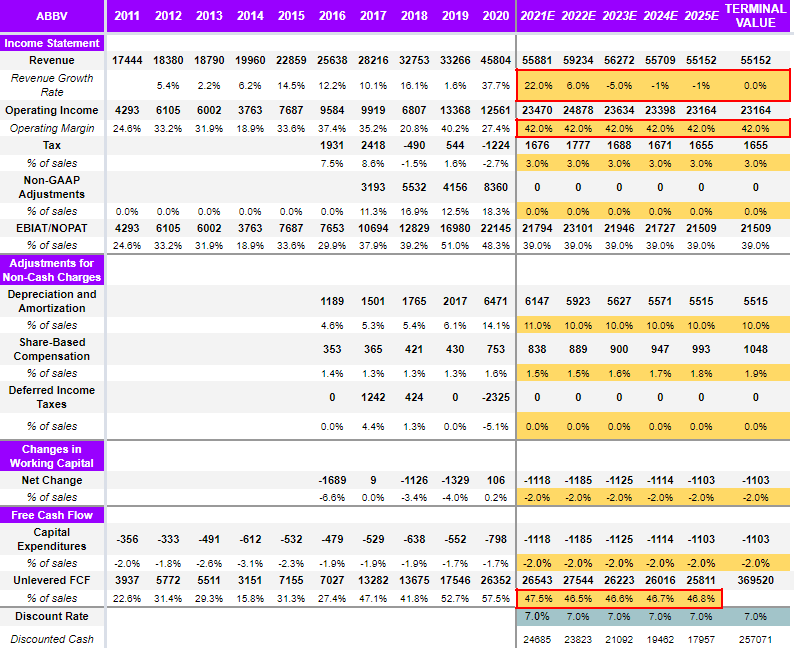

AbbVie's recent quarterly earnings report showcased a strong performance, exceeding analyst expectations across several key metrics. This success was largely driven by robust sales growth across its flagship products and effective strategic initiatives.

Strong Sales Growth Across Key Products

Several key drugs contributed significantly to AbbVie's impressive sales figures.

-

Humira: Despite facing biosimilar competition in certain markets, Humira continued to demonstrate strong performance, achieving [Insert Sales Figures and Percentage Increase]. This success reflects AbbVie's effective strategies in managing competition and maintaining market share.

-

Rinvoq: Rinvoq, a treatment for rheumatoid arthritis and other inflammatory conditions, showed exceptional growth, with sales reaching [Insert Sales Figures and Percentage Increase]. This reflects its growing market share and increased acceptance among healthcare professionals.

-

Skyrizi: Skyrizi, another key drug in AbbVie's portfolio, also contributed significantly to overall sales growth, achieving [Insert Sales Figures and Percentage Increase]. Its success is partly attributed to its strong efficacy and favorable safety profile.

-

New Product Launches: The successful launch and market penetration of [mention new drug names] further boosted AbbVie's overall revenue stream, showcasing the strength of their innovative pipeline.

Factors Contributing to Sales Success

Several factors contributed to AbbVie's sales success:

- Strong Market Demand: Increased demand for AbbVie's innovative treatments across its therapeutic areas fueled sales growth.

- Effective Marketing and Sales Strategies: AbbVie's strategic marketing campaigns and effective sales force successfully reached target audiences and healthcare providers.

- Favorable Regulatory Environment: Approvals and positive regulatory decisions facilitated smoother market access for key products.

- Strategic Partnerships: Collaboration and strategic partnerships with other companies broadened AbbVie's market reach and enhanced its product offerings.

Revised Profit Guidance: A Positive Outlook for AbbVie (ABBV) Stock

The exceeding sales performance led AbbVie to revise its profit guidance for the year, signaling a positive outlook for AbbVie (ABBV) stock.

Upward Revision of Earnings Forecasts

AbbVie significantly raised its earnings forecast for the year. The company now projects [Insert Updated Profit Forecast]. This upward revision is primarily attributed to:

- Exceeding Sales Expectations: Strong sales of key products outperformed initial projections.

- Cost-Cutting Measures: Effective cost management initiatives contributed to improved profitability.

- Strong Operational Efficiency: Improvements in operational efficiency further enhanced the company's bottom line.

Investor Confidence and Market Reaction

The revised guidance triggered a positive market reaction, with AbbVie (ABBV) stock price experiencing a notable increase. Trading volume also surged, reflecting increased investor interest and confidence.

- Stock Price Increase: AbbVie's stock price increased by [Insert Percentage or Dollar Amount] following the earnings announcement.

- Positive Analyst Ratings: Many investment analysts upgraded their ratings for AbbVie stock following the strong performance.

- Increased Investor Confidence: The positive earnings report reinforced investor confidence in AbbVie's future prospects.

Long-Term Prospects for AbbVie (ABBV) Stock

The long-term prospects for AbbVie (ABBV) stock appear promising, driven by a strong pipeline of innovative drugs and strategic initiatives. However, certain risks and challenges should be considered.

Pipeline of Future Drugs and Innovation

AbbVie's robust R&D efforts are fueling a pipeline of promising new drugs. These future products have the potential to significantly contribute to future revenue growth and further strengthen AbbVie's market position.

- Promising Drug Candidates: AbbVie is developing several promising drugs in various therapeutic areas, offering potential for future growth.

- Strategic Acquisitions: Acquisitions of smaller biotech companies could accelerate AbbVie's innovation and expand its product portfolio.

- Licensing Agreements: Licensing agreements with other pharmaceutical companies could broaden AbbVie's access to cutting-edge technologies and drug candidates.

Risks and Challenges

While the outlook is positive, investors should be aware of potential risks:

- Patent Expirations: Patent expirations for key drugs could lead to increased competition and decreased revenue.

- Competitive Landscape: The highly competitive pharmaceutical industry presents ongoing challenges.

- Regulatory Hurdles: Navigating regulatory approvals for new drugs can be challenging and time-consuming.

AbbVie is actively mitigating these risks through strategic planning, diversification, and ongoing R&D investments.

Conclusion

AbbVie (ABBV) stock's recent rise reflects the company's strong financial performance, exceeding sales expectations and revising its profit guidance upward. This positive outlook, fueled by robust sales of key products like Humira, Rinvoq, and Skyrizi, and a promising pipeline, signals a positive trajectory for AbbVie. However, investors should remain aware of potential risks such as patent expirations and competition. To stay informed on the future performance of AbbVie (ABBV) stock, continue to monitor financial news and company announcements. Consider conducting your own thorough research before making any investment decisions regarding AbbVie (ABBV) stock. Remember to consult with a financial advisor before making any investment decisions related to AbbVie (ABBV) stock or any other investment.

Featured Posts

-

Ai Digest Transforming Repetitive Documents Into Engaging Podcasts

Apr 26, 2025

Ai Digest Transforming Repetitive Documents Into Engaging Podcasts

Apr 26, 2025 -

Getting My Nintendo Switch 2 Preorder The Game Stop Approach

Apr 26, 2025

Getting My Nintendo Switch 2 Preorder The Game Stop Approach

Apr 26, 2025 -

Effective Middle Management A Foundation For A Thriving Workplace

Apr 26, 2025

Effective Middle Management A Foundation For A Thriving Workplace

Apr 26, 2025 -

Chinese Made Vehicles Are They A Viable Alternative

Apr 26, 2025

Chinese Made Vehicles Are They A Viable Alternative

Apr 26, 2025 -

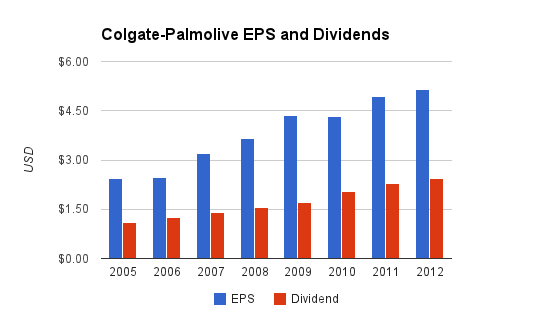

Colgate Cl Sales And Profit Decline 200 Million Tariff Impact

Apr 26, 2025

Colgate Cl Sales And Profit Decline 200 Million Tariff Impact

Apr 26, 2025

Latest Posts

-

Professional Styling Decoded Understanding Ariana Grandes Dramatic Makeover

Apr 27, 2025

Professional Styling Decoded Understanding Ariana Grandes Dramatic Makeover

Apr 27, 2025 -

Exploring Ariana Grandes Hair And Tattoo Transformation Professional Commentary

Apr 27, 2025

Exploring Ariana Grandes Hair And Tattoo Transformation Professional Commentary

Apr 27, 2025 -

Ariana Grandes Bold New Look A Professional Assessment Of Her Hair And Tattoos

Apr 27, 2025

Ariana Grandes Bold New Look A Professional Assessment Of Her Hair And Tattoos

Apr 27, 2025 -

Analyzing Ariana Grandes New Style Professional Opinions On Her Transformation

Apr 27, 2025

Analyzing Ariana Grandes New Style Professional Opinions On Her Transformation

Apr 27, 2025 -

The Professionals Take On Ariana Grandes Latest Hair And Tattoo Choices

Apr 27, 2025

The Professionals Take On Ariana Grandes Latest Hair And Tattoo Choices

Apr 27, 2025