AbbVie (ABBV): Increased Profit Guidance Reflects Success Of Newer Drugs

Table of Contents

The Rise of AbbVie's Newer Drugs: A Key Driver of Profit Growth

The remarkable success of Skyrizi and Rinvoq is undeniably the cornerstone of AbbVie's burgeoning profits. These innovative drugs have rapidly gained significant market share, exceeding expectations and contributing substantially to revenue growth. Their ability to compete effectively, even amidst the challenges posed by Humira biosimilars, represents a strategic triumph for AbbVie.

-

Skyrizi's Triumph in Psoriasis and Psoriatic Arthritis: Skyrizi has established itself as a leading treatment for psoriasis and psoriatic arthritis, demonstrating superior efficacy and safety profiles in numerous clinical trials. This has translated to strong sales figures and rapid market penetration.

-

Rinvoq's Expanding Horizons: Rinvoq's success extends beyond rheumatoid arthritis, with impressive results in treating atopic dermatitis and other inflammatory conditions. This diversification across multiple therapeutic areas strengthens AbbVie's revenue streams and reduces reliance on any single indication.

-

Navigating the Competitive Landscape: AbbVie's strategic positioning within the competitive pharmaceutical landscape is noteworthy. The company has effectively leveraged its research and development capabilities to create innovative treatments that meet significant unmet medical needs, thereby securing a leading position in key markets.

-

Quantifiable Success: Sales figures for both Skyrizi and Rinvoq show exponential growth, significantly exceeding initial projections. Market share gains continue to climb, further solidifying AbbVie's position as a major player in the pharmaceutical industry. Analysts project continued strong sales growth for these drugs in the coming years.

Mitigating Humira Biosimilar Competition: A Strategic Masterstroke

The launch of Humira biosimilars presented a significant challenge to AbbVie. However, the company’s proactive strategy, centered on the timely and successful launch of Skyrizi and Rinvoq, has proven remarkably effective in mitigating the anticipated revenue decline.

-

The Impact of Humira Biosimilars: The entry of biosimilars into the market inevitably led to price erosion for Humira, AbbVie's blockbuster drug. This competition created a pressure point that required a robust and effective counter-strategy.

-

AbbVie's Proactive Approach: AbbVie didn't wait for the biosimilar impact to hit; instead, the company invested heavily in the development and launch of Skyrizi and Rinvoq, positioning these newer drugs as superior alternatives and building anticipation well before Humira faced competition.

-

Financial Impact and Mitigation: While Humira sales have inevitably declined, the substantial growth of Skyrizi and Rinvoq has more than offset this loss, resulting in overall revenue growth for AbbVie. This demonstrates the success of their diversification and mitigation strategy.

AbbVie's Strong Financial Performance: A Reflection of Strategic Success

AbbVie's recent financial results paint a picture of robust growth and profitability, directly reflecting the success of its strategic initiatives. Strong revenue growth, increased earnings per share (EPS), and healthy profit margins all point to a financially healthy and thriving company.

-

Key Financial Figures: AbbVie's reported revenue for [Insert relevant reporting period] showcased significant year-over-year growth, fueled by the strong performance of Skyrizi and Rinvoq. EPS also demonstrated impressive growth, exceeding analyst expectations. Profit margins remained healthy, indicating efficient operations and strong pricing power.

-

New Drug Impact on Financial Results: The contribution of Skyrizi and Rinvoq to AbbVie's overall financial performance is undeniable. These drugs are the primary drivers of revenue growth and enhanced profitability.

-

Future Outlook and Stock Price: AbbVie's positive financial results and the continued strong outlook for Skyrizi and Rinvoq have positively impacted the company's stock price, signaling investor confidence in the company's future. Analysts are projecting continued growth and a positive outlook for the coming years.

Conclusion

AbbVie's increased profit guidance is a resounding testament to the success of its strategic investments in innovative new drugs. Skyrizi and Rinvoq are not only mitigating the impact of Humira biosimilars but are actively driving significant revenue growth and strengthening AbbVie's overall financial position. This represents a strategic masterstroke that underscores the company's commitment to research and development, resulting in a positive outlook for investors. Stay informed about AbbVie (ABBV) and the ongoing performance of its innovative drugs. Research ABBV stock thoroughly before making any investment decisions, but the current performance strongly suggests AbbVie (ABBV) is a potentially strong addition to a diversified investment portfolio.

Featured Posts

-

Europe Rejects Ai Regulation Amidst Trump Administration Pressure

Apr 26, 2025

Europe Rejects Ai Regulation Amidst Trump Administration Pressure

Apr 26, 2025 -

Trumps Tariffs Ceos Highlight Negative Impact On Economy And Consumer Confidence

Apr 26, 2025

Trumps Tariffs Ceos Highlight Negative Impact On Economy And Consumer Confidence

Apr 26, 2025 -

Will Chinese Cars Dominate The Global Market An Analysis

Apr 26, 2025

Will Chinese Cars Dominate The Global Market An Analysis

Apr 26, 2025 -

The China Market Navigating Challenges For Bmw Porsche And Other Automakers

Apr 26, 2025

The China Market Navigating Challenges For Bmw Porsche And Other Automakers

Apr 26, 2025 -

The Often Overlooked Value Of Middle Managers A Strategic Asset

Apr 26, 2025

The Often Overlooked Value Of Middle Managers A Strategic Asset

Apr 26, 2025

Latest Posts

-

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025

Two Wind Farms And A Pv Plant Approved For Pne Group In Germany

Apr 27, 2025 -

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025

German Renewables Expansion Pne Group Receives Permits For Wind And Pv Projects

Apr 27, 2025 -

Pne Group Awarded Permits For Two Wind Farms And A Solar Plant In Germany

Apr 27, 2025

Pne Group Awarded Permits For Two Wind Farms And A Solar Plant In Germany

Apr 27, 2025 -

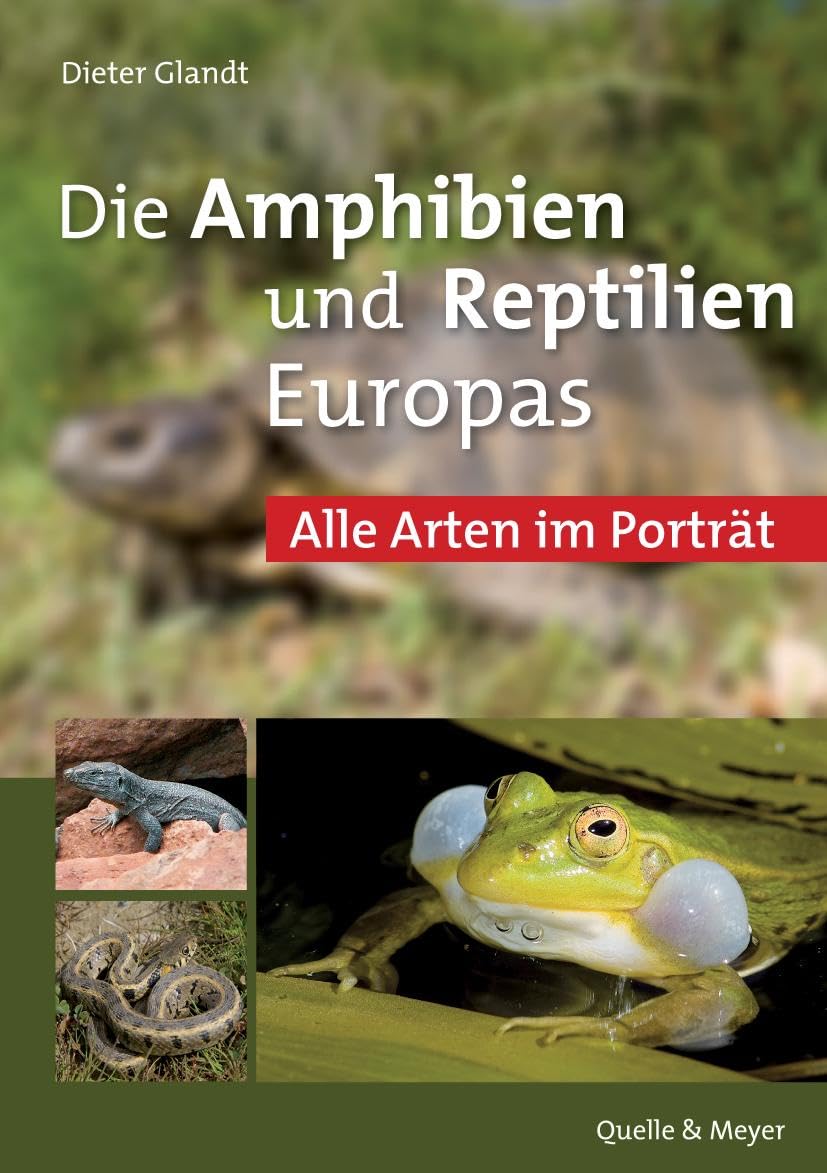

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025

Thueringen Artenvielfalt Von Amphibien Und Reptilien Im Neuen Atlas Dokumentiert

Apr 27, 2025 -

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025

Entdecken Sie Die Amphibien Und Reptilien Thueringens Der Neue Atlas

Apr 27, 2025