X's New Financials: A Deep Dive Into Musk's Debt Sale Impact

Table of Contents

The Debt Sale: A Closer Look

Elon Musk's acquisition of X involved a significant debt financing component. While the exact figures aren't always publicly disclosed in the same level of detail as a publicly traded company, news reports and financial analyses paint a picture of substantial borrowing. Reports from late 2022 indicated a complex financing structure involving various lenders and a mix of high-yield debt and bank loans.

- Amount of debt raised: While the precise figure remains somewhat opaque, estimates suggest billions of dollars were borrowed to finance the acquisition and subsequent operations.

- Lenders involved: A consortium of banks and investment firms participated in providing the debt financing. Specific details about individual lenders and their contribution levels are often kept confidential.

- Interest rates and repayment terms: The interest rates are likely high, reflecting the risk associated with lending to a company under significant financial strain following a leveraged buyout. Repayment terms likely span several years, potentially impacting X's cash flow for the foreseeable future.

- Use of funds: The borrowed funds were primarily used to finance the acquisition of X itself, along with covering operational expenses and potentially some strategic investments or acquisitions.

- Impact on X's debt-to-equity ratio: The massive debt injection significantly increased X's debt-to-equity ratio, increasing financial risk and potentially impacting its credit rating.

Impact on X's Revenue and Profitability

The debt sale's impact on X's revenue and profitability is a complex issue. While the platform boasts a large user base, translating that into consistent and growing revenue remains a challenge.

- Changes in revenue compared to previous quarters/years: Analyzing X's revenue requires careful consideration of reporting periods and changes in accounting practices. Publicly available data may not always provide a complete picture.

- Impact on profitability (net income, operating income): The increased debt servicing costs associated with Musk's financing strategy are likely to negatively impact both net income and operating income. Profit margins are likely under pressure.

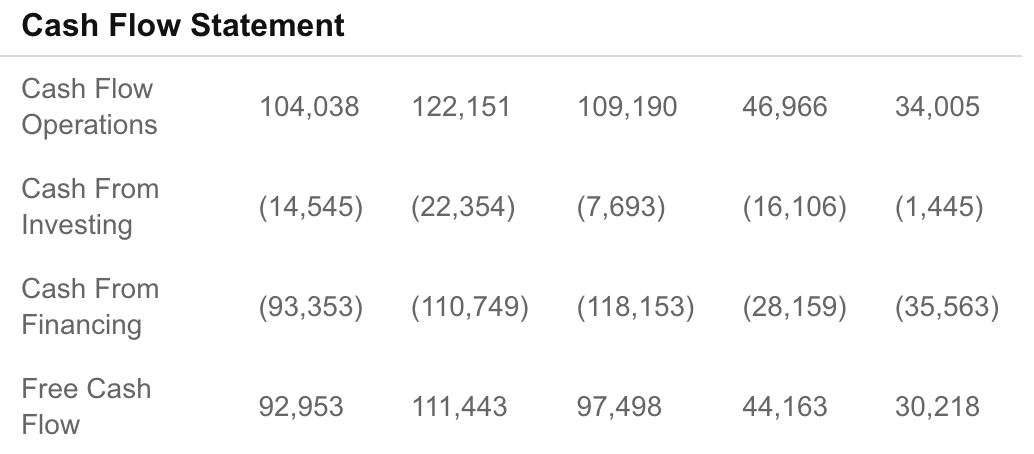

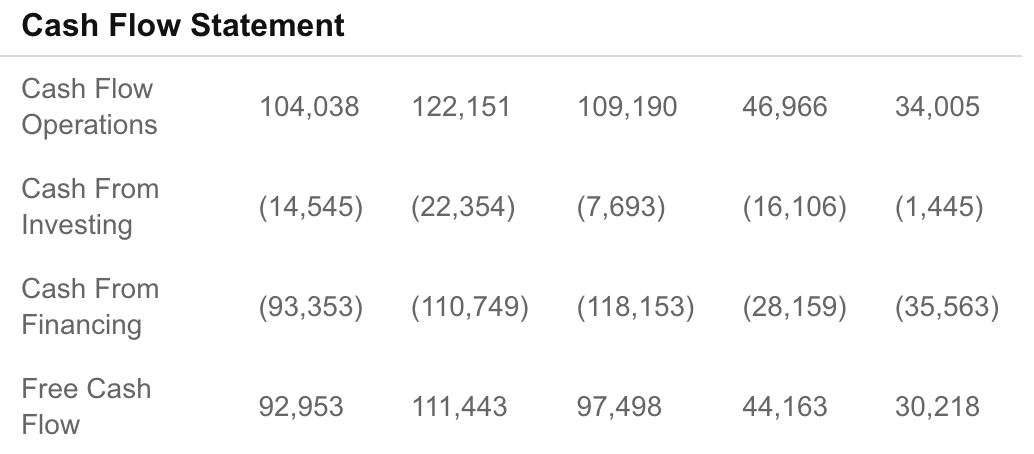

- Effect on key financial metrics (e.g., EBITDA, free cash flow): Metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and free cash flow will provide valuable insights into X's operational efficiency and ability to generate cash after covering its operating expenses and debt obligations.

- Analysis of subscription model performance (if applicable): X's attempt to diversify revenue streams through subscription models like X Premium needs to be carefully evaluated to determine its contribution to the overall financial health of the company.

Long-Term Financial Sustainability of X

The long-term financial sustainability of X hinges on its ability to manage its significant debt burden and generate sufficient revenue growth. The situation is precarious.

- Evaluation of X's debt servicing capabilities: A key factor determining long-term sustainability is X's ability to consistently make its debt payments. This will depend on future revenue performance and potential cost-cutting measures.

- Potential risks associated with high debt levels: High debt levels increase financial vulnerability. Even a small downturn in revenue could trigger financial distress. Debt restructuring or default are potential risks.

- Outlook for future revenue growth and profitability: X needs to demonstrate sustained growth in its revenue streams to address its debt burden. This will likely require a more robust monetization strategy than previously implemented.

- Analysis of the company's overall financial strategy: A comprehensive analysis of X's financial strategy is needed to assess its likelihood of achieving long-term financial stability. This includes reviewing its cost-cutting measures, its focus on subscription revenue, and its overall approach to debt management.

Impact on Investors and the Stock Market

While X is a privately held company, the financial health of X is still of significant interest to investors and analysts. The impact of the debt sale on its hypothetical stock price (if it were publicly traded) can be inferred from the financial situation.

- Stock price fluctuations following the release of financials: Though X isn't publicly traded, the perceived financial health of the company directly influences the valuation of any potential future stock offering or sale.

- Analyst ratings and recommendations: Financial analysts are closely monitoring X's financial performance, and their evaluations will influence investor sentiment.

- Investor confidence levels: Investor confidence is likely low given the considerable debt and uncertainty surrounding X's future revenue streams.

- Potential impact on future funding rounds or IPOs: The level of debt and current financial situation may influence future decisions regarding additional funding rounds or a potential initial public offering (IPO).

Comparison to Industry Peers

Benchmarking X's performance against competitors like Meta and Snap is crucial. It helps contextualize X's financial situation and highlights potential strengths and weaknesses.

- Comparison with key competitors (e.g., Meta, Snap, etc.): Comparing X's key financial metrics, such as revenue growth, profitability, and debt levels, to its peers can provide valuable insights into its relative financial health.

- Analysis of relative financial strength and weakness: Identifying where X performs better or worse than its peers can provide a clearer understanding of its strategic challenges and opportunities.

- Market share implications: The financial struggles of X might impact its ability to compete effectively for market share in the competitive social media landscape.

Conclusion

X's new financials reveal a company burdened by significant debt resulting from Elon Musk's acquisition. The impact on X's revenue, profitability, and long-term sustainability remains a major concern. While the potential for a turnaround exists through successful implementation of its subscription model and cost-cutting strategies, the significant debt load presents considerable risk. Investor confidence remains low, and the long-term outlook for X remains uncertain. Understanding X's financials is key to navigating the complexities of this evolving tech landscape.

Call to Action: Stay informed on the evolving financial landscape of X. Continue following our updates for further analysis and insights into X's financials and the broader implications of Musk's business strategies. For in-depth financial reporting and analysis, subscribe to our newsletter on [link to newsletter signup]. Understanding X's financials is crucial to navigating the complexities of the tech market.

Featured Posts

-

The Greatest Basketball Announcer Mike Breens Pick Is Marv Albert

Apr 28, 2025

The Greatest Basketball Announcer Mike Breens Pick Is Marv Albert

Apr 28, 2025 -

Richard Jeffersons Latest Comment Sparks Debate Is It Aimed At Shaq

Apr 28, 2025

Richard Jeffersons Latest Comment Sparks Debate Is It Aimed At Shaq

Apr 28, 2025 -

Recent Gpu Price Hikes A Detailed Analysis

Apr 28, 2025

Recent Gpu Price Hikes A Detailed Analysis

Apr 28, 2025 -

You Boo Him He Gets Better Michael Jordans Bold Hamlin Support

Apr 28, 2025

You Boo Him He Gets Better Michael Jordans Bold Hamlin Support

Apr 28, 2025 -

A Turning Point Mets Pitchers Improved Performance And Rotation Impact

Apr 28, 2025

A Turning Point Mets Pitchers Improved Performance And Rotation Impact

Apr 28, 2025