US Dollar Climbs On Reduced Political Uncertainty Regarding The Federal Reserve

Table of Contents

Diminished Political Pressure on the Federal Reserve

Reduced political interference allows the Federal Reserve to focus on its core mandate: price stability and maximum employment. This focused approach fosters confidence among investors and contributes to US dollar strength. Previously, frequent calls for specific actions from political figures created uncertainty and volatility. The current climate of reduced pressure is a welcome change.

- Reduced calls for immediate interest rate cuts from political figures: The absence of politically motivated demands for immediate rate adjustments allows the Fed to make data-driven decisions, enhancing its credibility and predictability.

- Increased bipartisan support for the Fed's independence: A growing consensus across the political spectrum regarding the importance of the Fed's independence strengthens its position and reduces the risk of politically motivated interventions.

- Less public scrutiny of the Fed's decision-making process: A decrease in intense public scrutiny allows the Federal Reserve to operate with greater autonomy, enabling more effective monetary policy implementation.

This reduced pressure translates to greater market confidence. Investors respond positively to a predictable and transparent monetary policy environment, increasing demand for the US dollar and contributing to its recent surge in value. The US dollar strength reflects this newfound stability.

Positive Economic Indicators Boosting the Dollar

Recent positive economic data further bolsters the US dollar's value. Stronger-than-expected performance in key areas reinforces investor confidence and fuels demand for the US currency.

- Stronger-than-expected job growth figures: Robust employment numbers signal a healthy economy, supporting the US dollar's value. This positive indicator reassures investors about the US economy's strength and resilience.

- Easing inflation pressures (or at least slowing inflation): While inflation remains a concern, signs of slowing inflation or easing price pressures are viewed favorably by markets, contributing to a stronger US dollar. This indicates that the Federal Reserve's monetary policy actions are having the intended effect.

- Positive consumer confidence indicators: High consumer confidence suggests a strong domestic economy, bolstering the US dollar's appeal to investors seeking stability and growth.

These positive economic indicators collectively reinforce investor confidence in the US economy, leading to increased demand for the US dollar and driving up its value. The US Dollar value directly reflects the health of the US economy.

Global Economic Uncertainty Favoring the US Dollar as a Safe Haven

Global economic instability is driving investors towards the perceived safety of the US dollar, further strengthening its position in the foreign exchange market. The US dollar's role as a safe haven currency is significantly impacted by global events.

- Increased demand for US Treasury bonds as a safe haven asset: During times of global uncertainty, investors flock to US Treasury bonds, considered a low-risk investment, driving up demand for the US dollar.

- Capital flight from riskier assets into the US dollar: Investors often move their capital from riskier assets to the perceived safety of the US dollar during periods of global instability, increasing its value.

- Impact of geopolitical events on global currency markets and the strengthening of the dollar: Geopolitical tensions and uncertainties often lead to increased demand for the US dollar as a safe haven currency, further boosting its value. The US Dollar exchange rate is heavily influenced by these global factors.

The US dollar's status as a safe haven currency is a significant factor in its recent appreciation. As global economic uncertainty persists, investors continue to seek refuge in the US dollar, pushing its value higher.

Potential Impact on International Trade and Investment

A stronger US dollar has significant implications for international trade and investment.

- Impact on US exports (making them more expensive): A stronger dollar makes US exports more expensive for foreign buyers, potentially impacting US export volumes and the profitability of US companies.

- Impact on US imports (making them cheaper): Conversely, a stronger dollar makes imports cheaper for US consumers, potentially increasing consumption of foreign goods.

- Effects on multinational corporations and their profitability: Multinational corporations with significant international operations will experience varying impacts on their profitability depending on their specific revenue and cost structures. Fluctuations in the US Dollar exchange rate directly impact these companies.

The consequences of a strong US dollar are multifaceted, with both positive and negative impacts on different stakeholders involved in international trade and investment.

Conclusion

The recent rise in the US dollar's value is a result of several interconnected factors: reduced political uncertainty surrounding the Federal Reserve, positive economic indicators, and global economic uncertainty driving safe-haven demand. These factors have collectively boosted investor confidence and significantly impacted market dynamics. The strength of the US dollar is a reflection of these complex economic and geopolitical forces.

To effectively navigate this evolving landscape, stay informed about the ongoing developments affecting the US dollar and its implications for your investment strategy. Monitor economic indicators and global events to understand the future trajectory of the US dollar's value. Consider diversifying your portfolio to mitigate risks associated with US dollar fluctuations.

Featured Posts

-

The China Market Analyzing The Struggles Of Bmw Porsche And Other Automakers

Apr 24, 2025

The China Market Analyzing The Struggles Of Bmw Porsche And Other Automakers

Apr 24, 2025 -

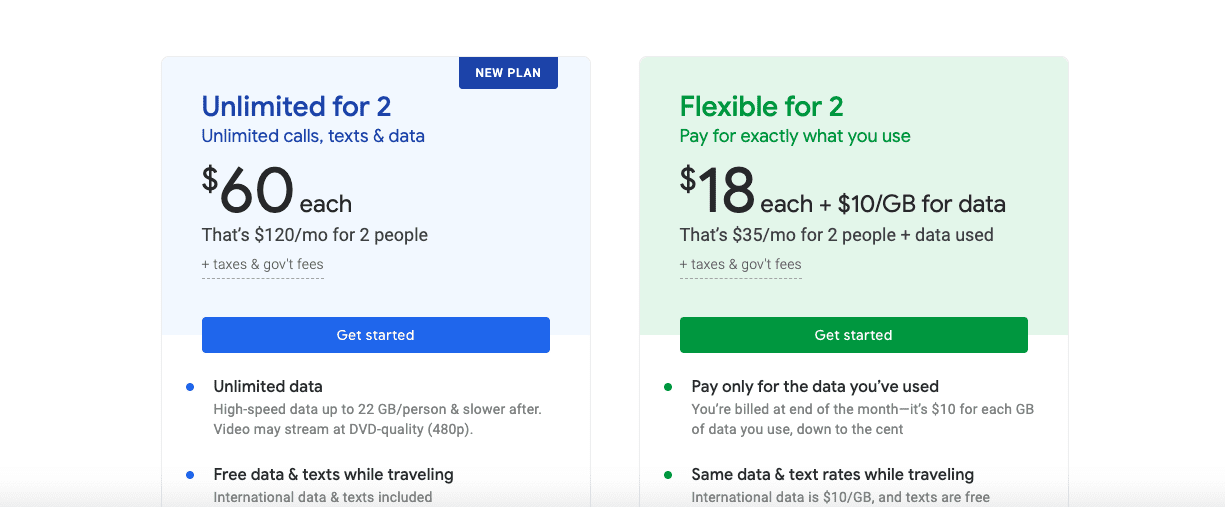

Google Fi Launches Budget Friendly Unlimited Data Plan For 35

Apr 24, 2025

Google Fi Launches Budget Friendly Unlimited Data Plan For 35

Apr 24, 2025 -

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

Diversification Of Lpg Sources Chinas Response To Us Trade Policies

Apr 24, 2025

Diversification Of Lpg Sources Chinas Response To Us Trade Policies

Apr 24, 2025 -

60 Minutes Executive Producers Resignation Independence Concerns Following Trump Legal Action

Apr 24, 2025

60 Minutes Executive Producers Resignation Independence Concerns Following Trump Legal Action

Apr 24, 2025