Understanding The Recent GPU Price Increases

Table of Contents

Global Chip Shortage and Supply Chain Disruptions

The foundation of the current GPU price crisis lies in the ongoing global chip shortage. This shortage isn't isolated to GPUs; it affects a wide range of electronic devices, but the high demand for GPUs exacerbates the problem.

Semiconductor Manufacturing Bottlenecks

The production of semiconductors is an incredibly complex and intricate process. This complexity, coupled with the concentration of advanced chip manufacturing in specific regions, makes the system highly vulnerable to disruptions.

- Complex Manufacturing: Producing a single chip involves hundreds of steps, requiring specialized equipment and highly skilled labor. Any disruption in this delicate process creates significant bottlenecks.

- Geographic Concentration: A significant portion of advanced semiconductor manufacturing is concentrated in a few key regions, primarily in East Asia. This geographic concentration makes the industry susceptible to geopolitical instability and natural disasters.

- Geopolitical Factors: Trade disputes, sanctions, and political tensions can disrupt supply chains and further limit production capacity, impacting the availability and price of GPUs.

- Factory Closures and Disasters: Unexpected events like factory closures due to power outages, fires, or pandemics, as well as natural disasters such as earthquakes or typhoons, significantly impact production and exacerbate existing shortages.

Increased Demand for Components

The surge in demand for GPUs from various sectors fuels the price increases. This increased demand outstrips the already constrained supply, creating a perfect storm for price hikes.

- Gaming Boom: The ever-growing popularity of PC gaming and the release of new, demanding games consistently push the need for higher-performance GPUs. This increased demand contributes heavily to the GPU shortage.

- Cryptocurrency Mining: The rise of cryptocurrencies like Ethereum, particularly before the Merge, significantly increased the demand for powerful GPUs for mining. This demand, often driven by speculation and volatile market conditions, further strained the available supply.

- AI and Machine Learning: The rapid advancements in artificial intelligence and machine learning require high-performance computing capabilities, driving a significant demand for GPUs in research, development, and data centers.

Increased Raw Material Costs & Manufacturing Expenses

Beyond the supply chain issues, the rising costs of raw materials and manufacturing contribute significantly to the GPU price increases.

Rising Costs of Raw Materials

The production of GPUs relies on various raw materials, many of which have experienced significant price increases due to inflation and global market instability.

- Silicon: Silicon, the fundamental component of semiconductors, has seen price fluctuations, adding to the overall cost of production.

- Precious Metals: Precious metals like gold, platinum, and palladium are used in some GPU components, and their price volatility impacts the final cost of the product.

- Other Materials: Other essential raw materials, like specialized gases and chemicals, have also seen price increases, contributing to the higher manufacturing costs.

Transportation and Logistics Challenges

Global shipping disruptions and increased freight costs further exacerbate the problem. The cost of transporting components and finished products has increased significantly, directly impacting the final price of GPUs.

- Port Congestion: Significant port congestion worldwide has led to delays in shipping, increasing transportation costs and delivery times.

- Container Shortages: A shortage of shipping containers has added to the logistical challenges, contributing to higher transportation costs.

- Fuel Price Increases: The increase in fuel prices has directly impacted the cost of transporting goods globally, adding to the overall expenses and ultimately the GPU prices.

Speculation and Scalping

The activities of resellers and scalpers contribute significantly to the inflated GPU prices. Their actions exacerbate an already strained market.

The Role of Resellers and Scalpers

Resellers and scalpers utilize automated systems and other methods to purchase large quantities of GPUs at retail price, then resell them at significantly inflated prices, profiting from the shortage.

- Scalping Mechanics: Scalpers use bots and other techniques to acquire GPUs in bulk, often bypassing normal purchasing limits, leaving legitimate consumers empty-handed.

- Ethical Considerations: The practice of scalping raises ethical concerns, as it exploits market shortages to unfairly profit at the expense of consumers.

- Legal Ramifications: In some regions, scalping practices might fall under scrutiny, potentially facing legal ramifications, especially in cases involving deceptive practices or manipulation.

Cryptocurrency Mining's Impact on Market Prices

The volatility of the cryptocurrency market directly influences GPU demand and prices. A surge in cryptocurrency prices often leads to an increase in mining activity, driving up the demand for GPUs and consequently their prices. Conversely, a decline in cryptocurrency prices can lead to a decrease in mining activity, potentially easing the pressure on GPU supply and prices, but this is cyclical and often unpredictable.

Conclusion

The recent GPU price increases are the result of a complex interplay of factors. The global chip shortage, increased production costs, logistical challenges, and market speculation all contribute to the current situation. The future outlook remains uncertain, with potential scenarios ranging from easing supply chain issues to persistent market volatility. Understanding these underlying factors is crucial for navigating the current market. To stay informed about GPU prices, monitor reputable tech news sources and price comparison websites, keeping an eye on supply chain updates and cryptocurrency market trends before making your purchase. Stay informed about future GPU cost fluctuations and make educated purchasing decisions.

Featured Posts

-

Actors And Writers Strike A Complete Shutdown Of Hollywood

Apr 28, 2025

Actors And Writers Strike A Complete Shutdown Of Hollywood

Apr 28, 2025 -

Unexpected Trump Zelensky Encounter Precedes Popes Funeral

Apr 28, 2025

Unexpected Trump Zelensky Encounter Precedes Popes Funeral

Apr 28, 2025 -

Is Kuxius Solid State Power Bank Worth The Higher Price

Apr 28, 2025

Is Kuxius Solid State Power Bank Worth The Higher Price

Apr 28, 2025 -

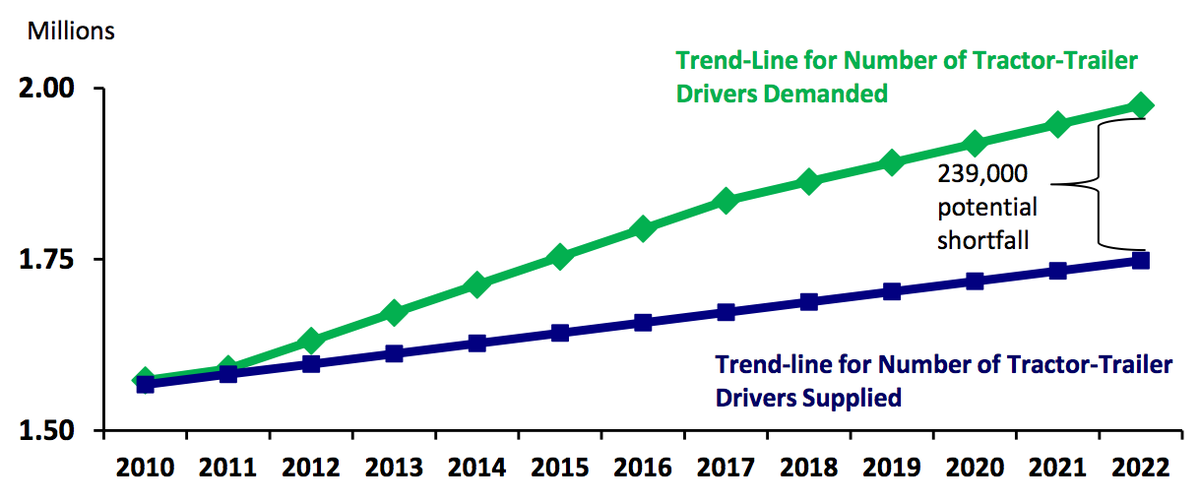

Can We Curb Americas Excessive Truck Size Exploring Potential Solutions

Apr 28, 2025

Can We Curb Americas Excessive Truck Size Exploring Potential Solutions

Apr 28, 2025 -

Jetour Dashing Tampil Dengan Tiga Pilihan Warna Baru Di Iims 2025

Apr 28, 2025

Jetour Dashing Tampil Dengan Tiga Pilihan Warna Baru Di Iims 2025

Apr 28, 2025