U.S. Dollar's Steepest Decline In Decades: A Nixon-Era Parallel?

Table of Contents

The Current State of the U.S. Dollar: A Deep Dive

The ongoing decline of the U.S. dollar is a complex phenomenon driven by a confluence of internal and external factors. Understanding these factors is crucial to predicting future trends and mitigating potential risks.

Factors Contributing to the Decline

Several interconnected factors are contributing to the current weakness of the U.S. dollar.

Internal Factors:

- High Inflation: Persistent inflation, significantly exceeding the Federal Reserve's target rate, erodes the purchasing power of the dollar, reducing its attractiveness to foreign investors.

- Rising Interest Rates: While interest rate hikes aim to curb inflation, they also increase borrowing costs, potentially slowing economic growth and impacting the dollar's value.

- Soaring National Debt: The ever-increasing U.S. national debt raises concerns about the long-term stability of the American economy, affecting investor confidence in the dollar.

- Political Uncertainty: Political polarization and instability can create uncertainty in the markets, weakening investor confidence and impacting the dollar's value.

External Factors:

- Global Economic Slowdown: A slowdown in global economic growth reduces demand for the dollar, as it's often used in international trade and investment.

- Rising Strength of Other Currencies: The Euro, Japanese Yen, and Chinese Yuan have all shown relative strength against the dollar, reflecting shifts in global economic power and investor sentiment.

- Geopolitical Instability: Ongoing geopolitical tensions and conflicts contribute to global uncertainty, weakening investor appetite for riskier assets, including the dollar.

Economic Indicators: The decline is clearly visible in key indicators like the U.S. Dollar Index (DXY), which tracks the dollar against a basket of other major currencies. Inflation rates, as measured by the Consumer Price Index (CPI), and interest rate differentials between the U.S. and other countries also paint a clear picture. (Insert chart visualizing the decline of the DXY here)

Impact of the Decline on Global Markets

The weakening dollar has significant implications for global markets:

- Commodity Prices: A weaker dollar typically makes dollar-denominated commodities like oil and gold more expensive for buyers using other currencies, potentially driving up inflation globally.

- International Trade and Investment: Fluctuations in the dollar's value can significantly impact international trade flows and investment decisions, creating both opportunities and challenges for businesses and investors.

- Developing Nations: Countries heavily reliant on the dollar for trade and debt servicing face increased vulnerability to currency fluctuations, potentially exacerbating economic hardship.

- Global Financial Stability: A sharp and sustained decline in the dollar's value could have far-reaching consequences for global financial stability, potentially triggering a crisis.

The Nixon Shock of 1971: A Historical Perspective

The Nixon shock of 1971 provides a historical parallel to the current situation, albeit with crucial differences.

Context and Causes of the 1971 Devaluation

The Bretton Woods system, established after World War II, pegged the value of the U.S. dollar to gold. However, persistent trade deficits and inflation put immense pressure on the system. President Nixon's decision to close the gold window in 1971 effectively ended the gold standard and allowed the dollar to float freely.

Long-Term Effects of the Nixon Shock

The Nixon shock had profound long-term consequences:

- Shift to a Fiat Currency System: The dollar transitioned to a fiat currency system, meaning its value is determined by market forces rather than its convertibility to gold.

- Increased Volatility: Currency markets became significantly more volatile, increasing risk for businesses and investors.

- Long-Term Inflationary Pressures: The devaluation of the dollar contributed to increased inflation in the years that followed.

Comparing and Contrasting the Two Periods: Key Similarities and Differences

| Feature | Current Situation | Nixon Shock (1971) |

|---|---|---|

| Underlying Cause | Inflation, global economic slowdown, geopolitical risks | Trade deficits, inflation, weakening gold standard |

| Policy Response | Interest rate hikes, potential fiscal measures | Closing the gold window, floating exchange rates |

| Global Landscape | More interconnected global economy, diverse currencies | Less interconnected global economy, dollar dominance |

| Outcome (So Far) | Ongoing dollar decline, market volatility | Initial devaluation, shift to fiat currency system |

Potential Future Scenarios and Predictions

Predicting the future trajectory of the U.S. dollar is challenging, but several scenarios are plausible:

- Continued Devaluation: The dollar could continue its decline, potentially leading to increased inflation and market volatility.

- Stabilization: The dollar might stabilize at a lower level, reflecting a new equilibrium in global currency markets.

- Policy Intervention: Government intervention, such as fiscal or monetary policy changes, could influence the dollar's value.

Expert opinions vary, with some forecasting further dollar weakness while others anticipate stabilization. (Include quotes from relevant financial experts here)

Conclusion: Navigating the Uncharted Waters of the U.S. Dollar's Steepest Decline

The current decline of the U.S. dollar presents both challenges and opportunities. While parallels exist with the Nixon shock, the current global economic landscape differs significantly. Understanding the factors driving this steepest decline – from persistent inflation and rising national debt to global economic slowdown and geopolitical uncertainties – is critical. The long-term implications remain uncertain, but proactive monitoring and informed decision-making are crucial. To stay informed about U.S. dollar fluctuations and their impact on your finances, subscribe to our newsletter, follow reputable financial news sources, and consider consulting a financial advisor for personalized guidance on navigating this dynamic period of U.S. dollar trends and potential dollar devaluation.

Featured Posts

-

Redicks Reaction To Espns Jefferson Decision

Apr 28, 2025

Redicks Reaction To Espns Jefferson Decision

Apr 28, 2025 -

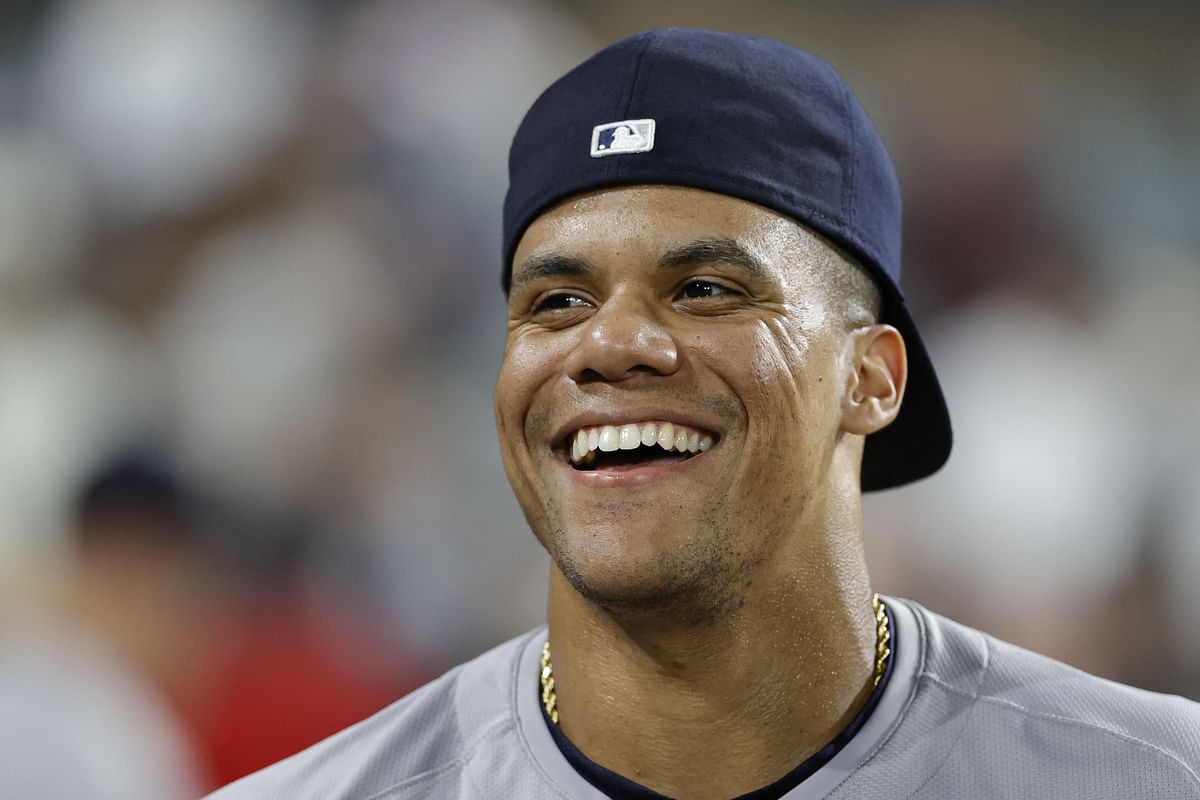

The Yankees Lineup Shuffle Aaron Judges Position And Boones Explanation

Apr 28, 2025

The Yankees Lineup Shuffle Aaron Judges Position And Boones Explanation

Apr 28, 2025 -

Bubba Wallace Involved In Nascar Phoenix Crash Due To Brake Problems

Apr 28, 2025

Bubba Wallace Involved In Nascar Phoenix Crash Due To Brake Problems

Apr 28, 2025 -

Merd Fn Abwzby Yntlq Rsmya Fy 19 Nwfmbr

Apr 28, 2025

Merd Fn Abwzby Yntlq Rsmya Fy 19 Nwfmbr

Apr 28, 2025 -

Fn Abwzby Brnamj Almerd Walfealyat Almsahbt 19 Nwfmbr

Apr 28, 2025

Fn Abwzby Brnamj Almerd Walfealyat Almsahbt 19 Nwfmbr

Apr 28, 2025