U.S. Dollar's First 100 Days: A Comparison To The Nixon Presidency.

Table of Contents

The Nixon Shock: A Defining Moment for the U.S. Dollar

The Nixon Shock, a series of economic measures implemented by President Richard Nixon in August 1971, dramatically altered the global economic landscape and irrevocably changed the relationship between the U.S. dollar and gold.

Closing the Gold Window: A Seismic Shift in Global Finance

President Nixon's decision to close the gold window—the system by which foreign governments could exchange U.S. dollars for gold at a fixed rate—marked a pivotal moment in monetary history.

- Impact on the international monetary system: The closure ended the Bretton Woods system, a post-World War II agreement that pegged the value of other currencies to the U.S. dollar, which in turn was backed by gold. This fixed exchange rate system had maintained relative stability for decades but was increasingly strained by growing U.S. trade deficits.

- End of Bretton Woods agreement: The Bretton Woods agreement, designed to promote international monetary cooperation, effectively collapsed, ushering in an era of floating exchange rates.

- Immediate devaluation of the dollar: The decision led to an immediate devaluation of the dollar as other nations were no longer obligated to maintain fixed exchange rates against it.

- Global uncertainty and market reactions: The move created widespread uncertainty in global financial markets, causing significant volatility and speculation.

Short-Term and Long-Term Consequences: A Legacy of Change

The Nixon Shock's consequences rippled through the global economy for years to come.

- Inflationary pressures: The devaluation of the dollar contributed to inflationary pressures worldwide, as the cost of imported goods increased.

- Rise of floating exchange rates: The shift away from fixed exchange rates led to the development of more flexible and market-driven exchange rate systems.

- Restructuring of global trade and finance: The Nixon Shock forced a restructuring of global trade and financial relationships, paving the way for the modern international monetary system.

- Political ramifications, both domestically and internationally: The decision had significant political consequences, both domestically, influencing the 1972 election, and internationally, straining relationships with key economic allies.

Comparing Current Economic Conditions to the Early 1970s

Analyzing current economic indicators in relation to those of the early 1970s helps draw parallels and identify potential divergence in the path of the U.S. dollar.

Key Economic Indicators: Then and Now

Comparing key economic metrics reveals both similarities and stark differences between the early 1970s and today.

- Data points showing similarities and differences: While inflation is a shared concern, the current rates, while elevated, are not as dramatically high as those experienced in the early 1970s. Interest rates are also a point of comparison, though the context and monetary policy tools differ significantly. Unemployment figures, too, show differences in the severity and nature of job losses.

- Analysis of economic growth trajectories: Economic growth patterns differ considerably, with the 1970s experiencing the oil crisis and stagflation while the current situation presents a different set of challenges.

- Discussion of potential parallels in global economic landscapes: Global interconnectedness is a major similarity, highlighting the ripple effects of economic events across borders, although the specific factors and relationships differ.

Current Administration's Economic Policies: Impact on the U.S. Dollar

Current economic policies significantly influence the U.S. dollar's value and future trajectory.

- Specific policies affecting the dollar's value: Fiscal and monetary policies, such as government spending, interest rate adjustments, and trade agreements, all play a role.

- Predictions of short-term and long-term effects: Analysts offer varying predictions on the short-term and long-term effects of these policies on the dollar's strength and stability.

- Potential risks and opportunities: The current economic landscape presents both risks, such as persistent inflation and geopolitical instability, and opportunities, such as technological innovation and economic diversification.

Parallel Challenges and Divergent Solutions

Despite differences, certain parallels exist between the economic pressures faced during Nixon's era and the present day.

Similarities in Global Economic Pressures

Several global economic challenges resonate across both eras.

- Examples of similar economic crises or global events: Both periods witnessed global economic uncertainty, though the triggers – oil crisis then, pandemic and supply chain disruptions now – varied.

- Analysis of common economic pressures: Inflation, geopolitical instability, and anxieties over global trade are common threads.

Differences in Policy Responses

However, the policy responses differ markedly.

- Different approaches to currency devaluation: The Nixon administration opted for a unilateral devaluation; the current approach is more nuanced and collaborative.

- Differing strategies for managing inflation: Today's strategies emphasize monetary policy tools such as interest rate adjustments, rather than the wage and price controls used in the 1970s.

- Contrasting perspectives on international trade: The current approach to international trade shows a greater emphasis on multilateral agreements and cooperation, although protectionist tendencies continue to exist.

Conclusion

Comparing the first 100 days of the Nixon administration and the current presidency reveals both parallels and significant differences in their impact on the U.S. dollar. The Nixon Shock serves as a stark reminder of the potential for dramatic shifts in the global monetary system and the far-reaching consequences of economic policy decisions. While the specific challenges differ, the importance of understanding historical context remains paramount. The lessons from the Nixon Shock, particularly regarding the fragility of fixed exchange rate systems and the inflationary pressures of rapid currency devaluation, are crucial for navigating current economic headwinds.

Understanding the historical context of the U.S. dollar's vulnerability, as exemplified by the Nixon Shock, is crucial for navigating current economic challenges. Stay informed about the ongoing developments affecting the U.S. dollar and its global impact by continuing to research and follow the latest economic news. Further analysis of the U.S. dollar's trajectory requires continued monitoring of key economic indicators and governmental policies.

Featured Posts

-

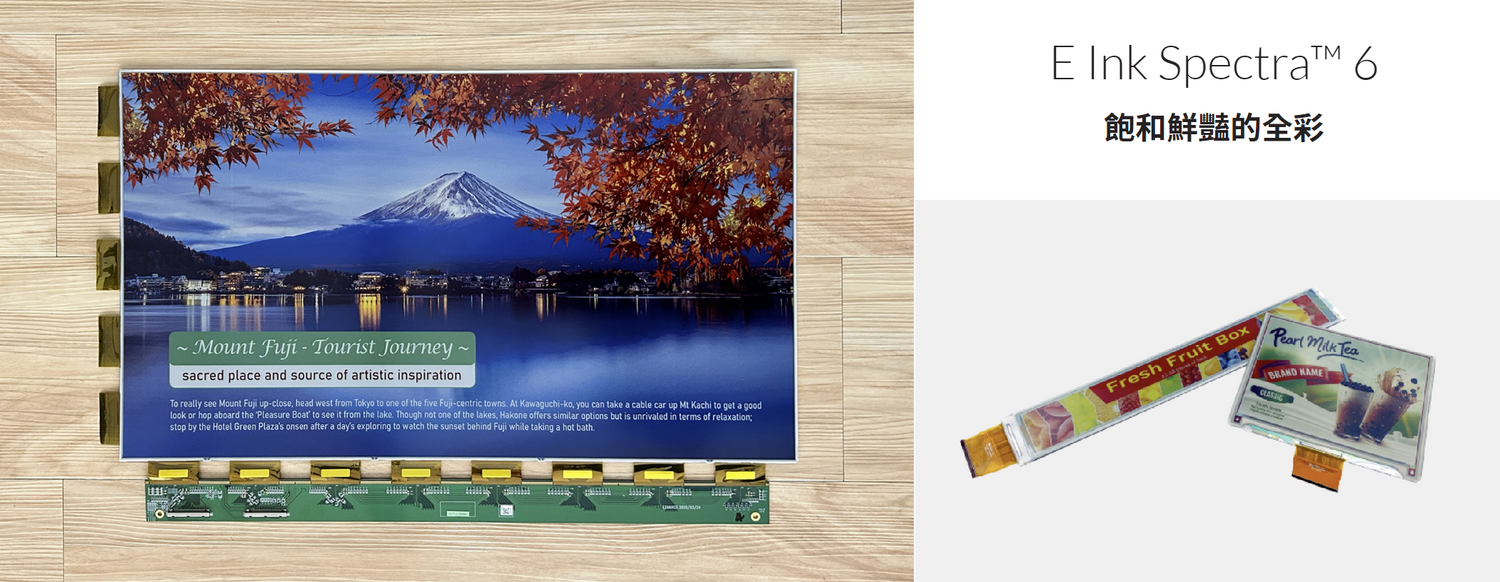

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025 -

Dollars Troubled Start Worst First 100 Days Since Nixon Presidency

Apr 28, 2025

Dollars Troubled Start Worst First 100 Days Since Nixon Presidency

Apr 28, 2025 -

Virginia Giuffres Death Impact On Epstein Case And Prince Andrew Accusations

Apr 28, 2025

Virginia Giuffres Death Impact On Epstein Case And Prince Andrew Accusations

Apr 28, 2025 -

Abu Dhabis 2024 Success Key Projects Real Estate Growth And Ai Initiatives

Apr 28, 2025

Abu Dhabis 2024 Success Key Projects Real Estate Growth And Ai Initiatives

Apr 28, 2025 -

Projecting The Mets Opening Day Lineup Week 1 Spring Training Insights

Apr 28, 2025

Projecting The Mets Opening Day Lineup Week 1 Spring Training Insights

Apr 28, 2025