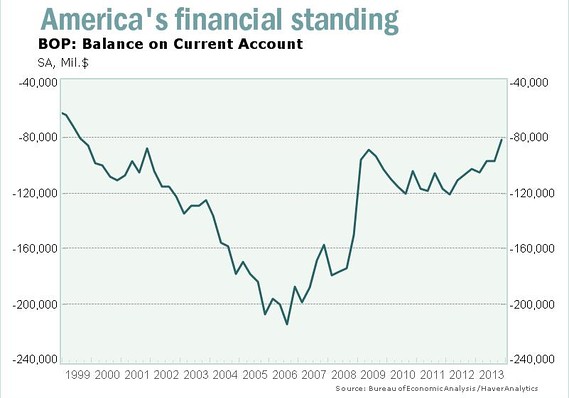

Trump's Trade Agenda: Risks And Realities For America's Financial Standing

Table of Contents

The Tariffs and Their Ripple Effects

The cornerstone of Trump's trade policy was the imposition of tariffs on a wide range of imported goods. While proponents argued these tariffs would protect American industries and jobs, the reality proved far more complex and nuanced, generating significant ripple effects throughout the economy.

Increased Prices for Consumers

Tariffs directly increased the cost of imported goods, leading to higher prices for consumers. This impact was felt across various sectors:

- Increased prices on clothing and textiles: Tariffs on Chinese textiles translated to higher prices for consumers, impacting household budgets.

- Higher costs for steel and aluminum: Tariffs on steel and aluminum increased production costs for numerous industries relying on these materials, ultimately leading to higher prices for finished goods.

- Studies showing significant price increases: Numerous economic studies demonstrated a clear correlation between the imposition of tariffs and a rise in consumer prices, contributing to inflation.

Retaliatory Tariffs and Trade Wars

The imposition of US tariffs triggered retaliatory measures from other countries, escalating into a series of trade wars. This retaliatory action undermined the intended benefits of the tariffs and harmed US exports:

- China's retaliatory tariffs on agricultural goods: American farmers faced significant challenges due to increased tariffs on soybeans, pork, and other agricultural exports to China.

- EU tariffs on various US goods: The European Union responded with tariffs on a range of American products, impacting exports from various US industries.

- Disruption of global supply chains: The trade wars significantly disrupted global supply chains, creating uncertainty and increasing costs for businesses worldwide.

Impact on Specific Sectors

The impact of Trump's trade policies wasn't uniform across all sectors. Some industries benefitted while others suffered significant losses:

- Agriculture: The agricultural sector, particularly soybean farmers, experienced substantial losses due to retaliatory tariffs from China.

- Manufacturing: While some segments of the manufacturing sector might have received temporary protection, others experienced increased input costs due to tariffs on raw materials.

- The steel industry: The steel industry initially benefited from tariffs, but the resulting trade wars and disruptions to global supply chains ultimately had a mixed effect.

Renegotiated Trade Agreements (USMCA)

One significant aspect of Trump's trade agenda was the renegotiation of NAFTA, resulting in the United States-Mexico-Canada Agreement (USMCA). While presented as a victory, the long-term economic impacts of the USMCA are still unfolding.

Changes from NAFTA

The USMCA introduced several key changes compared to NAFTA, including:

- Increased rules of origin: Stricter rules of origin for automobiles and other manufactured goods aim to encourage more North American production.

- Digital trade provisions: The agreement includes provisions addressing digital trade and intellectual property rights.

- Labor and environmental standards: The USMCA includes stronger labor and environmental standards, aiming to improve working conditions and environmental protection in participating countries.

Impact on Labor and Wages

The effects of the USMCA on American jobs and wages are debated. Proponents argue it will create jobs and boost wages, while critics express concerns about job displacement and stagnant wages:

- Arguments for job creation: Supporters claim that the USMCA's stricter rules of origin will incentivize companies to shift production back to North America, creating jobs in the US.

- Arguments for wage stagnation: Critics argue that the benefits of the USMCA will be limited, with modest impacts on job growth and wages. Furthermore, the increased costs associated with stricter rules of origin might offset any potential job gains.

Long-Term Economic Consequences

Assessing the long-term economic consequences of Trump's trade agenda remains a complex task. The full impact will only become apparent over time.

Debt and Deficit Implications

Trade disputes and economic slowdowns triggered by the trade policies could exert significant pressure on the national debt and budget deficit:

- Reduced economic growth: Trade wars can lead to slower economic growth, impacting tax revenues and potentially increasing the need for government spending.

- Increased government spending: Government support for affected industries might necessitate increased government spending, further contributing to the budget deficit.

- Uncertainty regarding future economic trends: The long-term fiscal impacts of Trump's trade policies remain uncertain and subject to ongoing economic analysis.

Geopolitical Ramifications

Trump's trade policies significantly impacted US relationships with other countries and the global trade system:

- Strained relations with China: The trade war with China severely strained US-China relations, impacting broader geopolitical dynamics.

- Impact on international alliances: The unilateral nature of some of Trump's trade policies caused friction with traditional allies.

- Uncertainty in the global trade system: The actions taken during this period introduced a level of uncertainty into the global trade system, impacting international cooperation and stability.

Conclusion

Trump's trade agenda presented a multifaceted approach to international trade, generating both benefits and significant drawbacks for America's financial standing. The impact varied widely across different sectors, with some industries experiencing growth while others faced considerable challenges. The long-term consequences, especially regarding national debt, budget deficits, and geopolitical ramifications, are complex and require continued analysis. Understanding the lasting effects of Trump's trade agenda is crucial for informing future economic policies. Continue researching the complexities of trade and its influence on America's financial standing to make informed decisions.

Featured Posts

-

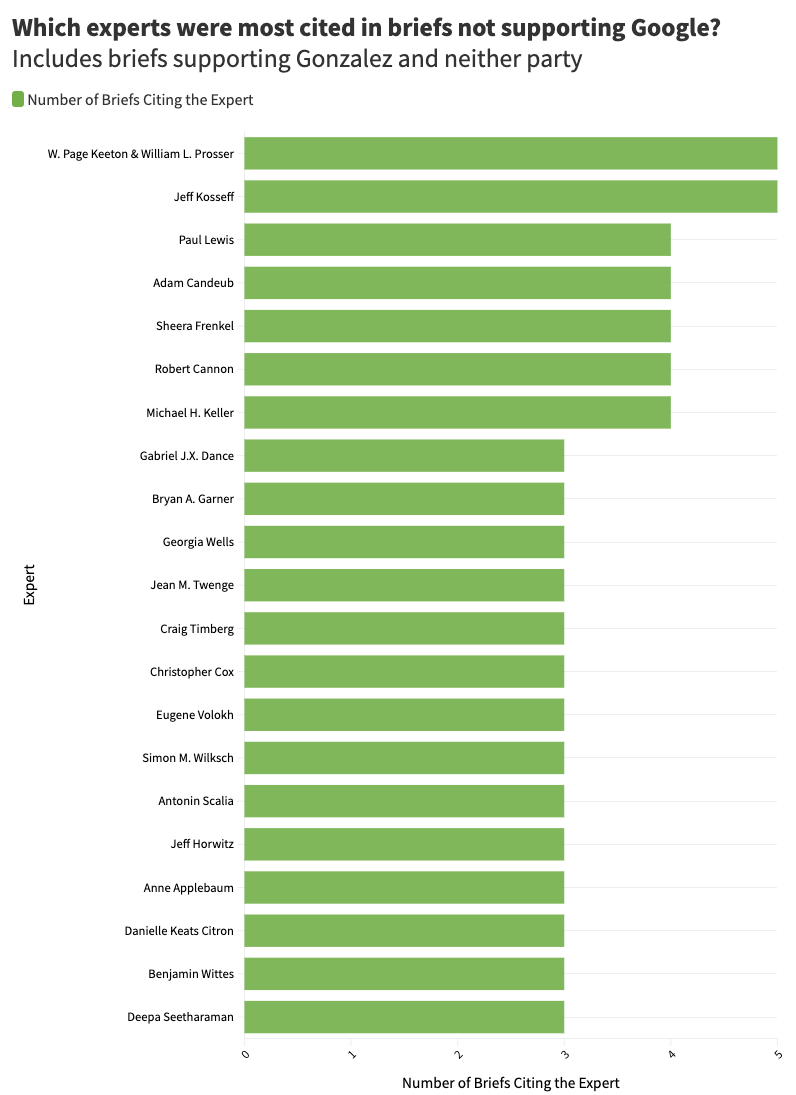

Examining The Arguments For And Against A Google Breakup

Apr 22, 2025

Examining The Arguments For And Against A Google Breakup

Apr 22, 2025 -

Metas Future Under The Shadow Of The Trump Administration Zuckerbergs Challenges

Apr 22, 2025

Metas Future Under The Shadow Of The Trump Administration Zuckerbergs Challenges

Apr 22, 2025 -

Remembering Pope Francis Legacy Of A Pontiff

Apr 22, 2025

Remembering Pope Francis Legacy Of A Pontiff

Apr 22, 2025 -

Blue Origins Failures More Significant Than Katy Perrys Career Missteps

Apr 22, 2025

Blue Origins Failures More Significant Than Katy Perrys Career Missteps

Apr 22, 2025 -

Analyzing The Pan Nordic Military Strengths Of Sweden And Finland

Apr 22, 2025

Analyzing The Pan Nordic Military Strengths Of Sweden And Finland

Apr 22, 2025