Trump's Criticism Of Jerome Powell: Context And Consequences

Table of Contents

Jerome Powell, appointed to lead the Federal Reserve in 2018, holds the immense responsibility of overseeing the US monetary system. The Federal Reserve's primary functions include setting interest rates, managing inflation, and ensuring the stability of the financial system. His actions, therefore, directly impact economic growth, employment, and the value of the dollar.

This article aims to analyze the underlying reasons for Trump's discontent with Powell and examine the resulting economic and political repercussions.

The Roots of Trump's Discontent

Trump's antagonism towards Powell stemmed from a confluence of factors, primarily centered around monetary policy decisions and diverging economic philosophies.

Powell's Monetary Policy Decisions

Powell's tenure was marked by several interest rate hikes aimed at controlling inflation. These decisions directly clashed with Trump's preference for persistently low interest rates to stimulate rapid economic growth.

- December 2018: The Fed raised interest rates for the fourth time that year, citing a strong economy and rising inflation. This move was met with immediate criticism from Trump.

- July 2019: Another rate cut, though smaller than Trump had hoped for, was still met with displeasure, with the President openly expressing his disappointment.

- The approach to quantitative easing: Trump also criticized the Fed's gradual unwinding of quantitative easing, arguing it hindered economic expansion.

These policy decisions, made against the backdrop of a robust economy, were viewed by Powell as necessary to prevent overheating and potential future economic instability. However, Trump saw them as undermining his economic agenda, focused on achieving rapid GDP growth and historically low unemployment.

Trump's Economic Ideology and Expectations

Trump's economic philosophy prioritized rapid economic growth, often emphasizing tax cuts and deregulation as key drivers. He consistently advocated for low interest rates, viewing them as a crucial tool to fuel economic expansion and boost investor confidence.

- Tax Cuts and Jobs Act of 2017: This legislation, a cornerstone of Trump's economic policy, aimed to stimulate economic growth through substantial tax cuts for businesses and individuals.

- Deregulation Agenda: Trump's administration pursued an aggressive deregulation agenda, aiming to reduce the regulatory burden on businesses and encourage investment.

Powell's actions, perceived as counter to this agenda, fueled Trump's frustration. The President viewed interest rate hikes as a deliberate attempt to hinder his economic successes, leading to frequent public criticism.

Political Pressure and Independence of the Fed

The inherent tension between the political pressures faced by the Federal Reserve and its crucial need for independence came to the fore during Trump's presidency. Trump's repeated public criticism constituted a direct assault on the Fed's autonomy.

- Public Statements and Tweets: Trump frequently used public statements and Twitter to express his dissatisfaction with Powell’s policies.

- Attempts to Influence Policy: While stopping short of direct interference, Trump's actions created an atmosphere of political pressure, threatening the Fed’s ability to make independent decisions based purely on economic data.

The independence of the Federal Reserve is paramount to maintaining economic stability. Political interference can lead to short-sighted decisions driven by partisan interests rather than sound economic principles, potentially exacerbating economic volatility.

Consequences of Trump's Criticism

Trump's persistent attacks on Powell and the Federal Reserve had several significant consequences.

Market Volatility and Uncertainty

Trump's public criticism introduced considerable uncertainty into financial markets. Investors reacted negatively to the perceived political pressure on the Fed, leading to heightened market volatility.

- Stock Market Fluctuations: The stock market experienced significant fluctuations in response to Trump's statements about the Federal Reserve.

- Increased Uncertainty: The President's actions created uncertainty regarding the future direction of monetary policy, impacting investment decisions and economic planning.

This volatility eroded investor confidence and increased the risk premium demanded by investors, potentially hindering economic growth.

Erosion of Public Trust in the Fed

Trump's attacks also risked eroding public trust in the Federal Reserve's ability to manage the economy effectively. The perception of political influence undermined the institution's credibility.

- Damage to Institutional Credibility: Trump's actions damaged the reputation and credibility of the Federal Reserve as an independent and impartial economic authority.

- Reduced Public Confidence: The public's faith in the Fed's ability to make unbiased decisions crucial for economic stability was significantly diminished.

This erosion of public trust can have long-term consequences, making it more challenging for the Federal Reserve to effectively implement its monetary policies.

Implications for Future Monetary Policy

Trump's actions raised concerns about the long-term impact on the Federal Reserve’s independence and its ability to make objective decisions in the future.

- Potential for Future Political Interference: Trump's behavior set a precedent that could encourage future administrations to exert undue influence on the Fed.

- Impact on Decision-Making: The potential for political pressure may influence the Fed's approach to future economic challenges.

Maintaining the Fed's independence is crucial for safeguarding the stability of the US economy and preserving its role as a global economic leader.

Conclusion

Trump's criticism of Jerome Powell had far-reaching consequences, creating market volatility, eroding public trust in the Federal Reserve, and raising concerns about the institution's long-term independence. The context of these criticisms, stemming from differing economic philosophies and political pressures, highlights the delicate balance between political influence and the need for an independent central bank. The impact of Trump's actions on the US economy and the future of monetary policy continues to be debated. Learn more about the ongoing debate surrounding the independence of the Federal Reserve and the potential long-term consequences of political influence on monetary policy. Understand the implications of Trump's criticism of Jerome Powell and its impact on the economy.

Featured Posts

-

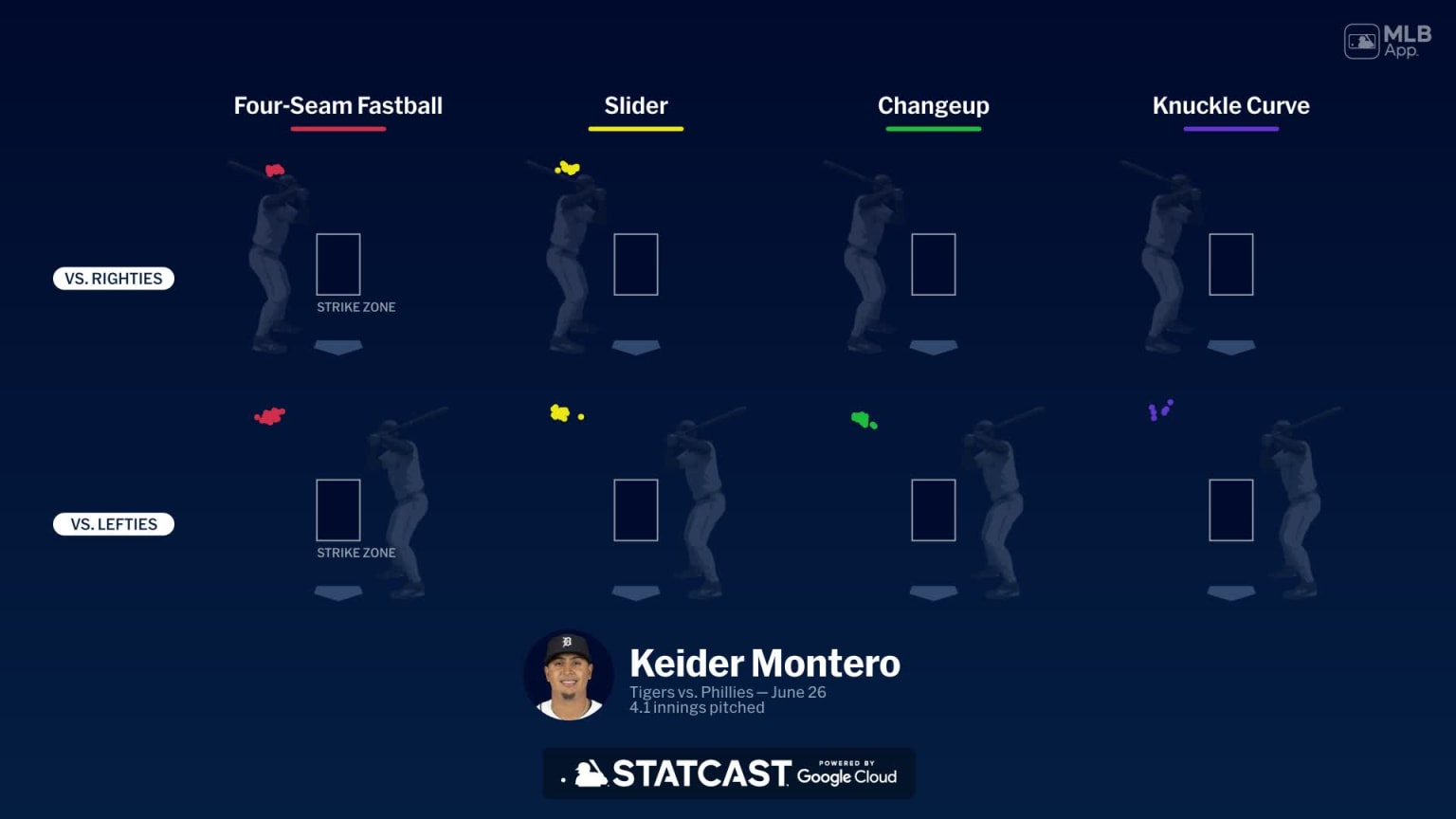

Keider Montero In The Spotlight Tigers Loss To Brewers

Apr 23, 2025

Keider Montero In The Spotlight Tigers Loss To Brewers

Apr 23, 2025 -

Yankees Loss Brewers Gain Cortes Pivotal Role In Victory Against Reds

Apr 23, 2025

Yankees Loss Brewers Gain Cortes Pivotal Role In Victory Against Reds

Apr 23, 2025 -

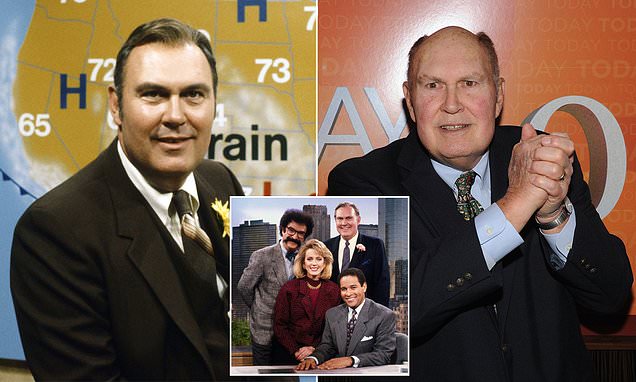

Provus Remembers Uecker A Touching Tribute From A Fellow Broadcaster

Apr 23, 2025

Provus Remembers Uecker A Touching Tribute From A Fellow Broadcaster

Apr 23, 2025 -

Brewers Shatter 33 Year Old Record With Nine Stolen Bases

Apr 23, 2025

Brewers Shatter 33 Year Old Record With Nine Stolen Bases

Apr 23, 2025 -

Nestor Cortes Shuts Down Reds Securing Third Consecutive Loss For Cincinnati

Apr 23, 2025

Nestor Cortes Shuts Down Reds Securing Third Consecutive Loss For Cincinnati

Apr 23, 2025