Trump Reassures Markets: Stock Futures Jump After Powell Comments

Table of Contents

Powell's Comments and Their Market Impact

Jerome Powell's comments regarding interest rates and the broader economic outlook significantly influenced market sentiment. His statements, delivered during a press conference following a Federal Reserve meeting, were closely scrutinized by investors worldwide.

-

Summary of Powell's key statements: Powell's remarks focused on the current state of the US economy, hinting at potential adjustments to monetary policy. He acknowledged concerns about inflation but indicated a cautious approach to raising interest rates. Specific details about the Fed's ongoing quantitative easing program were also discussed.

-

Initial market reaction: The market's initial reaction to Powell's comments was mixed. Some interpreted his words as signaling slower economic growth, leading to a dip in stock futures. This initial uncertainty reflected anxieties surrounding the delicate balance between controlling inflation and stimulating economic expansion.

-

Implications for future monetary policy: Powell's comments provided insights into the Federal Reserve's potential future course of action regarding monetary policy. His cautious approach suggested a willingness to adapt to evolving economic conditions, but the uncertainty regarding the future path of interest rates remained a key concern for investors. This uncertainty directly impacts investor decisions regarding future investments.

-

Influencing economic indicators: Several economic indicators, including inflation rates, unemployment figures, and GDP growth projections, likely played a crucial role in shaping Powell's comments. A careful analysis of these indicators is vital for understanding the rationale behind the Fed's monetary policy decisions.

Trump's Reassuring Statements and Their Effect on Stock Futures

Following Powell's comments, President Trump issued statements aimed at reassuring markets and bolstering investor confidence. His words played a significant role in reversing the initial negative trend in stock futures.

-

Trump's calming quotes: President Trump's specific quotes, often shared via social media and press releases, emphasized his confidence in the US economy's strength and resilience. He often highlighted ongoing trade negotiations and their potential positive impact on future economic growth.

-

Countering negative sentiment: Trump's statements directly countered the negative sentiment created by concerns about potential slower economic growth signaled by Powell's comments. This demonstrates the significant influence political leaders can have in shaping market perceptions and investor confidence. His words aimed to reduce political uncertainty, a major factor influencing the stock market.

-

Immediate impact on stock futures: The immediate impact of Trump's statements was a sharp upward surge in stock futures. This dramatic shift illustrates the considerable power of presidential pronouncements on market psychology and trading decisions. This immediate response highlights the market's sensitivity to political narratives.

-

Long-term effects on market stability: While the short-term impact was clear, the long-term effects of Trump's intervention on market stability remain to be seen. His actions could contribute to increased market volatility in the future depending on the consistency of his messaging and the overall political climate.

Analysis of the Stock Futures Jump

The surge in stock futures following Trump's statements was significant and warrants further analysis.

-

Magnitude of the jump: A quantitative analysis of the percentage increase in stock futures provides a clear measure of the market's dramatic reaction to Trump's reassurances. This quantifiable change allows for objective analysis of market behavior.

-

Comparison to previous fluctuations: Comparing this surge to previous market fluctuations and similar events offers valuable context. Analyzing previous instances of political influence on market trends helps provide a broader perspective and context for this specific event.

-

Beyond Trump and Powell: Other contributing factors, such as global economic news and developments in other major markets, could have influenced this significant market movement. A comprehensive understanding requires considering a variety of external factors.

-

Market indicators: Examining trading volume and other market indicators, like the VIX (volatility index), during this period provides further insights into the market's overall sentiment and behavior. Analyzing these factors provides further context and a holistic picture of the market's dynamics.

Conclusion

This article examined the significant impact of both Chairman Powell's comments and President Trump's subsequent reassurances on stock futures. The immediate surge in stock futures highlights the powerful influence of political pronouncements on market sentiment and investor confidence. The interplay between economic policy and political statements remains a critical factor influencing market volatility. Understanding this complex relationship is vital for investors and market analysts alike.

Call to Action: Stay informed about the ever-changing dynamics of the stock market. Follow our updates for further analysis of how Trump's actions and the Federal Reserve's policies influence market movements and affect stock futures. Understanding these key factors is crucial for navigating the complexities of the stock market and making informed investment decisions.

Featured Posts

-

Strategic Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025

Strategic Partnership Saudi Arabia And India To Establish Two Oil Refineries

Apr 24, 2025 -

Fbi Hacker Made Millions From Compromised Executive Office365 Accounts

Apr 24, 2025

Fbi Hacker Made Millions From Compromised Executive Office365 Accounts

Apr 24, 2025 -

Optimus Robot Development How Chinas Rare Earth Policy Creates Challenges For Tesla

Apr 24, 2025

Optimus Robot Development How Chinas Rare Earth Policy Creates Challenges For Tesla

Apr 24, 2025 -

Teslas Q1 2024 Financial Performance Significant Net Income Decrease

Apr 24, 2025

Teslas Q1 2024 Financial Performance Significant Net Income Decrease

Apr 24, 2025 -

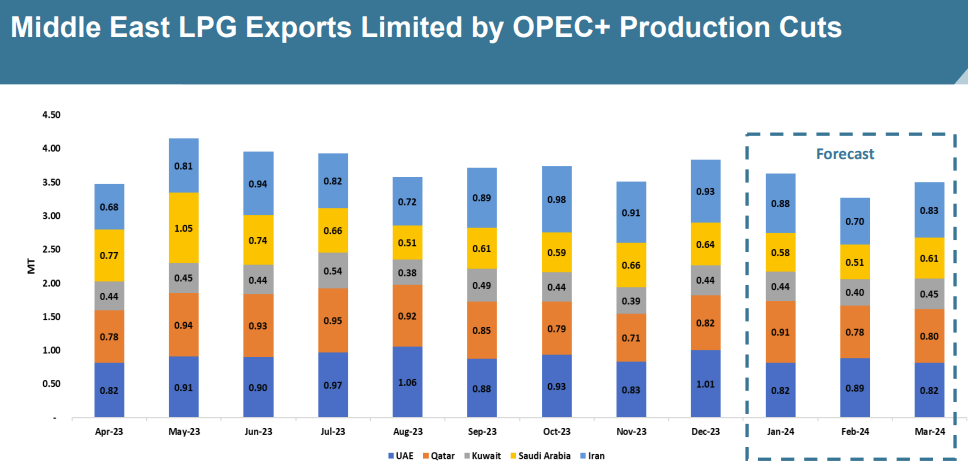

Impact Of Us Tariffs Chinas Turn To Middle East For Lpg Supply

Apr 24, 2025

Impact Of Us Tariffs Chinas Turn To Middle East For Lpg Supply

Apr 24, 2025