The Dax: A Reflection Of Bundestag Elections And Business Confidence

Table of Contents

The Impact of Coalition Governments on the DAX

The formation of a government after a Bundestag election significantly impacts the DAX. The period of coalition negotiations and the subsequent policy announcements directly influence investor confidence and market volatility.

Policy Uncertainty and Market Volatility

The process of forming coalition governments can be lengthy and uncertain. This period of ambiguity can create market volatility as investors react to the potential policy changes.

- Example 1: The 2017 election resulted in a protracted period of coalition negotiations, leading to some initial uncertainty and minor DAX fluctuations before a stable government was formed.

- Example 2: Potential changes in tax policies, particularly corporate tax rates, can significantly affect the profitability of DAX-listed companies and thus, the overall index performance. Similarly, new environmental regulations might disproportionately impact energy or automotive companies.

- Economic Forecasts and Analyst Predictions: During coalition negotiations, economic forecasts and analyst predictions play a crucial role in shaping investor expectations and influencing the DAX. Positive predictions generally lead to increased investor confidence, while negative forecasts can cause the DAX to decline.

Stability and Economic Growth

Conversely, a stable coalition government with a clear economic agenda can foster investor confidence and lead to sustained economic growth, positively impacting the DAX.

- Example 1: Periods of stable government in Germany have historically been associated with periods of strong DAX performance and economic expansion.

- Predictable Policies Encourage Investment: Predictable policies, including clear regulatory frameworks and stable tax systems, encourage long-term investment, leading to economic growth and a healthy DAX.

- Investor Sentiment, GDP Growth, and the DAX: A strong correlation exists between positive investor sentiment, robust GDP growth, and a rising DAX. Confidence in the government's economic strategy directly translates into investment, boosting economic activity and subsequently, the DAX.

Sector-Specific Responses to Election Outcomes

Different sectors within the DAX react differently to Bundestag election outcomes, depending on the specific policies proposed and implemented by the winning coalition.

Automotive Industry Sensitivity

The automotive industry, a significant component of the DAX, is highly sensitive to government policies. Environmental regulations and trade policies are particularly influential.

- Party Platforms and the Automotive Sector: Parties with differing stances on environmental regulations (e.g., stricter emission standards) can significantly affect the performance of automotive companies.

- Past Election Cycles and Automotive Companies: Analyzing past election cycles and the subsequent impact on major automotive companies like Volkswagen and BMW reveals a direct correlation between policy changes and their stock performance.

- Investment Opportunities and Risks: Understanding the potential impact of election outcomes on the automotive industry can help investors identify both investment opportunities and potential risks.

Energy Sector Volatility

The energy sector's performance within the DAX is highly sensitive to government policies on renewable energy, nuclear power, and fossil fuels.

- Climate Change Policies and Energy Companies: Parties with varying approaches to climate change will impact the energy sector differently. Increased investment in renewable energy might benefit some companies, while others reliant on fossil fuels could face challenges.

- Investment in Renewable Energy Infrastructure: Government support for renewable energy infrastructure directly impacts investment in this sector, influencing the DAX performance of related companies.

- Post-Election Performance of Energy Companies: Analyzing the performance of energy companies listed in the DAX after past elections provides valuable insights into the sector's response to policy shifts.

International Implications and Global Market Reactions

The results of Bundestag elections have significant international implications, impacting the broader Eurozone and influencing global investor sentiment towards the DAX.

Eurozone Impact

Germany's economic strength and influence within the Eurozone make Bundestag elections significant events for the entire region.

- Germany's Role in the Eurozone: As Europe's largest economy, Germany's economic policies have a ripple effect throughout the Eurozone. Political stability and economic confidence in Germany positively influence other European markets.

- Investor Confidence and European Stock Markets: Investor confidence in Germany’s economic future directly impacts other European stock markets, leading to either increased or decreased investment.

- Correlation Between the DAX and Other European Indices: A strong correlation exists between the DAX and other major European indices, indicating the interconnectedness of European economies.

Global Investor Sentiment

Global investors closely monitor Bundestag elections, as the outcomes directly influence their investment decisions.

- Global News and Investor Sentiment: Global financial media significantly influences investor sentiment towards the DAX. Positive news reports usually lead to higher investor confidence, while negative news can cause a decline.

- International Political Events and the DAX: International political events can also influence investor sentiment toward the DAX. Global uncertainty might affect investment decisions, leading to volatility in the DAX.

- The DAX and Global Stock Market Indices: The DAX is correlated to global stock market indices, reflecting the interconnectedness of global markets and the importance of Germany's economic health to the worldwide economy.

Conclusion

The DAX index serves as a powerful indicator of Germany's economic health, highly responsive to the outcomes of Bundestag elections. The policies implemented by the resulting government significantly influence business confidence, affecting various sectors and triggering market reactions. Understanding the historical relationship between election outcomes and DAX performance is crucial for investors and businesses alike. By carefully analyzing the platforms of different parties and their potential implications, informed decisions can be made regarding investments and long-term economic strategies. Stay informed on future Bundestag elections and their potential impact on the DAX to make sound investment choices. Monitoring the DAX and understanding its correlation to political events is key to navigating the complexities of the German and European markets.

Featured Posts

-

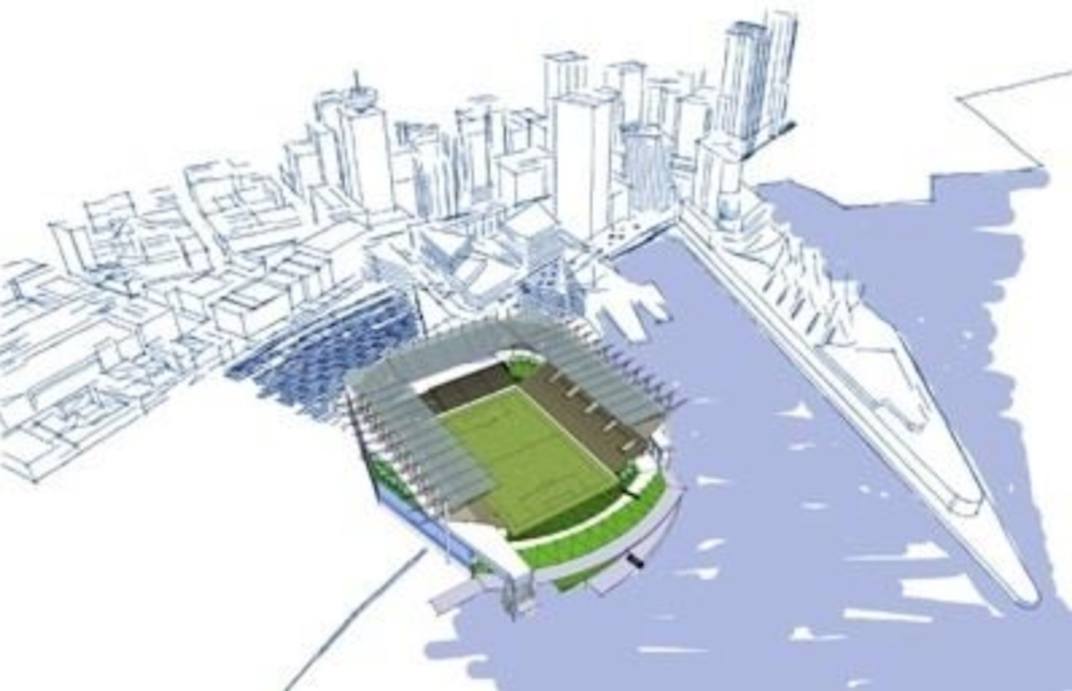

New Whitecaps Stadium Possible Negotiations With Pne Fairgrounds

Apr 27, 2025

New Whitecaps Stadium Possible Negotiations With Pne Fairgrounds

Apr 27, 2025 -

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025 -

Buy Canadian A Key Strategy For Napoleons Success

Apr 27, 2025

Buy Canadian A Key Strategy For Napoleons Success

Apr 27, 2025 -

Pfc Takes Action Eo W On Hold After Discovery Of False Documents Submitted By Gensol Promoters

Apr 27, 2025

Pfc Takes Action Eo W On Hold After Discovery Of False Documents Submitted By Gensol Promoters

Apr 27, 2025 -

Professional Stylist Behind Ariana Grandes Dramatic Hair And Tattoo Reveal

Apr 27, 2025

Professional Stylist Behind Ariana Grandes Dramatic Hair And Tattoo Reveal

Apr 27, 2025