The Broadcom-VMware Deal: An Extreme Price Increase For AT&T And Others?

Table of Contents

Broadcom's Acquisition Strategy and Market Dominance

Broadcom has a long history of acquisitions, consistently aiming for market consolidation and dominance. This strategy involves acquiring key players in various sectors, integrating their technologies, and leveraging economies of scale to control pricing. The VMware acquisition is a prime example of this aggressive approach.

- Past Acquisitions and Pricing Impact: Broadcom's past acquisitions of companies like CA Technologies and Symantec have, in some cases, led to increased prices for their software and services. Analysts point to reduced competition and market consolidation as major contributing factors.

- Current Market Share: Broadcom already holds substantial market share in various sectors, including networking equipment and semiconductor components. The addition of VMware's extensive portfolio significantly expands their influence, particularly in the enterprise software and cloud computing markets.

- Potential for Monopolies: The combination of Broadcom's existing portfolio and VMware's leading virtualization technology raises concerns about the creation of monopolies. This could significantly restrict competition and give Broadcom unprecedented power to dictate pricing.

- Antitrust Concerns: The acquisition is already facing scrutiny from regulatory bodies worldwide, raising concerns about potential antitrust violations. The outcome of these investigations will significantly impact the future pricing strategies of the combined entity.

VMware's Importance to AT&T and Other Telecom Giants

AT&T and other major telecom companies rely heavily on VMware's virtualization and cloud computing solutions for their critical infrastructure. VMware's products are integral to their network operations, data center management, and overall digital transformation strategies.

- Network Virtualization and Cloud Infrastructure: VMware's technology is crucial for virtualizing networks, allowing telecoms to efficiently manage and scale their infrastructure. This improves agility and reduces capital expenditure.

- Data Center Management: VMware's solutions are widely used for managing and optimizing data centers, improving efficiency and reducing operational costs. AT&T, for example, uses VMware vSphere to manage its vast data center footprint.

- Disruption from Price Increases: Significant price increases for VMware products and services could disrupt AT&T's operations, impacting its ability to provide services efficiently and potentially affecting its bottom line.

- Crucial VMware Products: Specific VMware products like vSphere, NSX, and vSAN are critical components of AT&T's infrastructure, making any price changes particularly impactful.

The Potential for Price Increases Post-Acquisition

Several factors suggest a strong likelihood of increased pricing for VMware products and services following the Broadcom acquisition.

- Reduced Competition: The acquisition eliminates a major competitor in the virtualization market, reducing competitive pressure and giving Broadcom significant pricing power.

- Leveraging Market Power: Broadcom is likely to leverage its newly expanded market power to increase prices, particularly for essential products and services.

- Impact on Licensing Fees and Support Costs: Expect increases in licensing fees, maintenance contracts, and support costs for existing and new VMware customers.

- Bundling and Forced Upgrades: Broadcom might bundle VMware products with its other offerings, potentially forcing customers into more expensive packages or upgrades.

Impact on Innovation and Competition

The Broadcom-VMware merger could stifle innovation within the virtualization and cloud computing sectors.

- Reduced R&D Investment: Post-acquisition, there's a risk of reduced investment in research and development, leading to slower innovation and fewer advancements in virtualization technology.

- Impact on Smaller Competitors: Smaller competitors and startups might struggle to compete against the combined might of Broadcom and VMware, potentially leading to a less diverse and innovative market.

- Reduced Choice and Flexibility: Customers might face reduced choice and flexibility, with less opportunity to select alternative solutions tailored to their specific needs.

Alternative Solutions and Mitigation Strategies

AT&T and other affected companies need to proactively explore alternative solutions and mitigation strategies.

- Open-Source Alternatives: Open-source virtualization platforms like OpenStack and Proxmox offer potential alternatives to VMware, although they may require significant investment in implementation and support.

- In-House Solutions: Investing in developing and maintaining in-house virtualization solutions could provide greater control and independence from Broadcom's pricing power, though this is a costly and time-consuming option.

- Negotiating Contracts: Companies might explore negotiating bulk discounts or alternative contract structures with Broadcom to mitigate potential price increases, but success in such negotiations is not guaranteed.

Conclusion

The Broadcom-VMware deal presents a significant challenge for AT&T and other telecom companies heavily reliant on VMware's technologies. The potential for substantial price increases, reduced competition, and stifled innovation is a serious concern. The long-term impact remains uncertain, but proactive strategies are needed to mitigate potential negative consequences.

Call to Action: Stay informed about the unfolding ramifications of the Broadcom-VMware deal. Monitor industry news and expert analysis to understand how this acquisition may impact your organization’s reliance on VMware and explore alternative solutions to mitigate potential Broadcom-VMware price increases. Understanding the potential implications of the Broadcom-VMware deal is crucial for effective long-term planning.

Featured Posts

-

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

Canadian Dollar Weakness Diving Despite Us Dollar Gains

Apr 24, 2025

Canadian Dollar Weakness Diving Despite Us Dollar Gains

Apr 24, 2025 -

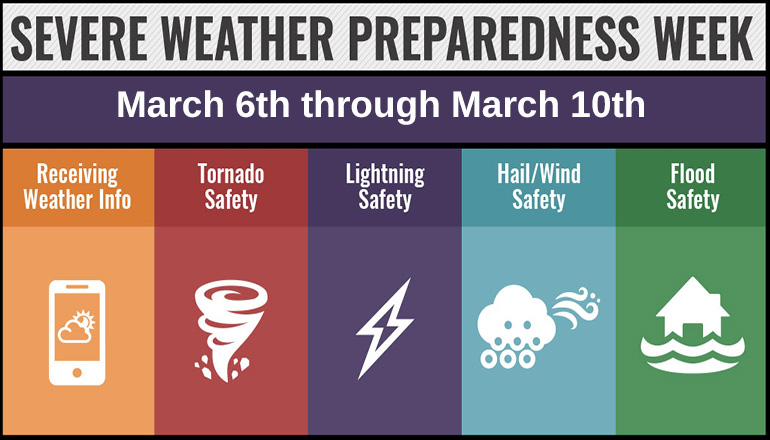

Severe Weather Preparedness Underfunded Examining The Risks During Tornado Season

Apr 24, 2025

Severe Weather Preparedness Underfunded Examining The Risks During Tornado Season

Apr 24, 2025 -

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025 -

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025