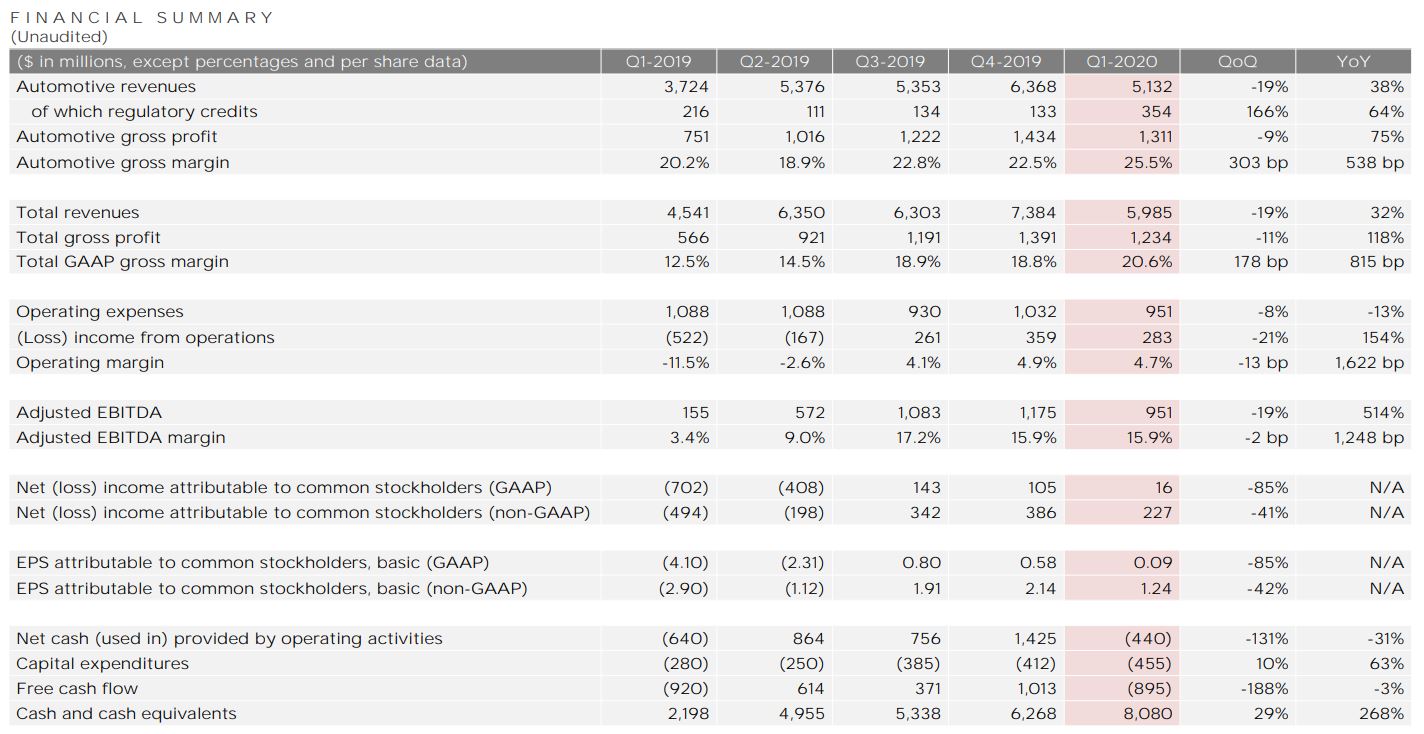

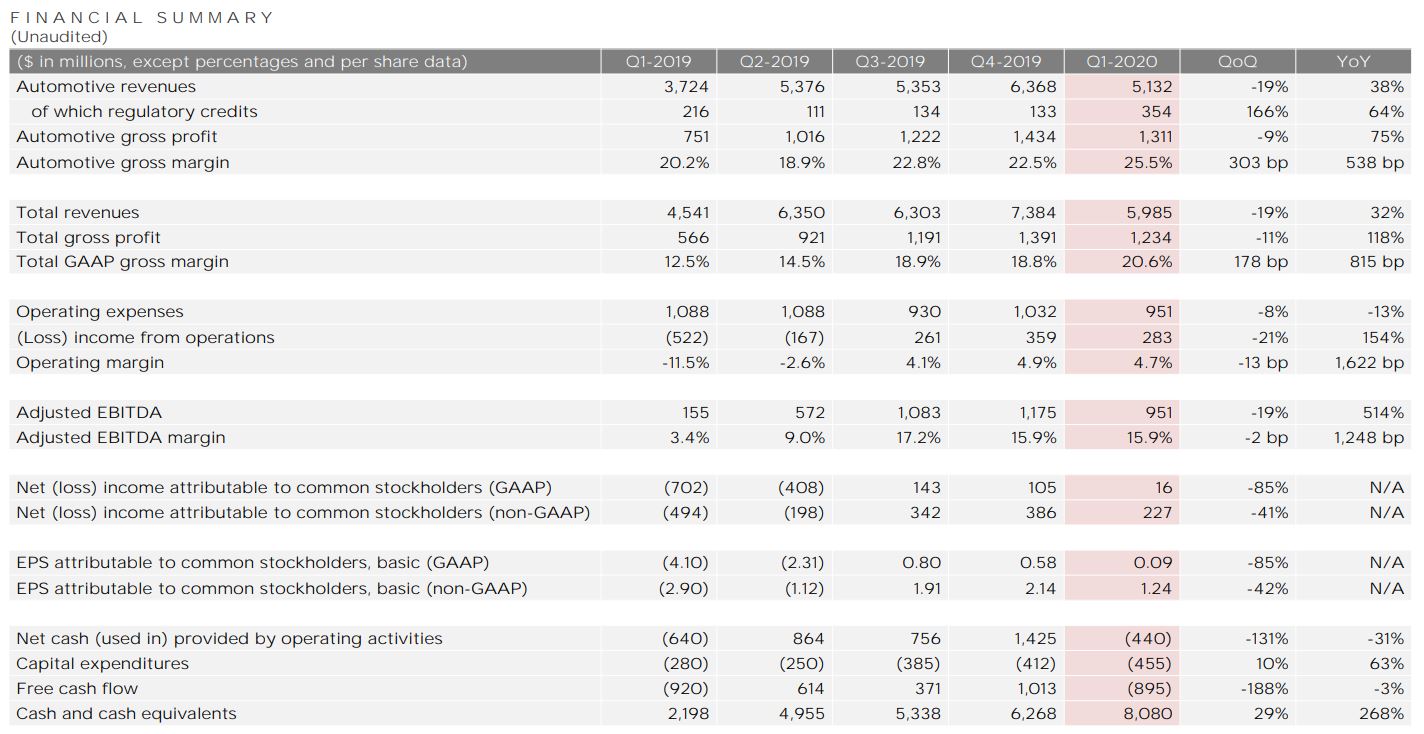

Tesla Q1 Financial Results: Political Controversy Impacts Profitability

Table of Contents

Record Deliveries Despite Supply Chain Challenges

Tesla reported record vehicle deliveries in Q1 2024, demonstrating robust demand for its electric vehicles (EVs) despite significant supply chain challenges.

Strong EV Demand

The demand for Tesla vehicles remains exceptionally strong, fueled by several factors:

- Specific sales figures: (Insert actual Q1 2024 sales figures here – e.g., "Tesla delivered X number of vehicles globally, a Y% increase compared to Q1 2023.")

- Market share comparisons: (Insert data comparing Tesla's market share to competitors – e.g., "Tesla maintained a Z% market share in the luxury EV segment.")

- Factors driving demand: New features like enhanced Autopilot capabilities and the introduction of new models contributed significantly to sales. Government incentives in various regions also boosted demand for Tesla vehicles. This underscores strong Tesla sales Q1 and overall EV market growth.

Supply Chain Disruptions and Mitigation Strategies

Despite strong demand, Tesla faced ongoing supply chain disruptions impacting production and profitability:

- Specific supply chain challenges: (Detail specific challenges faced, e.g., shortages of specific components, logistics bottlenecks, geopolitical instability).

- Tesla's mitigation strategies: Tesla actively worked to overcome these hurdles through diversification of suppliers, increased vertical integration (taking control of more aspects of production), and optimized logistics.

- Cost implications: These supply chain issues inevitably led to increased production costs, impacting Tesla's profit margins. The intricacies of Tesla's supply chain are crucial to understanding their overall EV manufacturing capabilities.

Price Wars and Margin Compression

Tesla's aggressive price cuts significantly impacted its profit margins during Q1 2024.

Aggressive Pricing Strategies

The price reductions implemented by Tesla sparked a price war within the EV market:

- Details of price reductions: (Specify the extent and timing of price cuts across various Tesla models).

- Competitor responses: Competitors responded with their own price adjustments, further intensifying the pressure on profit margins.

- Effect on sales volume vs. profitability: While the price cuts boosted sales volume, they led to a compression of profit margins, a key factor impacting Tesla profitability.

Impact on Investor Sentiment

The price war and its impact on profitability directly influenced investor sentiment:

- Stock price fluctuations: (Detail the fluctuations in Tesla's stock price during the period).

- Analyst reactions: (Summarize analyst reactions and forecasts, noting concerns about long-term profitability).

- Investor concerns regarding long-term profitability: Investors expressed concerns about the sustainability of Tesla's aggressive pricing strategy and its potential long-term effect on Tesla valuation.

Political Controversies and Regulatory Scrutiny

Political controversies surrounding Elon Musk and increasing regulatory scrutiny added another layer of complexity to Tesla's Q1 performance.

Elon Musk's Public Statements and Their Repercussions

Elon Musk's public statements frequently generated controversy, impacting Tesla's brand image and investor confidence:

- Specific examples of controversial statements or actions: (Provide specific examples and explain their impact).

- Their effect on public perception: These controversies negatively affected Tesla's public perception and potentially alienated some customers.

- Potential legal ramifications: Some actions may have legal ramifications, further impacting the company's financial outlook. The Elon Musk controversy has become a major factor affecting Tesla's reputation and brand image.

Government Regulations and Their Financial Implications

Evolving government regulations pose significant challenges and opportunities for Tesla:

- Specific regulations impacting Tesla: (Identify specific regulations impacting Tesla's operations, such as emission standards, tax credits, or safety regulations).

- Compliance costs: Compliance with these regulations incurs significant costs, further impacting profitability.

- Potential for future regulatory changes: Future regulatory changes could create additional challenges and uncertainties for Tesla. The impact of government policies and EV regulations is substantial in shaping the future of Tesla and the broader electric vehicle industry.

Conclusion

Tesla's Q1 2024 financial results reveal a mixed bag. Record deliveries highlight strong EV demand, but this was counterbalanced by supply chain disruptions, aggressive pricing strategies leading to margin compression, and the considerable impact of political controversies and regulatory pressures on Tesla profitability. Both internal factors (pricing strategies, supply chain management) and external factors (political climate, regulatory environment) played significant roles in shaping the company's financial performance. The interplay between these factors underscores the complexity of navigating the rapidly evolving EV market.

To stay informed about Tesla's future financial performance and the ongoing impact of political factors on the electric vehicle industry, keep an eye on future Tesla Q[number] financial results. Further reading and analysis on topics such as "Tesla financial analysis," "Tesla Q2 earnings preview," and "impact of politics on Tesla" will provide a deeper understanding of this dynamic landscape.

Featured Posts

-

The Impact Of The La Palisades Fires Which Celebrities Lost Their Homes

Apr 24, 2025

The Impact Of The La Palisades Fires Which Celebrities Lost Their Homes

Apr 24, 2025 -

Oblivion Remastered Launch Day For Bethesdas Classic Rpg

Apr 24, 2025

Oblivion Remastered Launch Day For Bethesdas Classic Rpg

Apr 24, 2025 -

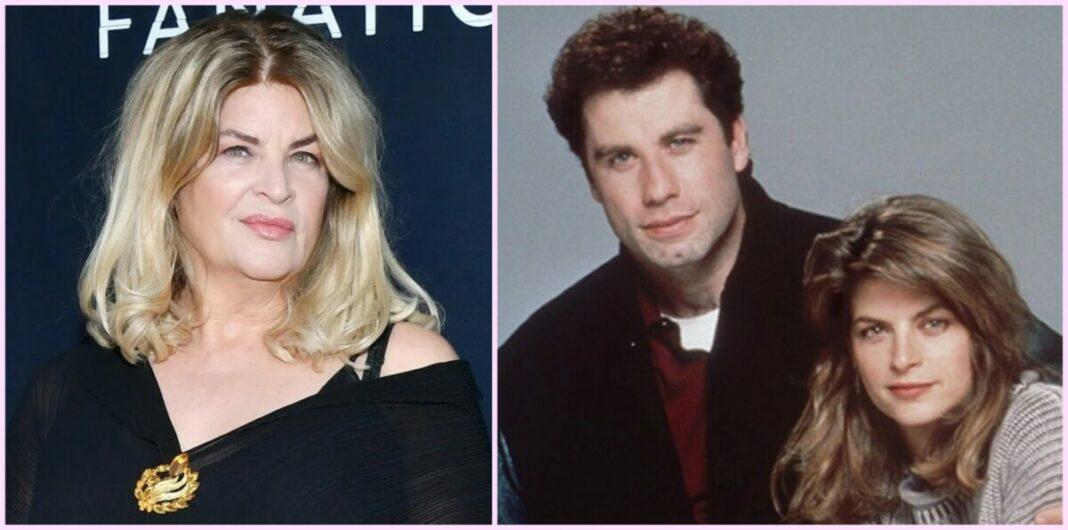

I Thlipsi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025

I Thlipsi Toy Tzon Travolta Gia Ton Thanato Toy Tzin Xakman

Apr 24, 2025 -

New Google Fi 35 Unlimited Plan A Detailed Review

Apr 24, 2025

New Google Fi 35 Unlimited Plan A Detailed Review

Apr 24, 2025 -

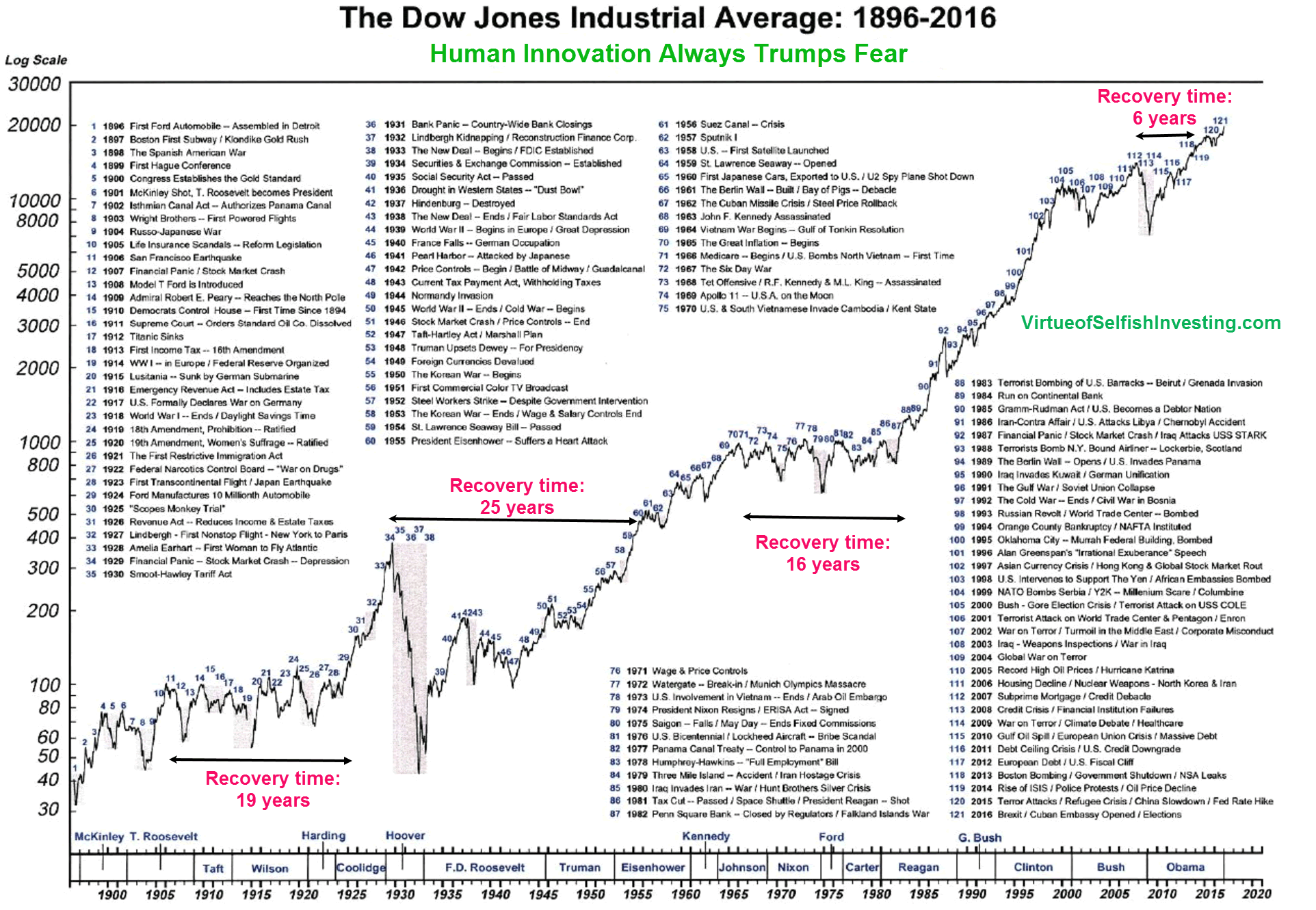

Stock Market Gains S And P 500 Nasdaq And Dows Significant Rise

Apr 24, 2025

Stock Market Gains S And P 500 Nasdaq And Dows Significant Rise

Apr 24, 2025