Tech Sector Propels US Stock Market Gains: Tesla's Impact

Table of Contents

Tesla's Contribution to the Tech Sector's Success

Tesla's remarkable growth has undeniably propelled the tech sector's success. Its innovative electric vehicles (EVs) and ambitious energy initiatives have captivated investors, leading to a substantial increase in its market cap and influencing the overall stock valuation of technology and renewable energy companies.

- Tesla Stock Price Surge: Tesla's stock price has seen phenomenal increases over the past several years, boosting investor confidence and drawing significant capital into the tech sector. These increases reflect not only strong sales but also anticipation of future growth in the EV market and Tesla's expansion into related technologies.

- Dominance in the EV Market: Tesla's significant market share in the rapidly expanding electric vehicle market speaks volumes. Their consistent production increases and innovative technology have solidified their position as a market leader, impacting the valuation of other EV companies and contributing to the overall sector's success.

- Investor Sentiment: Tesla's success has positively impacted investor sentiment toward technology and renewable energy stocks. The company's innovative spirit and aggressive growth strategy have become benchmarks for other companies, leading to increased investment in related sectors.

- Product Launches and Announcements: Major product launches, such as new EV models, energy storage solutions, and advancements in autonomous driving technology, consistently fuel investor enthusiasm and contribute to the positive market sentiment surrounding Tesla and the broader tech sector.

The Broader Tech Sector's Influence on Market Gains

While Tesla's contribution is significant, the overall performance of the tech sector is a collective effort. Other major technology companies have also significantly contributed to the recent stock market gains.

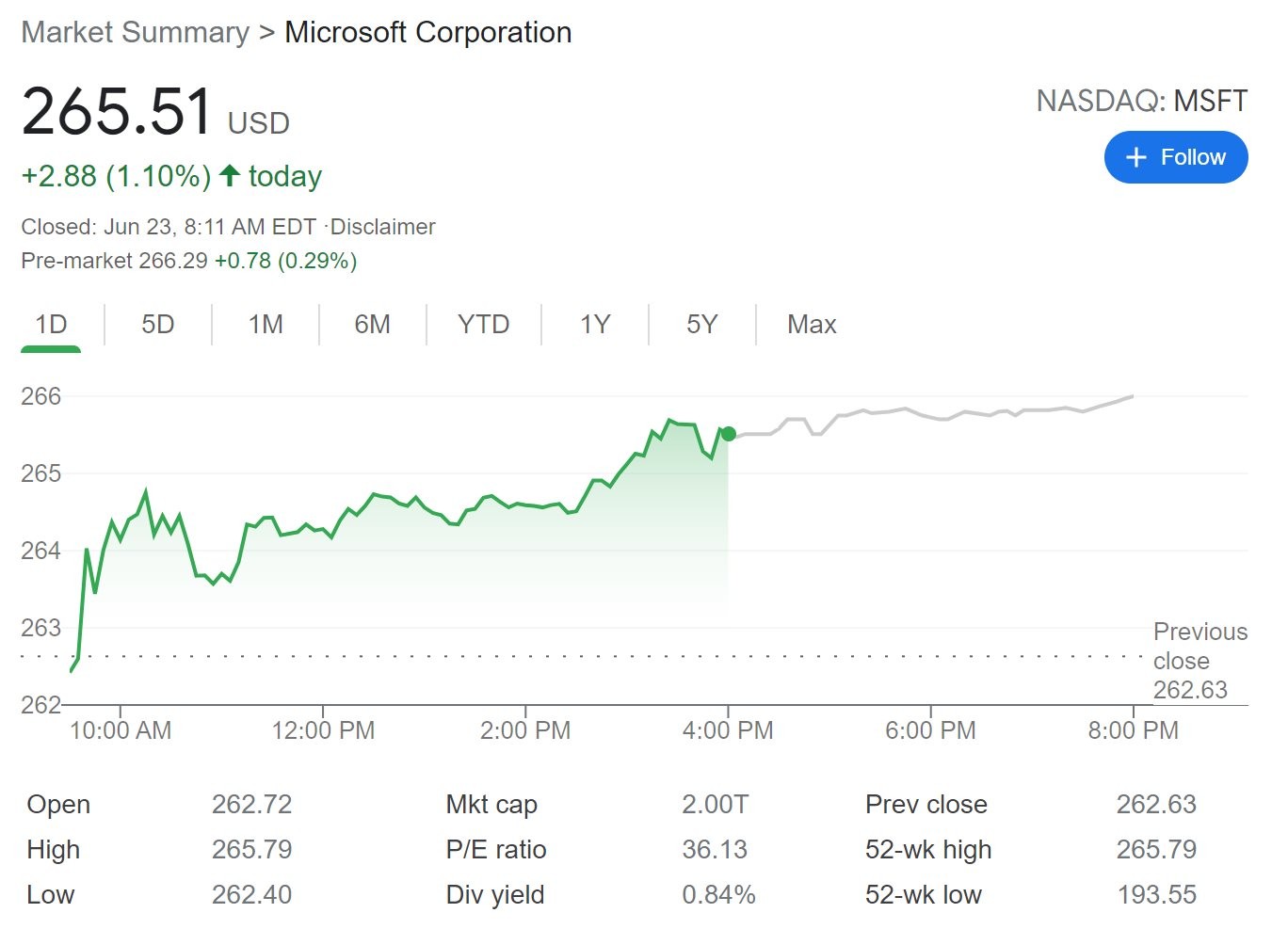

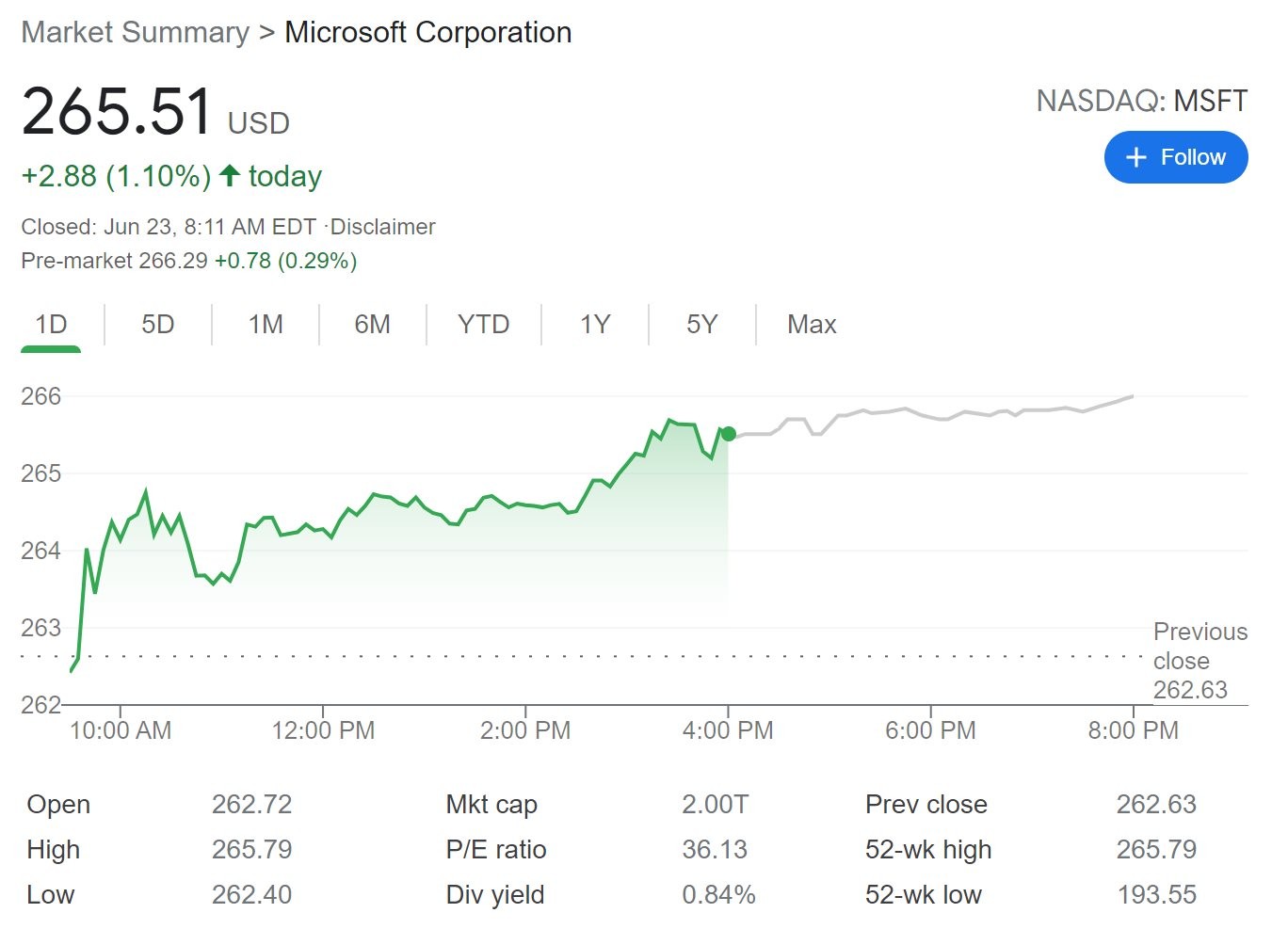

- FAANG Stock Performance: The performance of FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google) significantly impacts the Nasdaq and the broader US stock market. Their consistent growth and innovative products drive a considerable portion of market capitalization gains.

- Nasdaq Performance: The Nasdaq Composite, a key index tracking technology-focused companies, reflects the overall health of the tech sector. Its strong performance correlates directly with the growth experienced in the broader US stock market.

- Semiconductor Industry's Role: The semiconductor industry plays a crucial role, providing essential components for various technological advancements. The growth of this industry directly supports the success of other tech companies and contributes to overall market performance.

- Software Companies' Impact: The consistent growth and innovation within the software sector further contributes to the tech sector's strength. Software companies provide vital tools and services across multiple industries, fueling productivity and driving economic growth.

Economic Factors Contributing to the Tech Sector's Growth

Several economic factors have contributed to the strong performance of the tech sector. Understanding these factors provides a broader context for the observed market gains.

- Interest Rates and Inflation: While fluctuating interest rates and inflation can impact stock valuations, the tech sector's overall resilience and growth potential have often insulated it from the negative effects of these economic factors.

- Consumer Spending: Strong consumer spending, particularly on technology products and services, fuels the demand for tech products and positively impacts the industry's growth trajectory.

- Technological Innovation: Continuous technological innovation is the lifeblood of the tech sector. This constant drive for improvement drives both internal growth and creates new market opportunities, ensuring long-term growth.

- Economic Recovery: As economies recover from downturns, the demand for technological solutions increases, further fueling the growth of the tech sector and its positive influence on the stock market.

Future Outlook for the Tech Sector and US Stock Market

Predicting the future is inherently uncertain, but analyzing current trends and potential challenges offers a perspective on the future trajectory of the tech sector and its impact on the US stock market.

- Future Tech Trends: Emerging technologies like artificial intelligence (AI), machine learning (ML), and the metaverse are expected to drive significant growth within the tech sector in the coming years.

- Potential Risks and Challenges: Regulatory changes, geopolitical instability, and supply chain disruptions are potential risks that could impact the tech sector's growth. Careful risk assessment is crucial for investors.

- Investment Strategies: Diversification within the tech sector and a long-term investment strategy are generally recommended for mitigating risk and maximizing returns.

- Market Volatility: Market volatility is expected to continue. Investors should carefully monitor market conditions and adjust their investment strategies accordingly.

Conclusion

The tech sector, with Tesla playing a particularly prominent role, has been a significant driver of recent US stock market gains. Tesla's innovative products, strong market performance, and positive investor sentiment have significantly contributed to this growth. However, the success of the broader tech sector is a collective effort, encompassing the performance of major tech companies, the semiconductor industry, and continuous technological innovation, all within the context of broader economic factors. Staying updated on the latest developments in the tech sector is crucial for making informed decisions about your investment portfolio. Keep track of Tesla's performance and other leading tech stocks for a better understanding of US stock market gains.

Featured Posts

-

Deportation To Russia Harvard Researchers Legal Battle In Louisiana

Apr 28, 2025

Deportation To Russia Harvard Researchers Legal Battle In Louisiana

Apr 28, 2025 -

Red Sox Vs Blue Jays Lineup Buehler Pitches Outfielder Back In Action

Apr 28, 2025

Red Sox Vs Blue Jays Lineup Buehler Pitches Outfielder Back In Action

Apr 28, 2025 -

Red Sox Blue Jays Game Lineups Buehlers Role And Outfielders Comeback

Apr 28, 2025

Red Sox Blue Jays Game Lineups Buehlers Role And Outfielders Comeback

Apr 28, 2025 -

Securing A Mets Starting Rotation Spot A Young Pitchers Guide

Apr 28, 2025

Securing A Mets Starting Rotation Spot A Young Pitchers Guide

Apr 28, 2025 -

World Famous Chefs Fishermans Stew Garners Eva Longorias Praise

Apr 28, 2025

World Famous Chefs Fishermans Stew Garners Eva Longorias Praise

Apr 28, 2025