Stock Market Valuation Concerns: BofA's Reassuring Analysis

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's analysis presents several key arguments suggesting that current stock market valuations aren't as alarming as some might believe. Their perspective is grounded in a detailed examination of underlying economic fundamentals and long-term trends.

Focus on Earnings Growth

BofA highlights the robust earnings growth of many companies as a primary counter-argument to overvaluation claims. This suggests that current valuations are, to a significant degree, supported by strong fundamentals.

- Increased corporate profitability in specific sectors: Technology, healthcare, and certain consumer staples have shown exceptional profitability in recent quarters, driving overall market growth.

- Positive revenue growth projections for the coming quarters: Analysts' forecasts indicate continued revenue growth for many companies, suggesting sustained earnings potential.

- Resilience of certain industries despite economic headwinds: Even amidst inflationary pressures and geopolitical uncertainty, some industries have demonstrated surprising resilience, further bolstering earnings.

- Examples of specific companies showing strong earnings growth: While specific company names are not always included in such broad analyses to avoid appearing as recommendations, the report likely showcased examples from various sectors illustrating the underlying earnings strength.

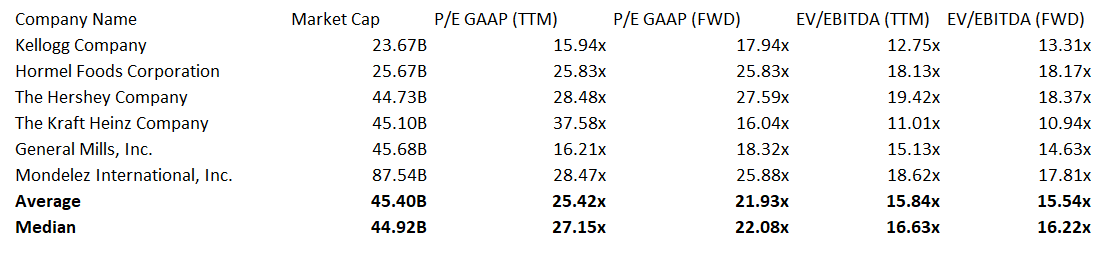

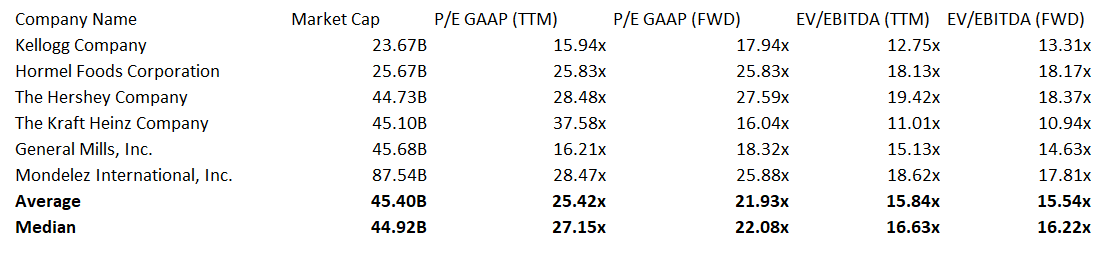

Moderate Price-to-Earnings Ratios (P/E)

While acknowledging that stock market P/E ratios aren't at historically low levels, BofA's analysis suggests they are not excessively high compared to historical averages, especially when adjusted for the current economic environment.

- Comparison of current P/E ratios to historical averages: The analysis likely compared current P/E ratios to averages from previous economic cycles, demonstrating that the current levels are not unprecedented.

- Analysis of P/E ratios across different sectors: Different sectors naturally exhibit different P/E ratios. The analysis likely provided a sector-specific breakdown to paint a complete picture.

- Adjustments made to P/E ratios to account for interest rate hikes and inflation: BofA likely adjusted the P/E ratios to factor in the impact of inflation and higher interest rates on future earnings, providing a more nuanced valuation picture.

- Explanation of the methodology used to calculate P/E ratios: Transparency in methodology is crucial for credibility. The report should detail how P/E ratios were calculated, clarifying any assumptions made.

Importance of Long-Term Investment Horizon

BofA emphasizes the crucial role of a long-term investment strategy in navigating market fluctuations. Focusing on short-term movements can be detrimental to long-term growth.

- The risks associated with short-term trading strategies: Short-term trading often involves higher transaction costs and a greater susceptibility to emotional decision-making.

- Advantages of a buy-and-hold approach to investing: A buy-and-hold strategy allows investors to ride out market downturns and benefit from long-term growth.

- The historical performance of long-term investment strategies: Historical data consistently demonstrates the superiority of long-term investment strategies over short-term trading.

- The importance of diversification in a long-term portfolio: Diversification is crucial to mitigating risk and maximizing long-term returns within a long-term investment strategy.

Addressing Specific Valuation Concerns

BofA's analysis directly addresses several specific concerns frequently voiced about current stock market valuation.

Addressing Inflationary Pressures

While acknowledging the impact of inflation, BofA argues that many companies possess pricing power and are effectively managing rising costs.

- Examples of companies successfully navigating inflation: The analysis likely cited examples of companies that have successfully passed increased costs onto consumers.

- Strategies companies are using to mitigate inflation's impact: Cost-cutting measures, supply chain optimization, and increased efficiency are some strategies companies are utilizing.

- Analysis of inflation's effect on different sectors: The report likely analyzed how inflation is differentially impacting various economic sectors.

Impact of Interest Rate Hikes

BofA's analysis considers the impact of interest rate hikes on valuations. They suggest that these hikes are already, to some degree, priced into the market.

- The effect of interest rates on company borrowing costs: Higher interest rates increase borrowing costs for companies, impacting profitability and potentially slowing investment.

- The impact of interest rate hikes on investor sentiment: Higher rates can shift investor sentiment towards bonds, potentially reducing demand for equities.

- Analysis of interest rate sensitivity across different sectors: The impact of interest rate hikes varies across different sectors, with some being more sensitive than others.

Geopolitical Risks and Market Volatility

BofA acknowledges the undeniable impact of geopolitical uncertainty and market volatility. However, they emphasize that these factors are often temporary and don't necessarily negate long-term growth prospects.

- Examples of past geopolitical events and their market impact: The analysis likely reviewed past events to illustrate the often temporary nature of such impacts.

- BofA's assessment of the likelihood and impact of future geopolitical risks: The analysis likely includes a risk assessment based on their understanding of current geopolitical tensions.

- The importance of risk management in investing: A well-defined risk management strategy is crucial for weathering market volatility and maintaining a long-term perspective.

Conclusion

BofA's analysis offers a reassuring perspective on current stock market valuation concerns. While acknowledging challenges like inflation and geopolitical uncertainty, their report emphasizes the strength of underlying earnings growth and suggests that current valuations, considered within a long-term context, aren't excessively high. Investors should prioritize a well-diversified, long-term investment strategy rather than reacting to short-term market volatility. Remember to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions. Don't let short-term stock market valuation concerns derail your long-term investment plans. Understand the nuances of market valuation and build a robust, informed investment strategy.

Featured Posts

-

Analyzing The Impact Of Blue Origins Setbacks Compared To Katy Perrys Career Trajectory

Apr 22, 2025

Analyzing The Impact Of Blue Origins Setbacks Compared To Katy Perrys Career Trajectory

Apr 22, 2025 -

Key Economic Themes From The English Language Leaders Debate

Apr 22, 2025

Key Economic Themes From The English Language Leaders Debate

Apr 22, 2025 -

Death Of Pope Francis The World Reacts

Apr 22, 2025

Death Of Pope Francis The World Reacts

Apr 22, 2025 -

Closer Security Links China And Indonesias Strategic Partnership Expands

Apr 22, 2025

Closer Security Links China And Indonesias Strategic Partnership Expands

Apr 22, 2025 -

Cnn Exposes Tik Toks Role In Circumventing Trump Tariffs

Apr 22, 2025

Cnn Exposes Tik Toks Role In Circumventing Trump Tariffs

Apr 22, 2025