Stock Market News: Dow Futures Drop, Dollar Slides On Tariff Fears

Table of Contents

Dow Futures Plunge Amidst Tariff Uncertainty

The significant drop in Dow futures is a clear indicator of growing unease in the market. The E-mini Dow futures contract, a popular benchmark for tracking the Dow Jones Industrial Average, experienced a sharp decline. This reflects a significant shift in investor sentiment, moving from cautious optimism to outright concern.

- Quantifiable Drop: Dow futures fell 250 points, representing a 1% decline at the time of writing.

- Contributing Factors: This drop can be attributed to several factors, including increased trade war rhetoric between major global powers, disappointing economic data releases highlighting slower-than-expected growth, and a general sense of uncertainty surrounding future trade negotiations.

- Investor Sentiment: Fear, uncertainty, and doubt (FUD) are currently dominating investor sentiment. Risk-off strategies are prevalent as investors seek safety in less volatile assets.

- Analyst Comments: Several market analysts have expressed concerns about the potential for a prolonged period of market volatility, urging investors to adopt a cautious approach and diversify their portfolios.

Dollar Weakness Reflects Risk-Off Sentiment

The weakening dollar is strongly correlated with the negative stock market news, signifying a broader risk-off sentiment among investors. A falling dollar often indicates a flight to safety, as investors move away from riskier assets and seek refuge in the perceived stability of safe-haven currencies.

- Risk Aversion: Investors are moving away from the US dollar, reflecting a lack of confidence in the US economy given the uncertainty surrounding trade disputes.

- Currency Performance: The dollar has weakened against major currencies such as the euro and the Japanese yen, further highlighting this trend.

- Impact of Tariff Fears: The escalating tariff war is a key factor contributing to the dollar's decline. Uncertainty about future trade policies and their potential impact on the US economy is eroding investor confidence.

- Economic Indicators: Weakening economic indicators, such as a decline in manufacturing activity or slowing consumer spending, can also contribute to dollar weakness.

- Analyst Opinions: Many analysts predict continued dollar volatility in the short term, dependent on the progress (or lack thereof) in trade negotiations.

Tariff Fears Continue to Dominate Market Narrative

The ongoing impact of tariff disputes is undeniably shaping the global market narrative. The uncertainty surrounding trade policies is creating significant headwinds for businesses and investors alike.

- Countries Involved: The US and China remain central to this ongoing trade dispute, with ripple effects impacting numerous other countries and regions.

- Sectoral Impact: Tariffs are significantly impacting various sectors, particularly technology and manufacturing, leading to increased production costs and reduced competitiveness.

- Long-Term Consequences: Prolonged trade wars could lead to a slowdown in global economic growth, impacting supply chains, investment, and overall consumer confidence.

- Potential Solutions: While negotiations continue, the path to a resolution remains uncertain. Finding a balance between protecting national interests and fostering global trade cooperation is a major challenge.

- Further Information: For detailed information on the latest developments in the tariff disputes, refer to reputable financial news sources such as the Wall Street Journal and Bloomberg.

Impact on Other Global Markets

The ripple effect of the Dow futures drop and dollar slide is evident in other global markets. The interconnectedness of the global financial system ensures that events in one market quickly influence others.

- International Indices: Major international indices, including the FTSE 100 and Nikkei 225, have also experienced some degree of decline, reflecting the global nature of the concerns.

- Commodity Prices: Commodity prices, including oil and gold, are also experiencing fluctuations, influenced by the broader market sentiment and uncertainty.

- Global Investor Confidence: The overall impact is a decrease in global investor confidence, as investors grapple with uncertainty and seek safer investment options.

- Country-Specific Reactions: Different countries are responding to the market downturn in various ways, depending on their economic structures and exposure to the trade disputes.

Conclusion

The significant drop in Dow futures, the weakening dollar, and the pervasive influence of tariff fears are all interconnected factors shaping the current stock market news. These events highlight the increasing volatility and interconnectedness of global markets. Understanding these dynamics is critical for investors and businesses alike. Stay updated on the latest stock market news for crucial insights into market volatility. Understanding the implications of tariff wars is essential for informed stock market investment. Stay tuned for further updates.

Featured Posts

-

Exploring The Pan Nordic Military Alliance Swedish Tanks And Finnish Troops

Apr 22, 2025

Exploring The Pan Nordic Military Alliance Swedish Tanks And Finnish Troops

Apr 22, 2025 -

Over The Counter Birth Control A Post Roe Game Changer

Apr 22, 2025

Over The Counter Birth Control A Post Roe Game Changer

Apr 22, 2025 -

Bof A On Stock Market Valuations Addressing Investor Concerns

Apr 22, 2025

Bof A On Stock Market Valuations Addressing Investor Concerns

Apr 22, 2025 -

Car Dealers Renew Opposition To Electric Vehicle Mandates

Apr 22, 2025

Car Dealers Renew Opposition To Electric Vehicle Mandates

Apr 22, 2025 -

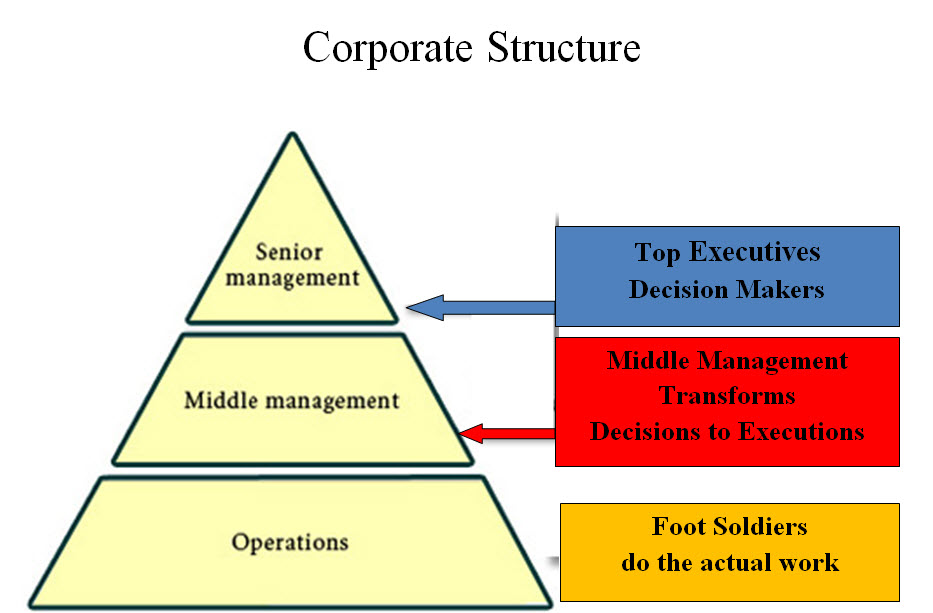

Middle Managers The Bridge Between Leadership And Employees And Their Crucial Role In Business Success

Apr 22, 2025

Middle Managers The Bridge Between Leadership And Employees And Their Crucial Role In Business Success

Apr 22, 2025