Pre-Turmoil Cracks In The Private Credit Market: A Credit Weekly Perspective

Table of Contents

The private credit market encompasses a range of lending activities outside the traditional banking system, including direct lending, leveraged loans, and mezzanine financing. It's a significant source of capital for businesses, particularly those unable to access traditional bank financing. This article aims to analyze pre-existing vulnerabilities within this market that have been amplified by recent economic shifts, offering a timely and relevant perspective from Credit Weekly.

Rising Interest Rates and Their Impact on Private Credit

The sharp increase in interest rates globally has had a profound impact on the private credit market. This rise has dramatically altered the cost of borrowing and investor sentiment, creating significant headwinds for borrowers and lenders alike.

Increased Borrowing Costs

Rising interest rates directly translate to increased borrowing costs for private credit borrowers. This impacts profitability and significantly increases the risk of default.

- Increased debt servicing costs: Higher interest rates mean borrowers must allocate a larger portion of their cash flow to debt repayment, leaving less for operational expenses, investments, and potential repayments.

- Reduced deal flow: The higher cost of borrowing makes financing new deals less attractive, leading to a slowdown in deal flow within the private credit market.

- Pressure on leveraged buyout (LBO) financings: LBOs, heavily reliant on debt financing, are particularly vulnerable to interest rate hikes. The increased cost of debt can make these transactions economically unviable.

For example, the Federal Reserve's series of interest rate hikes in 2022 led to a noticeable decrease in new LBO activity as sponsors struggled to secure financing at acceptable terms.

Reduced Investor Appetite

Rising interest rates also make alternative investments, such as government bonds, more appealing. This shift reduces investor appetite for private credit, which typically offers lower liquidity and longer lock-up periods.

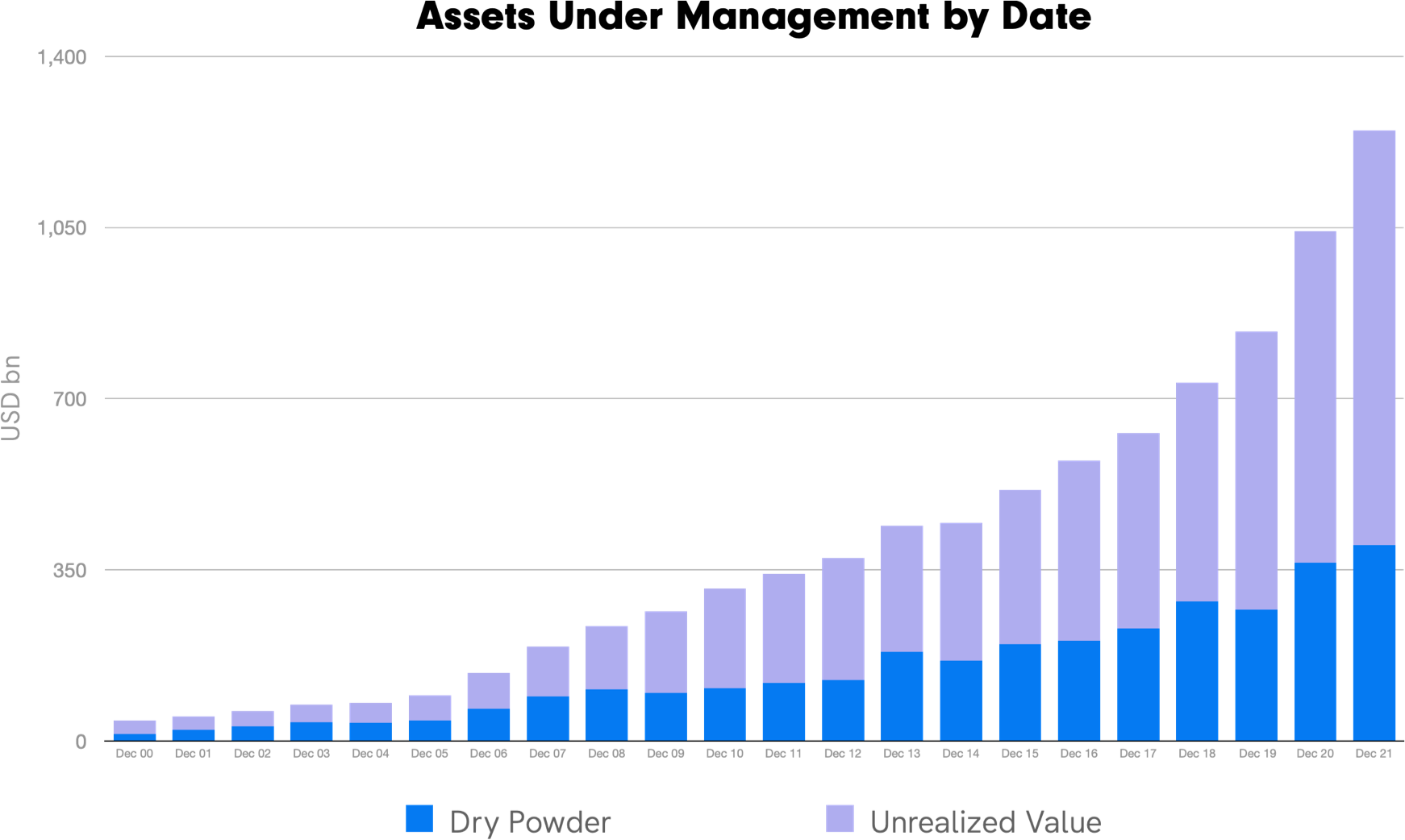

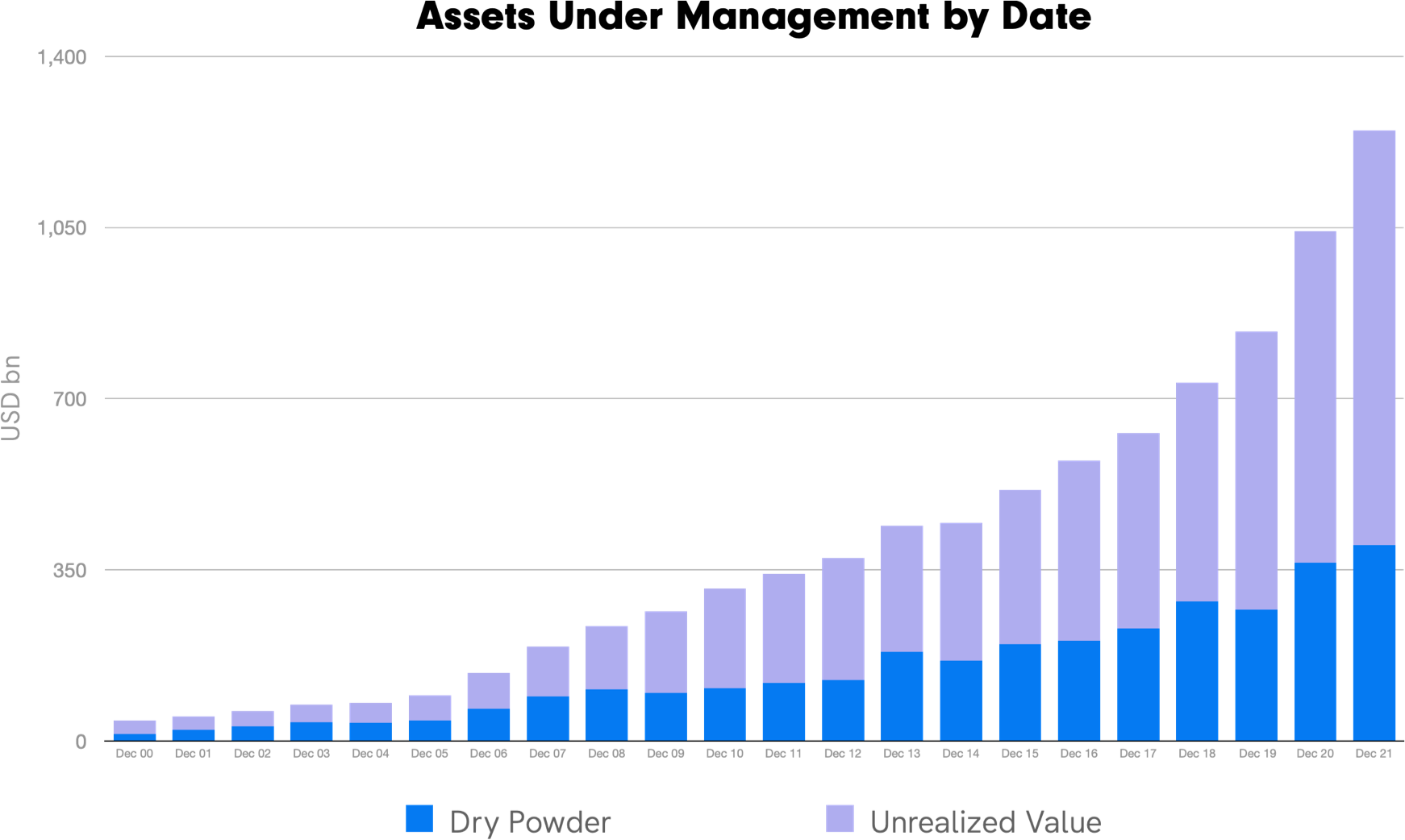

- Decreased fund inflows: Private credit funds are facing difficulty attracting new capital as investors seek safer, higher-yielding alternatives.

- Difficulty in fundraising for new private credit funds: The current environment makes raising capital for new funds significantly more challenging.

- Potential for fire sales of assets: Some investors might be forced to liquidate assets to meet redemption requests or cover losses, potentially driving down valuations.

Several private credit funds have reported decreased investor commitments and challenges in closing new funds, reflecting the reduced investor appetite.

Increased Leverage and Risk Concentration

Many private credit transactions involve high levels of leverage, amplifying both potential returns and risks. This concentration of risk creates vulnerabilities within the market.

Highly Leveraged Transactions

The use of high leverage in private credit transactions increases their sensitivity to economic downturns and interest rate fluctuations.

- Increased sensitivity to interest rate fluctuations: Highly leveraged borrowers are particularly vulnerable to rising interest rates, as their debt servicing costs increase disproportionately.

- Higher risk of default: Higher leverage magnifies the risk of default, especially if the underlying assets decline in value.

- Potential for cascading failures: Defaults by highly leveraged borrowers could trigger a chain reaction, impacting other lenders and borrowers.

The collapse of several highly leveraged companies in the past year exemplifies the inherent risks associated with this strategy.

Concentration Risk

The private credit market exhibits significant concentration risk, with a small number of borrowers or sectors dominating the lending landscape.

- Overexposure to specific industries: Many private credit funds have concentrated their investments in specific sectors, making them vulnerable to shocks affecting those industries.

- Reliance on a few key borrowers: A few large borrowers can account for a significant portion of a fund's portfolio, increasing the impact of defaults.

- Lack of diversification: The lack of diversification across borrowers and industries increases the overall systemic risk within the market.

The heavy reliance of certain private credit funds on the real estate sector highlights the concentration risk within this market.

Lack of Transparency and Liquidity

The private credit market is characterized by a lack of transparency and liquidity, making it difficult to assess and manage risk effectively.

Limited Public Information

The limited public information available on private credit transactions makes it difficult to accurately assess the underlying risk.

- Difficulty in assessing underlying collateral value: The opaque nature of many private credit deals makes it challenging to determine the true value of the underlying collateral.

- Limited public reporting requirements: Unlike publicly traded debt, private credit transactions are not subject to the same stringent reporting requirements.

- Opaque pricing mechanisms: The pricing of private credit transactions is often opaque, making it difficult to compare returns across different investments.

This lack of transparency contrasts sharply with the relatively transparent nature of publicly traded debt markets.

Liquidity Concerns

Private credit assets are typically illiquid, meaning they cannot be easily sold quickly in times of stress.

- Long-term investment horizons: Private credit investments usually have longer lock-up periods, limiting the ability to liquidate positions quickly.

- Illiquid assets: The underlying assets backing private credit loans are often illiquid, making it difficult to sell them quickly to raise cash.

- Difficulty in finding buyers during market downturns: During periods of market stress, it becomes extremely difficult to find buyers for private credit assets, even at significantly discounted prices.

Several private credit funds have experienced difficulty liquidating assets during recent market turmoil.

Conclusion: Pre-Turmoil Cracks in the Private Credit Market: A Credit Weekly Perspective

This Credit Weekly analysis reveals significant pre-existing vulnerabilities within the private credit market. Rising interest rates have increased borrowing costs and reduced investor appetite, while high leverage and concentration risk amplify the potential for defaults and cascading failures. Further, the lack of transparency and liquidity exacerbates these issues, hindering effective risk management. These weaknesses are interconnected and mutually reinforcing, creating a precarious situation. The recent market stresses have exposed these pre-existing cracks, highlighting the need for greater transparency, diversification, and prudent risk management practices within the private credit market. Stay informed about developments in this crucial sector by regularly reviewing Credit Weekly reports for insights and analysis into pre-turmoil cracks and other critical market trends impacting private credit. Subscribe to Credit Weekly today for in-depth analysis and stay ahead of the curve in the dynamic world of private credit.

Featured Posts

-

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025

Bencic Triumphs At The Abu Dhabi Open

Apr 27, 2025 -

Vaccine Skeptic David Geier Analyzing Vaccine Research For Hhs

Apr 27, 2025

Vaccine Skeptic David Geier Analyzing Vaccine Research For Hhs

Apr 27, 2025 -

Analyzing Ramiro Helmeyers Blaugrana Ambition

Apr 27, 2025

Analyzing Ramiro Helmeyers Blaugrana Ambition

Apr 27, 2025 -

Pne Group Expands Wind Energy Portfolio With Two New Farms

Apr 27, 2025

Pne Group Expands Wind Energy Portfolio With Two New Farms

Apr 27, 2025 -

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

Apr 27, 2025

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

Apr 27, 2025