Navigate The Private Credit Boom: 5 Dos And Don'ts For Job Seekers

Table of Contents

Do Your Research: Understanding the Private Credit Landscape

Before diving into your job search, thorough research is crucial. The private credit market isn't monolithic; it encompasses various specializations, each with its own skill requirements and career paths.

Research Specific Niches

The private credit industry offers diverse career paths. Understanding these differences is key to targeting your application effectively.

- Direct Lending: Providing loans directly to companies without intermediary financial institutions.

- Mezzanine Financing: A hybrid of debt and equity financing, typically used for expansion or acquisitions.

- Distressed Debt: Investing in debt securities of companies experiencing financial distress.

- Real Estate Lending: Specializing in loans secured by real estate properties.

- Private Equity-backed debt: Providing financing to companies backed by private equity firms.

Research firms specializing in these areas to identify those aligning with your skills and interests. Analyze job descriptions to understand the specific skills and experience valued within each niche. This targeted approach will significantly improve your chances of landing an interview for private credit jobs.

Network Strategically

Networking is paramount in the private credit industry. It's not just about finding jobs; it's about understanding the market dynamics and building relationships that can open doors to unadvertised opportunities.

- Attend industry events: Conferences, seminars, and workshops offer excellent networking opportunities.

- Leverage LinkedIn: Connect with professionals in your target firms, join relevant groups, and participate in discussions.

- Reach out to professionals: Don't hesitate to contact individuals in your network or those you admire in the industry. A brief, personalized email expressing your interest can go a long way.

Networking allows you to gather invaluable insights, learn about unadvertised private credit jobs, and gain a deeper understanding of the industry's culture and challenges.

Do Highlight Relevant Skills and Experience

Your resume and cover letter should clearly demonstrate your suitability for private credit jobs. Focus on skills directly relevant to the industry's demands.

Emphasize Financial Modeling Proficiency

Private credit roles heavily rely on financial modeling, valuation, and credit analysis. Demonstrate your expertise by showcasing quantifiable results.

- Include specific examples: Quantify your achievements in your resume and cover letter. Did you improve a model's accuracy? Did you identify a key risk factor? Highlight these successes.

- Showcase your abilities: Describe your experience building financial models from scratch, conducting sensitivity analysis, interpreting complex financial statements, and using specialized software (e.g., Bloomberg Terminal).

Private credit firms need analysts who can not only build models but also understand and interpret their implications.

Showcase Industry Knowledge

Highlight your understanding of key concepts and processes within the private credit world.

- Mention relevant coursework: Include any relevant coursework, projects, or research related to finance, credit analysis, or private equity.

- Certifications: Highlight relevant certifications such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

- Previous work experience: Emphasize previous experiences demonstrating skills in credit risk assessment, due diligence, and portfolio management.

Demonstrate that you're not only familiar with the terminology but possess the practical application skills needed for private credit jobs.

Don't Neglect Soft Skills

While technical skills are vital, soft skills are equally important in the collaborative environment of private credit.

Communication and Collaboration

Private credit professionals constantly interact with clients, colleagues, and other stakeholders. Effective communication is essential.

- Emphasize teamwork: Highlight your experience working effectively in teams, contributing to shared goals, and resolving conflicts constructively.

- Showcase negotiation skills: Demonstrate your ability to negotiate effectively and reach mutually beneficial agreements.

- Highlight presentation skills: Show your ability to communicate complex information clearly and concisely, both verbally and in writing.

In interviews, use the STAR method (Situation, Task, Action, Result) to provide concrete examples of your communication and collaboration skills.

Problem-Solving and Critical Thinking

Analyzing complex situations, making sound judgments, and adapting to changing circumstances are critical in private credit.

- Give specific examples: Provide concrete examples of how you have solved challenging problems, made critical decisions, and demonstrated strategic thinking in previous roles.

- Showcase analytical abilities: Highlight your ability to identify potential risks and opportunities and develop effective solutions.

Demonstrate your ability to think critically and make informed decisions under pressure, vital attributes for private credit jobs.

Do Tailor Your Application Materials

Generic applications rarely stand out in a competitive market. Tailoring your materials to each specific firm and role is crucial.

Customize Your Resume and Cover Letter

Don't send the same resume and cover letter to every firm. Each application should be customized to reflect your understanding of the specific firm and the role's requirements.

- Research the firm: Understand their investment strategy, recent deals, and team members. This demonstrates your genuine interest and initiative.

- Highlight relevant experience: Focus on the aspects of your experience that directly align with the firm's needs and the role's responsibilities.

Show that you've done your homework and can contribute meaningfully to their team.

Prepare for Behavioral Interviews

Behavioral interview questions assess your personality and past experiences. Preparation is essential.

- Use the STAR method: Structure your answers using the STAR method to provide concise and impactful examples of your skills and experiences.

- Prepare questions to ask: Asking insightful questions demonstrates your genuine interest and initiative.

Demonstrate your understanding of the industry and your enthusiasm for private credit jobs.

Don't Underestimate the Importance of Networking

Networking is a continuous process, not just a one-time activity. Actively cultivate relationships to increase your chances of securing a private credit job.

Leverage Your Network

Inform your contacts about your job search and seek advice and referrals.

- Utilize LinkedIn: Engage with professionals in the private credit industry through comments, messages, and connection requests.

- Attend industry events: Use these events as opportunities to build relationships and learn about new opportunities.

- Reach out to alumni: If you have connections to alumni networks, leverage these resources to gain insights and potential referrals.

Personal recommendations and referrals can significantly increase your chances of success in landing private credit jobs.

Follow Up After Interviews

Following up after interviews demonstrates professionalism and reinforces your interest.

- Send a thank-you note: Express your gratitude for the interviewer's time and reiterate your interest in the position.

- Send a follow-up email: A brief follow-up email after a few days can help keep your application top-of-mind.

A timely and thoughtful follow-up demonstrates your initiative and commitment.

Conclusion

Landing a job in the booming private credit market requires a strategic approach. By following these dos and don'ts—researching the landscape, highlighting relevant skills, tailoring your application, and networking effectively—you can significantly improve your chances of securing a rewarding career in private credit jobs. Don't delay—start navigating the exciting world of private credit opportunities today!

Featured Posts

-

Secret Service Closes White House Cocaine Investigation

Apr 26, 2025

Secret Service Closes White House Cocaine Investigation

Apr 26, 2025 -

Karen Reads Murder Trials Key Dates And Events

Apr 26, 2025

Karen Reads Murder Trials Key Dates And Events

Apr 26, 2025 -

Ahmed Hassanein An Improbable Journey To The Nfl Draft

Apr 26, 2025

Ahmed Hassanein An Improbable Journey To The Nfl Draft

Apr 26, 2025 -

Dow Futures And The Global Market Chinas Economic Response To Trade Tensions

Apr 26, 2025

Dow Futures And The Global Market Chinas Economic Response To Trade Tensions

Apr 26, 2025 -

The Karen Read Case A Year By Year Timeline Of Legal Proceedings

Apr 26, 2025

The Karen Read Case A Year By Year Timeline Of Legal Proceedings

Apr 26, 2025

Latest Posts

-

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025

Crumbach Resignation Analysis Of The Spd Coalitions Future

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Implications For The Spd Coalition

Apr 27, 2025 -

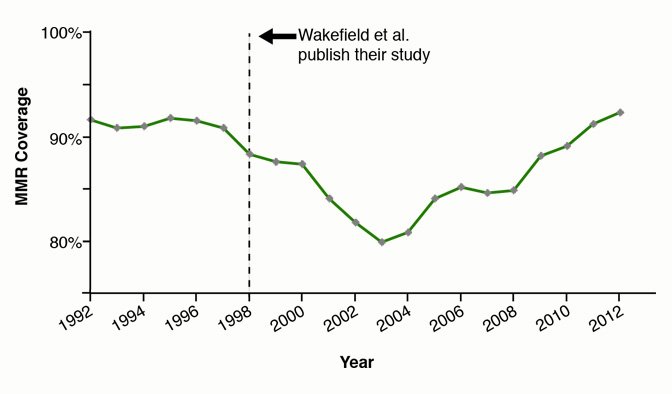

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025

Nbc 10 Reports Hhs Uses Anti Vaccine Advocate To Examine Disproven Autism Vaccine Link

Apr 27, 2025 -

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025

Anti Vaccine Activists Role In Hhs Autism Vaccine Review Sparks Outrage

Apr 27, 2025 -

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025

Hhs Controversy Anti Vaccine Advocate Reviews Debunked Autism Vaccine Connection

Apr 27, 2025