Is The Grim Retail Outlook Forcing The Bank Of Canada's Hand?

Table of Contents

Weakening Retail Sales Indicate Broader Economic Slowdown

Declining retail sales are a significant indicator of a broader economic slowdown. This weakening trend is impacting various sectors and painting a concerning picture for the Canadian economy.

Declining Consumer Spending

Falling consumer confidence is a primary driver of decreased retail spending. Canadians are tightening their belts in the face of persistent inflationary pressures and rising interest rates.

- Statistics: Statistics Canada reported a 1.2% decrease in clothing sales and a 0.8% drop in electronics sales in July 2024. The hardest-hit regions include Ontario and British Columbia, experiencing declines exceeding the national average.

- Reasons: High inflation, eroding purchasing power, elevated interest rates increasing borrowing costs, and high levels of household debt are all contributing factors to reduced consumer spending. This decreased consumer spending directly translates to lower sales for retailers across various sectors, from furniture and home goods to restaurants and entertainment.

Impact on Employment

The retail sector is a major employer in Canada. Weakening sales inevitably lead to job losses or reduced hiring, creating a ripple effect across the economy.

- Statistics: Preliminary data suggests a potential increase in retail sector unemployment, with several major retailers announcing hiring freezes or layoffs in recent months.

- Ripple Effect: Job losses in the retail sector decrease consumer spending further, perpetuating the cycle of economic contraction. This downward spiral necessitates a closer look at the underlying factors driving this trend, as well as potential policy responses to mitigate its impact.

Inflationary Pressures and the Bank of Canada's Dilemma

The Bank of Canada faces a complex dilemma: controlling inflation while supporting economic growth. The current inflationary environment is significantly influenced by various factors, including the ongoing impact on the retail sector.

Inflationary Impact of Supply Chain Issues and Global Events

Global supply chain disruptions and geopolitical instability continue to contribute to inflationary pressures in Canada.

- Examples: The ongoing impact of the war in Ukraine and persistent supply chain bottlenecks continue to drive up the prices of essential goods and commodities.

- Impact on Consumers: Increased prices for goods and services directly reduce consumer purchasing power, leading to further decreases in retail sales and overall economic activity.

The Bank of Canada's Mandate and Tools

The Bank of Canada's primary mandate is to maintain price stability through controlling inflation. Its primary tool for achieving this is adjusting interest rates.

- Interest Rate Adjustments: Increasing interest rates makes borrowing more expensive, potentially slowing down economic activity and reducing inflationary pressures. Conversely, decreasing interest rates stimulates borrowing and economic activity.

- Trade-offs: The Bank of Canada must carefully balance the need to control inflation with the potential negative impact of higher interest rates on economic growth and employment. This balancing act is particularly challenging in the face of a weakening retail sector.

Potential Policy Responses and Their Implications

The Bank of Canada’s response to the grim retail outlook and persistent inflation will significantly impact the Canadian economy.

Interest Rate Hikes and Their Impact on Retail

Further interest rate hikes are a potential response to persistent inflation, but they could negatively impact consumer spending and retail sales.

- Potential Scenarios: The Bank of Canada may opt for further interest rate increases, potentially leading to a more significant economic slowdown. Alternatively, they could choose to pause rate increases, risking higher inflation but potentially preventing a sharp economic downturn.

- Impact on Households: Higher interest rates increase household debt servicing costs, potentially further reducing consumer spending and exacerbating the already grim retail outlook. This could lead to a vicious cycle of declining sales, job losses, and further reduced consumer confidence.

Alternative Policy Options

The Bank of Canada might consider alternative policy options, such as quantitative easing or other monetary policy tools.

- Quantitative Easing: This involves injecting money into the economy to stimulate lending and spending. However, it carries the risk of fueling further inflation.

- Other Tools: Other tools might include targeted interventions to support specific sectors of the economy, although their effectiveness and potential drawbacks require careful consideration.

Conclusion

The grim retail outlook is undeniably linked to persistent inflation, presenting a significant challenge for the Bank of Canada's monetary policy decisions. The weakening retail sector's impact on the broader Canadian economy cannot be understated. Further interest rate hikes or alternative policies will have significant and far-reaching consequences. The interconnectedness of inflation, consumer spending, and the retail sector highlights the complexities facing Canadian policymakers.

Keep an eye on the Bank of Canada's next announcement to understand how the grim retail outlook continues to shape monetary policy. Stay updated on the evolving relationship between the grim retail outlook and the Bank of Canada's actions by regularly consulting the Bank of Canada website () and Statistics Canada ().

Featured Posts

-

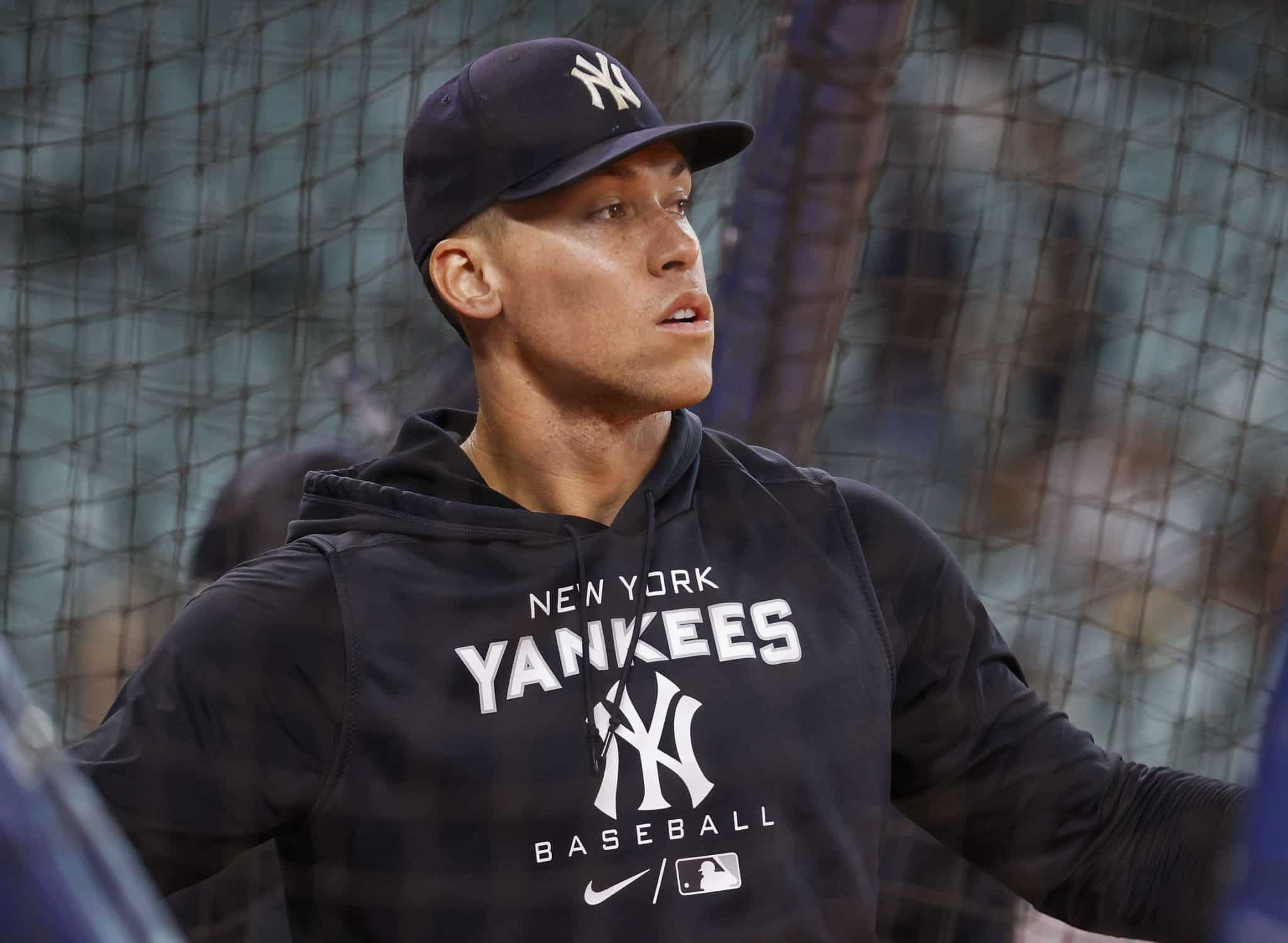

Aaron Judges Record Tying Performance Matching Babe Ruths Yankees Legacy

Apr 28, 2025

Aaron Judges Record Tying Performance Matching Babe Ruths Yankees Legacy

Apr 28, 2025 -

Denny Hamlin Triumphs At Martinsville Ending Winless Streak

Apr 28, 2025

Denny Hamlin Triumphs At Martinsville Ending Winless Streak

Apr 28, 2025 -

The Impact Of Musks X Debt Sale Unveiling The Companys Financial Transformation

Apr 28, 2025

The Impact Of Musks X Debt Sale Unveiling The Companys Financial Transformation

Apr 28, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 28, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcement

Apr 28, 2025 -

The Us Economy And The Canadian Travel Boycott A Posthaste Analysis

Apr 28, 2025

The Us Economy And The Canadian Travel Boycott A Posthaste Analysis

Apr 28, 2025