Investor Concerns About High Stock Market Valuations: BofA's Response

Table of Contents

BofA's Assessment of Current Valuations

BofA's assessment of current market valuations is nuanced and avoids simplistic pronouncements of "overvalued" or "undervalued." Their analysis, often published in research reports and communicated through their financial advisors, considers a multitude of factors beyond simple price-to-earnings ratios (P/E). While acknowledging that valuations are elevated compared to historical averages, they point to other indicators that influence their outlook.

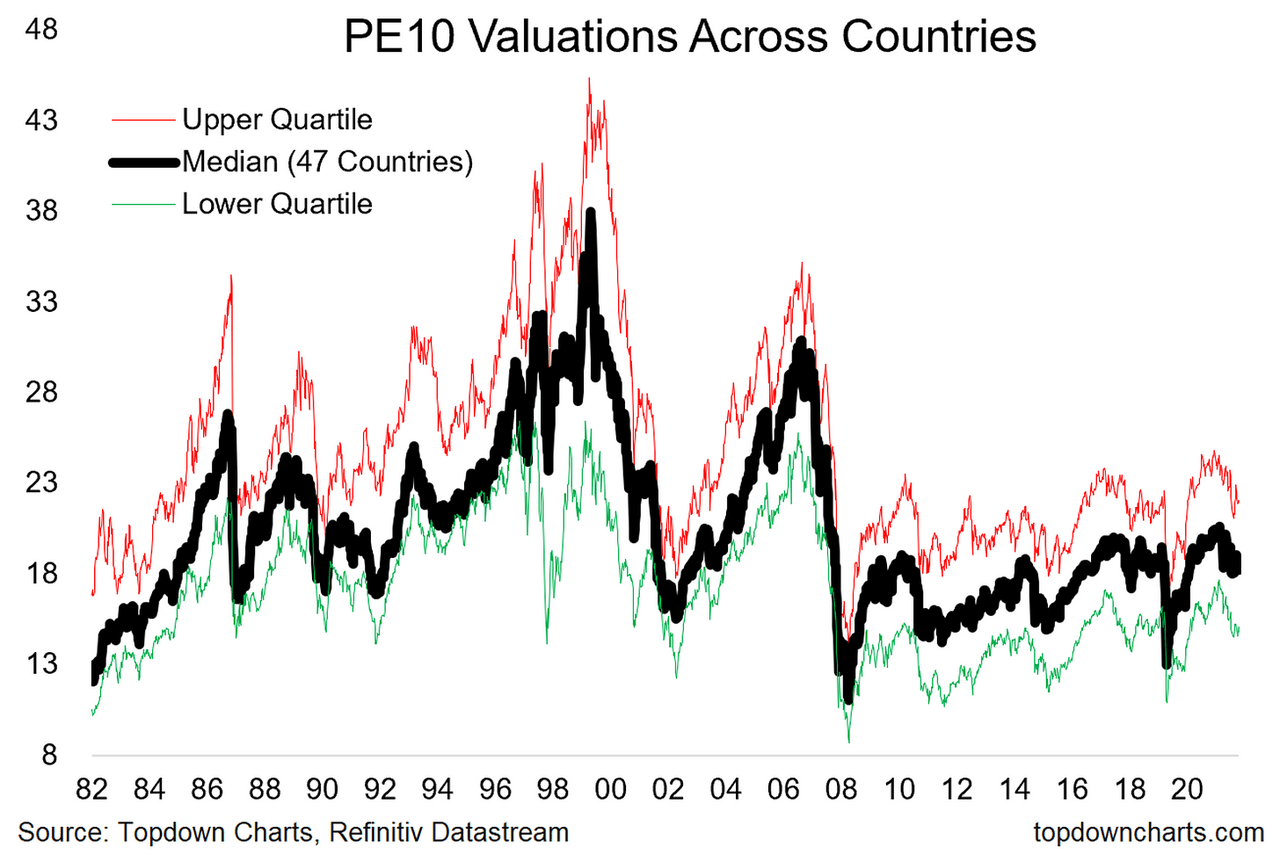

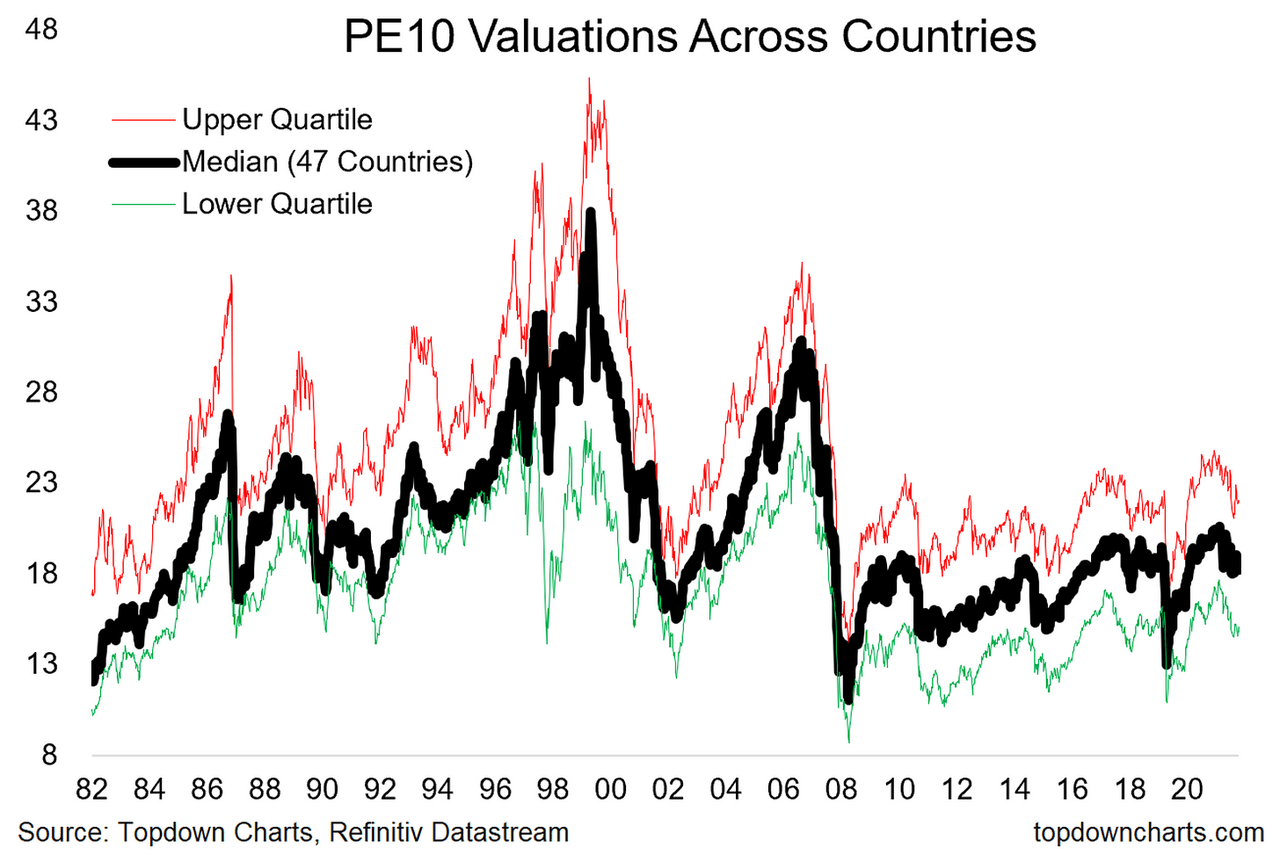

- BofA's valuation metrics used: BofA employs a range of valuation metrics, including the classic P/E ratio, the cyclically adjusted price-to-earnings ratio (Shiller PE), and various other sector-specific valuation models. They don't rely solely on one metric, understanding that each offers a different perspective.

- Key factors contributing to high valuations: BofA cites several key factors contributing to the currently elevated valuations. These include persistently low interest rates, robust corporate earnings growth (especially in the tech sector), ongoing technological advancements driving innovation and productivity, and a continued influx of investor capital seeking higher returns.

- Comparison to historical averages: While acknowledging that current valuations are above long-term historical averages, BofA emphasizes that these averages don't necessarily predict future performance. They highlight periods in history where valuations remained elevated for extended periods, fueled by significant economic shifts or technological revolutions.

- Specific sectors: BofA's analysis often points to certain sectors as potentially overvalued (e.g., certain segments of the technology sector during periods of rapid growth) while highlighting other sectors that appear more attractively valued given their growth prospects and underlying fundamentals.

Addressing Investor Fears of a Market Correction

The potential for a market correction or even a more significant downturn is a major concern for investors. BofA acknowledges this risk but avoids making definitive predictions about timing or severity. Their approach emphasizes preparing for volatility rather than trying to time the market.

- Predicted timeline: BofA generally refrains from providing specific timelines for market corrections. Their analyses focus more on identifying potential catalysts and suggesting strategies to manage risk.

- Potential catalysts for a downturn: BofA highlights several potential triggers for a market correction. These include a more rapid-than-expected increase in interest rates, persistent inflationary pressures impacting consumer spending, escalating geopolitical instability, and unforeseen negative economic shocks.

- Mitigating risk during market volatility: BofA's recommended strategies for mitigating risk involve diversification across various asset classes, employing robust risk management techniques like stop-loss orders, and maintaining a long-term investment horizon.

BofA's Investment Strategies in a High-Valuation Environment

Given the current environment of high stock market valuations, BofA recommends a cautious yet opportunistic investment strategy. This approach emphasizes careful selection of investments and a strong focus on risk management.

- Recommended asset allocation: BofA's asset allocation suggestions often emphasize a diversified portfolio, incorporating a mix of stocks, bonds, and potentially alternative investments based on an individual investor's risk tolerance and financial goals.

- Sectors for long-term growth: They typically recommend focusing on companies with strong fundamentals, sustainable competitive advantages, and a demonstrable path to long-term growth, even in sectors with relatively high valuations. Value investing approaches may also be emphasized.

- Strategies for managing risk: Risk management is paramount. This includes diversifying across sectors and asset classes, using stop-loss orders to limit potential losses, and regularly reviewing and rebalancing the portfolio to align with changing market conditions.

- Importance of a long-term horizon: BofA consistently stresses the importance of a long-term investment horizon. Short-term market fluctuations are viewed as less significant than long-term growth potential.

The Role of Interest Rates in Stock Market Valuations

Interest rates play a crucial role in influencing stock market valuations, according to BofA's analysis. This relationship is largely inverse: rising interest rates tend to put downward pressure on stock prices, while falling rates can boost valuations.

- Inverse relationship: Higher interest rates increase the attractiveness of fixed-income investments (bonds), diverting capital away from the stock market. Conversely, lower interest rates make stocks relatively more appealing.

- BofA's interest rate predictions: BofA's interest rate forecasts influence their investment recommendations. Their predictions about future interest rate movements are factored into their suggested asset allocations and sector choices.

- Impact on different asset classes: Changes in interest rates differentially affect various asset classes. Bonds are particularly sensitive, while the impact on stocks is more nuanced, depending on factors like company profitability and growth prospects.

Conclusion

BofA's response to concerns about high stock market valuations provides valuable insights for investors. They acknowledge the elevated levels but offer a nuanced perspective, carefully considering various factors shaping the market. Their recommendations, emphasizing diversification, robust risk management, and a long-term investment horizon, provide a sensible framework for navigating the current environment. By understanding BofA's analysis of these high stock market valuations and incorporating their strategic guidance, investors can position themselves to make more informed decisions and potentially mitigate risks. Remember to conduct your own thorough research and consult with a qualified financial advisor before making any significant investment decisions related to high stock market valuations.

Featured Posts

-

Real Time Stock Market Data Dow S And P 500 And Nasdaq April 23

Apr 24, 2025

Real Time Stock Market Data Dow S And P 500 And Nasdaq April 23

Apr 24, 2025 -

Sharks Missing Swimmer And A Found Body The Mystery Of The Israeli Beach

Apr 24, 2025

Sharks Missing Swimmer And A Found Body The Mystery Of The Israeli Beach

Apr 24, 2025 -

Understanding The Tradition Why The Popes Signet Ring Is Destroyed Upon Death

Apr 24, 2025

Understanding The Tradition Why The Popes Signet Ring Is Destroyed Upon Death

Apr 24, 2025 -

John Travolta Shares Moving Photo On Late Son Jetts Birthday

Apr 24, 2025

John Travolta Shares Moving Photo On Late Son Jetts Birthday

Apr 24, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 24, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amidst La Fires

Apr 24, 2025