Investment Opportunities: Identifying The Country's Rising Business Hotspots

Table of Contents

Analyzing Key Economic Indicators for Investment Opportunities

Indonesia's robust economic growth provides fertile ground for investment opportunities. Analyzing key economic indicators is crucial for identifying the most promising sectors.

GDP Growth and Sectoral Analysis: Indonesia's GDP consistently demonstrates strong growth, outpacing many of its regional peers. Specific sectors are experiencing particularly rapid expansion, offering lucrative investment prospects.

- Technology: The tech sector is booming, with a rapidly expanding digital economy and increasing adoption of fintech solutions. Projected growth: 15-20% annually.

- Renewable Energy: Indonesia's abundant natural resources and government commitment to renewable energy make this sector exceptionally attractive. Projected growth: 12-18% annually.

- Tourism: Indonesia's stunning natural beauty and diverse culture attract millions of tourists yearly, fueling growth in hospitality and related services. Projected growth: 10-15% annually.

- Infrastructure: Massive infrastructure development projects are underway, creating significant opportunities in construction, materials, and logistics.

These projections are based on data from the World Bank and the Indonesian Ministry of Finance. These sources indicate a strong potential for significant returns on investment in these sectors.

Infrastructure Development and Investment: Massive infrastructure projects, including new roads, ports, airports, and power plants, are transforming Indonesia's landscape. This development significantly improves logistics, reduces transportation costs, and unlocks new investment opportunities across various sectors.

- Trans-Java Toll Road: This massive project is improving connectivity across the island, opening up new markets and facilitating trade. Expected completion: 2024.

- New International Airports: Several new international airports are under construction, boosting tourism and foreign investment. Expected completion dates vary by project.

- Power Plant Developments: Investments in renewable and non-renewable power plants are crucial for supporting the country's growing energy demands. Multiple projects are underway across the archipelago.

These developments reduce logistical hurdles, making Indonesia an increasingly attractive destination for foreign direct investment (FDI).

Government Policies and Incentives: The Indonesian government is actively encouraging FDI through various initiatives.

- Tax Incentives: Significant tax breaks are offered to businesses investing in priority sectors.

- Streamlined Regulations: Efforts are underway to simplify regulations and reduce bureaucratic hurdles for investors.

- Special Economic Zones (SEZs): SEZs offer investors attractive benefits, including tax holidays and streamlined customs procedures.

While government support is generally positive, investors should be aware of potential policy changes and regulatory risks. Thorough due diligence is essential.

Identifying Geographic Business Hotspots

Indonesia's investment opportunities aren't limited to a single area; several regions present unique advantages.

Major Cities and Urban Centers: Major cities like Jakarta, Surabaya, and Medan offer robust infrastructure, skilled labor pools, and access to large markets, making them attractive investment destinations. However, high costs of living and competition should be considered.

- Jakarta: The nation's capital offers the largest market and concentration of businesses.

- Surabaya: Indonesia's second-largest city boasts a strong industrial base and growing manufacturing sector.

- Medan: A major economic center on Sumatra, Medan benefits from its proximity to natural resources.

Emerging Regional Hubs: Beyond major cities, several emerging regional hubs are showing exceptional potential.

- Bali: While already a tourism powerhouse, Bali's potential for growth in sustainable tourism and related industries is vast.

- Nusa Tenggara Barat: This region is benefiting from increasing investment in tourism and renewable energy.

- Papua: This resource-rich province offers immense potential, though it presents greater developmental challenges and risks.

Investing in emerging regions carries higher risk but can offer significant rewards for those willing to navigate the challenges.

Assessing Investment Risks and Mitigation Strategies

Political and Economic Stability: While Indonesia enjoys relative political stability, investors should be aware of potential risks.

- Political Instability: While generally stable, regional political dynamics can sometimes impact investment decisions.

- Currency Fluctuations: The Indonesian Rupiah's value can fluctuate, impacting investment returns.

- Regulatory Changes: Changes in government regulations can affect business operations.

These risks can be mitigated through diversification, hedging strategies, and careful monitoring of the political and economic landscape.

Due Diligence and Risk Management: Before making any investment decisions, comprehensive due diligence is paramount.

- Legal Assessments: Thorough legal review of contracts and regulatory compliance is essential.

- Financial Assessments: Careful analysis of financial statements and projections is crucial for evaluating investment viability.

- On-the-ground Research: Visiting potential investment sites and conducting market research are invaluable.

Seeking professional advice from experienced investment consultants can significantly improve the likelihood of success.

Conclusion:

Indonesia presents a wealth of investment opportunities across diverse sectors and geographic locations. By carefully analyzing key economic indicators, identifying emerging hotspots, and implementing robust risk management strategies, investors can capitalize on Indonesia's dynamic economy and achieve substantial returns. Start exploring these exciting investment opportunities today and capitalize on the burgeoning growth of Indonesia's dynamic economy. Learn more about the best investment opportunities in Indonesia by visiting the Indonesian Investment Coordinating Board website: [insert link here]. Don't miss out on the numerous investment prospects available in this rapidly developing nation.

Featured Posts

-

Rhlat Tyran Alerbyt Almbashrt Abwzby Kazakhstan

Apr 28, 2025

Rhlat Tyran Alerbyt Almbashrt Abwzby Kazakhstan

Apr 28, 2025 -

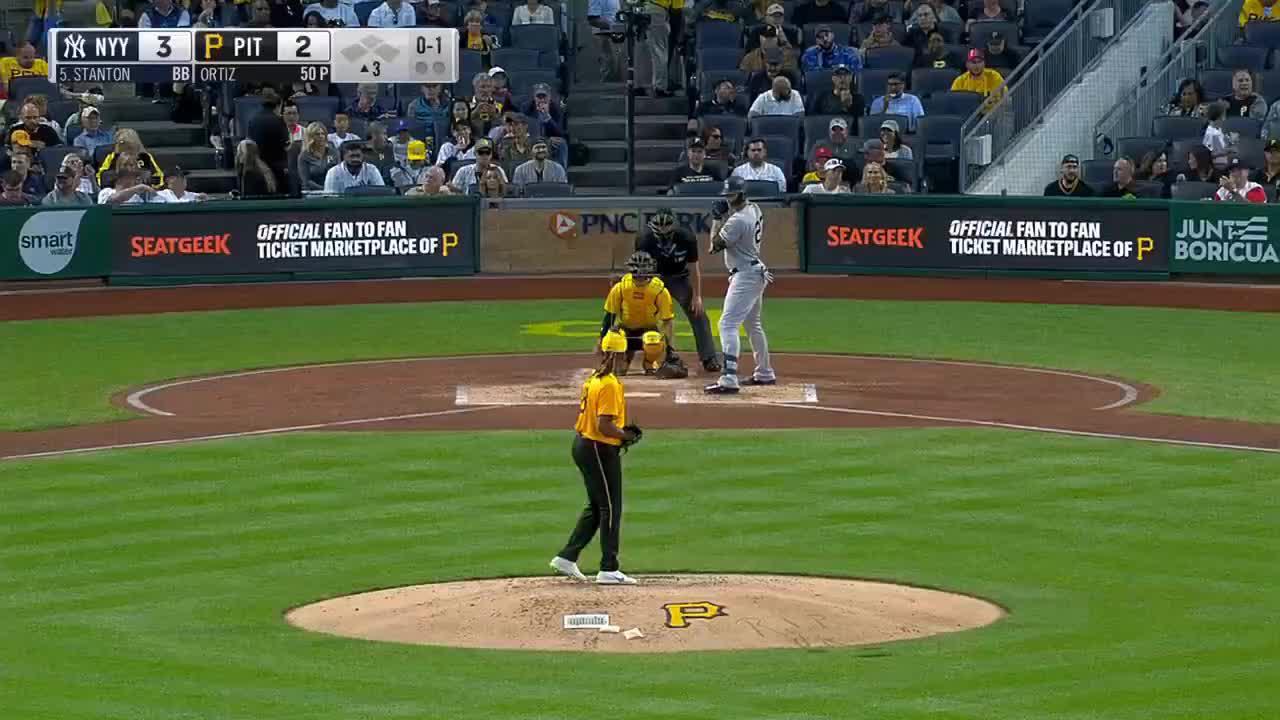

Yankees Max Fried Debut Highlights 12 3 Victory Against Pirates

Apr 28, 2025

Yankees Max Fried Debut Highlights 12 3 Victory Against Pirates

Apr 28, 2025 -

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 28, 2025

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 28, 2025 -

Dollars Troubled Start Worst First 100 Days Since Nixon Presidency

Apr 28, 2025

Dollars Troubled Start Worst First 100 Days Since Nixon Presidency

Apr 28, 2025 -

2 Year Old Us Citizens Deportation Federal Judge Schedules Hearing

Apr 28, 2025

2 Year Old Us Citizens Deportation Federal Judge Schedules Hearing

Apr 28, 2025